The need to calculate depreciation of buildings

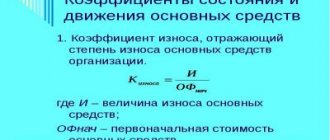

Buildings, as part of the assets of the enterprise, are used to support the production process and for administrative (management) purposes. Over the years, they gradually wear out, which is natural. Buildings lose their original properties and characteristics. As the technical condition deteriorates, their value decreases. When property is first entered into accounting records, it has an initial value. It is initially determined by the purchase price and the costs of putting it into operation.

Along with normal wear and tear, the value is subject to downward adjustment. That is why depreciation is calculated as a gradual attribution of the cost of fixed assets to the cost of goods manufactured, services provided or work performed.

Which depreciation group does non-residential premises belong to?

The only indication that can be relied upon in this case is paragraph 5 of Article 258, according to which the enterprise is allowed to be guided by “technical conditions and recommendations of manufacturing organizations.” Although, strictly speaking, this provision is provided for those types of fixed assets that are not indicated in depreciation groups, it is still not given otherwise. Consequently, if the documents received in the process of preparing for state registration (for example, an extract from the BTI technical passport) contain an indication of the standard service life of the building in which the purchased premises are located, then this should be chosen as the useful life. If there is no such data in the documents, then for this information, in our opinion, you should contact an independent expert working in the field of real estate valuation, or a construction organization constructing similar buildings. Suppose that, using one of the listed methods, the enterprise has determined that the building, which includes the purchased property, is expected to be useful for 50 years. However, this is not enough to correctly calculate the depreciation rate.

Additionally

At the same time, the legislation does not prohibit an organization, when establishing the SPI of buildings and structures, to be guided by the Classification of fixed assets included in depreciation groups used in tax accounting. If an organization systematically uses the Tax Classification when determining private investment income in accounting, it is advisable to consolidate this procedure in the Accounting Policy for accounting purposes. In addition, the establishment of a single SPI for buildings and structures in accounting and tax accounting will help reduce the differences between the two accounting systems.

Until January 1, 2021, the All-Russian Classifier of Fixed Assets OK 013-94 is in force, approved by Decree of the State Standard of Russia dated December 26, 1994 N 359 (hereinafter referred to as OK 013-94), according to which premises built into buildings and intended for shops, canteens, hairdressing salons , studios, rental points for cultural and household items and household items, kindergartens, nurseries, post offices, banks and other organizations whose purpose is different from the main purpose of the building are included in the main building. Despite the fact that this clarification concerned the subsection “Buildings (except residential)”, we believe that this can also be attributed to the subsection “Dwellings”.

Depreciation in accounting: basics

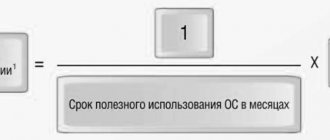

The starting element in the methodology for calculating depreciation is the useful life (LPI) of real estate assets. It is installed following the data of the “Classification of fixed assets included in depreciation groups.” It operates in accordance with government decree in 2002. It is also necessary to take into account the changes made on 07/07/2016. Their action began in January of this year.

The SPI is the period during which the building is able to serve productively as an asset and contribute to the accomplishment of the taxpayer's objectives.

The enterprise determines it itself, based on the date the building was put into operation and information about the OS classification: (click to expand)

| OS groups (buildings incl.) | SPI (years) | |

| over | up to (inclusive) | |

| 4th | 5 | 7 |

| 5th | 7 | 10 |

| 7th | 15 | 20 |

| 8th | 20 | 25 |

| 9th | 25 | 30 |

| 10th | 30 | |

The buildings belong to the 4th and 5th, as well as to 7-10 groups. The enterprise independently determines which of them its real estate should be classified as. The characteristics of each set of buildings provide a clue.

Changes in legislation - take one

What really put an end to the long-standing confrontation between taxpayers and regulatory authorities on the issue of starting to calculate depreciation on property, the corresponding rights to which must be registered, was Federal Law No. 206-FZ. The Ministry of Finance explains the change in the procedure for depreciation of real estate by the need to simplify tax accounting and bring it closer to accounting, which is one of the priorities of tax policy. The financial department indicated this in Letter No. 03-03-06/1/421 dated August 17, 2012, which noted that it is intended to highlight areas in which it is inappropriate for the legislation on taxes and fees to establish special rules for determining the indicators used in calculating the base for income taxes that differ from accounting rules. The number of such differences should ultimately be minimized, which was achieved, according to the Ministry of Finance, including by amending Chapter. 25 of the Tax Code of the Russian Federation in accordance with Federal Law No. 206-FZ.