Composition of an accountant's official calendar

The official calendar can be used by accountants of all organizations, including those keeping records on the simplified tax system.

The calendar presented in legal reference systems usually consists of 4 parts:

- A calendar based on set dates that are the same for everyone. It looks like a regular calendar with dates marked with hyperlinks. You can go through them and see what type of reporting or payment falls on this date and which payer it concerns.

- Calendar for unspecified dates. These dates refer to specific events. Here is a list of all official regulations in which you can clarify questions regarding reporting and payment. But if we are talking about the simplified tax system, such a calendar is not suitable.

- Grouping dates by events. This spreadsheet can be very useful if you have a list of taxes in front of you that need to be paid or for which the taxpayer must report. All events are listed here and dates are given. The simplified taxation system is highlighted in a separate line.

- Rules for rescheduling. Contains a list of all regulations related to these rules.

In general, navigating an accountant’s calendar is quite simple. However, if we are talking only about the simplified tax system, then you need to carefully monitor which dates relate exclusively to this regime. Many of its dates are easy to remember, because the options for deadlines for the simplified tax system are not very diverse. For them, as for all deadlines relating to the submission of reports and payment of taxes, the rule applies to the transfer of a date that falls on a weekend to the next working day.

Please note that the calendar does not provide information about payment deadlines:

- Personal income tax, subject to its own special rules;

- regional taxes and fees, the terms of which are established by the laws of the constituent entities of the Russian Federation and may vary significantly.

A version of the official accountant calendar is presented in our “Accountant Calendar” service.

If you do not submit reports to the Federal Tax Service or the Funds in a timely manner, sanctions will be imposed on both the company and its officials. Find out about liability for late submission of declarations and settlements in the ConsultantPlus ready-made solution by getting trial access for free.

Simplified balance: how to fill out correctly under the simplified tax system

The balance sheet allows you to assess the actual financial condition of the company: economic growth or unprofitability. Information from the balance sheet is needed to evaluate the company as a borrower and a reliable partner for counterparties. Balance sheet data also informs business owners about the state of affairs in the company. Government agencies need a balance both for generating statistical data on the industry and for tax control.

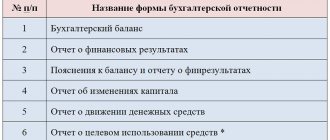

The accounting forms used do not depend on the taxation system chosen by the enterprise. Special regime officers report on the same forms as companies on OSNO.

For small businesses, including those using the simplified tax system, simplified forms of accounting reporting are provided (Appendix 5 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n). Most of the lines that are not used by simplifiers have been removed from the form. Accounting information is provided without detail.

The table below will give you an understanding of how to fill out the balance sheet under the simplified tax system and what information you will need to collect:

| Balance line | Accounting information |

| Tangible non-current assets |

|

| Intangible, financial, other non-current assets |

|

| Reserves |

|

| Cash and cash equivalents |

|

| Financial and other current assets |

|

| Capital and reserves |

|

| Long-term borrowed funds |

|

| Other long-term liabilities |

|

| Short-term borrowed funds |

|

| Accounts payable |

|

| Other current liabilities |

|

The company provides information for the reporting year, as well as for the two periods preceding it.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Below you can find a simplified balance sheet.

All simplified accounting reporting forms are available for download on our website.

How to fill out a simplified balance sheet under the simplified tax system if there are no indicators? In this case, a dash is placed in the corresponding lines.

What and when to submit to the Pension Fund using the simplified tax system

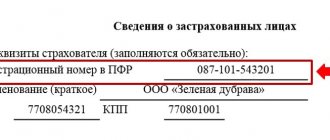

Reporting submitted to the Pension Fund concerns only employers. It consists of:

- from reporting on the length of service of employees (forms SZV-STAZH and EDV-1), submitted at the end of each year no later than March 1 of the following year;

- information about insured persons who worked for the employer in the past month (form SZV-M), submitted no later than the 15th day of the month following the reporting month.

- information on the labor activity of employees (SZV-TD), sent monthly before the 15th (except for hiring and dismissal of an employee, when the report is submitted no later than the next day).

Read about the rules for preparing and submitting annual reports in the article “How to fill out and submit reports to the Pension Fund for the year?”

Declaration according to the simplified tax system for 9 months

According to Art.

346.23 of the Tax Code of the Russian Federation, a tax return under the simplified tax system is submitted to the tax office at the end of the tax period, which is a calendar year. There are exceptions to this rule:

- the taxpayer can no longer be on the simplified tax system;

- The activities of the organization on the simplified tax system are terminated.

