Step by step filling

Let's look at the algorithm for creating a balance sheet using the example of Uproshchenets LLC. The organization has been operating since January 1, 2017 and applies the simplified tax system. In the process of preparing financial statements for 2017, the company’s accountant must perform the following actions:

.

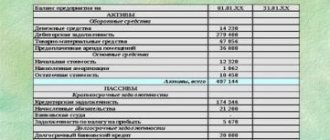

Create a balance sheet as of December 31, 2017; account balances are to be posted across balance sheet lines.

| Check | Balance | Check | Balance | Check | Balance |

| Dt 01 | 599900 | Dt 43 | 85000 | Kt 69 | 80000 |

| Kt 02 | 20140 | Dt 50 | 10000 | Kt 70 | 259000 |

| Dt 04 | 100340 | Dt 51 | 255000 | Kt 80 | 55000 |

| Kt 05 | 3000 | Dt 58 | 150000 | Kt 82 | 15000 |

| Dt 10 | 22000 | Kt 60 | 155000 | Kt 84 | 140000 |

| Dt 19 | 6000 | Kt 62/advance | 500620 |

Based on the balance sheet balance, determine the asset indicators taking into account the following rules

:

- line 1150 is defined as the difference between the value of non-current assets and the depreciation accrued on them: Dt 01 - Kt 02 = 580 thousand rubles;

- line 1170 includes the amount of intangible assets minus depreciation and the amount of financial investments: (Dt 04 - Kt 05) + Dt 58 = 247 thousand rubles;

- line 1210. It should reflect the cost of the enterprise’s material assets and finished products produced: Dt 10 + Dt 43 = 107 thousand rubles;

- line 1230 contains the amount of VAT paid when purchasing goods, works, services from the supplier: Dt 19 = 6 thousand rubles;

- line 1250 is formed by summing the funds at the cash desk and in current bank accounts: Dt 50 + Dt 51 = 265 thousand rubles;

- line 1600, according to which the book value of current and non-current assets amounted to 1205 thousand rubles;

Determination of indicators of the passive section of the balance sheet:

- line 1370 includes the amount of authorized and reserve capital, as well as the organization’s retained earnings: Kt 80 + Kt 82 + Kt 84 = 210 thousand rubles. (the line code is determined by the indicator that has the largest share in the group of items - retained earnings);

- line 1520 contains the remaining account balances - the amount of accounts payable to suppliers and employees, advances received from customers, as well as obligations to pay insurance premiums: Kt 60 + Kt 62/advances + Kt 69 + Kt 70 = 995 thousand rubles;

Comparison of data in lines 1600 and 1700: the asset and liability of Uproshchenets LLC is equal to 1205 thousand rubles, which means the balance is correct.

Since Uproshchenets LLC was registered in 2021, the balance sheet columns for the previous 2 years will not be filled in. Empty cells should be filled with dashes. Subsequently, when filling out these columns, the data should be taken from previous reporting forms adopted by regulatory authorities.

The simplified balance sheet visually looks like this:

How to draw up a Balance Sheet. An example of preparing a balance sheet for a small enterprise

An example of how to draw up an annual Balance Sheet for a small business that does cash accounting

Alpha LLC is a small business and provides legal consulting.

On March 23, 2021, Alpha’s accountant began preparing annual financial statements for 2015. The annual financial statements of a small enterprise consist of a Balance Sheet and a Statement of Financial Results.

The accountant, after drawing up the Financial Results Report for 2015, moved on to drawing up the Balance Sheet for 2015.

Before drawing up the balance sheet, Alpha's accountant checked, firstly, whether all business transactions for the reporting period were reflected in the accounts. And, secondly, are the turnovers on synthetic and analytical accounts formed correctly?

To fill out the Balance Sheet, the accountant used: – data about the organization (Table 1); – data on account balances as of December 31, 2015 (Table 2); – information about the assets and liabilities of the organization for 2014 and 2013, contained in the Balance Sheet for 2014 (Table 3).

Table 1

| Full name of the organization | Limited Liability Company "Alfa" |

| Code in accordance with the classifier of enterprises and organizations | 77123456 |

| TIN | 770013254479 |

| Type of economic activity | Activities in the field of law (74.11) |

| Organizational and legal form of OKOPF/OKFS | Limited Liability Company 65/16 |

| Unit of measurement (OKEI) | thousand roubles. (384) |

| The address of the organization, which is stated in the charter and recorded in the Unified State Register of Legal Entities | 125008, Moscow, st. Mikhalkovskaya, 21 |

In 2015, Alpha provided legal services in the amount of RUB 1,540,000.

In 2015, Hermes paid for the goods partially - in the amount of 961,000 rubles. (62%). The buyer transferred the remaining amount (RUB 578,925) in 2016.

Alpha's accounting policy stipulates that revenue is determined as money is received from customers, expenses are recognized as they are paid and reduce the financial result of the current period (clause 7 PBU 1/2008, clause 12 PBU 9/99, clauses 18 and 19 PBU 10/99).

