How is financial assistance calculated?

Financial assistance is paid from the enterprise’s own funds, i.e. does not apply to the cost of products, works, services.

To summarize information about all types of settlements with employees of an organization, except for settlements for wages and settlements with accountable persons, the Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) prescribes the use of an account 73 “Settlements with personnel for other operations.”

Financiers have repeatedly explained that the organization’s expenses for cultural and educational events, recreation, entertainment and other similar expenses, which include the payment of financial assistance, in accordance with the mentioned paragraph 11 of PBU 10/99, are other expenses (letters from the Ministry of Finance of Russia dated 10/20/2011 N 07-02-06/204, dated 06/19/2008 N 07-05-06/138, dated 12/19/2008 N 07-05-06/260). In this connection, such expenses should be taken into account in correspondence with account 91 “Other income and expenses”, subaccount 2 “Other expenses”:

Debit 91-2 Credit 73 - financial assistance accrued.

Many employers pay financial assistance to their former employees who have worked for a long time and retired. Settlements with them are reflected in account 76 “Settlements with various debtors and creditors”:

Debit 91-2 Credit 76 - financial assistance was accrued to a former employee.

In the case where the payment of financial assistance is provided for by the regulations on wages (for example, the payment of financial assistance for vacation for all employees), its accrual is reflected in the credit of account 70 “Settlements with personnel for wages” in correspondence with the cost accounts: 20 “ Main production", 26 "General business expenses", 44 "Sales expenses", etc.:

Debit 20 (26, 44) Credit 70 - financial assistance for vacation has been accrued.

The accrual of financial assistance to employees of the enterprise is carried out in accounting using the following entries:

Debit 91 “Other income and expenses” Credit 70 “Settlements with personnel for wages” - financial assistance has been accrued.

If the shareholders or members of the company made a decision to spend the profit (in fact, a distribution of profit was made), then the accrual of financial assistance is Debit 84 “Enterprise profit” Credit 70 “Settlements with personnel for wages”.

Accrued financial assistance can be paid either together with wages on a single payroll, or separately.

If financial assistance is paid along with wages, there is no need to prepare a separate statement for its payment. If financial assistance is not paid on time for payment of wages and three or more people receive it at the same time, then it is necessary to draw up a payslip. In other cases, financial assistance is paid according to an expenditure cash order.

The payment of financial assistance to an employee through the company's cash desk is reflected in the accounting records as follows:

Debit 70 “Settlements with personnel for wages” Credit 50 “Cash” - financial assistance was paid to the employees of the enterprise from the enterprise’s cash desk.

If the shareholders or participants of the company decided to distribute part of the profit for the payment of material assistance, then the accrual of financial assistance to former employees of the enterprise, as well as other individuals who are not in an employment relationship with the enterprise:

Debit 84 “Profit of the enterprise” Credit 76 “Settlements with various debtors and creditors” - financial assistance was accrued to former employees of the enterprise.

Payment of financial assistance to non-employees of the enterprise can also be made according to a statement or an expense cash order.

Payment of financial assistance through the enterprise's cash desk is reflected in the accounting records as follows:

Debit 76 “Settlements with various debtors and creditors” Credit 50 “Cash” - financial assistance was paid to persons who are not employees of the enterprise.

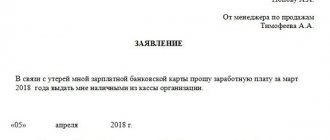

Payment can be made not only through the company's cash desk, but also by transferring money from a current account to a personal bank account.

Posting in accounting:

Debit 76 “Settlements with various debtors and creditors” Credit 51 “Current account” - material assistance was transferred from the company’s current account to persons who are not employees of the enterprise.

If the accrued financial assistance is subject to personal income tax, then the taxable part of the financial assistance is added to the basic salary paid to this employee in this organization and is taxed in the generally established manner at a rate of 13%. In accounting, income tax accrual is reflected in the following entries:

Debit 70, 76 Credit 68, subaccount “NDFL” - personal income tax is withheld from financial assistance.