Thus, a declaration under the simplified tax system for 9 months of 2021 needs to be submitted only in two cases:

- no later than October 26, 2021, if the taxpayer lost the right to use the simplified tax system in the 3rd quarter;

- no later than the 25th day of the month following the month of termination of business activity.

What and when to submit and pay to the Social Insurance Fund using the simplified tax system

To the Social Insurance Fund, employers still need to submit a quarterly report on contributions for injuries (Form 4-FSS), submitting it in the month following the end of each quarter, no later than:

- on the 20th, if the report is submitted on paper (this is available to policyholders with an average number of employees of no more than 25 people);

- 25th, if submitted electronically.

And they are still paid to the Social Insurance Fund with the same frequency (monthly) and within the same period (no later than the 15th day of the month following the reporting month).

Read more about these contributions in this material.

The need for annual confirmation of the type of activity carried out by the policyholder also remains. Documents for this, compiled according to the data of the previous year, must be submitted to the Social Insurance Fund no later than April 15 of the following year.

What reports should simplifiers submit to Rosstat?

Statistical reporting is submitted by small enterprises that were included in the sample (clause 1, article 5 of the Federal Law of July 24, 2007 No. 209-FZ). Statistics departments usually inform companies and individual entrepreneurs when they are included in the sample. But the letter could have been lost in the mail.

On the website statreg.gks.ru you can check whether you need to submit reports. Enter your TIN, OKPO or OGRN. The service will display a file with a list of statistical forms. In the file opposite each form you will see information about the deadlines. If your company or individual entrepreneur is not included in the selection, the site will return an empty file.

Rosstat allows you not to submit zero statistical reports (letter dated 02/17/17 No. 04-04-4/29-SMI). If the site produces unnecessary forms, send an official letter stating that you do not have indicators. List in the letter the forms that the company does not fill out because it does not conduct specific types of activities.

If a company does not submit reports to statistics on time, it will be fined a maximum of 70 thousand rubles, and the director in the amount of 10 thousand to 20 thousand rubles. (Article 13.19 of the Administrative Code).

- What statistical forms to submit.

If you are a micro-enterprise or individual entrepreneur, then you only need to report to “statistics” based on the results of the year. Other small firms report every quarter. In the table below, see which forms are submitted by simplifiers who were included in the sample in the first quarter of 2018.

| Who rents | In what form | When? | |

| 1 | Individual entrepreneurs | 1-IP, approved by order of Rosstat dated August 21, 2017 No. 541 | 2nd of March |

| 2 | Microenterprises | MP (micro), approved. by order of Rosstat dated August 21, 2017 No. 541 | February 5th |

| 3 | Other small companies | PM, approved by order of Rosstat dated August 11, 2016 No. 414* | January 29 |

* From the first quarter of 2021, submit a new form No. PM, approved. by order of Rosstat dated August 21, 2017 No. 541.

- How to fill out statistical reports.

- MP report (micro). The form is filled out by simplifiers who employ up to 15 people (Rosstat order No. 723 dated November 7, 2017). If you are included in the sample, then submit the calculation, even if you have not conducted any activity during the year. Then put zeros instead of cost indicators.

- In section 1 “QUESTIONNAIRE”, check line 01 if your company uses the simplified tax system.

- In section 2, reflect the average number of enterprises and the amount of salaries.

- Calculate the average number of employees (line 04), the average number of external part-time workers (line 05) and contractors (line 06).

- Do not take into account freelancers and external part-time workers when calculating the average headcount (clause 12 of the Directives, approved by Rosstat order No. 723 dated November 7, 2017).

- Do not include employees on maternity leave or maternity leave in the average headcount.

- Round the number to whole units or write it with one ten-digit decimal place.

An example of calculating the average number in the form No. MP (micro):

The company has 10 people on the simplified tax system. Therefore, the average number of employees for the year is 10 employees.

The company entered into a contract agreement with a freelancer from November 15 to December 31, 2021. The agreement was valid for 16 days in November and 31 days in December.

The average number of freelance workers per year is 0.1 [(0 people × 10 months + 1 person × 16 days: 30 days + 1 person × 31 days: 31 days) : 12 months]. The average number for the year is 10.1 people. (10 + 0.1).

In line 12 of section 2, reflect the number of man-hours worked. All employees worked according to the schedule - 5 days, 8 hours. There are a total of 247 working days in 2021. Three days were shortened by one hour. Therefore, the number of man-hours will be 19,730 (10 people × 1973 hours).