The organization's expenses in 2015 were:

- salary – 150,000 rubles. (actually 100,000 rubles were paid);

- Personal income tax – 14,943 rubles. (personal income tax is actually transferred to the budget);

- insurance premiums – 119,700 rubles. (50,000 rubles were actually paid);

- rent – 230,300 rubles. (actually 70,000 rubles were transferred);

- raw materials – 150,000 rubles. (actually paid 150,000 rubles);

- depreciation – 250,000 rubles. (fixed assets are fully paid);

- single tax – 20,000 rubles. (20,000 rubles were actually paid).

In accounting, the Alpha accountant made the following entries:

Debit 20 Credit 51 – 70,000 rub. – rental expenses are reflected at the time of actual payment;

Debit 97 Credit 70 – 114,943 rub. – labor costs are reflected;

Debit 70 Credit 51 – 100,000 rub. - salary was issued;

Debit 20 Credit 97 – 100,000 rub. – written off labor costs;

Debit 70 Credit Debit 68 subaccount “Personal Income Tax Payments” – 14,943 rubles. – personal income tax is reflected;

Debit 68 subaccount “Calculations for personal income tax” Credit 51 – 14,943 rubles. – personal income tax is transferred to the budget;

Debit 20 Credit 97 – 14,943 rub. – labor costs in terms of personal income tax are written off;

Debit 20 Credit 51 – 50,000 rub. – expenses are reflected in the amount of insurance premiums actually paid;

Debit 20 Credit 02 – 250,000 rub. – depreciation has been calculated on paid fixed assets;

Debit 10 Credit 60 – 150,000 rub. – purchased materials are reflected in accounting;

Debit 97 Credit 10 – 150,000 rub. – materials were released for the needs of the activity;

Debit 60 Credit 51 – 150,000 rub. – paid for materials;

Debit 20 Credit 97 – 150,000 rub. – the cost of materials is written off as expenses (to the extent paid);

Debit 51 Credit 90-1 – 961,000 rub. – revenue is reflected at the time of receipt of payment from the buyer;

Debit 90-2 Credit 20 – 634,943 rub. (RUB 70,000 + RUB 100,000 + RUB 14,943 + RUB 50,000 + RUB 250,000 + RUB 150,000) – the cost of services is written off;

Debit 68 subaccount “Calculations for single tax” Credit 51 – 20,000 rubles. – a single tax is transferred to the budget;

Debit 99 Credit 68 subaccount “Calculations for single tax” – 20,000 rubles. – a single tax is charged in the amount of the actual payment;

Debit 90-1 Credit 90-9 – 961,000 rub. – subaccount 90-1 is closed;

Debit 90-9 Credit 90-2 – 634,943 rubles. – subaccount 90-2 is closed;

Debit 90-9 Credit 99,326,057 rub. – profit from activities is reflected.

At the end of 2015, when preparing the annual financial statements, the accountant closed account 99 “Profits and losses”. At the same time, in the final entry of December, the amount of net profit of the reporting year was written off from account 99 “Profits and losses” to the credit of account 84 “Retained earnings (uncovered loss)”: Debit 99 subaccount “Net profit (loss)” Credit 84 - 306,057 rubles. (RUB 326,057 – RUB 20,000) – net (retained) profit of the reporting year is written off.

After reflecting all business transactions in accounting, the accountant received the following data on account balances as of December 31, 2015:

table 2

| Check | Account balances as of December 31, 2014, rub. | Account balances as of December 31, 2015, rub. | ||

| Debit | Credit | Debit | Credit | |

| 01 "Fixed assets" | 949 464 | 949 464 | – | |

| 02 “Depreciation of fixed assets” | 311 464 | – | 561 464 (311 464 + 250 000) | |

| 51 “Current account” | 4 480 000 | 5 036 057 (4 480 000 + 961 000 – 70 000 – 100 000 – 14 943 – 50 000 – 150 000 – 20 000) | – | |

| 80 “Authorized capital” | 10 000 | 10 000 | ||

| 84 “Retained earnings” | 5 108 000 | 5 414 057 (5 108 000 + 306 057) | ||

Table 3

| Indicator name | Code | As of December 31, 2014, thousand rubles. | As of December 31, 2013, thousand rubles. |

| ASSETS | |||

| Tangible non-current assets | 1150 | 638 | 520 |

| Intangible, financial and other non-current assets | 1110 | – | – |

| Reserves | 1210 | – | – |

| Cash and cash equivalents | 1250 | 4 480 | 2 320 |

| Financial and other current assets | 1240 | – | – |

| BALANCE | 1600 | 5 118 | 2 840 |

| PASSIVE | |||

| Capital and reserves | 1310 | 5 118 | 2 840 |

| Long-term borrowed funds | 1410 | – | – |

| Other long-term liabilities | 1450 | – | – |

| Short-term borrowed funds | 1510 | – | – |

| Accounts payable | 1520 | – | – |

| Other current liabilities | 1550 | – | – |

| BALANCE | 1700 | 5 118 | 2 840 |

The accountant began drawing up the balance sheet by indicating general information about the organization. Next, I started filling out the assets of the Balance Sheet.

