Data structure in the notification of controlled transactions in the form of the Federal Tax Service and in 1C

In accordance with paragraph 2 of Art.

105.16 of the Tax Code of the Russian Federation, subjects of controlled transactions (or equivalent to such) must send a notification to the Federal Tax Service reflecting information on these transactions by May 20 of the year following the reporting year. In 2021, May 20 falls on a work environment, which means there will be no postponements and you need to report on time.

Find out which transactions are considered controlled from the publication.

ATTENTION! In 2021, for 2019, the notification is submitted on a new form, as amended by the order of the Federal Tax Service of Russia dated July 26, 2019 No. ММВ-7-13/ [email protected] The changes in the new form are technical. They take into account last year’s amendments on controlled transactions (the criteria by which transactions are classified as controlled were adjusted, and fewer transactions became subject to price control).

notifications can be found at the link below.

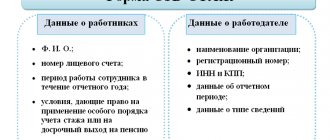

The notification of controlled transactions approved by the Federal Tax Service consists of the following main elements:

- 2 sheets reflecting information about the taxpayer;

- sections 1A and 1B, reflecting information about the taxpayer’s controlled transactions;

- sections 2 and 3, reflecting information about counterparties with whom the taxpayer entered into legal relations.

Modern accounting programs, such as 1C, allow you to fill out a notification form for controlled transactions by entering the above types of data into special forms in the software interface. After the user has entered all the data, the software automatically transfers them to the fields corresponding to sections 1A, 1B, 2 and 3 and generates a document identical to the form developed by the Federal Tax Service. It can be printed, signed and sent to the tax office.

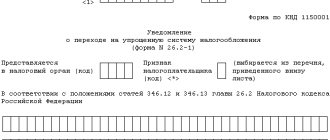

The notification in question can be submitted to the Federal Tax Service in electronic form, but for this, the payer must have a qualified electronic signature (or ESP) as well as appropriate software for sending a file with the ESP via the Internet.

Regardless of the method of generating a notification of controlled transactions (direct data entry into the form or through 1C), taxpayers have difficulty filling out sections 1A, 1B, 2 and 3 of the relevant document. Difficulties are associated primarily with determining a specific list of facts reflected in the notification.

Let's consider what information should be indicated in the document.

Who must report (give notice) for 2021?

In 2021, notifications must be submitted to the Federal Tax Service by organizations and individual entrepreneurs that had controlled transactions in 2021 (Clause 1 of Article 105.16, Article 105.14 of the Tax Code of the Russian Federation).

Controlled transactions are certain transactions between related parties and transactions equivalent to transactions between related parties (Article 105.14 of the Tax Code of the Russian Federation). Such transactions, in particular, include transactions for which the annual amount of income exceeds 60 million rubles. and at the same time, two conditions are met simultaneously (clause 4, clause 2, clause 3, article 105.14 of the Tax Code of the Russian Federation):

- the place of registration/residence/residence of all parties to the transaction is the territory of the Russian Federation;

- one of the parties to the transaction is a profit tax payer, and the other is not.

Notification of controlled transactions for 2021 is sent to the Federal Tax Service (Clause 2 of Article 105.16 of the Tax Code of the Russian Federation):

- at the location of the organization;

- at the place of residence of the individual entrepreneur.

We indicate information about controlled transactions in sections 1A and 2B: nuances

Section 1A contains information on each controlled transaction concluded by the taxpayer during the reporting period (or a set of similar transactions), as well as information on the financial conditions of the relevant transactions. You need to fill out as many sheets of Section 1A as there are transactions (or sets of similar legal relations) that have been concluded.

For most information, coding elements are used. Codes for filling out sections of the notification should be found in Appendix No. 1 to the procedure for filling out the notification, approved. by order of the Federal Tax Service dated 05/07/2018 No. ММВ-7-13/ [email protected]

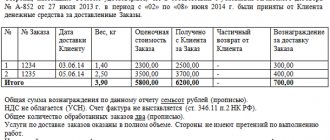

Section 1B records information about the subject of each of the controlled transactions reflected in section 1A. That is, information about those goods, services or work that were supplied or received by the taxpayer. Here are indicated, in particular:

- names of goods, works and services;

- dates and numbers of contracts for their supply;

- places of signing contracts (dispatching goods);

- the number of goods, works and services supplied and their contract price excluding VAT and other charges;

- total contract amount;

- the date of fulfillment of obligations under the transaction (determined on the basis of the income recognition mechanism adopted in the company’s accounting).

