Documenting

The amount of compensation for delayed wages is established in the collective or employment agreement.

For example, you can indicate that compensation is 0.06 percent of the amount owed for each day of delay in salary. If the amount of compensation is not established by an employment or collective agreement, then it is calculated based on 1/300 of the refinancing rate for each day of delay. Such rules are established in Article 236 of the Labor Code of the Russian Federation. Attention: the amount of compensation established by the organization for delayed salaries cannot be less than 1/300 of the refinancing rate. Otherwise, this condition of the collective (labor) agreement will be invalid (Article 8 of the Labor Code of the Russian Federation).

Pay compensation for the delay along with repayment of arrears of wages.

Situation: is it necessary to pay compensation for delayed wages in an increased amount (exceeding 1/300 of the refinancing rate), if such a condition is established by a regional agreement?

Yes, it is necessary if the organization has joined the regional agreement.

An increased amount of compensation for delayed wages may be established by regional agreement. Such agreements are concluded by regional executive authorities in agreement with trade unions and employers.

All organizations in the region can join the regional agreement, even if they did not participate in its conclusion. A proposal to join a regional agreement is officially published along with the text of the agreement. If within 30 calendar days the organization does not send a written reasoned refusal, it is considered that it agrees with the regional agreement. Consequently, the organization will be obliged, from the moment of official publication of the regional agreement, to establish compensation for delayed wages in an amount not lower than the regional one. If the organization decides not to join the agreement, it sends a written refusal to the executive body of the constituent entity of the Russian Federation.

This procedure is provided for in Article 48 of the Labor Code of the Russian Federation.

How to count

Before we figure out how to calculate compensation for late wages, let’s look at how to calculate the due amount. Compensation funds are accrued for the full period of deferred payment of wages, starting from the date following the payment day established by the institution until the date of actual transfer of remuneration.

The amount of the compensation payment must be fixed in the local regulations of the institution - collective and labor agreements, as well as in the regulations on remuneration.

If the amount of such compensation is not determined by internal regulations, then it is calculated based on the current key rate. At the moment, compensation for delayed wages, 2021 entries are similar to 2021 accounting entries, should not be lower than 1/150 of the key rate. The employer has the right to increase the amount of compensation established by the Labor Code of the Russian Federation.

Thus, the procedure for calculating the compensation amount is determined as follows: 1/150 of the refinancing rate for each day of late payment.

The calculation formula established in Art. 236 of the Labor Code of the Russian Federation, it will be like this:

Deadline for salary delay

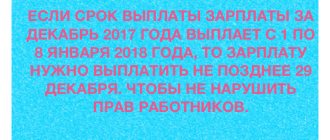

The organization must set a specific date for payment of salaries. It is impossible to establish a period during which wages should be paid, rather than a specific day of payment. When determining the set payment date, keep in mind that if the payment day coincides with a non-working day, the salary must be paid the day before.

Such conclusions follow from Article 136 of the Labor Code of the Russian Federation and are confirmed by paragraph 3 of the letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242.

Accordingly, define the period of salary delay as the number of days by which the payment is overdue. The first day of delay is the day following the due date for payment of wages. The last day of delay is the date of actual payment of wages. This procedure is established in Article 236 of the Labor Code of the Russian Federation.

Situation: how to determine the duration of the salary delay - in calendar or working days?

When calculating compensation, determine the duration of the delay in payment of wages in calendar days. Article 236 of the Labor Code of the Russian Federation states that compensation must be calculated for each day of delay. There is no reason to exclude weekends and holidays from this period.

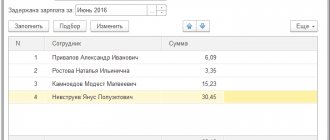

How to calculate compensation for salary delays in 1C 8

To correctly calculate compensation, it is necessary that in the organization’s settings (Organization directory - Accounting Policies tab and other settings - link Accounting and salary payment) the correct date of salary payment is indicated. It is on the basis of this date that it will be determined how many days the payment is overdue.