Awards

Bonuses are incentive payments that are paid to employees for conscientious performance of job duties or achievement of certain performance indicators. Bonuses are paid within the time limits established by the collective agreement or local regulations of your organization (Articles 129, 191 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated 02/14/2017 N 14-1/OOG-1293, Information from Rostrud).

In accordance with Art. 144 of the Labor Code of the Russian Federation - bonuses may be provided for by the remuneration system. The remuneration system adopted by the enterprise may provide for the payment of bonuses to a certain circle of people based on established specific indicators and bonus conditions. It is these bonuses that are included when calculating average earnings. When paying one-time bonuses, the circle of bonuses is not defined in the remuneration system. These bonuses are not included when determining average earnings. Bonuses are awarded on the basis of the bonus order.

Bonuses provided for by the remuneration system must be approved in a local regulatory document, that is, in the regulations on bonuses adopted by the organization. This provision must contain: bonus indicators; bonus conditions; size and scale of bonuses; circle of employees receiving bonuses; source of bonuses. In accordance with the bonus regulations, the amount of the bonus is determined by the employee’s specific performance results.

One-time incentive bonuses are awarded by decision of the enterprise administration. To accrue them, a provision on bonuses is not required; their accrual is also formalized by order.

Depending on the source of financing, premiums can be paid out of profits, and can also be included in the costs of the enterprise.

Debit 84 Credit 70 - the shareholders or members of the company made a decision on the distribution of profits, in particular the payment of a bonus at the expense of the profits generated at the time of distribution.

In other cases, it is calculated from the same account as the employee’s salary directly:

Debit 20 Credit 70 - bonus payment to workers of main production.

Debit 23 Credit 70 - the accrual of bonuses to workers in auxiliary production will be reflected in the posting.

Debit 25 Credit 70 - bonus payment to employees servicing the main production.

Debit 26 Credit 70 - accrual of bonuses to management employees.

Debit 91 Credit 70 - accrual of bonuses for work, the costs of which are not taken into account as expenses.

Debit 08 Credit 70 - accrual of bonuses to workers for capital costs.

Accrued bonuses are taken into account in the employee’s total income when determining the tax base for personal income tax and are taxed in the generally established manner at a rate of 13%. In accounting, the accrual of income tax is reflected in the following entry:

Debit 70 Credit 68, subaccount “NDFL” - personal income tax is withheld from the premium.

Postings for payment of personal income tax and contributions

In our country there is a personal income tax (NDFL). As a rule, it is 13% of the earnings of any citizen receiving a salary or other income (it is indexed directly depending on the size of the salary). It is deducted from the employee’s total income. In addition to this tax, the employer is obliged to pay all kinds of contributions to state insurance funds. Contributions can be both insurance and pension.

When transferring his salary to an employee’s account, the company must also calculate insurance premiums and tax deductions. A logical question arises: what accounts are used for such deductions? Let's figure it out.

On the day when employees are paid, the company pays personal income tax and insurance premiums for injuries. Money for other insurance premiums must be transferred to the company no later than the 15th of the next month. Payment should be made from the current account of the enterprise No. 51 and the debt to insurance funds should be closed with accounts No. 68 “Calculations for taxes and fees” and No. 69 “Calculations for social insurance and security”.

So the wiring will look like this:

- D68 K51 - Payment of personal income tax.

- D69 K51 - Payment of contributions.

An organization that has not paid insurance premiums and personal income tax may be punished with a fine of 20% of the amount of tax debt.

And if upon inspection it turns out that this was done intentionally, then the fine will be 40% of the unpaid amount.

Accounting for accruals for weekends and holidays in accounting

Additional payments for work on weekends, as well as holidays, are reflected in accounting in the same accounts as the calculation of the basic salary.