The total number of completed sheets in Section 1B must be equal to the number of transactions reflected in Section 1A (or groups of similar transactions).

When an interest-free loan is considered a controlled transaction, find out from the article.

From the Federal Tax Service to the Federal Tax Service

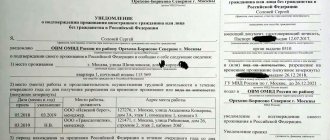

Not everyone knows that notifications are checked by Federal Tax Service specialists, although the form must be submitted to your tax office. Organizations submit notifications of controlled transactions to the inspectorate at their location within the established deadline. Entrepreneurs (notaries, privately practicing lawyers) report at their place of residence.

The tax office will transfer the report received from the taxpayer to the Federal Tax Service within 10 business days from the date of receipt.

As for the largest taxpayers, they predictably submit a notice of controlled transactions within the filing deadline established by law to the inspectorate, where they are registered as the largest taxpayers.

An organization that meets the criteria specified in Appendix 1 to the order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/308 is recognized as the largest taxpayer. One of the main criteria is the total amount of income received, determined from the annual profit and loss report. Such companies are administered either at the federal or regional level.

Filling out sections 2 and 3: what to pay attention to

If the taxpayer entered into a transaction with a counterparty in the status of a legal entity, then for this transaction he must fill out section 2 of the notification. If the contract is signed with a counterparty in the status of an individual, Section 3 of the notification must be completed. The structure of sections 2 and 3 is almost identical.

In column 015 of section 2 or 3 the same figure must be recorded as indicated in column 050 of section 1B. This is the serial number of the counterparty. The taxpayer determines it independently, for example, based on the order in which contracts are concluded.

Similarly, in column 010 of section 2 or 3, the same figure is recorded as indicated in column 010 of section 1A. It corresponds to the serial number of the transaction and is also determined by the taxpayer independently.

In general, the number of sheets in section 2 or 3 corresponds to the number of sheets in sections 1A and 1B. In practice, the number of controlled transactions and counterparties a company can have is very large, so indicating each individual transaction in a document can be an extremely labor-intensive process.

But taxpayers have the opportunity to reflect transactions of the same type in the notification - and this is a significant help for them in terms of saving time. However, the firm must have compelling reasons to group transactions into one group.

Let's study the main criteria for classifying transactions recorded in a notification as similar.

Similar transactions: what are their criteria?

Ideally, the Federal Tax Service is required to provide notifications of controlled transactions, reflecting all business transactions in as much detail as possible (letter of the Federal Tax Service of the Russian Federation dated August 30, 2012 No. OA-4-13/14433). But in practice, this wish of the tax authorities is obviously difficult to implement: the number of unique business transactions per legal entity, especially if it is a large business, can amount to tens of thousands.

Therefore, it makes sense for firms to take advantage of the opportunity to combine transactions of the same type into groups based on their similarity in type of goods, as well as comparability in financial conditions (clause 5 of Article 105.7 of the Tax Code of the Russian Federation). But the criteria for classifying transactions as similar, given in the Tax Code of the Russian Federation, are quite superficial, and their interpretation in the taxpayer’s version may not coincide with the approach of the Federal Tax Service (formed at the level of official instructions and understanding of the essence of transactions by a specific inspector).

What criteria should be considered objective?

The Ministry of Finance of the Russian Federation, in letter No. 03-01-18/33520 dated August 16, 2013, recommends merging transactions if they are similar in terms of profitability indicators, determined in accordance with the provisions of Art. 105.8 Tax Code of the Russian Federation. For example, the sale of vegetables and fruits has approximately the same profitability, regardless of the specific type of product sold.

The Office allows the following not to be indicated in the notification about a group of transactions:

- prices per unit of goods or services,

- number of goods and services supplied,

- the place where the transaction was concluded or the goods were sent.

But the form, as the Ministry of Finance notes, must record the names of groups of similar transactions, the amount of income received from them, as well as the pricing method.

Please note that the structure of the notification form does not allow grouping transactions for the supply of similar or even identical goods secured by different contracts with the same supplier. The fact is that in columns 060 and 065 of section 1B, in any case, the date and number of the specific agreement are indicated.

