Professional accounting for organizations and individual entrepreneurs in Ivanovo. We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

In 2021, the tariffs and amount of insurance premiums (as worded in Article 14 of Law No. 212-FZ) paid by insurance premium payers who do not make payments or other remuneration to individuals have not changed. But don’t let this mislead you into thinking that individual entrepreneurs will pay the same amount of contributions for themselves as in 2015. In ordinary language, the tariffs for individual entrepreneur contributions in the form of fixed payments and the formula for their calculation remain the same. However, in the mentioned formula there is such a constant as the minimum wage - minimum wage

.

And it just increased, and amounted to 6,204 rubles from January 1, 2021

. So, all individual entrepreneurs will have to pay more.

Not only will the base portion of fixed contributions paid by all entrepreneurs increase, but the amount of 1% on income exceeding 300 thousand rubles will also increase. More will need to be transferred to the Health Insurance Fund. Below you can find a detailed calculation for insurance premiums.

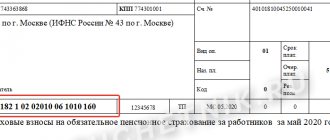

As for the budget classification codes that need to be written in payment orders and receipts for the transfer of insurance premiums in a fixed amount, here too in 2021 the Ministry of Finance of the Russian Federation made many changes with several orders. You can immediately in the form sent out by UPFR. And below, in the appropriate section, we have placed the BCC for fixed payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund (which have also become different).

Attention! You must pay insurance premiums in 2021 for 2021 and earlier periods according to the new BCC to the Federal Tax Service of the Russian Federation!

Insurance premiums for individual entrepreneurs for themselves in 2021 are fixed

Throughout the year (last day December 31, 2021), each individual entrepreneur registered in this status before 01/01/2016 is required to pay the following fixed insurance premiums for 2021:

- Fixed insurance contributions to the Pension Fund: 19,356.48

- Fixed insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund: 3,796.85

- not paid for 2021

The amounts of contributions are calculated based on the minimum wage applied from January 1, 2016, equal to 6,204 rubles.

Pension Fund: 6204 * 26% * 12 months. = 19,356.48 rubles.

FFOMS: 6204 * 5.1% * 12 months. = 3,796.85 rubles.

Contributions in the above amounts can be paid immediately, that is, in a lump sum, or they can be transferred every month or once a quarter.

In the latter case, the amounts paid during the reporting (USN 6%) or tax (UNDV) period can significantly reduce the amount of tax under special regimes, if the individual entrepreneur does not have employees. For these purposes, you can take the required amounts from the table below. Amounts of fixed insurance premiums for individual entrepreneurs for themselves in 2021

| Type of insurance premiums | In year | Per quarter | Per month | In a day |

| Fixed contributions to the Pension Fund | 19356,48 | 4839,12 | 1613,04 | 53,03 |

| Fixed contributions to the FFOMS | 3796,85 | 949,21 | 316,404 | 10,40233 |

Throughout the year, you can transfer any amounts in parts, even less than indicated in the table for a month or quarter. You will not be charged any penalties or fines for this. The main thing is that when you pay the last payments of the year, first add up all the previously transferred amounts. Subtract the contributions already paid from the amounts of fixed contributions for the year, and indicate on the payment slip or receipt exactly the remaining amount for both the Pension Fund and the Federal Compulsory Medical Insurance Fund.

To the Pension Fund of the Russian Federation, the entire amount of fixed contributions must be transferred in one payment using the KBK for payment of the insurance part of the labor pension (calculated from the amount of the payer’s income, not exceeding the income limit of 300,000 rubles). Even in the case where an individual entrepreneur has submitted an application to the Pension Fund for dividing insurance contributions into an insurance and funded part or for transferring the funded part of contributions to a non-state pension fund.

Procedure for insurance premiums

Insurance premiums are assessed by the payer himself within the framework of his taxation system and may vary depending on the level of income of a given entrepreneur. If his income exceeds a certain threshold, then in addition to the mandatory amount of the insurance contribution, he will also pay a certain percentage to the Pension Fund.

In this case, insurance premiums are paid by entrepreneurs monthly, until the fifteenth day. If this date falls on a weekend or holiday and payment needs to be made, it will be made on the next business day. But experts advise making payments in advance, because late payments will result in a fine. And if only him. For each late payment day, the entrepreneur may be obliged, or rather will be required to pay a penalty on the contribution, which has the following characteristics:

- Accrued daily

- Has a dependence on the CBR

- Must be paid without fail

Insurance premiums of individual entrepreneurs for themselves for 2015 in the amount of 1% over 300,000 rubles

If the total income (total for all types of activities and all tax regimes) of an individual entrepreneur for 2015 exceeded 300 thousand rubles, from the amount of income minus 300,000 rubles it will be necessary to transfer 1% of insurance contributions to the Pension Fund no later than April 1, 2021. However, there is an upper limit on the amount of such contributions.