The accountant determined the residual value of fixed assets as of December 31, 2015 as the difference between the balances of accounts 01 “Fixed assets” and 02 “Depreciation of fixed assets”: – RUB 388,000. (949,464 rubles – 561,464 rubles).

This amount was reflected in the corresponding column of line 1150 of the Balance Sheet. The accountant transferred the indicators of line 1150 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 638 thousand rubles; – as of December 31, 2013 – 520 thousand rubles.

There are no intangible, financial and other non-current assets, as well as financial and other current assets in the organization. Therefore, according to the order of filling out the Balance Sheet by line, lines 1110 and 1240 are not filled out.

There are no accounts receivable as of December 31, 2015.

The accountant determined the amount of cash as of December 31, 2015 from the balance of account 51 “Current accounts”: – RUB 5,036,057.

This amount was reflected in the corresponding column of line 1250 of the Balance Sheet. The accountant transferred the indicators of line 1250 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 4,480 thousand rubles; – as of December 31, 2013 – 2320 thousand rubles.

The value of line 1600 “BALANCE” of the Balance Sheet asset is equal to the sum of lines 1150, 1110, 1210, 1250 and 1240: – as of December 31, 2015 – 5424 thousand rubles. (388 thousand rubles + 5036 thousand rubles); – as of December 31, 2014 – 5118 thousand rubles. (638 thousand rubles + 4480 thousand rubles); – as of December 31, 2013 – 2840 thousand rubles. (520 thousand rubles + 2320 thousand rubles).

Next, the accountant began filling out the liabilities of the Balance Sheet.

When filling out line 1310 of the Balance Sheet, he used data on the credit balance of accounts 80 “Authorized capital” and 84 “Retained earnings (uncovered loss)” as of December 31, 2015. The balance is RUB 5,424,057. (RUB 5,414,057 + RUB 10,000) was reflected in the corresponding column of this line.

The accountant transferred the indicators of line 1310 as of December 31 of the previous year and as of December 31 of the year preceding the previous one from the Balance Sheet for 2014: – as of December 31, 2014 – 5118 thousand rubles; – as of December 31, 2013 – 2840 thousand rubles.

There are no long-term or short-term liabilities in the organization. Therefore, lines 1410, 1450, 1510, 1520 and 1550 of the Balance Sheet are not completed.

The value of line 1700 “BALANCE” of the liability side of the Balance Sheet is equal to the sum of lines 1310, 1410, 1450, 1510, 1520, 1550: – as of December 31, 2015 – 5424 thousand rubles; – as of December 31, 2014 – 5118 thousand rubles; – as of December 31, 2013 – 2840 thousand rubles.

The head of the organization signed the finished Balance Sheet for 2015 on March 25, 2021. On the same day, it was submitted to the tax office as part of the annual financial statements.

Zero balance

Temporary suspension of activities does not exempt

the enterprise from the obligation to provide financial statements. Must be provided to Rosstat and the territorial tax office. Otherwise, regulatory authorities have the right to apply sanctions to the debtor in the form of penalties and blocking of a bank account.

It should be noted that the balance cannot be zero even if activities are stopped. At a minimum, it reflects the authorized capital of the organization in lines 1300 of liabilities and 1250 of assets. If for some reason it is not contributed by the founders, then the assets of the balance sheet reflect the receivables of the founders on line 1230. Dashes

.

Even if they operate under the rules of a special regime, entities are not required to use simplified forms for reporting. In addition to the balance sheet and income statement, they have the right to draw up other documents in the form of appendices and explanations, if this method of reflecting information is more convenient.

How to prepare reports for the simplified tax system in 1C - in this video.

A simplified balance sheet is one of the accounting reports that small businesses file. According to Art. 4 of Law No. 209-FZ of July 24, 2007, enterprises are considered small if the share of third-party organizations in the management company is up to 25%, income does not exceed 400 million rubles, and the average number of employees is less than 100 people. Simplified financial statements are submitted for the calendar year.

The balance sheet (BB) is a snapshot of the balances of key accounting accounts as of a specific date. It does not demonstrate the results of the enterprise for a certain period, but rather shows the state of its affairs at the end of the reporting period. The form itself has three columns for entering indicators: for the reporting period and the two previous ones. Thanks to this form, it is easy to compare the company's performance over the past few years.

Criteria for small businesses

The criteria for small businesses (SMBs) are defined in Article 4 of the Federal Law of July 24, 2007 N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation.” These must be duly registered business societies, business partnerships, production and consumer cooperatives, peasant (farm) households and individual entrepreneurs who meet the following conditions:

- The average number of employees for the previous year was up to 100 people (among SMEs there are micro-enterprises with up to 15 people).

- Tax income excluding VAT for the previous year is not more than 800 million rubles. (for microenterprises - 120 million rubles).