Thus, taking into account the position of the Ministry of Finance, similar transactions can be grouped if they:

- reflect supplies of goods with the same profitability;

- delivered under one contract.

Commentary on Article 105.16 of the Tax Code of the Russian Federation

1. The commented article provides for and regulates the procedure for taxpayers to send notifications to the tax authorities about the controlled transactions they have completed in a calendar year, specified in Art. 105.14 of the commented chapter. The explanatory note to the bill, which proposed to include section V.1 in part one of the Tax Code of the Russian Federation, noted that the obligation of taxpayers to provide information about controlled transactions to the tax authorities is generally accepted in foreign countries with developed tax legislation; It is assumed that the submission by taxpayers of notifications of controlled transactions will contribute to the formalization of data on events and transactions that are the subject of tax control, the use of transfer pricing in order to minimize taxes, as well as improve financial discipline.

In accordance with Part 7 of Art. 4 of the Federal Law of July 18, 2011 N 227-FZ, the provisions of the commented article before January 1, 2014 are applied in cases where the amount of income from all controlled transactions made by the taxpayer in a calendar year with one person (several of the same persons, being parties to controlled transactions) exceeds, respectively: in 2012 - 100 million rubles; in 2013 - 80 million rubles (these rules also apply to Articles 105.15 and 105.17 of the first part of the Tax Code of the Russian Federation, regarding the term “several of the same persons who are parties to controlled transactions” see commentary to Article 105.15 of the Tax Code of the Russian Federation ).

As reported in the letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated March 2, 2012 N 03-01-10/1-24 <1>, in 2012 taxpayers are not required to send notifications about controlled transactions to the tax authorities. At the same time, reference was made to the norm of Part 5 of Art. 4 of the Federal Law of July 18, 2011 N 227-FZ, based on which the provisions of the commented article apply to transactions for which income and (or) expenses are recognized in accordance with Chapter. 25 “Organizational profit tax”, part two of the Tax Code of the Russian Federation from the date of entry into force of the specified Federal Law (i.e. from January 1, 2012), regardless of the date of conclusion of the relevant agreement. ——————————— <1> ATP.

In letters of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated March 11, 2012 N 03-01-18/1-26 <1> and dated March 19, 2012 N 03-01-18/2-32 <2> It was noted that in the case where a transaction is not recognized as controlled in accordance with Art. 105.14 of the Tax Code of the Russian Federation (for example, in the case when the amount of income from transactions (the sum of transaction prices) specified in subclause 1 of clause 2 of this article in 2012 does not exceed 3 billion rubles or for some other reason), the provisions of the commented article do not apply to such transactions. ——————————— <1> ATP.

<2> ATP.

2. The provisions of paragraph 2 of the commented article determine the procedure for taxpayers to send notifications about controlled transactions to the tax authorities:

notifications about controlled transactions must be sent by the taxpayer to the tax authority at the place of his location (for an organization) or place of residence (for an individual) no later than May 20 of the year following the calendar year in which the controlled transactions were carried out;

taxpayers, in accordance with Art. 83 parts of the first Tax Code of the Russian Federation classified as the largest, submit notifications of controlled transactions to the tax authority at the place of registration as the largest taxpayers.

The concept of place of residence of an individual is defined in paragraph 2 of Art. 11 of part one of the Tax Code of the Russian Federation (as amended by Federal Law No. 229-FZ of July 27, 2010) <1> as follows: address (name of a subject of the Russian Federation, district, city, other populated area, street, house number, apartment), according to which the individual is registered at the place of residence in the manner established by the legislation of the Russian Federation; if an individual does not have a place of residence on the territory of the Russian Federation, for the purposes of this Code, the place of residence may be determined at the request of this individual at the place of his residence; in this case, the place of residence of an individual is recognized as the place where the individual resides temporarily at the address (name of a subject of the Russian Federation, district, city, other populated area, street, house number, apartment) at which the individual is registered at the place of stay in the manner established by law RF. ——————————— <1> NW RF. 2010. N 31. Art. 4198.

Location of the legal entity in accordance with clause 2 of Art. 54 of Part 1 of the Civil Code of the Russian Federation (hereinafter as amended by the Federal Law of March 21, 2002 N 31-FZ) <1> is determined by the place of its state registration. It also provides that state registration of a legal entity is carried out at the location of its permanent executive body, and in the absence of a permanent executive body - another body or person authorized to act on behalf of the legal entity without a power of attorney. ——————————— <1> NW RF. 2002. N 12. Art. 1093.