- In the remaining sections, show data on your activities: the cost of goods, works, services sold, the volume of transportation in tons, if you use trucks, the cost of purchased fixed assets.

- Report 1-IP. The form is filled out by almost all individual entrepreneurs who were included in the sample, except for merchants who have not been active all year or who retail any goods except cars and motorcycles.

- In Form 1-IP, entrepreneurs answer five questions:

- Have you done business?

- Did you conduct business in the same region where you are registered?

- What is the amount of revenue from the sale of goods?

- What types of activities did you conduct, what products did you produce?

- How many people worked in the business - partners, family members, employees?

For example, in the fourth question, write down the name of the business “outerwear production.” Do not fill out the last column with the OKVED code. Statisticians will assign codes based on your description.

- Individual entrepreneurs who provide paid services to the population additionally submit Form 1-IP (services). Deadline: no later than March 2.

- PM report. Form No. PM is filled out by small enterprises that do not belong to microbusinesses (Rosstat order No. 37 dated January 25, 2017). Individual entrepreneurs do not fill out the report.

- In section 1 “QUESTIONNAIRE” on line 01, check the box if your organization uses the simplified tax system.

- In section 2, reflect the average number of employees, including full-time employees, contractors and part-time workers. Immediately reflect the amount of salary expenses.

- In Section 2, show your revenue, expenses for goods, the cost of fixed assets you bought, and the cost of real estate sold.

Source https://tpprf.ru/ru/

comments powered by HyperComments

What and when to submit and pay to the Federal Tax Service using the simplified tax system

Taxpayers using the simplified tax system submit a simplified tax return to the Federal Tax Service once a year (at the end of the year). The deadline for its submission for firms and individual entrepreneurs differs: organizations submit the declaration earlier - no later than March 31 of the year following the reporting year, and entrepreneurs have more time to prepare it and submit this report no later than April 30. In 2021, both dates are working, and therefore no postponements are expected.

The simplified tax system is paid quarterly (advance payments) no later than the 25th day of the month following the end of the next quarter. Payment at the end of the year is carried out within a time frame that coincides with the dates of filing simplified tax reporting and therefore differs for legal entities and individual entrepreneurs.

If an organization has grounds for the assessment and payment of land, transport or water tax, property tax based on cadastral value, then it submits reports on them (transport and land taxes are not declared) and makes payments within the legally established time frame. For individual entrepreneurs, the Federal Tax Service makes the calculation of property taxes, and he pays them in the same way as other individuals - once a year on the basis of a notification sent from the tax office, within the uniform period established for payments by individuals (until December 1 of the year following the billing year) .

Employers submit to the Federal Tax Service:

- a quarterly summary report on insurance premiums, submitted no later than the 30th day of the month following the reporting quarter;

- a quarterly report reflecting the amounts and timing of personal income tax due (form 6-NDFL), which is submitted no later than the last day of the month following the corresponding quarter, and no later than March 1 of the year following the reporting year, if the report refers to about the last quarter of the reporting year;

- annual reporting on employee income (Form 2-NDFL), submitted within the same deadline established for the submission of the last report for the year, Form 6-NDFL, if it concerns withheld tax, and submitted earlier (no later than March 1 of the year following the reporting period) ), if we are talking about unwithheld tax. For 2021, form 2-NDFL is submitted for the last time. Information on income for 2021 will be included in the annual 6-NDFL.

Payment of insurance premiums paid to the Federal Tax Service is carried out monthly no later than the 15th day of the month following the month being paid.

At the end of the year (no later than January 20), employers submit an annual report containing information on the average number of its employees.

Legal entities using the simplified tax system are not required to submit interim financial statements

Date of publication: 07/15/2013 12:37 (archive)

When conducting seminars with taxpayers, as well as oral consultations, organizations that apply the simplified taxation system are often asked the question of whether they need to submit interim financial statements to the tax authority in 2013?

Until 2013, organizations using the simplified taxation system (hereinafter referred to as the simplified taxation system) did not submit financial statements to the tax authority and were exempt from accounting in accordance with paragraphs 1, 3, article 4 of Law N129-FZ of November 21, 1996 (in edition dated November 28, 2011). However, if an organization combined the simplified tax system and UTII, it was obliged to keep accounting records and submit financial statements to the tax authorities.

On January 1, 2013, the Federal Law of December 6, 2011 came into force. N402 “On Accounting”, according to which all organizations, including those using the simplified tax system, must keep accounting records and also submit annual financial statements to the tax authority no later than three months after the end of the reporting year.