For business companies (JSC and LLC) and partnerships, additional restrictions are established on the types of activities and the structure of the authorized capital. In addition to size and income, at least one of the following requirements must be met:

- shares of joint-stock companies traded on the ORTS are classified as shares of the high-tech (innovative) sector of the economy in the manner established by the Government of the Russian Federation;

- the activity of the organization is to apply (implement) the results of intellectual activity, provided that exclusive rights belong to its founders - budgetary, autonomous scientific institutions;

- organization - participant of the Skolkovo project;

- the company's founders are included in the List of legal entities providing state support for innovation activities.

- the total share of the state, regions, public, religious organizations and charitable foundations in the authorized capital is no more than 25%, and the total share of foreign companies and organizations not related to the SMP in the authorized capital is no more than 49%.

events

and insurance premiums: new rules from January 1, 2021

February 11, 2021 at 14:00

Restrictions on the shares of foreign companies and non-SMEs in the authorized capital do not apply to the above-mentioned participants of the Skolkovo project, innovative organizations on the List, as well as companies implementing the results of intellectual activity with the transfer of exclusive rights to their founders - budgetary, autonomous scientific institutions.

The SMP category is determined in accordance with the largest condition established by the average number of employees and income.

For example, the average headcount of the organization was 25 people, and the annual income was 25 million rubles. According to the first criterion, the organization corresponds to the concept of a small enterprise, and according to the second - a microenterprise. Therefore, it is recognized as a small enterprise.

An organization ceases to be an SSE if, for three consecutive years, the actual indicators of the average headcount and income are higher than the limit values (clause 4 of Article 4 of Law No. 209-FZ).

To recognize an SMP organization, you do not need to receive a special document confirming this status. All SMEs are included in a special register on the Federal Tax Service website (https://rmsp.nalog.ru).

Classifying an organization as an SMP gives it many benefits, including in the field of accounting and reporting.

Find out if you are subject to mandatory audit

according to your situation and get advice from an auditor.

Request a call

Request a call

Filling out a simplified balance sheet

The balance sheet consists of two parts: assets and liabilities. The asset indicates all the tangible and intangible property of the enterprise, and the liability indicates the sources of formation of this property. In the simplified form of the BB there are significantly fewer items in the asset and liability. In particular, an asset contains 5 items, and a liability – 6 items. Filling out the balance sheet begins with entering the company’s details into the so-called “header” of the report. Here they indicate:

- OKPO codes, INN;

- full name of the enterprise;

- types of economic activities according to OKVED;

- units;

- location of the enterprise.

When entering indicators into the BB, you should remember that indicators entered into assets and liabilities do not count against each other. In particular, the same account may have credit and debit balances that must be posted to different parts of the balance sheet. Filling out balance sheet items each year must follow the same rules so that the data from each item can be compared and analyzed. To do this, the fundamental points for filling out the report are prescribed in the company’s accounting policy. The BB is considered completed only after the head of the enterprise puts his signature on its paper version.

Completing a simplified balance sheet begins with filling out an asset.

Accounting statements of small enterprises

Simplified reporting for a small business includes a balance sheet and income statement. Their difference from regular reporting is that simplified forms contain only items without detail.

Sample of filling out a balance sheet for small businesses

The balance sheet form of a small enterprise, as well as the balance sheet form 1, consists of assets and liabilities. For each specified type of asset or liability, information is reflected for the reporting year (as of December 31 of the reporting year) and for the two previous years (as of December 31 of these years).

The balance sheet will be drawn up correctly provided that the sum of all assets of the enterprise is equal to the sum of all liabilities. If, based on the results of filling out the balance sheet form, this equality is satisfied, then the report is completed correctly, you can submit it to the relevant regulatory authorities. If the equality is not satisfied, you will have to look for an error.

The header of the balance sheet form for small businesses is filled out as follows, indicating:

- date – the last day of the reporting period, for example, when filling out the balance sheet for 2014, indicate December 31, 2014;

- name of the small business entity;

- details: OKPO, INN, OKVED, OKOPF, OKFS;

- unit of measurement - all numerical values are expressed in thousands of rubles or in millions, if thousands are used, then the OKEI code is indicated - 384, if millions - then 385.

- legal address of a small enterprise.

The balance sheet form for small businesses is filled out as follows:

Filling out the assets of a small business balance sheet

Tangible non-current assets – the cost of fixed assets (without depreciation), as well as incomplete capital investments.

Intangible, financial non-current assets - the cost of intangible assets (after deduction of depreciation), unfinished investments in intangible assets, long-term financial investments, development results, research, deferred tax payments, moreover, financial investments must be accounted for at their original cost.

Inventory is the cost of goods for sale, finished goods and raw materials.

Cash and cash equivalents are funds in the bank, cash desk, as well as financial investments with high liquidity that can be sold at a predetermined cost.

Financial current assets - all short-term financial investments (with a maturity of less than 12 months), accounts receivable and other current assets that are not included in the previous lines.

Filling out the liabilities of a small business balance sheet

Capital, reserves - the volume of authorized capital, additional capital, retained earnings (or uncovered loss), reserves.