Or set a single checkbox in the salary calculation settings Register compensation for delayed payment of wages as income subject to insurance contributions , then this checkbox will be checked automatically in all newly created documents.

Compensation calculation

Calculate compensation for delayed wages using the formula:

| Compensation for delayed wages | = | Salary arrears | × | 1/300 of the refinancing rate (or a greater percentage established by the organization) | × | Number of days of delay |

An example of calculating compensation for delayed wages. The amount of compensation is established in the collective agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

According to the collective agreement, compensation for delayed wages is 0.06 percent for each day of delay.

The organization paid the final payment for December 2015, as well as the entire salary amount for January 2021, on February 16, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2015) – 47 days (from January 1 to February 16, 2021 (January 1–8, 2021 are holidays, so salaries for December must be paid on December 31, 2015));

- 250,000 rub. (advance payment for January 2021) – 27 days (from January 21 to February 16, 2021);

- 300,000 rub. (final calculation for January 2021) – 11 days (from February 6 to February 16, 2021).

Along with the arrears of wages, the organization paid compensation for the delay. The amount of compensation was: 300,000 rubles. × 47 days × 0.06% + 250,000 rub. × 27 days × 0.06% + 300,000 rub. × 11 days × 0.06% = 14,490 rub.

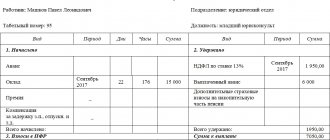

Situation: how to calculate the amount of debt owed to an employee, with which compensation must be paid for delayed payment of wages - taking into account personal income tax or without taking into account?

Determine the amount of wage arrears from which compensation is calculated without taking into account personal income tax.

When paying wages, the organization is obliged to withhold personal income tax from it, which means it should not pay it to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation). Personal income tax is not part of unpaid wages. And compensation for the delay must be calculated based on the actual amount of the debt (Article 236 of the Labor Code of the Russian Federation).

Situation: how to calculate compensation for delayed wages if the refinancing rate changed several times during the period of delay? According to the collective (labor) agreement, compensation is calculated based on the refinancing rate.

Calculate the amount of compensation, taking into account all changes in the refinancing rate. Divide the period of late payment of wages into periods in which different refinancing rates were in effect and calculate compensation for each of these periods. This conclusion follows from the literal interpretation of Article 236 of the Labor Code of the Russian Federation. It says that the amount of compensation for delayed wages is not less than one three hundredth of the refinancing rate in force at that time (i.e., during the period of delay).

An example of calculating compensation for delayed wages. The amount of compensation is not established by the collective (employment) agreement

The collective agreement adopted by the organization establishes the following terms for payment of wages:

- On the 20th – an advance of 40 percent of the salary;

- 5th – final payment.

The organization paid the final payment for December 2015, as well as the entire salary amount for January 2021, on February 26, 2016.

The amounts owed and the delay period were:

- 300,000 rub. (final payment for December 2015) – 57 days (from January 1 to February 26, 2021 (January 1–8, 2021 are holidays, so salaries for December must be paid on December 31, 2015));

- 250,000 rub. (advance payment for January 2021) – 37 days – from January 21 to February 26, 2021;

- 300,000 rub. (final calculation for January 2021) – 21 days – from February 6 to February 26, 2021.

Along with the arrears of wages, the organization paid compensation for the delay. Its size is not established in the collective agreement, so the calculation is made based on 1/300 of the refinancing rate, which is 11 percent.

Therefore, the amount of compensation was:

– for late wages for December 2015: 6270 rubles. (RUB 300,000 × 57 days × 1/300 × 11%);

– for late advance payment for January 2021: RUB 3,391.67. (RUB 250,000 × 37 days × 1/300 × 11%);

– for late wages for January 2021: 2310 rubles. (RUB 300,000 × 21 days × 1/300 × 11%).

