Acceptance of fixed assets for accounting

So, the company has an operating system on which depreciation is calculated in accounting and tax accounting.

It doesn’t matter whether the property was purchased, donated or contributed as payment for the authorized capital, the procedure for calculating depreciation does not depend on the method of obtaining fixed assets. But initially the asset is reflected as an investment in non-current assets. When should it be transferred to the operating system and start accruing depreciation? In accounting, this should be done when the asset is ready to be used for its intended purpose. For example, a purchased machine that does not require installation is transferred to the OS immediately after it is received by the organization, since it is at this moment that you can begin to use it. In tax accounting, the situation is different: property that is used to generate income is initially recognized as depreciable (see Table 1).

Acceptance of fixed assets for accounting and choice of depreciation calculation procedure

| Name | Accounting | Tax accounting |

| Acceptance of fixed assets for accounting | The property is transferred to the fixed assets at the moment of readiness for operation (clause 4 of PBU 6/01 “Accounting for fixed assets”), the actual use of the fixed assets does not matter | Depreciable property is property that is used to generate income (clause 1 of Article 256 of the Tax Code of the Russian Federation), the actual use of fixed assets matters |

| State registration of property rights does not affect the acceptance of fixed assets for accounting: | ||

| see PBU 6/01 and clause 52 of the “Methodological guidelines for accounting of fixed assets” (approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n) | see paragraph 4 of Art. 259 of the Tax Code of the Russian Federation, valid from 01/01/2013 | |

| Methods for calculating depreciation and conditions for their selection | Selected once for all operating systems or for a group of operating systems: — linear method; — reducing balance method; — method of writing off value by the sum of the numbers of years of useful life; — method of writing off cost in proportion to the volume of products (works) | Selected for all OS in accordance with the accounting policy of the organization: — linear method (always prescribed for 8–10 depreciation groups, see clause 3 of Article 259 of the Tax Code of the Russian Federation); - nonlinear method. The “tax” method can be changed from January 1 of the next year, but you cannot leave the non-linear method earlier than 5 years from the start of its use |

| Depreciation calculation | Monthly from the first day of the month following the month the asset was accepted for accounting : | |

| see clause 24 PBU 6/01 | see paragraph 4 of Art. 259 Tax Code of the Russian Federation | |

Please note that the need for state registration of the right to property at the time of acceptance of OS for accounting and tax accounting does not affect. For example, if in March 2014 an organization received from the seller purchased non-residential premises in a condition suitable for the planned use, then, regardless of the state registration of the right and even the fact of filing documents for registration, it must include it in the operating system in the same month.

Web service for small businesses. Clear for the director, convenient for the accountant! The first month of work is free.

To learn more

Accounting for depreciation on intangible assets

Depreciation is accrued not only for fixed assets, but also for intangible assets (intangible assets). The classifier does not define groups of intangible assets due to the wide variety of funds and individual approach to the useful life of assets. The period of use is determined in accordance with documents confirming the right to intellectual property. Intangible assets, for which it is impossible to determine the period of use in generating income, are defined in NU within 10 years.

The list of intangible assets used in NU is defined in Art. 257 Tax Code of the Russian Federation. The closed list does not contain a number of types of intangible assets, unlike accounting accounting, in which the list of assets is open. Funds without copyrights, business reputation and other types are not taken into account as assets. Expenses on the basis of which intangible assets are not formed must be taken into account as part of others. The possibility of changing the value of intangible assets in NU is not provided.

Depreciation calculation

In both accounting and tax accounting, depreciation is accrued monthly from the first day of the month following the month the asset was accepted for accounting. The organization itself chooses which procedure to use when calculating depreciation in its accounting policies.

Thus, for accounting purposes, you can choose one of four methods: the linear method, the reducing balance method, the method of writing off the cost by the sum of the numbers of years of the useful life, the method of writing off the cost in proportion to the volume of production (work). The depreciation calculation method can be selected for all fixed assets or for a particular group of fixed assets. For example, you can determine that the linear method is used for office equipment, and the reducing balance method is used for machine tools.