The reporting date for the preparation of financial statements is considered to be the last calendar day of the reporting period (Part 6, Article 15 of Law N402-FZ, paragraph 4, 12 PBU 4/99).

The reporting period is the period for which the organization must prepare financial statements (clause 4 of PBU 4/99). The reporting period for annual accounting (financial) statements (reporting year) is the calendar year - from January 1 to December 31 inclusive, with the exception of cases of creation, reorganization and liquidation of a legal entity (Part 1 of Article 15 of Law N402-FZ).

If the state registration of an organization was carried out after September 30, the first reporting year is, unless otherwise established by the organization, the period from the date of state registration to December 31 of the calendar year following the year of state registration, inclusive (Part 3 of Article 15 of Law N402- Federal Law). Thus, an organization registered on October 1 or later has the right to choose the period that is its first reporting year:

- from the date of state registration to December 31 of the year in which state registration was made, inclusive;

- from the date of state registration to December 31 of the year following the year of state registration, inclusive.

The organization's financial statements must be signed by the head of the organization (Part 8, Article 13 of Law N402-FZ).

Taxpayers are liable for failure to submit financial statements to the tax authorities in accordance with Article 126 of the Tax Code of the Russian Federation.

At the same time, from January 1, 2013, the obligation to submit interim accounting statements to the tax authority for legal entities using the simplified tax system is no longer provided (Article 18 of Law N402-FZ).

Accountant calendar 2021 for individual entrepreneurs and organizations using the simplified tax system

| Month | Receiving authority | Reports and payments | Deadline for submission (payment) |

| January | Pension Fund | Reports SZV-M and SZV-TD for December 2021 | 15.01.2021 |

| FSS | Payment of contributions for injuries for December 2021 | 15.01.2021 | |

| 4-FSS report for 2021 on paper | 20.01.2021 | ||

| Report 4-FSS for 2021 electronically | 25.01.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for December 2021 | 15.01.2021 | |

| Unified calculation of insurance premiums for 2021 | 01.02.2021 | ||

| February | Pension Fund | Report SZV-M and SZV-TD for January 2021 | 15.02.2021 |

| FSS | Payment of contributions for injuries for January 2021 | 15.02.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for January 2021 | 15.02.2021 | |

| March | Pension Fund | SZV-STAZH and EDV-1 reports for 2021 | 01.03.2021 |

| Report SZV-M and SZV-TD for February 2021 | 15.03.2021 | ||

| FSS | Payment of contributions for injuries for February 2021 | 15.03.2021 | |

| Inspectorate of the Federal Tax Service | 2-NDFL certificates for 2021 | 01.03.2021 | |

| Report 6-NDFL for 2021 | 01.03.2021 | ||

| Payment of insurance premiums for February 2021 | 15.03.2021 | ||

| Accounting for 2021 for legal entities | 31.03.2021 | ||

| April | Pension Fund | Report SZV-M and SZV-TD for March 2021 | 15.04.2021 |

| FSS | Payment of contributions for injuries for March 2021 | 15.04.2021 | |

| Confirmation of the type of activity carried out | 15.04.2021 | ||

| 4-FSS report for the 1st quarter of 2021 on paper | 20.04.2021 | ||

| Report 4-FSS for the 1st quarter of 2021 electronically | 26.04.2021 | ||

| Inspectorate of the Federal Tax Service | USN declaration and payment of simplified tax system for 2021 for legal entities | 31.03.2021 | |

| Payment of insurance premiums for March 2021 | 15.04.2021 | ||

| Payment of advance payment for the simplified tax system for the 1st quarter of 2021 | 26.04.2021 | ||

| Unified calculation of insurance premiums for the 1st quarter of 2021 | 30.04.2021 | ||

| Report 6-NDFL for the 1st quarter of 2021 | 30.04.2021 | ||

| USN declaration and payment of simplified tax system for 2021 for individual entrepreneurs | 30.04.2021 | ||

| May | Pension Fund | Report SZV-M and SZV-TD for April 2021 | 17.05.2021 |

| FSS | Payment of contributions for injuries for April 2021 | 17.05.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for April 2021 | 17.05.2021 | |

| June | Pension Fund | Report SZV-M and SZV-TD for May 2021 | 15.06.2021 |

| FSS | Payment of contributions for injuries for May 2021 | 15.06.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for May 2021 | 15.06.2021 | |

