In order to control the calculation of insurance premiums by the organization and their transfer to the Pension Fund of the Russian Federation, employees of this government body conduct a desk audit based on a detailed study of the primary documentation on wages and reporting to the fund. This procedure is standard and is used to check reporting for companies with different forms of ownership. In this article we will look at how a desk audit of the Pension Fund of the Russian Federation is carried out, what are the deadlines for conducting it, the necessary documents and fines.

The essence of a desk audit of the Pension Fund of Russia

The essence of a desk audit by employees of the Pension Fund is that the submitted reports are analyzed for the correctness of their preparation, and also correlated with the amount of insurance premiums that were paid in this period. The desk audit is carried out on the basis of reports provided by the accountant to the Pension Fund, and is carried out directly at the place of work of the fund’s employees without traveling to the territory of the business entity.

A desk audit is carried out on submitted reports within three months, that is, until the reporting period for the next billing period. If errors are discovered, employees may require explanations for discrepancies or request any additional documents indicating the correct interpretation of a particular point.

An inspection of this kind is carried out by employees of the Pension Fund, who, in accordance with their official duties, have the right and must perform tasks of this kind assigned to them. At the same time, they do not require permission from management, since the implementation of this activity is their direct job responsibility.

Deadlines for conducting a desk tax audit

Desk inspections are carried out at the location of the territorial body of the Pension Fund Art. The maximum period for a desk audit is 3 months! The verification period corresponds to the period of the submitted calculation. The FSS conducts on-site inspections of employers to check whether they comply with the legislation on compulsory social insurance, Art. In addition to desk inspections, the Pension Fund also conducts on-site inspections of employers Art. A joint tax audit is an on-site audit in which, in addition to employees of the Federal Tax Service, police are involved.

From October 1 of the year, the Instructions on personalized accounting are applied in a new edition. The changes were made by Order of the Ministry of Labor of Russia dated October 1 of the year, the company itself can correct errors without a fine only in the information that the Pension Fund of the Russian Federation accepted, or submit a supplementary SZV-M before the end of the deadline for submitting the primary report, that is, before the first day of the month following the reporting one. taking into account the transfer rules.

Home Documents Article Desk audit The document has become invalid or cancelled.

The purpose and objectives of the desk audit of the Pension Fund of Russia

The purpose of the desk audit by the Pension Fund is to determine the correctness or violation on the part of organizations of maintaining personalized records for employees and to identify errors or inaccuracies that need to be corrected. In other words, a desk audit is needed in order to provide all working citizens with their pension rights, which depend on how personnel and salary records are maintained at the enterprise.

In accordance with this goal, certain tasks are identified that must be solved by a desk audit by the Pension Fund. These include:

- control over the correct application of the regulatory legislation of the Russian Federation in the field of pension rights of employees of organizations;

- identifying any violations regarding the calculation and payment of insurance premiums, as well as preventing their reoccurrence;

- collection of amounts owed on insurance transfers, if such is present in the activities of the business entity;

- application of penalties in cases of gross violation of Russian legislation;

- development of a schedule of desk inspections and identification of organizations that require on-site inspections.

Objects of analysis during a desk audit of the Pension Fund of Russia

When conducting a desk audit, the Pension Fund examines and analyzes certain documents submitted to business entities. First of all, these include:

| Document | A comment |

| RSV-1 (calculation of insurance premiums) | The document contains information in a generalized form for all employees of the enterprise (except for Section 6). This report reflects information on accrued wages; amounts for which pension insurance contributions are not calculated; direct amounts of insurance contributions. RSV-1 calculates both contributions to compulsory pension and compulsory health insurance for employees of the organization. In addition, the calculation contains data on whether the enterprise has employees for whom a reduced interest rate or an additional tariff for hazardous working conditions is used. RSV-1 is rented quarterly on an accrual basis |

| Personalized accounting (Section 6 of calculation of insurance premiums) | This section is part of the RSV-1 and is of greatest interest to employees of the Pension Fund, since it contains personalized information for each employee. At the same time, this section includes information such as accrued wages, non-contributory amounts, the amount of contributions to the Pension Fund, the period of work of the employee and its coding, as well as the use of an additional tariff when working in harmful or dangerous conditions. The report is submitted quarterly, like RSV-1 |

| SZV-M | The report appeared in 2021 and its purpose is to identify employees who receive a pension, but at the same time have official employment. This report indicates only the employee’s full name, his insurance certificate number in the Pension Fund and TIN |

When determining the base for calculating insurance premiums, special attention is paid to amounts that are not subject to contributions, that is, excluded from the calculation base. These include various types of social benefits, whether for temporary disability, illness or injury, in connection with maternity, as well as individual payments in the form of financial assistance to employees (see → Financial assistance to an employee: accounting, taxes, insurance contributions) .

