The responsibility to record all ongoing business transactions falls on the shoulders of many legal entities and individual entrepreneurs. According to Russian legislation, economic entities must constantly maintain accounting records, unless otherwise provided by Federal Law N 402 “On Accounting” dated December 6, 2011.

The cornerstone of accounting can be considered an accounting entry, with the help of which any action of the company (purchase of materials, payment of salaries, etc.) is reflected in numbers - that is, the fact of a change in the state of the objects taken into account is recorded. Let's discuss how typical accounting entries are prepared and look at examples.

What is an accounting account?

It is very difficult for novice accountants to understand the preparation of entries without a clear understanding of what an account is, so it is better to move “from the stove”.

An accounting account is a certain position in business accounting necessary for continuous monitoring of the ongoing movement of property owned by the company, as well as the sources of its formation. This is done by using the double entry method, when one transaction is reflected twice - as a debit to one account and as a credit to another. All accounts that are used in the accounting of commercial companies are systematized and grouped in a special document - the chart of accounts.

Advice: when analyzing transactions and making entries, it is best to keep at hand the general chart of accounts for accounting the financial and economic activities of organizations.

Accounting accounts are divided into three types depending on what object is subject to accounting:

- Active – designed to display in monetary terms information about the organization’s economic assets and resources. For example, materials (10), cash in the cash register (50), finished products (43), etc. The opening balance of active accounts is recorded only by debit, the ending balance is the same. Transactions that are characterized by an increase in the company's funds are indicated as a debit of the account. If resources decrease, the entry is credited.

- Passive - they take into account in monetary terms the state, movements and changes in the sources through which the company’s economic assets were formed. For example, depreciation of fixed assets (02), trade margin (42), authorized capital (80), etc. The opening and closing balances can only be for the loan. Entries that increase the account go to credit, and those that decrease it go to debit.

- Active-passive – insidious accounts that play the role of both passive and active. It is important to understand which account sign is triggered in each specific situation. The opening balance can be recorded both as a debit and as a credit; It is possible to have a debit and credit opening balance at the same time. For example, active-passive account 76 “Settlements with various debtors and creditors.” If a company has accounts receivable (that is, someone owes it), then the amount is written as a debit, and in the case of accounts payable (the company owes someone), the figure is reflected as a credit.

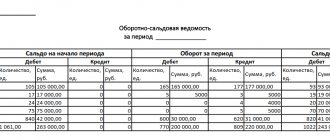

When accountants were forced to carry out calculations without using a computer, accounts were drawn in the form of original tablets, which were popularly called “airplanes.” Each account has its own scheme, they look like this.

- Typical active account scheme:

- Typical passive account scheme:

- Typical active-passive account scheme:

Credits and loans

- Loan repayment in accounting

- Payment of interest on a loan in accounting

- Loan repayment in accounting

- What are the types of loans, transactions, examples?

- Letter of credit - what is it, table of accounting entries

- What is a bill of exchange? Reflected in accounting

- Short-term and long-term loans

- Postings for loan repayment

- Reflection of deposits in accounting

- We reflect the organization's loans for its employee - preparation of accounting entries

- Factoring: examples, postings

- Calculation of interest on loans issued

- Calculation of interest on loans received

- Loans between organizations

- Obtaining a loan from an organization

- Issuing a loan to a legal entity or individual

- Typical accounting entries for loans

- Loans from the founder/posting founder

- Features of an interest-free loan between enterprises

- How are deposits reflected in accounting?

How are accounting entries prepared?

Accounting entries are based on the principle of double entry: the transaction amount is recorded as a debit to one account and a credit to another, that is, a balance is always maintained, which is why the asset must always be equal to the liability.

Example: suppose the founder of an LLC made a contribution to the authorized capital in the amount of 10,000 rubles by depositing the money into a current account. Then we can draw the following conclusion - the company acquired assets (cash), and at the same time, obligations to the founder arose. The result will be the following double entry: Dt 51 “Current account” – Kt 80 “Authorized capital” – 10,000 rubles.

The meaning and essence of the wiring is easy to understand if you realize that nothing in this world comes out of nowhere and disappears without a trace. Everything is logical - we bought the materials, which means we paid money for them. In other words, there was an increase in materials, but a decrease in finances. There is an interesting point here: movement between items can occur without changing the total for assets and liabilities. For example, the production of goods was completed, therefore, they became finished goods. Two active accounts were affected - one decreased and the other increased by the same amount. Posting in this situation: Dt 43 “Finished products” - Kt 20 “Main production” .