The maximum amount of all fixed contributions to the Pension Fund for 2015: 148,886.40 rubles.

From this amount you need to subtract fixed contributions for all individual entrepreneurs (in 2015) - 18,610.80 rubles.

The maximum contribution amount of 1% to the Pension Fund for 2015: 130 275,60

rubles

If your 1% for 2015 from an amount of income over 300 thousand rubles turned out to be more than 130,275 rubles. 60 kopecks, then by April 1, 2021 you in any case must pay only 130,275.60 rubles and not a penny more! If you have already overpaid, you should write to the Pension Fund an application to offset the amount of overpayment against insurance premiums in 2021 (the application form has changed).

Attention!

We pay contributions in the amount of 1% of the excess income only to the Pension Fund!

From January 1, budget classification codes for insurance premium payers have been changed

11 January 2021 16:29

The amount of the fixed payment and the budget classification codes (BCC) for the payment of insurance premiums by payers who do not make payments to individuals (individual entrepreneurs, lawyers, notaries, heads of peasant farms and individuals) have been changed.

From January 1, 2021, the minimum wage (minimum wage) is set at 6,204 rubles. per month. Accordingly, the fixed amount for paying insurance premiums for compulsory pension insurance in 2021 will be 19,356 rubles. 48 kopecks (6204*12*26%), for compulsory health insurance - 3796 rubles. 85 kopecks (6204*12*5.1%). For payers who registered or de-registered during a calendar year, the amount of insurance premiums is calculated in proportion to the number of calendar months, starting from the calendar month of commencement of activity. For an incomplete month of activity, the fixed amount of insurance premiums is determined in proportion to the number of calendar days of this month.

The BCC for payment of insurance premiums for compulsory pension insurance, which was in force in 2015, has been cancelled. From January 1, 2016, fixed payment payers pay insurance premiums on income not exceeding 300 thousand rubles in 2021. on KBK 39210202140061100160 and with income over 300 thousand rubles. at KBK 39210202140061200160.

Debts for 2014 and 2015 are paid to the same BCC in the same manner. The arrears of penalties for 2014 and 2015 are paid to BCC 39210202140062100160.

To pay insurance premiums for compulsory health insurance, a new BCC 39210202103081011160 was introduced from January 1, 2021. Debt on insurance premiums for compulsory medical insurance for all periods is carried out to the same BCC. The debt on penalties is paid to KBK 39210202103082011160.

Insurance premiums for individual entrepreneurs for themselves for 2021 in the amount of 1% over 300,000 rubles

As soon as the total income of individual entrepreneurs for all types of activities carried out and for all tax regimes exceeds 300,000 rubles from the beginning of 2016, you can begin to pay fixed insurance contributions to the Pension Fund in the amount of 1% of the amount exceeding 300 thousand. But you don’t have to rush. It is enough to pay only the fixed contribution amounts established for all individual entrepreneurs by December 31, 2016. And the amount of 1% will need to be transferred no later than April 1, 2021, immediately or in parts.

Maximum amount of contributions to the Pension Fund for 2021: 154,851.84 rubles.

From this amount you need to subtract fixed contributions to the Pension Fund for all individual entrepreneurs - 19,356.48 rubles.

The maximum contribution amount of 1% to the Pension Fund for 2021: 135 495,36

rubles

If your 1% from the amount of income for 2021 over 300 thousand rubles turned out to be more than the above amount in bold, then until 04/01/2017 you in any case must pay only 135,495.36 rubles and not a penny more! If you suddenly overpaid, submit an application to the Pension Fund to offset the amount of the overpayment against the payment of fixed contributions in 2021. If the overpayment is significant, you can write a request for a refund of overpaid insurance premiums. However, these applications can only be submitted after the end of 2021. Application forms change from time to time, please note.

Attention!

We pay contributions in the amount of 1% of the excess income only to the Pension Fund!

For which contributions are thresholds relevant?

The most frequently considered threshold value is the level of annual income of 300 thousand rubles, since when income reaches this mark, it becomes relevant for individual entrepreneurs to consider a new formula for calculating a fixed insurance contribution for pension insurance.