In addition, Pension Fund employees also pay attention to the additional tariff that must be paid by the organization for those employees who work in hazardous conditions. To calculate it, workplace certification must be carried out, based on the results of which positions that correspond to harmful or dangerous production conditions are identified.

The process of conducting a desk audit of the Pension Fund of Russia

The direct process of conducting a desk audit by the Pension Fund begins only when the business entity has submitted the necessary reports for consideration. It should be noted that for organizations with more than 25 people, it must be transmitted via secure electronic communication channels through a special operator. It provides information that the document has been submitted to the Pension Fund, but is not yet considered submitted, or has been verified and accepted by the Pension Fund.

All documents submitted by the organization are subject to verification to ensure their compliance with the requirements of Russian regulatory legislation. If any errors or inaccuracies are identified, Pension Fund employees request explanations from the organization or additional documents. It should be noted that, if necessary, the Pension Fund may request information from the Social Insurance Fund, since in some cases the calculation of contributions to both of these funds is the same. For example, in both cases, contributions are not calculated on amounts for temporary disability certificates, benefits for the birth of a child or up to 1.5 years.

Errors or omissions identified during the RSV-1 check must be corrected within five days, and an updated RSV-1 with corrected indicators must be sent. In the event that a business entity does not agree with the corrections, it needs to write an official letter in which it indicates why it entered certain data in the calculation. It is also necessary to attach copies of supporting documents to the letter, if available. Letters with supporting documentation are also sent via secure electronic communication channels using a simple, formalized letter.

Deadline for desk inspection of SSV m

You can also consult with lawyers online for free directly on the website. A desk audit is carried out on submitted reports within three months, that is, until the reporting period for the next billing period.

If errors are discovered, employees may require explanations for discrepancies or request any additional documents indicating the correct interpretation of a particular point.

Organizations that have concluded labor and civil contracts for the performance of work or provision of services with individuals are required to report using this form. In September, when submitting a declaration or settlement in person, the deadline begins to run from the date of its submission, which is confirmed by a stamp affixed to the first sheet of reporting.

The SZV-M must be submitted no later than the 1st day of the month following the reporting month. What if the deadline falls on a weekend? As, for example, it happened in September of this year. In this situation, you can report on the next working day.

However, inspectors often do not comply with inspection deadlines and also commit other violations when carrying out an inspection and recording its results. In such situations, the policyholder may challenge the results of the inspection on procedural grounds. In other words, a desk audit is needed in order to provide all working citizens with their pension rights, which depend on how personnel and salary records are maintained at the enterprise.

Agree, a very effective tool for raising money. Let's figure out what companies and entrepreneurs are fined for in terms of information on the SZV-M form and to what extent the controllers' claims are actually justified. In order to control the calculation of insurance premiums by the organization and their transfer to the Pension Fund of the Russian Federation, employees of this government body conduct a desk audit based on a detailed study of the primary documentation on wages and reporting to the fund.

This procedure is standard and is used to check reporting for companies with different forms of ownership. For example, in the report for October they provided data on 10 employees, but did not report on two who were fired in the middle of the month. If it is necessary to submit an updated declaration, the verification period for the previous one is reset, and the verification starts again. In case of disagreement with the results of the audit, the taxpayer submits objections to the desk audit report to the tax authority that issued the specified document.

Next, we will look at what procedural violations are most often committed by inspectors from Pension Fund departments and give examples of how the courts react to the mistakes of inspectors. Moreover, they refer to clause N n, which gives the policyholder two weeks to correct inaccuracies and re-send the reports.

And this, by the way, fits perfectly into the provisions of Art. Foundation specialists will check the accepted report and send a positive or negative report, which will indicate errors. They must be corrected within five business days. If an error is discovered by a Fund branch, it should not immediately impose a fine. It must first provide notice to resolve any discrepancies.

