Who should pay?

The employer is responsible for deductions of personal income tax to the state from the income of its employees. In this situation, the fact of what form of ownership the enterprise has and what its status does not matter.

In the situation of private practice, the amount of income is determined as the value of profit from conducting independent activities.

Articles 226 and 227 of the Tax Code of the Russian Federation legally establish the norms for the calculation and withholding of the tax under study.

At the end of the tax period calculated in a year, the organization must submit to tax reporting in the form of 2-NDFL certificates, which are carried out in the context of each employee of the company. Within these certificates, it is necessary to indicate the amounts of income received by employees for the year by month, as well as the amounts of tax calculated and paid to the budget. Certificates on this form must be submitted no later than April 1 of the reporting year.

When does responsibility come?

Situations where the taxpayer (employer) does not pay the personal income tax amount on time can be identified quite easily by the tax authorities. An important point here is the calculation of the period during which the employer can be held liable.

The size of this period may depend on the fact how the income was received by the employees. Among the possible methods we will indicate: (click to expand)

- money received in cash;

- in its natural form;

- material benefit;

- cashless transfer.

It should not be forgotten that in addition to the fine, you will also have to pay a penalty according to a special calculation. The fine can be significant and amounts to 20% of the unpaid amounts, and in some situations it can reach up to 40% depending on the period of missed payments.

Personal income tax penalties in 2021

The calculation of penalties in 2021 is made in accordance with Article 75 of the Tax Code of the Russian Federation:

- If the delay is less than 30 days, then organizations are charged a penalty in the amount of 1/300 of the Central Bank refinancing rate currently in effect.

- If the delay is more than 30 days, then penalties are charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for the first 30 days and in the amount of 1/150 of the refinancing rate of the Central Bank of the Russian Federation starting from the 31st day of delay.

The accrual of penalties, their payment and write-off occurs on the basis of the Tax Code of the Russian Federation, as well as PBU 10/99. The entire process of generating entries is possible in two versions, depending on the way the accounting or tax accounting requirements are interpreted. From the point of view of accounting standards, these penalties are considered as penalties, and they are written off in the same amount. As for tax accounting, penalties and fines differ both in characteristics and in the method of reflection. Penalties do not have any signs of a fine, since they do not have a fixed amount and are not taken into account when reducing the tax base. In this case, 91 and 99 accounts can be used, and the chosen method must be fixed in the company’s accounting policy.

50,000 x (1/300 x 7.75) x 10 = 129.17 rubles

The company made the following accounting entries:

| Business transaction | D | TO |

| Personal income tax penalties accrued in the amount of 129.17 rubles | 99 | 68.4 |

| Personal income tax penalties in the amount of 129.17 rubles were paid from the current account | 68.4 | 51 |

When does a company face a personal income tax fine?

There are various possible bases for calculating fines for non-payment of personal income tax. The table below presents the possible options clearly.

There are 4 grounds for charging a fine, which are listed in the table below.

| Base | Link to article of the Tax Code of the Russian Federation | Characteristic |

| Didn't hold (not completely) | Article 123 of the Tax Code of the Russian Federation | Amounts not withheld or incompletely withheld |

| Not listed | Article 123 of the Tax Code of the Russian Federation | Amounts withheld but not transferred |

| Transferred untimely | Article 123 of the Tax Code of the Russian Federation | Amounts withheld but not transferred on time |

| Not fully listed | Article 123 of the Tax Code of the Russian Federation | Amounts withheld but not transferred |

How to determine the date correctly?

To ensure that fines are not assessed against the taxpayer, it is enough to follow one simple rule: clearly know and comply with the payment deadlines for this tax.

The table below shows the deadlines for paying tax amounts, which depend on the type of income received.

| Income | Receipt time | Hold date |

| Payment for work performed | The very last day of the month, or the very first day of the next month | On the day of transfer of funds |

| Cash as income | The day the payment was made | Date on which payment was made |

| Vacation payment | Last day of payment | On the last date of the payment month |

| Sickness benefits | Last day of payment | On the last date of the payment month |

It should be noted that if the taxpayer fails to fulfill his obligations, the amount of the fine will be withheld, but the amount of the arrears itself cannot be withdrawn and collected.