When the entrepreneur’s income does not reach the threshold amount or is equal to it, then the calculation of contributions is simple. The minimum wage is multiplied by the interest rate, and then by the number of workers for a given individual entrepreneur months.

If the individual entrepreneur has high income, then the contribution amount will increase accordingly. But how much depends on the income itself. Indeed, to determine the amount added to the standard formula, they do not use the entire amount of income, but the amount by which it exceeds 300 thousand.

So, if an individual entrepreneur has an income greater than 300 thousand, then to determine the amount of the contribution he will need the following indicators:

- The current minimum wage. For 2021 it is 7,500 rubles.

- Interest rate. For pension insurance it is 26%.

- Work time. This refers to the number of working months.

- The difference between the income received and the threshold amount.

- The rate is 1%. It is this that is used to determine the amount added to the standard contribution.

How to calculate income under different tax regimes in 2021

In order to determine whether you need to pay something else for the past year to the Pension Fund of the Russian Federation or not, you need to calculate the income of the individual entrepreneur for the reporting period. If you apply only one tax regime, then there should be no problems. As a rule, by April individual entrepreneurs submit tax returns for the year, or at least they have already filled them out. In this case, the income of the individual entrepreneur, for the purpose of calculating insurance contributions to the Pension Fund in a fixed amount, is taken from the tax return:

- On OSNO - the amount in line 110 (clause 3.1) minus the amount in line 120 (clause 3.2) of sheet B

of the 3-NDFL declaration;

* - On OSNO - line 030 (clause 2.1) of sheet B of

the 3-NDFL declaration (KND Form 1151020); - On the simplified tax system - with the object of taxation Income (USN 6%) line 113 of Section 2.1.1

of the declaration; - On the simplified tax system - with the taxable object Income-expenses (15% simplified tax system), line 213 of Section 2.2

of the declaration; - On UTII - the sum of lines 100 of all Sections 2

of the declarations

for 2015

(we add up the amounts for these lines in the declarations for the 1st, 2nd, 3rd and 4th quarters); - On the Unified Agricultural Tax - line 010 of Section 2

of the declaration (Form according to KND 1151059); - On PSN - potential income - tax base (indicated in the patent).

if you don’t want disputes, you can use the previous option and pay extra fees:

If you apply the UTII regime in several municipalities at once, you need to add up the calculated income for all UTII declarations for the year in all municipalities.

If an individual entrepreneur has received several patents for different types of activities, or in different regions of Russia, it is necessary to sum up the potential income for all patents received during the year.

If you use several tax regimes simultaneously for different types of activities, then you need to add up the income from them. The resulting amount will be the total income, from which 300 thousand rubles must be subtracted. Compare the remaining amount with the 1% limit for 2015 or 2021. If the balance is less than the maximum contribution amount, divide it by 100. You will get the amount in rubles and kopecks, which must be transferred to the Pension Fund by April 1, 2016 (for 2015) or 2021 (for 2016) inclusive.

*

Taking into account the Resolution of the Constitutional Court of the Russian Federation of November 30, 2021 No. 27-P. Just don’t forget to first calculate the benefits, since you will have to pay additional personal income tax and pay tax penalties, as well as submit updated returns.

KBC for insurance premiums for 2021

From January 2021, payment orders for payment of contributions must indicate new BCCs.

The corresponding codes were approved by orders of the Ministry of Finance of Russia dated 06/08/15 No. 90n and dated 12/01/2015 No. 190n. Read about which BCCs have changed in 2021 in the article 03.25.2016

BCC 2021 Pension Fund

The KBK of the Pension Fund of Russia 2021 has changed only for individual entrepreneurs. Now they differ for fixed amounts and for contributions from income over 300,000 rubles. In particular, the BCC are as follows:

- BCC in the Pension Fund of Russia in 2021 in a fixed amount - 392 1 0200 160;

- KBK in the Pension Fund for 2021 with income over 300,000 rubles. — 392 1 0200 160.

But the KBK PFR 2021 for employees has not changed. As before, contributions to the Pension Fund must be transferred to one KBK to pay the insurance part of the pension - 392 1 0200 160.

KBK FFOMS for 2021

The KBK FFOMS for 2021 has also changed only for individual entrepreneurs. Now, in the payment form for the payment of contributions for compulsory medical insurance, individual entrepreneurs must indicate KBK 392 1 0211 160.

The KBK FFOMS for 2021 for employees remained the same - 392 1 0211 160.