And the policyholder must provide updated data within two weeks after receiving such notification. If he does not correct the errors within this period, the Pension Fund branch itself must correct the individual information. The policyholder will be informed about this no later than 7 days from the date of the decision. Self-discovered errors can also be corrected without penalties. The start of the event period begins counting from tomorrow, after registration of documents with the Federal Tax Service p.

The declaration can be sent to the tax authority via Russian Post. The inspection period in this case is calculated from tomorrow, after the declaration arrives at the inspection. The desk audit is carried out on the basis of reports provided by the accountant to the Pension Fund, and is carried out directly at the place of work of the fund’s employees without traveling to the territory of the business entity.

When the period ends on a day of the month that is not on the calendar, a decision based on the results is made on the last day of the current month.

These are general rules. In reality, everything can be much more interesting, as evidenced by judicial practice. More on this below. But first you need to understand the procedural issues and figure out how to file complaints. By virtue of the Law on Individual Personalized Accounting, an institution, being an insured under compulsory pension insurance, is obliged to submit, within the period established by law, information regarding insured persons in the forms SZV-M and SZV-STAZH p. When reconciling information about insured persons in these two reports, Pension the fund revealed that the SZV-STAZH form did not include information about six insured persons.

Based on the results of the inspection, an act was drawn up and a decision was made to hold the institution accountable in the form of a fine under Art. Since the requirement to pay the fine was not fulfilled voluntarily, the Foundation went to court with a demand to forcefully collect sanctions from the institution. Having examined the case materials, the courts of three levels came to the conclusion that the Fund did not comply with the procedure for notifying the policyholder of errors identified in the information provided to them.

Let us recall that the Law on Individual Personified Accounting, Art. The right of the policyholder to supplement and clarify the information transmitted to him about the insured persons is established by law, Art. If the insured eliminates all inaccuracies within the established time frame, financial sanctions are not applied to him. In such circumstances, the courts refused the Pension Fund to satisfy its demands, the decision of the Central District Court of September 20. The Pension Fund of the Russian Federation changed the form of this report and the rules for filling it out, therefore it issued many explanations regarding entering data into it and checking it.

Let's look at the most important of them. A report on insurance experience will need to be submitted in different cases. The form will have to be submitted to the fund’s specialists upon liquidation of the company. There are four forms in total:.

The direct process of conducting a desk audit by the Pension Fund begins only when the business entity has submitted the necessary reports for consideration. It should be noted that for organizations with more than 25 people, it must be transmitted via secure electronic communication channels through a special operator.

It provides information that the document has been submitted to the Pension Fund, but is not yet considered submitted, or has been verified and accepted by the Pension Fund. All documents submitted by the organization are subject to verification to ensure their compliance with the requirements of Russian regulatory legislation.

If any errors or inaccuracies are identified, Pension Fund employees request explanations from the organization or additional documents. It should be noted that, if necessary, the Pension Fund may request information from the Social Insurance Fund, since in some cases the calculation of contributions to both of these funds is the same.

For example, in both cases, contributions are not calculated on amounts for temporary disability certificates, benefits for the birth of a child or up to 1.5 years. Errors or omissions identified during the RSV-1 check must be corrected within five days, and an updated RSV-1 with corrected indicators must be sent.

In the event that a business entity does not agree with the corrections, it needs to write an official letter in which it indicates why it entered certain data in the calculation. It is also necessary to attach copies of supporting documents to the letter, if available.

Letters with supporting documentation are also sent via secure electronic communication channels using a simple, formalized letter.

Upon completion of the desk audit, Pension Fund employees draw up a report within 10 days that reflects all errors or inaccuracies that must be corrected. It must be sent to the audited legal entity within 5 days, and a response to it must be sent within 15 days.

The employer always has the right to agree or disagree with the results of the audit, as well as try to independently understand the difficult situation or seek help from the judicial authorities. If a response is not received from the legal entity, the Pension Fund makes a Decision to hold the contribution payer accountable, which comes into force 10 days after it is drawn up and signed.

Such a decision can be appealed in court within 3 months from the date of its receipt. The essence of a desk audit by employees of the Pension Fund is that the submitted reports are analyzed for the correctness of their preparation, and also correlated with the amount of insurance premiums that were paid in this period.