Deadline for payment of personal income tax by a tax agent so that there are no fines

Type of income

When income is considered received

When to withhold personal income tax

When to transfer taxes to the budget

The last day of the month for which earnings were accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation)

The calculated amount of tax should be withheld directly from income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation)

No later than the next day after the day of payment of income

Income in kind

Day of transfer of income in kind (subclause 2, clause 1, article 223 of the Tax Code of the Russian Federation)

The calculated amount of tax should be withheld directly from income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation)

No later than the next day after the day of payment of income

Vacation and sick leave

Day of payment of funds or transfer to a bank account (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation)

The calculated amount of tax should be withheld directly from income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation)

No later than the last day of the month in which payments were made

Deadlines depending on payment methods

Compliance with deadlines for payment of withholding amounts also depends on the type and method of payment. This information is reflected in the table below.

| In case of non-cash transfer | Payment date = transfer date |

| In the situation of receiving cash payments | No later than one day after the day of receipt of funds |

| Paying in cash, but at the bank's cash desk | On the day of receipt (moment of receipt) |

If we are talking about individual entrepreneurs or individuals, then the tax amount can be paid in accordance with the end of the reporting period, that is, no later than the 15th day of the post-reporting month.

The possibility of non-assessment of fines and sanctions appears only in one case: timely transfer of the tax amount to the budget. Therefore, the need to track deadlines and payments is very important for the employer.

In what cases is a payment order issued by decision of the Federal Tax Service?

If legal entities do not comply with the norms of the Tax Code, the company’s accountant makes mistakes (payment of contributions, taxes later than the deadline specified in the legislation, failure to pay tax obligations), then the company will soon be sent a request from the tax inspectorate to transfer the missing amounts, including penalties and fines.

Having received a request to repay the arrears from the supervisory authority, bona fide taxpayers issue a payment order to pay the obligations.

When entering information into a payment document, the same form is used as when transferring current tax obligations.

The form of payment is fixed by the regulations of the Central Bank of the Russian Federation (No. 383-P) and is designated by the index 0401060.

For timely fulfillment of the requirement, it is necessary to issue a payment order indicating all the necessary data. The indicated amounts of debt are transferred using the same details that are entered when paying a tax or fee.

The recipient of the payment order will be the tax office unit territorially assigned to the organization.

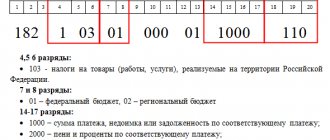

Filling out the lines of a payment order when receiving a request for payment of arrears:

To fulfill the obligation to repay any arrears of taxes and fees, the payment slip must carefully indicate the Federal Treasury account and the name of the recipient's bank, and special attention must be paid to the KBK.

In accordance with the norms of Article 45 (clause 7) of the Tax Code of the Russian Federation, from 2021 it is permissible to clarify the Federal Treasury account, which allows the taxpayer, if an error occurs in writing the account, to write an application to clarify the payment; there is no need to repay the debt or return incorrectly transferred funds.

If the amounts invoiced are incorrect in the opinion of the company management, and there is evidence to submit them to the court, payment may be made in part.

Having received a demand, the taxpayer can express disagreement with the amount of debt issued and begin to appeal the document.

For example, in accordance with a previously signed reconciliation report with the Federal Tax Service, the company fulfilled all its obligations. In this regard, the submitted demand can be considered erroneous and disagreement with the amounts presented can be expressed.

The order of current taxes paid voluntarily in the 21 fields of the payment order is indicated by the number 5. This value is entered until a request for repayment of the arrears is received.

The third priority when processing payment at the request of tax inspectors emphasizes the priority of debt repayment, and current taxes are paid later.

The basis for sending a request is an inspection by a regulatory authority and the discovery of a debt for mandatory tax deductions, omission, or late payment of taxes, fees, and contributions from a particular enterprise.

If the request records a debt for several BCCs, then a separate payment order is generated for each line.

You also need to separate debts for taxes, penalties and fines.

payment order when paying arrears - link.

Changes to the payment procedure in 2021

The year 2021 opened with the introduction of a new procedure for filling out and submitting a declaration in form 6-NDFL. This document provides tax authorities with the opportunity to control the dates of payment of personal income tax amounts and their compliance with regulatory deadlines. And in case of violation of such deadlines, the Federal Tax Service retains the right to apply sanctions in the form of fines and penalties.

The amount of the established fine for late payment of amounts in 2021 also remains at 20% of the unpaid amounts, and penalties should also be added here.

The number of days that were missed from the established deadline does not matter for calculating the amount of penalties.

There are no circumstances under which sanctions can be relaxed. If the receipt for payment of the fine has not arrived, this does not mean that it will be absent.

Cases and payment procedure

When receiving a salary, the taxpayer himself does not need to worry about transferring it. The employer must withhold personal income tax and send this amount to the budget independently. He will also submit all necessary reports to the tax service.

In the following cases, you must file a declaration and pay the tax yourself:

- operates as an individual entrepreneur, a notary and does not apply special regimes;

- when selling property, regardless of whether the money was received by transfer or other means;

- when receiving income outside the Russian Federation;

- when receiving income from which tax was not withheld (for example, from investments in securities).

The report is submitted by April 30, and payments are transferred to the budget by July 15 of the year following the reporting year.