The criteria for classifying organizations - legal entities as the largest taxpayers subject to tax administration at the federal and regional levels were approved by Order of the Federal Tax Service of Russia dated May 16, 2007 N MM-3-06 / [email protected] <1>, and Peculiarities of registering the largest taxpayers - by Order of the Ministry of Finance of Russia dated July 11, 2005 N 85n <2>. According to clause 1 of these Features, registration of the largest taxpayer is carried out in the interregional (interdistrict) inspectorate of the Federal Tax Service of Russia for the largest taxpayers, the competence of which includes tax control over compliance by this largest taxpayer with legislation on taxes and fees. ——————————— <1> Economy and life. 2007. N 23.

<2> RG. N 179. 2005. August 16.

As provided in paragraph 2 of the commented article, notifications of controlled transactions can be submitted to the tax authority at the choice of taxpayers on paper or in established formats in electronic form. This rule is established by analogy with the provisions of paragraph 3 of Art. 80 of part one of the Tax Code of the Russian Federation (hereinafter as amended by the Federal Law of December 30, 2006 N 268-FZ) <1>, according to which the tax return (calculation) is submitted to the tax authority at the place of registration of the taxpayer (tax payer, tax agent ) in the established form on paper or in established formats in electronic form, together with documents that, in accordance with this Code, must be attached to the tax return (calculation). At the same time, no analogy was used with other provisions of this paragraph, which establish the obligation to submit tax returns (calculations) to the tax authorities in established formats in electronic form in relation to taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as taxpayers classified as in accordance with Art. 83 of this Code to the largest category. ——————————— <1> NW RF. 2007. N 1 (part 1). Art. 31.

The powers to approve forms (formats) of notification of controlled transactions, as well as the procedure for filling out the form and the procedure for submitting notification of controlled transactions in electronic form, the federal legislator in paragraph 2 of the commented article delegated to the federal executive body authorized for control and supervision in the field of taxes and fees, i.e. Federal Tax Service of Russia (see commentary to Article 105.3 of the Tax Code of the Russian Federation). At the same time, the federal legislator ordered the Federal Tax Service of Russia to exercise these powers in agreement with the Ministry of Finance of Russia. Thus, we should expect the publication of a corresponding order by the Federal Tax Service of Russia. On the official website of the Federal Tax Service of Russia, nalog.ru, in the “Documents” section, on February 21, 2012, a draft Order of the Federal Tax Service “On approval of the forms and formats of notification of controlled transactions, provided for in paragraph 2 of the commented article, as well as the procedure for filling out the notification form of controlled transactions” was posted transactions and the procedure for submitting notifications of controlled transactions electronically via telecommunication channels" for conducting an independent anti-corruption examination.

Along with other things, paragraph 2 of the commented article provides for the right of the taxpayer, in the event of detection of incomplete information, inaccuracies or errors in filling out the submitted notification of controlled transactions, to send an updated notification. This rule is established by analogy with the provisions of paragraph 1 of Art. 81 of Part 1 of the Tax Code of the Russian Federation (hereinafter as amended by Federal Law No. 137-FZ of July 27, 2006), according to which, if a taxpayer discovers inaccurate information in the tax return submitted by him to the tax authority, as well as errors that do not lead to an understatement amount of tax payable, the taxpayer has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner prescribed by this article. In this regard, it seems appropriate to draw an analogy with the provision of the specified paragraph, which establishes that an updated tax return submitted after the expiration of the established deadline for filing the return is not considered submitted in violation of the deadline.

3. Paragraph 3 of the commented article defines a list of information that must be contained in information indicated in notifications of controlled transactions submitted by taxpayers to the tax authorities. It should be emphasized that the list of such information is formulated as exhaustive.

As noted in paragraph 1 of the letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated November 28, 2011 N 03-01-07/5-14, disclosure of information about the methods used, provided for in Chapter 14.3 of Part One of the Tax Code of the Russian Federation, in the notification Clause 3 of the commented article does not provide for controlled transactions; documentation containing the specified information may be requested from the taxpayer by the Federal Tax Service of Russia no earlier than June 1 of the year following the calendar year in which the controlled transactions were carried out, in the manner established by Art. 105.15 of this Code; Thus, this Code does not provide for the preliminary declaration by the taxpayer of the choice of pricing method.