Debit 20 Credit 70 - accrual of additional payment for work on weekends (holidays) for workers of the main production is reflected by posting -.

Debit 23 Credit 70 - accrual of additional payment for work on weekends (holidays) for workers in auxiliary production.

Debit 25 Credit 70 - accrual of additional payment for work on weekends (holidays) to employees servicing the main production.

Debit 26 Credit 70 - accrual of additional payments for work on weekends (holidays) for management employees.

Debit 08 Credit 70 - accrual of additional payment for work on weekends (holidays) for capital costs, etc.

Amounts of additional payments for work on weekends and holidays are subject to personal income tax and are also subject to inclusion in the base for calculating insurance premiums.

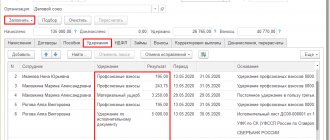

Postings for deductions from wages

In Russia, it is legally possible for an employer to withhold from an employee’s salary the amount that he must pay to an enterprise, individual, etc.

Certain amounts of money are withheld from the salaries of enterprise employees monthly for various reasons:

- Personal income tax (NDFL) is withheld from the employee's salary.

- The advance received by the employee earlier is withheld from the salary.

- Retention of material damage caused.

- Withholding money to third parties (at the request of the employee).

- Collection of uncollected amounts from the employee.

20% is the maximum amount of deductions from the employee’s earnings (with the deduction of personal income tax). But in some cases, which are described by federal laws, their amount can reach up to 50% of the salary.

In addition, if the holdings may be in favor of the state (taxes, fines) and third parties (alimony, union dues, etc.).

It should be borne in mind that excessively accrued wages cannot be recovered from an employee if this did not occur as a result of a computational error, but due to other reasons, for example, due to insufficient professional suitability or qualifications of the employee and incorrect calculation of wages because of this.

Deductions for wages are carried out on account No. 70 and corresponded to the credit of accounts No. 20,23,25,26,29,44,76,51.

The posting for salary deductions looks like this:

- D70K20

- D.70 K71

- D70 K44 and so on.

Calculation of temporary disability benefits

In accordance with Art. 183 of the Labor Code of the Russian Federation, in case of temporary disability, the employer pays the employee temporary disability benefits in accordance with federal laws. Thus, Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ) regulates the procedure for assigning and paying benefits for temporary disability.

According to paragraphs. 1 clause 1 art. 2 of Law N 255-FZ - the right to receive benefits for temporary disability are employees who are subject to compulsory social insurance in case of temporary disability and in connection with maternity:

1) persons working under employment contracts, including heads of organizations who are the only participants (founders), members of organizations, owners of their property;

2) state civil servants, municipal employees;

3) persons holding government positions in the Russian Federation, government positions in a constituent entity of the Russian Federation, as well as municipal positions filled on a permanent basis;

4) members of a production cooperative who take personal labor participation in its activities;

5) clergy;

6) persons sentenced to imprisonment and involved in paid work.

Temporary disability benefits are paid:

1) to insured persons for the first 3 days of temporary disability at the expense of the policyholder (employer), and for the remaining period, starting from the 4th day of temporary disability - at the expense of the budget of the Social Insurance Fund of the Russian Federation;

2) insured persons who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 4.5 of Law N 255-FZ, at the expense of the budget of the Social Insurance Fund of the Russian Federation from the 1st day of temporary disability.

Temporary disability benefits relate to expenses for ordinary activities on the basis of paragraphs 5 and 8 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

The accrual of temporary disability benefits is reflected in the following accounting entries:

Debit 20, 25, 26, 44, etc. Credit 70 - in part of the benefit paid by the company for the first three calendar days of temporary disability;

Debit 69, subaccount “Settlements with personnel for wages”, Credit 70 - in terms of benefits paid from the funds of the Federal Social Insurance Fund of Russia.