The total amount of compensation was 11,971.67 rubles. (6270 rubles + 3391.67 rubles + 2310 rubles).

All about compensation for delayed wages in 2021

This is explained as follows.* In the accounting of budgetary institutions: The procedure for recording in the accounting of income from voluntary compensation by an employee the amount of a fine paid due to his fault is not defined. At the same time, when resolving the issue under consideration, budgetary institutions can turn to. This is due to the fact that a uniform procedure has been established for the application of the chart of accounts by all institutions. Payment of wages to employees, according to internal regulations, occurs before the 5th. The employer was supposed to pay salaries to employees on May 5, but due to a lack of funds in the current account, it paid off its obligations on May 28.

In accounting, the procedure for recording transactions related to the calculation of compensation for delayed wages depends on the type of institution. An employee has the right to demand that an employer who has delayed wages accrue and pay compensation. Its size is established by internal regulations (collective or labor agreement).

Accounting

Payment of compensation for delayed wages is not related to expenses for ordinary activities. Compensation is a sanction for violation of the terms of an employment (collective) agreement.

In accounting, take this payment into account in other expenses (clause 11 of PBU 10/99). The accrual of compensation is not related to calculations of wages, so reflect it on account 73 “Settlements with personnel for other operations” (Instructions for the chart of accounts).

In accounting, reflect the accrual of compensation by posting:

Debit 91-2 Credit 73

– compensation for delayed wages has been accrued.

Compensation is calculated on the day the salary is paid. Only at this moment can the amount of expenditure be accurately determined, and, accordingly, the requirements of paragraph 16 of PBU 10/99 will be met.

What accounting entries appear when calculating and paying compensation?

To reflect settlements with employees for the calculation of compensation amounts, use account 73 of the chart of accounts. In accounting, classify it as other income and expenses. For convenience, the entries when paying compensation for late payment of wages are shown in the table.

| Operation | Debit | Credit |

| Compensation accrued for late transfer of wages | 91 | 73 |

| Fixed tax expense calculated | 99 | 68 |

| Insurance and injury premiums assessed | 91 | 69 |

| Accrued amounts paid to employees | 73 | 50, 51 |

In tax accounting, compensation payments cannot be recognized as expenses (Letter of the Ministry of Finance dated October 31, 2011 No. 03-03-06/2/164).

Legal documents

- Article 236 of the Labor Code of the Russian Federation

- Art. 217 Tax Code of the Russian Federation

- Art. 422 Tax Code of the Russian Federation

- 125-FZ

Personal income tax and insurance premiums

The amount of compensation cannot be less than 1/300 of the refinancing rate in force during the period of delay of the amounts not paid on time for each day of delay (Article 236 of the Labor Code of the Russian Federation). That is, the organization has the right to pay compensation in a larger amount. The procedure for taxation of personal income tax will depend on the registration of such compensation. The table will help you figure this out.

| Compensation amount | Provided for by the collective (labor) agreement | Obligation to withhold and remit personal income tax |

| 1/300 refinancing rate | doesn't matter | No |

| more than 1/300 of the refinancing rate | Yes | No |

| more than 1/300 of the refinancing rate | No | yes, from the amount exceeding the minimum amount of compensation |

This follows from the provisions of paragraph 3 of Article 217 of the Tax Code of the Russian Federation, Article 236 of the Labor Code. The correctness of this approach is confirmed by letters of the Ministry of Finance of Russia dated April 18, 2012 No. 03-04-05/9-526, dated November 28, 2008 No. 03-04-05-01/450, dated August 6, 2007 No. 03- 04-05-01/261 and the Federal Tax Service of Russia dated June 4, 2013 No. ED-4-3/10209 (the document is posted on the official website of the tax service in the section “Explanations mandatory for use by tax authorities”).

Situation: is it necessary to charge insurance premiums for compensation for delayed payment of wages?

Yes need.