4. The norm of paragraph 4 of the commented article provides that the information specified in paragraph 3 of this article, to be indicated in notifications of controlled transactions submitted by taxpayers to the tax authorities, can be prepared for a group of similar transactions. Homogeneous transactions for the purposes of the commented chapter in accordance with clause 5 of Art. 105.7 of Part One of the Tax Code of the Russian Federation recognizes transactions the subject of which may be identical (homogeneous) goods (work, services) and which were concluded under comparable commercial and (or) financial conditions (see commentary to this article).

5. In accordance with the norm of paragraph 5 of the commented article, the tax authority that received the notification of controlled transactions is obliged to send this notification to the Federal Tax Service of Russia. At the same time, it is directly established that the notification must be sent electronically.

The obligation in question must be fulfilled within 10 days from the date the tax authority receives notification of controlled transactions. Taking into account the norm of paragraph 6 of Art. 6.1 of Part 1 of the Tax Code of the Russian Federation (as amended by Federal Law No. 137-FZ of July 27, 2006) refers to working days. As defined in this norm, a working day is considered a day that is not recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday.

6 - 7. The provisions of paragraphs 6 and 7 of the commented article determine the consequences of detection by the tax authority conducting a tax audit of facts of controlled transactions, information about which was not provided in accordance with paragraph 2 of this article:

the said tax authority is obliged to independently notify the Federal Tax Service of Russia about the fact of identifying controlled transactions and send the received information about such transactions to the Federal Tax Service of Russia. The authority to approve the form of the notice and the procedure for sending it is vested in the Federal Tax Service of Russia. Thus, we should expect the publication of a corresponding order by the Federal Tax Service of Russia;

the said tax authority is also obliged to notify the taxpayer about sending the notice and relevant information to the Federal Tax Service of Russia. Notification must be made no later than 10 days from the date the notice was sent. Similar to what was said above, it should be noted that we are talking about working days;

The sending by the specified tax authority of the information received by it about controlled transactions to the Federal Tax Service of Russia is not an obstacle to the continuation and (or) completion of such an audit and the adoption of a decision based on the results of consideration of the tax audit materials in the prescribed manner.

It should be noted that in order to ensure the implementation of the norms of the commented article, Federal Law of July 18, 2011 N 227-FZ introduced Art. 129.4, which provides for liability for such tax offenses as unlawful failure to submit a notification of controlled transactions, provision of false information in a notification of controlled transactions. In accordance with this article, the taxpayer’s unlawful failure to submit to the tax authority within the prescribed period a notice of controlled transactions completed in a calendar year, or the taxpayer’s submission to the tax authority of a notice of controlled transactions containing false information, entails a fine of 5,000 rubles.

Results

All firms that are subjects of controlled transactions must send notifications of controlled transactions to the Federal Tax Service by May 20 of the year following the reporting year. This source reflects data on the relevant transactions, as well as information about the counterparties of the company involved in them.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated July 26, 2019 N ММВ-7-13/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Please note the changes for 2019

From 2021, the criteria for controlled transactions will change. The Federal Tax Service warns taxpayers about this in its message dated December 28, 2018.

Changes to Article 105.14. The Tax Code of the Russian Federation, introduced by Federal Law No. 302-FZ of August 3, 2018, has reduced the number of controlled transactions.

Foreign trade transactions from January 1, 2021 are considered controlled if the amount of income on them for a calendar year exceeds 60 million rubles.

And domestic Russian transactions will be considered controlled if two criteria are simultaneously met:

- if the amount of income from such transactions for the corresponding calendar year exceeds 1 billion rubles;

- if the transactions satisfy the conditions specified in paragraph 2 of Article 105.14 of the Tax Code of the Russian Federation.

The following items have been added to the list of conditions specified in paragraph 2 of Article 105.14 of the Tax Code of the Russian Federation:

- if the parties apply different tax rates on profits from the activities within which the transaction was concluded;

- if income (expenses) from the transaction are taken into account when determining the tax base for the tax on additional income from the production of hydrocarbons.

The updated criteria apply to transactions for which income and (or) expenses are recognized when calculating income tax from January 1, 2021, regardless of the date of conclusion of the relevant agreement. Thus, the new criteria do not affect the conditions for generating a notification of controlled transactions for 2018. It must be compiled according to the previous rules.