Payroll entries

Labor law states that salaries must be paid to employees at least twice a month, and the first of these several payments is considered an advance.

Account No. 70 “Settlements with personnel for wages” is the main account for carrying out any actions designed to accrue wages . Expenses incurred in connection with these actions are charged to the cost of production of the enterprise. Because of this, the following accounts correspond to account No. 70:

- No. 29 “Service industries and farms”;

- No. 23 “Auxiliary production”;

- No. 26 “General business expenses”;

- No. 20 “Main production”;

- No. 25 “General production expenses.”

If the enterprise is manufacturing

The posting that accountants use when calculating wages looks like this: D20 (44,26,29,23...) K70.

This posting is made for the entire amount of accruals for one month. To do this, use a time sheet and a payslip.

Accounting for account No. 70 is carried out for all employees of the organization separately.

If you need to calculate salary payments in kind, you must keep in mind that:

- Organizations are legally allowed to make calculations for earnings in kind, but provided that they do not amount to more than 20% of the total salary.

- When paying an employee's earnings with the company's products, its price is considered in accordance with the retail market price.

- The cost of the enterprise's products issued to the employee is also subject to personal income tax, as is wages in banknotes.

Accounting for vacation pay accruals

Accounting for vacation pay accruals in accounting is carried out on the same accounts where the employee’s wages are accrued. The exception is cases when vacation is accrued “in advance”, that is, for example, vacation pay is accrued in June, and the vacation period also includes the days of July. In such cases, the amount of accruals is calculated for each period separately and accrued in two transactions:

Debit 20 Credit 70 - accrued vacation pay for March;

Debit 97 Credit 70 - accrued amount of vacation pay for April.

In the future, at the end of April, deferred expenses will be classified as current expenses. This will be reflected in the accounting by the following entry:

Debit 20 Credit 97 - the amount of vacation pay for April is taken into account in the current expenses of the enterprise.

Compensation for training costs at the expense of the employer upon dismissal of an employee

The employee is obliged to reimburse the costs of your organization for his training in the event of dismissal without good reason before the expiration of the period established by the student or employment contract. Calculate the amount of compensation by the employee for training costs in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement, and reflect the employee’s debt in accounting as of the date of dismissal.

Include the amount reimbursed by the employee as part of other income (clause 7 of PBU 9/99 “Income of the organization”). Such income must be reflected in accounting in the reporting period, obtaining the employee’s written consent for partial reimbursement of training costs (clause 10.2, 16 PBU 9/99).

To account for settlements with employees for transactions not related to wages, including reimbursement of training costs upon dismissal, account 73 “Settlements with personnel for other transactions” is intended.

An employee can repay the debt by depositing cash into the cash register or transferring it to the organization’s current account.

He can also submit an application to the accounting department with a request to withhold the existing debt to the employer or part of it from wages. Such an operation will not constitute forced retention within the meaning of Art. 137 Labor Code of the Russian Federation. Therefore, the norms provided for by the provisions of Art. Art. 137, 138 of the Labor Code of the Russian Federation, on limiting the types and amount of deductions from wages. A similar point of view regarding the possibility of repaying the amount of the loan provided at the expense of wages at the request of an employee is expressed in the Letter of Rostrud dated September 26, 2012 N PG/7156-6-1.

The entries for recording employee compensation for training expenses are as follows:

Debit 73 Credit 91-1 - Reflects the debt recognized by the employee for partial reimbursement of expenses for his training;

Debit 70 Credit 73 - The amount of partial reimbursement of training expenses was withheld from wages;

Debit 50 (51) Credit 73 - The employee’s debt was repaid by depositing cash into the organization’s cash desk (by transferring money to the current account).

If you receive compensation for training costs after the dismissal of an employee, then settlements with him should be carried out on account 76 “Settlements with various debtors and creditors”. In this case, on the date of dismissal of the employee, transfer the amount of debt from account 73 to the debit of account 76.