Long-term loans - the total volume of all loans, loans that must be repaid in more than 12 months.

Other long-term liabilities with a maturity exceeding 12 months.

Short-term loans – the amount of debt on loans that must be repaid in less than 12 months.

Accounts payable is the value of short-term debts to the budget, counterparties, and employees, the repayment period of which does not exceed 12 months.

Other short-term liabilities - the value of short-term liabilities that cannot be attributed to other balance sheet lines, with a maturity not exceeding 12 months. In the event that this is a partial payment for supplies, VAT should be deducted.

Based on the results of the completed lines, the final result for assets and liabilities is calculated, after which these two values are compared.

The balance sheet for small businesses for 2014 can be found at the end of the article.

Sample of filling out a statement of financial results (profit and loss)

For each line of the report, you must indicate data for the reporting year and for the same period of the previous year.

The header of the report is filled out in the same way as the profit and loss report Form 2.

The income statement itself contains the following lines:

Volume of revenue – income from core activities, from which VAT and excise tax have been deducted (export customs duties should not be deducted).

Expenses for core activities - the volume of all expenses for business activities without division into cost, administrative and commercial expenses (deductions and minus indicators must be indicated in parentheses).

Interest required to be paid - the amount of all interest that is required to be paid on loans, credits, minus those that are included in the cost of investment assets.

Other income - rent, you can deduct expenses that relate to this section of income.

Other expenses – expenses in connection with the rental of individual objects or write-off of fixed assets.

Income tax is the volume of current income tax, deferred tax liabilities and assets (the law allows not to calculate deferred taxes, asset liabilities).

Net profit is the total profit or loss (excluding tax).

Regulatory authorities may require attachments to the financial results report:

- on cash flow;

- on changes in the volume of fixed capital;

- other explanations.

If all key indicators are fully disclosed in the balance sheet, no appendices are required. Small businesses submit reports not only to the tax office, but also to statistical authorities. The financial statements of a small enterprise are considered prepared only after they have been signed by the manager on a paper copy (an accountant’s signature is not required). The signature must contain a number.

Requirements for filling out a simplified balance sheet

The annual balance sheet must contain data on the assets and liabilities that the organization has at the end of the reporting year, that is, as of December 31. Additionally, information on previous years is entered into the balance sheet, that is, as of December 31 of last year and as of December 31 of the year before. For example, the balance sheet prepared by an enterprise for 2021 must contain data as of December 31, 2017, December 31, 2021 and December 31, 2015.

All last year's information is taken from last year's reports. And for indicators for the current year, information is taken from sources such as:

- The balance sheet for the organization as a whole for the reporting year;

- Indicators of accrued interest on credits (loans) for the reporting year.

Due date and accountant's responsibility

The deadlines for submitting reports in a simplified form are no different from the deadlines for submitting documentation of such a plan in the usual form. For example, you must submit a simplified form for 2021 before April 2, 2021. If the authorized person is late and does not submit a report to the regulatory authorities on time, then he will bear administrative responsibility. Administrative liability is expressed in the accrual of a fine equal to 1000 rubles.

But it is better to avoid such cases, since additional checks are of no use to the company.

Similar articles

- Small business: eligibility criteria 2018

- Composition of financial statements 2021 for small businesses

- Balance sheet for 2021 form

- Accounting statements of small businesses 2017

- Accounting statements for 2021 under the simplified tax system

How to correct the balance

In accounting, errors must be corrected according to different rules, depending on whether these errors are significant or not. But small enterprises can correct any errors that were discovered after the approval of the financial statements as insignificant (clause 9 of PBU 22/2010). If such a rule is fixed in the accounting policy, then all errors can be corrected in the current period. That is, in the one in which they were identified (clause 14 of PBU 22/2010).

Possible wording for correcting errors: “The organization corrects significant errors identified after the approval of the annual financial statements by entries for the current period in the relevant accounting accounts in the month in which the error was identified, without retrospective recalculation.”

Balance sheet for small businesses (features)

If an organization does not apply the specified forms, then in the balance sheet, statement of financial results, report on the intended use of funds, it can include indicators only for groups of items (without detailing the indicators for items) (clause “a”, clause 6 of the Order of the Ministry of Finance of Russia dated 07/02/2010 N 66n, clause 27.1 of the Information of the Ministry of Finance of Russia dated 06/29/2016 N PZ-3/2016).

Attention! Religious organizations that did not have an obligation to pay taxes and fees during the reporting (tax) periods of the calendar year are not required to submit annual accounting (financial) statements to the tax authority

Simplified accounting (financial) statements (KND 0710096) >>>

Simplified form of balance sheet (OKUD 0710001) >>>

Simplified form of financial performance report (OKUD 0710002) >>>

Simplified form of a report on the intended use of funds (OKUD 0710006) >>>

The accountant determined the value of the indicator for line 2120 “Cost of sales” (for 2015) on the basis of data on the total debit turnover for 2015 in the subaccount “Cost of sales” of account 90 “Sales” in correspondence with account 20 “Main production”. The cost of services provided for 2015 amounted to RUB 634,943. The accountant transferred the indicator for line 2120 of the previous year from the Financial Results Report for 2014: – RUB 205,000. The organization did not attract borrowed funds. Accordingly, there is no income in the form of interest received. Therefore, line 2330 “Interest payable” of the Statement of Financial Results is not completed. There are no other income or other expenses in the organization. Therefore, lines 2340 “Other income” and 2340 “Other expenses” of the Statement of Financial Results are not completed.