In tax accounting, you can choose a linear or nonlinear method, but for all operating systems. The exception is buildings, structures, transmission devices included in depreciation groups 8–10. The linear method is always used for them.

Please note the significant difference between accounting and tax accounting. In accounting, the method of calculating depreciation is selected once in relation to each fixed asset and in the future the fixed asset does not change for this purpose. And in tax accounting, at each specific moment, the method specified in the accounting policy is used. That is, if an organization wants to change the “tax” method, it can do so from January 1 of the next year.

The only limitation is that you cannot “leave” the nonlinear method earlier than 5 years after the start of its use. Let's look at the procedure for calculating depreciation using examples.

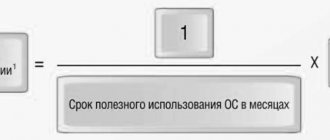

Example 1. An organization uses a linear method (method). In April 2014, she commissioned an operating system with an initial cost of 96,000 rubles and set its useful life at 4 years (48 months). This means that in tax accounting, fixed assets are included in the third depreciation group (fixed assets with a useful life of 3 to 5 years inclusive). Thus, starting from May 2014, depreciation will be accrued monthly in accounting and tax accounting in the amount of 2,000 rubles.

Example 2. In the conditions of example 1, we assume that to calculate depreciation for all fixed assets in accounting, the reducing balance method is established (paragraph 3 of clause 19 of PBU 6/01) with a coefficient of 2. In this case, the annual depreciation rate will be 50% (100 %/4 years × 2). Let us remind you that during the year, depreciation is accrued monthly in the amount of 1/12 of the annual amount, regardless of the method used (paragraph 5, clause 19 of PBU 6/01).

Then in 2014, the organization will accrue depreciation in the amount of 28,000 rubles (96,000 rubles × 50% / 12 × 7). At the beginning of 2015, the residual value of fixed assets will be 68,000 rubles, and the amount of depreciation will be 34,000 rubles (68,000 × 50%).

Accordingly, in 2021, accrued depreciation will be 17,000 rubles (34,000 × 50%), and for 5 months of 2021 (by the end of the useful life) - 3,541.67 rubles.

As a result, the amount of 13,458.33 rubles will remain unwritten. The current regulations do not say what to do with this amount. This means that the organization must determine the procedure for repaying the remaining value of an asset at the end of its useful life when calculating depreciation using the reducing balance method (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”). The Russian Ministry of Finance also pointed this out in letter No. 07-05-06/18 dated January 29, 2008.

In particular, due to the insignificance of the remaining amount, one can provide for its one-time attribution to expenses in the month of expiration of the useful life.

Accrual methods used in taxation

Organizations have the right to use linear and non-linear methods of calculating depreciation for NC purposes.

| Condition | Linear method | Nonlinear method |

| Write-off procedure | Evenly throughout the entire period | Unevenly with a larger amount written off at the beginning of operation |

| Accrual | By inventory item | By group of objects |

| Group restrictions | None | Not used for 8-10 depreciation groups |

| Accelerated write-off | Not applicable | Apply by using multiplying factors |

The use of the linear method is justified for enterprises with a constant volume of output and revenue. The nonlinear method is justified for organizations with unstable sales volumes or during periods of high profit.

From nonlinear to linear

An “analog” of the reducing balance method in tax accounting can, with certain reservations, be called the non-linear method of calculating depreciation. However, when using it, the depreciation rate for each group is clearly established (Article 259.2 of the Tax Code of the Russian Federation).

Example 3. In the conditions of example 1, assume that the organization has established a non-linear method in tax accounting and does not have other fixed assets belonging to the third depreciation group (see Table 2).