Example No. 1.

If you take line 120 of form 6-NDFL, then the employer indicates the date no later than which the tax must be transferred. Term 140 indicates the required amount to be received into the budget. From this amount, the tax authorities subtract the returned personal income tax from line 090.

When a company transfers personal income tax amounts later than the date indicated in line 120, a notice of delay appears in the tax authorities within the framework of the budget settlement card. The desk audit inspector enters information about taxes paid based on the company's invoices.

The appendix to the article provides an example of entries from Form 6-NDFL.

Procedure for calculating fines in 2021

In 2021, the amount of interest payments on penalties remained unchanged, but the procedure for calculating them changed slightly.

The main features include: (click to expand)

- if you take vacation payments, then the tax must be calculated at the same moment when the benefit itself is calculated;

- the deadline for submitting a 2-NDFL certificate for full payment of tax amounts remained unchanged - until 04/03/2021, and in a situation where the tax was not fully transferred, these deadlines were reduced until March;

- If previously the tax amount had to be paid on the same day when the salary was paid, now this period has increased by one knock;

- If we take into account social guarantees, it should be noted that they are now listed at the place of performance of the labor function.

Amounts and amounts of fines in 2021

The punishment itself for situations of non-payment of tax amounts remains severe.

The justification for this punishment is presented in Art. 123 Tax Code of the Russian Federation. It specifies the cases for which such punishment is possible. Situations highlighted among them are:

- complete lack of budget funds for payments;

- payment of only part of the tax;

- untimely payment of amounts.

The fine will be 20% of the unpaid amounts.

Situations are possible when the employer not only fails to pay the amounts, but also fails to submit the tax return itself. In such a situation, it is possible to schedule an on-site tax audit.

Once violations are identified, the following sanctions will be applied:

- calculation of penalties;

- charging a fine;

- in more complex situations involving large sums, criminal liability may be applied when the case is referred to the prosecutor's office. In such a situation, the fine may reach 500 rubles, or the relevant persons may be punished up to imprisonment.

Sanctions for agents, individuals and payers

Tax payments of 13% must be made by the following groups of persons:

- employers;

- specialists with private practice;

- foreign companies.

Important! If they fail to comply with established obligations, the fine will be 20% of the amount owed.

As for individuals, personal income tax amounts are applied to them in a situation where they receive income from the sale of property. The fine is also 20%.

Important! The fine can be increased to 40% for particularly large and malicious violations.

How to reduce sanctions or avoid them altogether?

There may be situations where even in the event of a violation, liability does not arise.

Such cases include:

- early payment of the tax amount;

- the tax was transferred even before the salary was paid;

- funds to the budget were transferred to the head office of the tax office, and not to the territorial department.

In such situations, the taxpayer is able to defend his right and avoid liability.

Possible options for reducing fines are as follows:

- proven program failures and errors;

- change of management in the company;

- the employer himself admitted guilt;

- there are no debts on other tax obligations;

- The company operates in the social sphere.

If the situation is characterized by at least one of the listed signs, then the fine can be reduced by almost half. In addition, you can contact the judicial authorities.

The table below presents options on how to avoid a fine for failure to pay personal income tax late.

| The company withheld, but transferred the tax late | |

| Previously | Now |

| The company lists the arrears, penalties and submits an update on 6-NDFL | The company transfers arrears and penalties before submitting the initial 6-NDFL |

| The company receives an exemption from the fine (subclause 1, clause 4, article 81 of the Tax Code of the Russian Federation) | Exemption from fine |

| In a dispute with the tax company, the company refers to the decision of the Supreme Arbitration Court of March 18, 2014 No. 18290/13 | In case of tax disputes, you can refer to the resolution of the Constitutional Court dated 02/06/2021 No. 6-P |

The Constitutional Court obliged everyone to apply Resolution 6-P.