An inspection of this kind is carried out by employees of the Pension Fund, who, in accordance with their official duties, have the right and must perform tasks of this kind assigned to them. At the same time, they do not require permission from management, since the implementation of this activity is their direct job responsibility.

EFA-1 is not submitted as a stand-alone report. From the register, fund specialists will find out the amounts of additional accrued contributions and see the breakdown of payments by period.

A separate section is devoted to the early assignment of pensions. The procedure and deadlines for submitting reports on insured persons to the Federal Tax Service, the Social Insurance Fund and the Pension Fund of Russia this year will be discussed in our article. Any accountant, when preparing reports for regulatory authorities, tries to reconcile the data to the last point in order to prevent errors.

Moreover, mistakes can be expensive this year. For example, for false information, SZV-M will issue a fine of rubles for each insured person. In this article, we will look in detail at how to avoid errors in forms for the Russian Pension Fund, as well as which services to use to check Pension Fund reports online for free. With the transfer of insurance premiums under the control of the Federal Tax Service, the list of reporting to the Pension Service has changed.

Policyholders are now required to provide the following information:. For insurance premium payers with fewer than 25 people, it is acceptable to provide reporting documentation on paper.

Other organizations must report only electronically. If you violate this condition, the institution will be fined rubles. It is necessary for all policyholders to check the reporting before sending it, regardless of the type of delivery on paper, electronically, and here’s why:. It’s easy to eliminate such problems; to do this, you need to check the reporting in the Pension Fund online.

A large number of Internet services or applications with convenient and simple interfaces will allow you to quickly identify and eliminate inaccuracies in reporting documentation. The programs are absolutely free and are freely available on the Internet. You can download the application on the official website of the Pension Fund. To work, you need to download the program and install it on your work computer. Checking programs from the Pension Fund of Russia are updated periodically, so be sure to check the application version before starting work.

If the program is not updated, errors in reports may remain. To eliminate systematic monitoring and updating of test programs on your work computer, use online services. Let's look at how to check SZV-M. Step 1. Registering in the system is completely optional.

Documents drawn up during a desk audit of the Pension Fund of Russia

Upon completion of the desk audit, Pension Fund employees draw up a report within 10 days that reflects all errors or inaccuracies that must be corrected. It must be sent to the audited legal entity within 5 days, and a response to it must be sent within 15 days. The employer always has the right to agree or disagree with the results of the audit, as well as try to independently understand the difficult situation or seek help from the judicial authorities.

If a response is not received from the legal entity, the Pension Fund makes a Decision to hold the contribution payer accountable, which comes into force 10 days after it is drawn up and signed. Such a decision can be appealed in court within 3 months from the date of its receipt.

How Pension Fund employees check data

Pension Fund employees check the calculation itself and other documents at their disposal. If there are errors in the calculation, the OPFR may request oral or written explanations and additional documents and demand that the calculation be corrected.

The payer must make corrections within five working days (Parts 3, 4, Article 34 of the Federal Law of July 24, 2009 No. 212-FZ). If necessary, the territorial body of the Pension Fund of the Russian Federation may even call the payer to give oral explanations (clause 3, part 1, article 29 of the Federal Law of July 24, 2009 No. 212-FZ).

If, during a desk audit, OPFR employees find errors, they will draw up a desk audit report in the form established by Order of the Ministry of Labor of Russia dated November 27, 2013 No. 698n. They will do this within 10 working days.

If the organization does not agree with the facts set out in the act, or with the conclusions of the inspectors, then within 15 days it can submit written objections to the OPFR (Part 5, Article 38 of the Federal Law of July 24, 2009 No. 212-FZ). You can attach documents (copies) to them that confirm the validity of the company’s objections (Part 5, Article 38 of the Federal Law of July 24, 2009 No. 212-FZ).

Based on the received documents, the manager (deputy manager) initiates consideration of the inspection materials. Moreover, the OPFR must inform the company of the time and place of this event: the organization has the right to participate in it (Part 3 of Article 39 of the Federal Law of July 24, 2009 No. 212-FZ).