This is due to the fact that such compensation is not named in the closed lists of payments not subject to insurance premiums, namely:

– in Article 9 of the Law of July 24, 2009 No. 212-FZ – in relation to contributions to compulsory pension (social, medical) insurance;

– in Article 20.2 of the Law of July 24, 1998 No. 125-FZ – in relation to contributions for insurance against industrial accidents and occupational diseases.

This means that it must be regarded as a payment made to employees within the framework of labor relations, and subject to insurance premiums in the general manner (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Part 1 of Article 20.1 of the Law dated July 24, 1998 No. 125-FZ).

A similar conclusion was made in letters from the Ministry of Labor of Russia dated August 6, 2014 No. 17-4/B-369, and the Ministry of Health and Social Development of Russia dated March 15, 2011 No. 784-19.

Advice: there are arguments for not charging insurance premiums for compensation. They are as follows.

Compensation for delayed payment of wages cannot be regarded as an employee's remuneration, but is considered the financial responsibility of the employer. It is an independent type of legally established compensation payments related to the performance of a person’s labor duties. Consequently, compensation for delayed payment of wages is not subject to insurance premiums on the basis of:

- paragraph “i” of Part 2 of Article 9 of the Law of July 24, 2009 No. 212-FZ - in relation to contributions to compulsory pension (social, medical) insurance;

- subclause 2 of part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ - in relation to contributions for insurance against industrial accidents and occupational diseases.

This approach is confirmed by arbitration practice (see, for example, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13, the ruling of the Supreme Court of the Russian Federation dated December 18, 2014 No. 307-KG14-5726, the decisions of the Arbitration Court of the North-Western District dated October 2, 2014 No. A56-3173/2014, FAS Volga District dated July 21, 2014 No. A06-6685/2013, Far Eastern District dated May 15, 2013 No. F03-1527/2013, Moscow District dated March 27, 2013 No. A41-28843/12, Volga-Vyatka District dated October 25, 2012 No. A31-11529/2011).

The procedure for calculating other taxes depends on what taxation system the organization uses.

Penalties for late payment of wages 2021 posting kosgu

Note. Please note that the amount of monetary compensation paid to an employee may be increased by a collective or labor agreement. In accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 1, 2013 N 65n, expenses for payment of compensation for late payment of wages are reflected in Article 290 “Other expenses” of KOSGU.

In times of crisis, many Russian companies, often small businesses, are increasingly delaying wages (hereinafter referred to as wages) to their employees. In most cases, this is not the fault of the company: each of them is a link in a dependent chain of counterparties.

We recommend reading: What do debt collectors have the right to by law?

Income tax

Payment of compensation for delayed wages is provided for by labor legislation. It is a sanction for violating the terms of an employment (collective) agreement. This follows from Article 236 of the Labor Code of the Russian Federation. Despite this, the Russian Ministry of Finance prohibits taking such payments into account as expenses.

Situation: is it possible to take into account the amount of compensation for delayed wages as part of non-operating expenses or labor costs? The organization applies a general taxation system.

No you can not.

Expenses for payment of compensation for delayed wages are not considered non-operating expenses in the form of sanctions for violation of contractual obligations (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation). The obligation to pay compensation for delayed wages is provided for by labor legislation, and subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation applies to civil law relations.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38.

Labor costs taken into account when calculating income tax include compensation charges related to work hours or working conditions provided for by Russian legislation and labor (collective) agreements (Article 255 of the Tax Code of the Russian Federation). Compensation for delayed wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, these payments do not reduce taxable profit as labor costs.

Such clarifications are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38, as well as in the resolution of the Federal Antimonopoly Service of the Central District dated February 21, 2008 No. A09-7868/05-15.

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of expenses (non-operating or labor costs). They are as follows.