See also: Advantages and disadvantages of Sberbank gold card (Visa and MasterCard)

And if a company pays a debt to a supplier from a current account, then there will be a simultaneous decrease in assets and liabilities, since this operation affects the active cash account and the active-passive (the passive sign is triggered, as our company must) account reflecting accounts payable. Posting: Dt 60 “Settlements with suppliers and contractors” – Kt 51 “Settlement account” .

Accounting entries for specific business transactions

The number of balance sheet accounts approaches a hundred - of course, this is a lot, especially if you remember that some have numerous sub-accounts. This diversity leads to complications: there are a great many typical accounting entries - just imagine all the possible combinations. Moreover, it must be borne in mind that some transactions are recorded not in one, but in several transactions. It is probably impossible to consider all the options, but it is quite possible to highlight those that most organizations face. Let's discuss different cases, presenting information with answers in tables.

For fixed assets accounting

Fixed assets are tangible assets that are directly involved in production processes and are present in the activities of many companies (buildings, structures, transport, tools and even perennial crops and breeding livestock). Their distinctive feature is the period of use - it must exceed one year. For example, fixed assets (PE) include production equipment. Everyone understands that you can work with it for more than 12 months, but over time, its useful life expires, that is, banal wear and tear occurs. Therefore, the cost of fixed assets is gradually transferred to the cost of production through depreciation.

Let us present in the table the postings-responses for those typical accounting transactions that relate to fixed assets:

Fixed assets are accepted for accounting at their original cost, which is the sum of all costs associated with the acquisition of an asset. That is, this includes not only the direct costs of purchasing an OS or its construction, but also the cost of delivery, installation, consulting services, and the like. However, we must remember that, in accordance with PBU 6/01, assets whose value does not exceed 40,000 rubles can be reflected in accounting as part of inventories (inventory) - their receipt is reflected in account 10 “Materials”.

By accounting for intangible assets

A company's intangible assets have no physical form, yet they are capable of generating economic benefits and can be clearly identified. For example, intangible assets include the business reputation of a company and various objects of intellectual property - you cannot touch it with your hands, but exclusive rights to something (a trademark, a program, breeding achievements, etc.) often make it possible to receive significant income.

See also: How to draw up a commercial proposal for the provision of transport services?

Answers to the main questions related to accounting of intangible assets are presented in the table:

Organizational expenses incurred during the formation of a legal entity cannot be classified as intangible assets (PBU 14/07).

According to inventory accounting

All companies involved in manufacturing are constantly faced with the need to purchase materials (inventory, or inventories). As a rule, even for novice accountants, their accounting does not cause difficulties - the answers and postings for typical transactions can be seen in the table:

Nowadays, fuel cards are widely used by many organizations whose activities are closely related to transport. Novice financiers often have difficulties with accounting for fuel and lubricants on fuel cards, since at present there is no clear legally approved procedure for carrying out this procedure - some believe that account 10 “Materials” can be used, but experts say that this approach is incorrect and advise use off-balance sheet accounts.

Advice: several years ago, a universal transfer document specially developed by the Federal Tax Service came into use among accountants, but not all companies wanted to get acquainted with it, fearing innovations. If you do not yet use UPD, then you should think about changing the situation, since this will allow you to significantly reduce document flow, and therefore significantly save time.

By accounting for production costs

For people starting to understand the preparation of accounting entries, it is sometimes quite problematic to deal with the accounting of production costs, because several accounts are intended for them. Usually, the accounting policy of the organization prescribes how the valuation of retiring inventories occurs (PBU 5/01). Let's look at the answers to the most common situations in the table:

Production cost accounts include 20, 21, 23, 25, 26, 28, 29.

For accounting of finished products and goods

Many companies build their business on the sale of any goods, so it is important for novice accountants to understand how their accounting is carried out. Answers in the form of entries for typical business transactions involving the purchase and sale of marketable products can be found in the table:

If an organization is engaged in purchasing goods from suppliers, then great attention should be paid to checking the documentation provided by the counterparty. Remember that you have the right not to rush joyfully to the first offer if it seems unprofitable. In this case, a protocol of disagreements to the contract is usually drawn up, reflecting the position of the party who disagrees with any of the terms.