Calculation of depreciation using the non-linear method for 2014 for fixed assets of the third group*

| Month | Total balance of the group at the beginning of the month, ₽ | Depreciation rate | Amount of accrued depreciation (4 = 2 × 3), ₽ | Total balance minus depreciation (5 = 2 – 4), ₽ |

| (1) | (2) | (3) | (4) | (5) |

| May | 96 000,00 | 5,6/100 = 0,056 | 5 376,00 | 90 624,00 |

| June | 90 624,00 | 5 074,94 | 85 549,06 | |

| July | 85 549,06 | 4 790,75 | 80 758,31 | |

| August | 80 758,31 | 4 522,47 | 76 235,84 | |

| September | 76 235,84 | 4 269,21 | 71 966,64 | |

| October | 71 966,64 | 4 030,13 | 67 936,50 | |

| November | 67 936,50 | 3 804,44 | 64 132,06 | |

| December | 64 132,06 | 3 591,40 | 60 540,67 |

Further, the procedure for calculating depreciation will be the same.

If the organization does not acquire other operating systems of the third group by September 2021, the total balance of this group will become less than 20,000 rubles. In this case, clause 11 of Art. 259.2 of the Tax Code of the Russian Federation allows the entire total balance to be allocated to non-operating expenses, and the depreciation group to be liquidated.

But suppose that an organization that has been using the non-linear method since 2009 decides to return to the linear depreciation method in 2015. What to do in this case is written in paragraph 4 of Art. 322 of the Tax Code of the Russian Federation. First of all, you need to calculate the residual value of each fixed asset as of January 1, 2015. In our case, the residual value of the only fixed asset from the third group coincides with the total balance of the group as of January 1, 2015 - 60,540.67 rubles.

Next, we determine the remaining useful life. The OS was used for 7 months, so the remaining useful life is 41 months (48 - 7). Straight-line depreciation is calculated based on two previously determined indicators. That is, the depreciation rate will be (1/41) × 100% = 2.44%, and the monthly depreciation amount in tax accounting will be 1,476.60 rubles (60,540.67 × 0.0244).

Temporarily disposed property

Property is temporarily removed from depreciable property in the following cases:

- when transferring (receiving) fixed assets for free use (except for the transfer of objects for free use to state and municipal authorities, institutions, unitary enterprises, if the obligation to transfer is established by law);

- when transferring fixed assets to conservation for a period of more than three months by decision of the organization’s management;

- during the reconstruction and modernization of fixed assets lasting more than 12 months (except for those cases when organizations continue to use the reconstructed (modernized) objects in activities aimed at generating income).

Such rules are established by paragraph 3 of Article 256 of the Tax Code of the Russian Federation.

Situation: at what point in tax accounting should you stop and then resume depreciation on a fixed asset transferred for free use?

Fixed assets transferred under contracts for free use are temporarily excluded from depreciable property (clause 3 of Article 256 of the Tax Code of the Russian Federation).

As a general rule, depreciation on such objects is suspended from the 1st day of the month following the month in which the fixed assets were transferred for free use. And it is renewed - from the 1st day of the month following the month in which they were returned to the owner.

An exception to this rule is the transfer of fixed assets for free use to state and municipal structures (if such an obligation is established by the legislation of the Russian Federation). There is no need to suspend depreciation for these fixed assets. This is provided for in paragraph 3 of paragraph 2 of Article 256, paragraph 2 of Article 322 of the Tax Code of the Russian Federation.

If the organization was liquidated or reorganized, then depreciation stops on the 1st day of the month following the one in which the liquidation or reorganization was completed. In a reorganized organization, depreciation is resumed on the 1st day of the month following the month of its state registration.

The Russian Ministry of Finance gave separate clarifications regarding the case when the reorganization took place on the 1st of the month. In this case, start accruing depreciation on the same day. That is, without waiting until next month. In this case, the reorganized legal entity will accrue depreciation until the end of the month preceding the month in which the new organization was created. This is stated in letters of the Ministry of Finance of Russia dated June 22, 2015 No. 03-03-06/1/35987, dated March 30, 2015 No. 03-03-06/1/17383.

An exception to these rules is reorganization in the form of transformation (change in legal form). In this case, accrue depreciation in the usual manner (there will be no breaks in accrual).

Such features of calculating depreciation during the liquidation or reorganization of an organization are set out in paragraph 5 of Article 259 of the Tax Code of the Russian Federation.