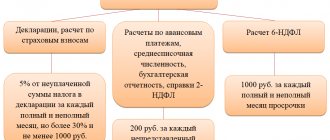

Penalties for detecting errors

If gross errors were discovered during a desk audit, the Pension Fund has the right to hold the contribution payer accountable, including issuing a fine for illegal actions. This type of liability may include:

| Description of the violation | Fine |

| Failure to submit RSV-1 on time | Depends on the amount of insurance premiums to be paid – if there is a delay of up to six months – 5% of the amount of contributions for each month (no more than 30% and no less than 100 rubles) – if the delay is more than six months – 30% of the amount of contributions and 10% for each month (at least 1000 rubles, the final limit of the fine has not been established) |

| Failure to submit RSV-1 at all | The fine is calculated only after the on-site inspection and will be the sum of fines for all periods |

| Full or partial non-payment of insurance premiums | – 20% of unintentionally unpaid insurance premiums – 40% of the intentionally unpaid insurance premiums In addition, liability also includes the accrual of penalties for late payments. |

| Refusal to submit required documents upon request | 50 rub. for any document not submitted |

Desk inspection after closure of LLC

In the event that an organization closes, it is obliged to pay all necessary insurance contributions to the Pension Fund and fully report to government authorities. Even if the enterprise is already closed, the Pension Fund has the right to conduct a desk audit of the submitted reports and the correctness of the calculation of contributions and payment of payments. For this reason, it is necessary to store all documentation for the period established by law, for an individual entrepreneur - 4 years, for an organization - 5 years.

During a desk audit, Pension Fund employees carry out the following actions:

- check the reports for correctness;

- analyze the legality of applying a reduced tariff;

- monitor the correctness of calculation of pension contributions;

- monitor the timeliness of payment of insurance premiums.

Features of a desk audit

A desk audit is carried out with the study of reporting.

The specialist analyzes the correctness of calculation of contributions, the timing of their transfer and the quality of filling out reports. All employers are subject to this procedure, regardless of their form of ownership. Inspection of individual entrepreneurs is carried out according to the same plan as for legal entities. The inspection period is three months. The check is carried out at the location of the Pension Fund where the employer is registered. If any inaccuracies are found, employees will ask you to provide explanations and additionally provide documents confirming your position. In addition, they have the right to request additional information from the Social Insurance Fund if necessary. If they consider your arguments unfounded, you will have to submit a corrective form, and the inspectors will charge you fines and penalties.

If any inaccuracies are found, employees will ask you to provide explanations and additionally provide documents confirming your position.

A desk audit reveals inaccuracies in personalized accounting, which makes it possible to provide working citizens with pension rights. The purpose of such verification includes:

- Control over calculated and paid contributions.

- Identification of violations of current legislation and their prevention.

- In case of gross violation of the law, penalties are imposed.

- If there is arrears in contributions, Pension Fund employees during the audit take measures to collect it.

- Based on the results of desk audits, a schedule of on-site activities for individual companies is developed.

When conducting a desk audit, PFR employees analyze the following reports for compliance:

- RSV-1.

- Personalized forms.

- SZV-M.

When analyzing the forms, the specialist pays special attention to the additional tariff and non-taxable amounts. If an enterprise uses an additional tariff, then workplace certification must be carried out, which will actually confirm the danger of some professions.

The audit is carried out only after submission of quarterly reports. Upon completion of the process, a report is issued that reflects the errors detected. A sample inspection report for 2021 in Form 16-PFR can be found here. Inaccuracies identified as a result of the cameras must be corrected within five days. If you disagree with the decision made, you must issue an official letter, attaching supporting primary documents to it, and send it to the fund via telecommunication channels.

You should not ignore the decision received, because in this case, after 15 days, the Pension Fund may bring you to administrative liability.

Please note that the Pension Fund has the right to conduct an audit after the closure of the enterprise, therefore all documentation regarding the calculation of contributions must be retained for up to 5 years for legal entities and up to 4 years for individual entrepreneurs. If specialists request the required document, but the organization does not provide it, a fine of up to 500 rubles may be imposed (Part 3 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

The legality of conducting desk audits is regulated by Art. 34 of Federal Law No. 212-FZ. Desk control does not provide for a specific plan for inspections of the Pension Fund of Russia. However, employers applying the reduced tariff are the first to be checked. When analyzing the statements, the auditor may require additional forms confirming your actions. There is no approved list of documents.

Based on the results of desk audits, the Pension Fund draws up a schedule of scheduled audits for the next year.