The basis for including compensation for delayed wages in non-operating expenses is that subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not directly indicate in case of violation of which contractual obligations - civil or labor - it is applied. Therefore, this subclause can also be applied to compensation for delayed wages. In addition, such compensation is not named in Article 270 of the Tax Code of the Russian Federation as expenses not taken into account when taxing profits. Therefore, it can be taken into account as part of non-operating expenses. This position is confirmed by judicial practice (see, for example, decisions of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 11, 2008 No. A29-5775/2007, Ural District dated April 14, 2008 No. F09-2239/08-S3, Volga District dated June 8, 2007 No. A49-6366/2006).

Compensation for delayed wages can also be taken into account as part of labor costs. It is explained this way. Taxable profit is reduced by any payments to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255 of the Tax Code of the Russian Federation). The exception is the payments listed in Article 270 of the Tax Code of the Russian Federation. When calculating the tax base for income tax, they cannot be taken into account under any circumstances. In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25 of Article 255 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can also be taken into account as part of labor costs. This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09.

Under such circumstances, the organization can independently decide which group of expenses to include the costs associated with the payment of compensation for delayed wages (clause 4 of Article 252 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. General organization

In August, Alpha LLC delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases.

The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

In tax accounting, the amount of compensation for delayed wages is not taken into account. Alfa does not withhold personal income tax from the compensation amount.

Postings for wages in budget accounting

Every month, each organization pays insurance contributions to the Pension Fund, mandatory social contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund. The object of taxation is payments and other remuneration accrued by employers in favor of employees.

- A unified chart of accounts for government agencies, local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (Order of the Ministry of Finance of the Russian Federation dated December 1, 2021 No. 157n);

- Instructions for the use of the chart of accounts for budget accounting (Order of the Ministry of Finance dated December 16, 2021 No. 174n).

simplified tax system

If an organization applies a simplification with the object of taxation being income, do not take into account compensation for delayed wages when calculating the single tax (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the amount of compensation for delayed payment of wages as part of labor costs? The organization applies a simplification; it pays a single tax on the difference between income and expenses.

No you can not.

An organization can reduce the income received by paying for labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). Labor costs include, among other things, compensation accruals related to the work schedule or working conditions provided for by the norms of Russian legislation and labor (collective) agreements (Article 255, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation).

Compensation for delayed payment of wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, it is impossible to take into account compensation for delayed payment of wages as part of labor costs. A similar conclusion is contained in the letter of the Federal Tax Service for Moscow dated August 6, 2007 No. 28-11/074572.

The same explanations are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38. Despite the fact that the explanations of the specialists of the financial department are addressed to income tax payers, simplified organizations can also be guided by them (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of labor costs. They are as follows.

Labor costs include any accruals to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255, paragraph 2 of Article 346.16 Tax Code of the Russian Federation). In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25, article 255, clause 2, article 346.16 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can be taken into account as part of labor costs when calculating the single tax under simplification.

This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09. This resolution is dedicated to organizations on the general taxation system. However, simplified organizations can also be guided by the conclusions drawn in it (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization applies a simplification (“income minus expenses”)

Alpha LLC applies a simplified tax system and pays a single tax on the difference between income and expenses. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

When calculating the single tax, compensation for delayed wages is not taken into account in expenses. Alfa does not withhold personal income tax from the compensation amount.

Posting compensation for late payment of wages budget accounting

Personal income tax accrued: Dt 0 30211 830 “Reduction of payables for wages” Kt 0 30301 730 “Increase in payables for personal income tax” 3. The accrual according to the writ of execution is reflected: Dt 0 30211 830 Kt 0 304 03 730 “Increase in accounts payable for settlements of deductions from payments for wages" 4. Salaries were paid from the cash register: Dt 0 30211 830 Kt 0 20214 610 "Cash funds from the cash desk of a budgetary institution" 5. Salaries were transferred to bank cards: Dt 0 302 11 830 Kt 0 20211 610 "Cash outflow institutions from personal accounts with the treasury body" 6. Unpaid amounts deposited: Dt 0 30211 830 Kt 0 30402 730 "Increase in accounts payable to depositors" 7. Contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund have been accrued. Every month, each organization pays insurance contributions to the Pension Fund, mandatory social contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

Reflection of payment of compensation for delayed wages

KOSGU, read here. Postings for wages in a budgetary institution Based on the above regulatory documents, we will draw up the main entries for wages in the accounting of a budgetary organization. 1. Salary, vacation pay, bonus have been accrued. In this case, wage costs can be attributed to several different accounting accounts:

Compensation has been accrued for delayed salaries of employees. If these expenses form the cost of finished products, works, services that the institution sells for a fee, write them off to ( ). This procedure is established by paragraphs, Instruction No. 162n.