Accounting statements for 2021

The vast majority of small businesses, incl. and applying the simplified tax system, prepares financial statements using simplified forms.

According to Part 4 of Article 6 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, and in accordance with paragraphs. “a” clause 6 of the Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n, as well as in accordance with clause 27.1 of the Information of the Ministry of Finance of Russia dated 06/29/2016 No. PZ-3/2016, the decision to use a simplified form of accounting statements is made by each organization independently. In this case, your choice must be recorded in the accounting policy of the organization (clause 4 of PBU 1/2008).

By virtue of the law, simplified financial statements of small businesses for 2021 include only two forms:

- Balance sheet;

- Income statement.

Let us also note that these forms can be filled out in a simplified form by small businesses, incl. and applying the simplified tax system. The simplification lies in the fact that all indicators are given only for groups of articles, without detailing them for specific articles.

Small businesses, incl. and those applying the simplified tax system, in cases where it is necessary to indicate the most important information, without knowledge of which it is impossible to correctly assess both the economic position of the enterprise and its financial success, they independently decide to include in the financial statements a statement of changes in capital and a statement of cash flows , as well as the necessary attachments to the reporting forms (clause “b”, clause 6 of the Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n; clause 26 of the Information of the Ministry of Finance of Russia dated 06/29/2016 No. PZ-3/2016; Letter of the Federal Tax Service of Russia dated 20.02. 2017 No. SD-4-3/ [email protected] ). Each organization must consolidate its decision on the choice of reporting forms in its accounting policies.

We have decided on the forms of financial statements. But at the same time, there is also tax reporting in the form of a declaration. What is the relationship between accounting and tax reporting indicators?

Let us say right away that there are no clear correlations between the indicators of the financial reporting forms and tax returns, because these indicators are formed according to different rules.

However, in practice, small businesses that use the simplified tax system are often faced with the fact that tax inspectors quite often find discrepancies between certain indicators of accounting and tax reporting and draw the attention of taxpayers to this.

GOOD TO KNOW:

The information in the reporting must be reliable. Accounting (financial) statements must be prepared on the basis of data contained in accounting registers, as well as information determined by federal and industry standards.

The fact is that the tax declaration paid in connection with the application of the simplified tax system was approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] , and the control ratios to the tax return were sent by letter of the Federal Tax Service of Russia dated May 30, 2016 No. SD-4-3/ [email protected]

Thus, if the object of taxation is “income,” then line codes 110-113 in section 2.1.1 of the declaration “Calculation of tax paid in connection with the application of the simplified taxation system” indicate the amount of income received by the taxpayer on an accrual basis for the entire tax period. And this is the tax base for calculating the “simplified” tax.

If the object of taxation is “income minus expenses”, then according to the line codes 210-213 of section 2.2 of the declaration “Calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax...” the amounts of income received are also indicated on an accrual basis for the entire tax period.

In this case, the procedure for determining income for tax purposes must comply with the requirements established by Art. Art. 346.15 and 346.17 of the Tax Code of the Russian Federation and satisfy the standards prescribed in paragraphs 1 and 2 of Article 248 of the Tax Code of the Russian Federation.

We emphasize that the indicated income in the tax accounting of the “simplified” tax system is taken into account on a cash basis, but the income specified in Article 251 of the Tax Code of the Russian Federation is not taken into account at all when determining the tax base.

Annual financial statements, including when applying the simplified tax system, are drawn up in accordance with the requirements established by Articles 13, 14 and 15 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

As a result, as we see, the legislation establishes different approaches to the preparation of tax and accounting reporting, so discrepancies are possible in determining individual indicators reflected in tax and accounting reporting.

GOOD TO KNOW:

One of the important points contributing to the discrepancy in indicators is that, in accordance with PBU 9/99, in accounting, income is recognized on the accrual basis, which is used by the vast majority of “simplified”.

Simplified balance sheet: example of filling

For example, if a company has the most accounts receivable at the end of the reporting period, then code 1230 is entered in the line “Financial and other current assets” in the balance sheet (see example of filling out a balance sheet for a small enterprise below).

Simplified balance sheet for small businesses: instructions for filling out

Let's start with the Balance Sheet Asset. It consists of five sections and the balance sheet currency for the Asset section (line 1600). The Asset reflects all the company’s property, which is divided into current and non-current assets.

The line “Tangible non-current assets” reflects data on fixed assets. These can be buildings, structures, transport, etc. The balance of accounts 01 and 03 is entered here minus the balance of account 02, and expenses for construction in progress (account 08) are also added.