| July | Pension Fund | Report SZV-M and SZV-TD for June 2021 | 15.07.2021 |

| FSS | Payment of injury fees for June 2021 | 15.07.2021 | |

| 4-FSS report for the first half of 2021 on paper | 20.07.2021 | ||

| 4-FSS report for the first half of 2021 electronically | 26.07.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for June 2021 | 15.07.2021 | |

| Payment of advance payment for the simplified tax system for the 2nd quarter of 2021 | 26.07.2021 | ||

| Unified calculation of insurance premiums for the first half of 2021 | 30.07.2021 | ||

| Report 6-NDFL for the half year 2021 | 02.08.2021 | ||

| August | Pension Fund | Report SZV-M and SZV-TD for July 2021 | 16.08.2021 |

| FSS | Payment of contributions for injuries for July 2021 | 16.08.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for July 2021 | 16.08.2021 | |

| September | Pension Fund | Report SZV-M and SZV-TD for August 2021 | 15.09.2021 |

| FSS | Payment of injury fees for August 2021 | 15.09.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for August 2021 | 15.09.2021 | |

| October | Pension Fund | Report SZV-M and SZV-TD for September 2021 | 15.10.2021 |

| FSS | Payment of contributions for injuries for September 2021 | 15.10.2021 | |

| 4-FSS report for 9 months of 2021 on paper | 20.10.2021 | ||

| Report 4-FSS for 9 months of 2021 electronically | 25.10.2021 | ||

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for September 2021 | 15.10.2021 | |

| Payment of advance payment for the simplified tax system for the 3rd quarter of 2021 | 25.10.2021 | ||

| Unified calculation of insurance premiums for 9 months of 2021 | 01.11.2021 | ||

| November | Inspectorate of the Federal Tax Service | Report 6-NDFL for 9 months of 2021 | 01.11.2021 |

| Pension Fund | Report SZV-M and SZV-TD for October 2021 | 15.11.2021 | |

| FSS | Payment of contributions for injuries for October 2021 | 15.11.2021 | |

| Inspectorate of the Federal Tax Service | Payment of insurance premiums for October 2021 | 15.11.2021 | |

| December | Pension Fund | Report SZV-M and SZV-TD for November 2021 | 15.12.2021 |

| FSS | Payment of contributions for injuries for November 2021 | 15.12.2021 | |

| Inspectorate of the Federal Tax Service | Payment of property taxes for 2021 individual entrepreneurs | 01.12.2021 | |

| Payment of insurance premiums for November 2021 | 15.12.2021 |

The accountant's calendar for other taxation systems was developed by ConsultantPlus experts. Get trial access to K+ for free and submit your reports on time.

Reporting forms

Primary statistical data are submitted to the territorial bodies of Rosstat by respondents according to the approved forms of federal statistical observation, which also indicate the deadlines for submission. If the last day of the deadline for submitting state statistical reports by reporting entities falls on a non-working day, the end of the deadline for submitting reports is considered to be the next working day (Resolution of the State Statistics Committee of Russia dated 03/07/2000 N 18).

Small enterprises submit quarterly Form N PM “Information on the main indicators of the activities of a small enterprise” . When submitting information for 2012, Form N PM was used, approved by Rosstat Order No. 355 dated August 15, 2011; when submitting data for January - March 2013, respondents will have to refer to Form N PM, approved by Rosstat Order No. 470 dated August 29, 2012. Information in Form N PM is given on an accrual basis for the period from the beginning of the reporting year. This form includes information for the legal entity as a whole, that is, for all branches and structural divisions of a given small enterprise, regardless of their location (clause 6 of the Instructions for filling out the federal statistical observation form N PM “Information on the main indicators of the activities of a small enterprise”, approved By Order of Rosstat dated December 30, 2011 N 531). The above provision also applies when filling out all the statistical observation forms listed below.

This form must be submitted to the statistics department no later than the 29th day of the month following the reporting quarter. Thus, for the period from January to December 2012, Form N PM must be submitted before January 29 of the current year inclusive.

For certain types of activities, special statistical forms are provided. Thus, organizations - small businesses whose main activities are wholesale and retail trade (including trade in motor vehicles, motorcycles, their components and accessories, motor fuel) monthly submit to the territorial statistics departments form N PM-torg “Information on the turnover of small trade enterprises" (approved by Order of Rosstat dated July 19, 2011 N 328). The deadline for its submission is the 4th day after the end of the reporting period. Based on this, Form N PM-Torg for December 2012 should have been submitted by these respondents on the first working day of 2013, that is, January 9.