UTII

If an organization pays UTII, the amount of compensation for delayed salaries will not affect the tax calculation in any way. UTII is calculated based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. The organization pays UTII

Alpha LLC is a UTII payer. In August, Alpha delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases. The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

Alfa does not withhold personal income tax from the compensation amount.

Postings in the Budgetary Institution of Deductions for Compensation for Delayed Salaries

Reflect the accrual and payment of compensation for delayed salaries to employees in accounting in accordance with the material provided, with the following entries: Debit 0.401.20.290 Credit 0.302.91.730 – compensation accrued for delayed salaries to employees; Debit 0.302.91.830. Payment based on average earnings on a business trip is a mandatory amount guaranteed by Article 168 of the Labor Code of the Russian Federation.

Compensation for delayed wages budget posting

VII of the Labor Code of the Russian Federation, and to the employer’s financial liability to employees, provided for in Section. XI of the Labor Code of the Russian Federation, which makes it difficult to classify this payment as compensation, the definition of which is contained in Art. 164 Labor Code of the Russian Federation. An employee of a budgetary institution made a mistake when transferring funds, which led to a delay in the payment of wages to the institution's staff.

/ / 03/19/2021 265 Views 03/25/2021 03/25/2021 03/25/2021 Federal Law of 07/24/2021 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Responsibility for delayed wages

Administrative liability is provided for late wages:

- for an organization – a fine in the amount of 30,000 to 50,000 rubles;

- for officials (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine of 1,000 to 5,000 rubles.

Repeated violation entails:

- for an organization – a fine from 50,000 to 70,000 rubles;

- for officials (for example, a manager) – a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years;

- for entrepreneurs – a fine from 10,000 to 20,000 rubles.

These are the requirements of parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

In addition, criminal liability is provided for officials (Article 145.1 of the Criminal Code of the Russian Federation) and disciplinary liability (Article 192 of the Labor Code of the Russian Federation).

KOSGU: payments to employees from 2020

- Subarticle 266 of KOSGU Social payments in cash - compensation in money in exchange for free purchase of medicines; child benefit in the amount of 50 rubles. up to 3 years of age.

- Subarticle 267 of KOSGU Social payments in kind - monetary compensation for sanatorium and resort treatment; children's voucher to a health camp; medical services.

We recommend reading: Photo divorce

Starting in 2021, a new procedure for applying KOSGU will be introduced. The most significant changes affect wages, social and non-social benefits, income in kind and cash. From this article you will learn how the classification of KOSGU codes has changed: wages, social benefits, benefits for public sector employees.

Criminal liability of the manager

The head of an organization may be held criminally liable provided that he was directly or indirectly interested in the delay in wages. It does not matter how many employees’ payments were delayed (one is enough). The deadlines for delaying wages, in case of violation of which the manager may be brought to criminal liability, are as follows:

- complete non-payment – over two months;

- payment of wages in an amount below the minimum wage (minimum wage) - more than two months;

- partial non-payment – over three months.

For a manager who has allowed partial non-payment of wages for more than three months, the following types of criminal liability are provided:

- a fine of up to 120,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to one year);

- deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year;

- forced labor for up to two years;

- imprisonment for up to one year.

The head of an organization in which wages were not paid in full for two months or were paid in an amount below the minimum wage is subject to more stringent criminal liability measures. Namely:

- a fine in the amount of 100,000 to 500,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to three years);

- forced labor for a period of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years;

- imprisonment for a term of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

These types of liability are listed in parts 1 and 2 of Article 145.1 of the Criminal Code of the Russian Federation.