In the line “Intangible, financial and other non-current assets” the value of intangible assets is formed (these include: scientific works, works of art, computer programs, inventions, etc.), deposit balances are reflected (account 55), long-term investments ( account 58), as well as the debit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

Filling out the “Inventories” line of the simplified balance sheet does not differ from the generally accepted filling out of financial statements. Inventories take into account the cost of raw materials and materials not transferred to production, but recorded in the debit of accounts 10, 15, 16, the cost of finished products reflected in the debit of accounts 43 and 45, the amount of costs for work in progress recorded in accounts 20,23,29 and so on.

The line “Cash and cash equivalents” indicates the presence of the company’s funds in Russian rubles and foreign currency, which are available in the accounts or at the cash desk of the enterprise, as well as cash equivalents. The account balance is reflected: 50, 51, 52, 55 (except for the amounts reflected on lines 1170 and 1240), 57.

The line “Financial and other current assets” displays information about short-term financial investments (account 58), accounts receivable claimed for VAT, but not accepted for deduction, the amount of excise taxes and other current assets of the organization.

In the currency of the asset, this is line 1600, indicating the sum of all the indicators discussed above. It reflects all the company's assets.

The liability side of the simplified balance sheet consists of 6 sections and reflects the sources of the company’s funds. Sources come in the form of own funds, they are reflected in the line “Capital and reserves” and include information about the authorized and additional capital, the reserve fund and retained earnings. Data for accounts 80 (minus the debit balance of account 81), 82, 83 and 84 is entered here.

Companies also attract borrowed funds, which are recorded in the line “Long-term borrowed funds.” Here is the debt on long-term loans and borrowings (account 67). Long-term are understood as liabilities with a maturity period of more than 1 year. This line reflects the balance of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76. And there is also “Short-term borrowed funds”, it reflects the balance of account 66.

The title of the line “Accounts payable” fully reveals its essence. This contains the credit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

The line “Other short-term liabilities” may well not be filled in if all the information has already been indicated.

The line indicator 1700 reflects the total amount of the organization's liabilities. The results of the Asset and Liability must be equal.

Profit and balance

Any enterprise and production must generate revenue. In the BB, revenue is reflected in a special way, since there is no line for it. Revenue is recorded in a special document - a statement of financial results. Such obligations have a balance upon registration.

However, revenue is credited to the BB based on a number of indicators. It is by them that it is determined whether production is profitable and whether the company has revenue. Moreover, revenue is indirectly determined in different sections. If in the first section there was a decrease in intangible assets, then revenue was received.

It is by changes of this kind that one judges whether companies of small, medium and other formats received revenue. In this case, the revenue itself is not reflected in the document. To a person who does not understand accounting, it may seem that there is no revenue in the BB. However, a specialist monitors revenue even by indirect parameters.

After all, the definition is based on basic criteria. This determination is the responsibility of accountants. After all, if production is profitable, then you can and should cooperate with such a company.

Who works for the simplified tax system in 2021

The use of a simplified regime by organizations and individual entrepreneurs is possible if a number of requirements

:

The transition to a simplified tax regime is possible after submitting an application to the Federal Tax Service: within 30 days

from the moment of termination of activity with payment of UTII and until the end of the current year in other cases.

In addition, the income received for the first 3 quarters of the current year should be summed up: they should not exceed a fixed amount of 112,500,000 rubles

.

Until 2021, the limit was calculated as multiplying the deflator coefficient by the income limit established for the previous period. From the beginning of 2021, the deflator is subject to freezing

, and from 2021 it will be

equal to one

.

In case of non-compliance with any requirement, the business entity loses the right to apply the simplified tax system and is obliged to switch to the general taxation regime from the beginning of the quarter in which the violation occurred.

The balance sheet, as one of the reporting forms of the simplified regime, must be submitted to the Federal Tax Service and Rosstat

before April 1 of the following year

.

Failure to submit the reporting form is fraught with administrative liability: a fine of 200 rubles

for an overdue document for the tax authorities and

up to 5,000 rubles

for statistical authorities.

A distinctive feature of the simplified balance sheet is the reflection of financial information enlarged

: Each row contains the aggregate information of an entire group of items. Rounded values are indicated in thousands or millions of rubles.

The balance sheet formed by the simplifier contains two sections

– active and passive articles.

An asset

characterizes the subject’s property, its composition and value.

The passive,

in turn, reveals the sources through which the property was acquired.

An indispensable condition is the equality of assets and liabilities.

The document is formed on an accrual basis as of the reporting date in dynamic comparison with data from similar periods of previous years: the 2021 balance sheet will contain information as of the end of the current year, December 31, 2021 and 2021.

Before drawing up form 0710001, it is necessary to close (reform) accounts 90, 91 and 99 with the formation of a final balance, which will subsequently serve as the basis for the balance sheet.