Important: the table shows only the basic standard accounting entries - in the accounting of goods and finished products, there are a lot of options possible, since they often need to be revalued and are sometimes made as a contribution to the authorized capital (or in general the company receives them for free). To become familiar with all situations, it is necessary to study in detail the Accounting Regulations and other special literature.

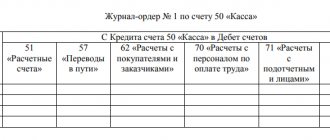

Cash accounting

While not all companies deal with the production of products, probably absolutely all of them work with money. For financial accounting, two accounts are most often used - 50 “Cash” and 51 “Current account”. From the names it is intuitively clear - money is usually stored either in the cash register or in a bank account. Let's look at typical transactions in the table that affect the organization's funds and give the answers in the form of transactions:

Novice accountants should remember that when carrying out transactions with funds, the appropriate documentation must be drawn up - payment orders, cash receipts and debit orders, advance reports, cash inventory reports, etc.

According to settlements with staff

Partial answers to questions on typical accounting entries affecting the payment of employees were given above; To make the information easier to perceive, we group them in a table:

See also: Public Speaking Techniques for Leaders

Accounting for loans and borrowings

Who hasn’t needed a loan in these difficult times? Entrepreneurs are no exception - often business development requires additional financial investments, and there is simply nowhere to get them... Then businessmen usually go to banking institutions. Novice accountants will be able to process “credit” transactions without any problems, because there are not many options here - you need to reflect the loan received, calculate the monthly loan payment, etc. For clarity, we present typical postings-responses in the table:

The table most often contains two accounts - 66 and 67. You need to choose depending on the loan term: account 66 is called “Calculations for short-term loans and borrowings,” and 67 is called “Calculations for long-term loans and borrowings.”

For transactions with authorized capital

Authorized capital is financial funds or any property that the founders contributed during the registration of the LLC. There is an opinion in society that a contribution to a management company necessarily represents money, but this is not at all true - if you are the owner of a building, then, of course, you can become the founder of an LLC by contributing your real estate to the authorized capital. What else can you use as a contribution? We will answer this question in the table, giving typical entries for accounting of authorized capital:

For accounting of financial results

Of course, the goal of any business activity is to generate income. The financial result is determined by the profit or loss generated by the end of the reporting period. If income exceeds expenses, then the property of the enterprise increases, that is, the company makes a profit; in the opposite situation, there is a loss. Let's consider in the table how entries are made for transactions related to the formation of the financial result:

Account 90 “Sales” reflects revenue as a debit, and as a credit – costs that relate to cost, as well as excise taxes and taxes. When the balance of account 90 is in credit at the end of the period, profit is recognized. If the balance is debit, then the company has incurred a loss. It should be remembered that account 99 is written off to 84 on the last day of the reporting period, that is, its balance becomes zero.

Primary documentation for recording

With the help of this documentation, you can certify the fact of the accomplishment of the chemical act and ensure the reliability of your employees. Some types of primary documents are unified, others are created by payers personally.

Primary documentation, reflecting the implementation of the economic organization and being the basis for creating accounting entries, can be generated both by the accounting service and by management, middle managers, and so on. These documents must contain certain information:

- Name

- signatures of officials

- information about the responsible employee

- deal name

- information about business entities involved in the transaction

- information about the entity of the enterprise

- date of registration of documentation

Thus, all financial entities in accounting must be accompanied by postings, which are the basis for reporting. The latter, in turn, allows you to analyze the financial results of the company. In addition, it contributes to the development of correct management decisions.

Write your question in the form below

Is it possible to make transactions online?

Today, many Internet services lure novice accountants with the opportunity to make transactions online - automatically, free of charge and in real time. Of course, no one forbids taking advantage of the offer, but it is worth understanding that the business operations of each specific company have their own subtleties and nuances, so it is easy to end up with incorrectly formed accounting entries. It is logical that a person involved in accounting should know the chart of accounts and PBU by heart, and the owners of this information usually do not need help in analyzing business transactions.

Important: if you still do not want to prepare accounting entries yourself, then it is better to use special software, for example 1C: Accounting.