If the delay in wages entailed serious consequences, then the punishment will be even more severe (Part 3 of Article 145.1 of the Criminal Code of the Russian Federation).

Criminal liability can be avoided if the cause of the delay did not depend on the will of the manager.

Financial responsibility of the organization

The financial liability of the organization in the form of payment of compensation for delayed wages is established by Article 236 of the Labor Code of the Russian Federation. The organization is obliged to pay the specified compensation to employees even if the delay in wages occurred due to reasons beyond its control. The amount of compensation for delayed payment of wages must be reflected in pay slips (Article 136 of the Labor Code of the Russian Federation).

If an organization does not pay compensation voluntarily, then the court can force it (clause 55 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

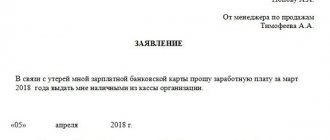

How to apply for compensation

Compensation payment for late payment of wages is calculated in accordance with the rules of Article 236 of the Labor Code of the Russian Federation. Labor legislation has established a minimum amount of compensation. The organization has the right to decide that compensation for delayed wages will be paid in an increased amount. Such a decision is approved in a collective agreement or other LNA.

Issue payments by order of the manager and create postings based on it. Familiarize each employee with the order.

Sample order

Bankruptcy

Let’s say that due to insufficient funds, the employer has an outstanding debt for payments due to employees (wages, severance pay, etc.) for more than three months. In this case, the head of the debtor organization or the individual entrepreneur himself must apply to the arbitration court with an application for bankruptcy. This is provided for in paragraph 1 of Article 9 of the Law of October 26, 2002 No. 127-FZ.

In addition, employees (including former employees) can apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments. This is stated in paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ.

Employees have the right to hold a meeting. Deadline – no later than five working days before the date of the meeting of creditors. The organization and holding of the meeting of employees is entrusted to the arbitration manager. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. The procedure for holding a meeting is described in detail in Article 12.1 of the Law of October 26, 2002 No. 127-FZ.

Claims for payment of arrears of wages and other remuneration to employees (including former employees) are included in the register of creditors' claims by the insolvency administrator or the registrar upon the proposal of the insolvency administrator. If such claims are disputed, they are included in the register on the basis of a judicial act establishing the composition and amount of these claims (clause 6 of Article 16 of the Law of October 26, 2002 No. 127-FZ).

Employee rights

An employee has the right to stop working if the salary is delayed for more than 15 days. In this case, the amount of debt and the guilt of the organization (lack of guilt) in the delay do not matter (clause 57 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). The maximum period of termination of work is until the debt is fully repaid. Before stopping work, employees are required to notify their supervisor in writing of their actions. After this, they have the right not to come to work at all (Part 3 of Article 142 of the Labor Code of the Russian Federation, Clause 57 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). In this case, employees are required to return to work only the next day after receiving written notification from the organization of their readiness to repay their arrears. At the same time, the organization must pay the delayed salary on the day they return to work.

Such conditions are provided for in Article 142 of the Labor Code of the Russian Federation. There is also a list of cases when stopping work due to delayed wages is prohibited.

During the period of suspension of work due to delays in salary, the employee is paid in the amount of average earnings. They also pay compensation for late payment.

These are the requirements of Part 4 of Article 142 and Article 236 of the Labor Code of the Russian Federation.

Account for posting payments for delayed payment of wages

According to Article 136 of the Labor Code of the Russian Federation, an employee’s wages must be accrued at least twice per calendar month. In this case, the payment day may be different - it must be specifically established in the collective agreement, employment contract or other local regulations.

The employer needs to transfer or issue money to employees on the specified day. If this does not happen, he will have to pay compensation on demand. Moreover, if the debt is not repaid within 15 days following the payment date, employees have the right not to fulfill their work duties.