The procedure for filling out a simplified statement of financial results

| Report line | Accounting account |

| 2110 "Revenue" | Difference of indicators: · Turnover on the credit of the “Revenue” subaccount to the “Sales” account · Turnover by debit of the “VAT” subaccount to the “Sales” account |

| 2120 “Expenses for ordinary activities” | Amount by debit of subaccounts to account 90 “Sales”, on which accounting is kept: · Cost of sales · Business expenses · Administrative expenses |

| 2330 “Interest payable” | The amount of accrued interest on loans for the current year is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2340 “Other income” | Difference of indicators: · Turnover on the credit of the subaccount “Other income” to account 91 “Other income and expenses” · Turnover on the debit of the “VAT” subaccount to account 91 “Other income and expenses” |

| 2350 “Other expenses” | Difference of indicators: · Turnover on the debit of the subaccount “Other expenses” to account 91 “Other income and expenses” · Indicator for line 2330 “Interest payable” The indicator is indicated in brackets, no minus sign is used. |

| 2410 “Profit taxes (income)” | · If an organization pays income tax, then the value of line 180 of sheet 02 of the income tax declaration is recorded · If the organization is on the simplified tax system (income), then indicate the difference in indicators on lines 133 and 143 of section 2.1.1 of the declaration according to the simplified tax system · If the organization is on the simplified tax system (income minus expenses), then indicate the indicator on line 273 of section 2.2 of the declaration under the simplified tax system. When paying the minimum tax, the indicator is indicated on line 280 of section 2.2 of the declaration according to the simplified tax system. · If the organization is on UTII, then the amount of UTII for all quarters is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2400 “Net profit (loss)” | Calculate the value as follows: page 2110 – page 2120 – page 2330 + page 2340 – page 2350 – page 2410 |

Simplified accounting and reporting are not related to taxation. It can be conducted by companies both using the simplified tax system and other modes, including the general one. This opportunity is provided to small businesses, non-profit organizations (except for foreign agents) and Skolkovo participants. In the article we will answer the question of whether it is necessary to submit the balance sheet of an LLC under the simplified tax system in 2021, as well as individual entrepreneurs and non-profit organizations.

The simplified requirements for legal entities are stricter: among other things, the value of their depreciable fixed assets on the balance sheet cannot exceed 100 million rubles.

The balance sheet for an LLC using the simplified tax system for 2021 can be compiled according to the simplified scheme provided for by Federal Law No. 402 and Order of the Ministry of Finance dated July 2, 2010 No. 66n. However, the detail of reporting is left to the discretion of the LLC: full and short versions are acceptable. What balance does the LLC submit to the simplified tax system? Read about it below.

Small business reporting: with or without applications?

You are well aware that the classic financial statements of a commercial organization for the year include : - balance sheet; - Profits and Losses Report; — Appendixes to the balance sheet and profit and loss account: — statement of changes in capital; — cash flow statement; — explanations (explanatory note). For companies subject to mandatory audit, an auditor's report is added to this set. But among small businesses there are few of them. Regulations on accounting and reporting No. 34n directly allow small business organizations not to submit appendices to the balance sheet and profit and loss account. The same norm was in the now unapplied Order No. 67n on reporting forms (Clause 85 of the Regulations, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n; clause 3 of the Instructions, approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n). The current Order No. 66n seems to be more strict - applications must be submitted, but they only reflect information that is extremely important for understanding the financial condition of clause 6 of Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). So should we present applications based on the results of 2011 or not? What is more important - Regulation No. 34n or Order No. 66n? These questions can be answered without knocking the mentioned documents against each other. Who, besides you, will check the importance of this or that indicator? Who, besides you, can determine how accurately reporting without attachments reflects the financial position of the organization? Consequently, a small enterprise, even at the end of 2011, may not submit appendices to the balance sheet and profit and loss account if it can explain that the statements are reliable without them. To finally solve the problem, we asked a question to a specialist from the Ministry of Finance.

From authoritative sources Igor Robertovich Sukharev, Head of the Accounting and Reporting Methodology Department of the Department for Regulation of State Financial Control, Auditing, Accounting and Reporting of the Ministry of Finance of Russia “A small enterprise must comply with PBU 4/99: if information is needed to understand the financial position of the organization, it must be you have to imagine. Therefore, on the issue of the need for appendices to the balance sheet and profit and loss account, I would give priority to Order No. 66n, since it corresponds to PBU 4/99. And the Regulations approved by Order No. 34n apply only in cases where otherwise is not established by other provisions (Clause 32 of the Regulations, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). The reporting system for small businesses is a set of standards that are applied at the discretion of the organization. Yes, there are simplifications for small businesses. But when generating reports, you must at least explain exactly what simplifications you have applied. Without this information, reporting will be incomprehensible. For example, an income statement prepared on a cash basis must be accompanied by an indication of this fact. In addition, disclosures may be necessary when significant transactions or events occur that are not reflected in the reports provided. For example, at the end of the year the company broke even or even made a loss. But the balance sheet at the end of the year shows huge net assets. Where did they come from? Maybe the participants contributed something. But the reporting user does not know this without explanation. And if you do not report changes in capital, you must at least describe the receipts from participants. That is, in such situations, additional information should be disclosed.”