KBK contributions to the Social Insurance Fund in 2021

Contributions to the Social Insurance Fund in 2021 must be paid only from payments to employees. Individual entrepreneurs are exempt from paying social contributions. They need to pay contributions to the FFOM only if they enter into a voluntary relationship under social insurance in case of temporary disability and in connection with maternity.

The BCC in the Social Insurance Fund for employees has not changed in 2021. In the payment form for payment of contributions, as in 2015, you must indicate the following BCC:

- for contributions for temporary disability and in connection with maternity - 393 1 0200 160;

- for contributions for injuries - 393 1 0200 160.

You can find more detailed information about all CBCs regarding insurance contributions for 2016 in the table.

Let us remind you that if an erroneous BCC is indicated in a payment order, the payment, at best, is returned back, or may be credited by the recipient as “unclarified,” or will be used to pay another tax. In any of these situations, payment deadlines will most likely be missed. Therefore, we advise you to always check the current classifier tables.

KBC for insurance premiums for 2021

| KBC for insurance premiums for 2021 | Description of the KBK for insurance premiums for 2016 |

| KBC on insurance premiums for 2021 for employees | |

| 392 1 0200 160 | Insurance contributions for pension insurance to the Pension Fund for employees |

| 392 1 0211 160 | Insurance contributions to the FFOMS budget for employees |

| 393 1 0200 160 | Insurance contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity for employees |

| 393 1 0200 160 | Insurance contributions to the Social Insurance Fund against industrial accidents and occupational diseases for employees |

| 392 1 0200 160 | Insurance contributions to the Pension Fund at an additional rate for insured persons employed in the relevant types of work, according to list 1 |

| 392 1 0200 160 | Insurance contributions to the Pension Fund at an additional rate for insured persons employed in the relevant types of work, according to list 2 |

| KBC for insurance premiums for 2021 for individual entrepreneurs for themselves | |

| 392 1 0200 160 | Insurance contributions for pension insurance of individual entrepreneurs for themselves in a fixed amount (based on the minimum wage) |

| 392 1 0200 160 | Insurance premiums for pension insurance of individual entrepreneurs for themselves on income exceeding 300,000 rubles. |

| 392 1 0211 160 | Insurance premiums for medical insurance for individual entrepreneurs for themselves in a fixed amount (based on the minimum wage) |

Magazine Salary

Post:

Comments

The procedure for calculating and paying fixed contributions

A fixed contribution is a stable amount that an entrepreneur must pay to the appropriate fund. This amount changes almost every year. Its value is directly influenced by the minimum wage, which is set by the government and undergoes annual correction. Thus, for 2021, the amount of the minimum wage has already reached 7,500 rubles, which caused an increase in the amount of contributions.

This amount is also directly affected by the interest rate that is used for this insurance industry. It may change, but over the past few years these indicators have been fairly stable. Thus, for several years in a row, the interest rate for health insurance is 5.1%. As for pension insurance, the rate in this area for 2021 is 26%.

Each entrepreneur has the right to decide for himself how he will pay the amount of the fixed contribution. For this purpose, the legislation offers three options:

- Enter the amount for the year

- Divide the amount quarterly

- Make monthly contributions

If an entrepreneur chooses to pay in installments, then within the framework of certain taxation systems, he will be given the right to reduce the amount of taxes to be paid to the budget by the amount of paid contributions.

KBC payment of contributions for compulsory pension insurance for legal entities

Contributions to the Federal Compulsory Medical Insurance Fund accrued to the working population:

- contributions – 39210202101081011160;

- penalties – 39210202101082011160;

- fines – 39210202101083011160.

2. Contributions credited until 2012 to the TFOMS, accrued to the working population:

- contributions – 39210202101081012160;

- penalties – 39210202101082012160;

- fines – 39210202101083012160.

Contributions in 2021 to the Pension Fund

The most extensive article concerns contributions to the Pension Insurance Fund, therefore, the changes there will be the most extensive:

1. Compulsory insurance contributions for the payment of the insurance and funded parts of the pension:

- contributions – 39210202010061000160;

- penalties – 39210202010062000160;

- fines – 39210202010063000160.

2. Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013):

- contributions – 39210202100061000160;

- penalties – 39210202100062000160;

- fines – 39210202100063000160.

3. Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013):

- contributions – 39210202110061000160;

- penalties – 39210202110062000160;

- fines – 39210202110063000160.

4. Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of the insurance and funded part of the labor pension:

- contributions – 39210202140061000160;

- penalties – 39210202140062000160;

- fines – 39210202140063000160.