Starting from reporting for January 2013, small enterprises engaged in wholesale and retail trade included in the sample must use form N PM-torg, approved by Rosstat Order No. 421 dated July 27, 2012, when compiling statistical reporting.

Small enterprises whose main activity is retail trade (including trade in motor vehicles and motor fuel), included in the statistical sample, submit quarterly data in Form N 3-TORG (PM) “Information on the sale and inventory of goods of a small retail enterprise” ( approved by Order of Rosstat dated July 19, 2011 N 328). The data is presented on a cumulative basis from the beginning of the year. These organizations must submit this form for January - December 2012 by January 15 of the current year.

Small enterprises carrying out economic activities in the field of mining, manufacturing, production and distribution of electricity, gas and water, logging, and fishing also report monthly to the territorial body of Rosstat at their location. Before the 4th day of the next month, they submit Form N PM-prom “Information on the production of products by a small enterprise” (approved by Rosstat Resolution No. 153 of July 28, 2009). They, like their trading colleagues, should have submitted this form for December 2012 on January 9 of this year.

Form N 2-MP innovation “Information on technological innovations of a small enterprise (organization) for 2012” (approved by Rosstat Order No. 367 of August 19, 2011) must be submitted by April 9, 2013 to small enterprises engaged in economic activities in the field of mining, manufacturing, production and distribution of electricity, gas and water and included in the sample.

In 2012, these respondents quarterly submitted to the statistics department Form N DAP-PM “Survey of business activity of small enterprises in mining, manufacturing, production and distribution of electricity, gas and water” (approved by Order of Rosstat dated September 23, 2008 N 235). This form must be submitted by the 10th day of the last month of the reporting period. To enter information for January - March 2013, respondents will need Form N DAP-MP, approved by the aforementioned Rosstat Order N 470. This form must be sent to small businesses before March 11 of the current year.

For micro-enterprises, the same Rosstat Order N 470 approved the form N MP (micro) “Information on the main performance indicators of a micro-enterprise” . All micro-enterprises must report on it, except those engaged in agricultural activities. This form is annual. Based on the results of 2012, it must be submitted to the statistical authorities before February 5, 2013.

Micro-enterprises that temporarily did not operate during the reporting year and in which production of goods and services or investment activities took place during part of it, submit the form in question on a general basis, indicating the time since when they suspended their activities.

Until February 5, 2013, micro-enterprises engaged in agricultural activities (including peasant (farm) farms) must submit information to the territorial bodies of Rosstat. They submit statistical reporting in the form N MP (micro)-skh “Information on the main performance indicators of a micro-enterprise engaged in agricultural activities” (approved by the aforementioned Order of Rosstat N 470).

If among the founders of a small enterprise there are foreign investors (legal entities or individuals), then the organization must submit to the territorial body of Rosstat Form No. 1-VES “Information on the activities of an enterprise with the participation of foreign capital” (approved by the aforementioned Order of Rosstat No. 470). This form is annual and must be submitted by March 24 after the reporting year. Since March 24, 2013 falls on a Sunday, the 2012 report is due no later than March 25.

For annual reporting of individual entrepreneurs, Rosstat has approved several forms depending on the types of their activities.

Based on the results of 2012, individual entrepreneurs engaged in agriculture must submit form N 1-IP-сх “Information on the activities of an individual entrepreneur engaged in agricultural activities” . The deadline for its submission is no later than March 4, 2013 (March 2 is a closed Saturday).

But individual entrepreneurs who are not engaged in agriculture, as well as retail trade and repair of household products and personal items included in the statistical sample, must submit Form N 1-IP “Information on the activities of an individual entrepreneur for 2012” (approved by the same Rosstat Order No. 470). The deadline is the same - no later than March 4, 2013.

Individual entrepreneurs selling goods to the public and repairing household products and personal items were required to submit data for 2012 by October 17 last year in Form N 1-IP (trade) “Information on the activities of an individual entrepreneur in retail trade” (approved By Order of Rosstat dated May 12, 2010 N 185). Since this form has not been canceled by Rosstat, individual entrepreneurs included in the statistical sample must be prepared to submit it for 2013 at the same time - October 17.

Results

Taxpayers using the simplified tax system can use the accountant’s general official calendar to determine the deadlines for filing the necessary reports and making payments. However, only certain dates of this calendar are significant for him, depending on who the taxpayer is (legal entity or individual entrepreneur), and on whether the individual entrepreneur has employees.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.