Arrears on personal income tax

Anna

I'm afraid not. But you can reduce its size. Here is the official information from the website In accordance with paragraph 4 of Article 112 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), circumstances mitigating or aggravating responsibility for committing a tax offense are established by the court or tax authority considering the case, and are taken into account when imposing sanctions for tax offenses in the manner established by Article 114 of the Tax Code of the Russian Federation. If there is at least one mitigating circumstance, the amount of the fine is subject to reduction by no less than two times compared to the amount established by the corresponding article of Chapter 16 of the Tax Code for committing a tax offense (clause 3 of Article 114 of the Tax Code of the Russian Federation). The list of mitigating circumstances is contained in paragraph 1 of Article 112 of the Tax Code of the Russian Federation. may recognize other circumstances not specified in subparagraphs 1 and 2 of paragraph 1 of the said article as mitigating circumstances. . An analysis of judicial practice shows that, as mitigating circumstances, in addition to those specified in clause. 1, 2 p. 1 art. 112 of the Tax Code of the Russian Federation can be recognized: 1) Difficult financial situation. This circumstance is clearly a mitigating circumstance only in relation to an individual. The decision to recognize this provision as a circumstance mitigating the organization’s liability is made based on each specific case. At the same time, this circumstance may be recognized as mitigating on the basis of relevant documents submitted by the taxpayer (for example, confirming that the taxpayer has unpaid receivables, the presence of significant accounts payable; documents confirming the receipt of significant losses as a result of financial and economic activities, the bank’s failure to fulfill collection orders for write-off taxes imposed by the tax authority on the company's account, the organization being in bankruptcy proceedings, etc.). Proof of the current difficult financial situation are copies of the balance sheet, profit and loss statement of the organization, a bank certificate on the turnover of funds in the current accounts of the offending organization and statements from its current accounts. Evidence of debt to counterparties or, conversely, accounts receivable are acts of mutual reconciliation; 2) Committing an offense for the first time. 3) Admitting one’s guilt in the committed offense, admitting that a mistake was made and independently correcting it before a decision is made to prosecute. This circumstance is recognized as a mitigating circumstance if there are documents confirming the taxpayer’s actions to independently correct the error, eliminate violations (for example, payment of additional taxes, penalties, submission of an updated declaration, etc. ). 4) No debt to the budget for the payment of current taxes, which can be confirmed by an act of joint reconciliation of tax calculations signed by the tax authority and the taxpayer. The following may also be recognized as mitigating circumstances: disproportionality of the sanction to the consequences of the offense committed; the insignificance of the delay in fulfilling the relevant obligation; a technical failure when submitting tax reports via telecommunication channels, which can be confirmed, for example, by a report from an electronic document management operator, a letter from an electronic document management operator about problems in the system; objective impossibility of submitting documents caused by circumstances beyond the control of the taxpayer, such as theft of accounting documents, destruction of documents by a natural disaster (possible evidence of the occurrence of such circumstances may be a resolution to initiate a criminal case on the fact of theft; a document from an authorized body recording the fact of a natural disaster (certificate Ministry of Emergency Situations)); ambiguity of the applicable legislation (evidence of this circumstance can be references to rules of law that are ambiguous in content, different judicial practice in the application of rules; contradictory explanations of authorized bodies on the application of controversial rules of law); socially significant nature or non-commercial nature of the taxpayer’s activity (type of activity, status of agricultural producer, etc.); minimal damage to the budget (for example, filing an updated declaration for payment, payment for which was made by the taxpayer as soon as possible; before filing the updated declaration, the taxpayer paid the tax and penalties, but did not fulfill other conditions provided for in paragraph 4 of Article 81 of the Tax Code of the Russian Federation) and other circumstances . The list of mitigating circumstances when committing a tax offense is open and is not limited only to the above cases. In any case, the presence of mitigating circumstances must be documented. Thus, the answer to the question of what is a mitigating circumstance and what is not depends entirely on an objective assessment of the evidence presented by the taxpayer. This means that the preparation of this evidence cannot be a mere formality for the taxpayer, and it must be treated with the utmost care and seriousness. The more carefully and seriously the taxpayer approaches the preparation of a request to take into account mitigating circumstances (listing specific facts and presenting evidence of their existence), the greater the chance of significantly reducing the amount of the fine. A corresponding petition for the application of circumstances mitigating liability for committing tax offenses, accompanied by documentary evidence of their existence, must be submitted in advance before considering the audit report. Inspectorate of the Federal Tax Service of Russia for Tomsk

https://www.nalog.ru/rn70/news/tax_doc_news/4281265/

Cancellation of fines for late payment of personal income tax: recent changes

On December 25, 2021, changes to the Tax Code of the Russian Federation were approved, according to which it is possible to cancel the fine for late payment of personal income tax for tax agents (bill No. 527676-7). To do this, a number of conditions must be met.

Such conditions include:

- timely provision of 6-NDFL calculations;

- 6-NDFL is completed correctly and without errors, it does not contain data on underestimated amounts of personal income tax;

- Personal income tax and penalties were paid before the tax authorities learned about the delay and scheduled an on-site audit.

Important! All these conditions must be met simultaneously. In such a situation, a fine can be avoided

How can a tax agent avoid punishment?

Article 123 of the Tax Code of the Russian Federation provides for the possibility of not paying fines for late payment of personal income tax in 2021. To do this, you only need to fulfill two conditions:

- Always submit fiscal reports on time. If you find an error in 6-NDFL, then immediately send a corrective report. Check your personal income tax calculation before submitting. Information about income, deductions and deductions must be reflected reliably and in full.

- At the same time as the adjustment, pay the identified arrears, as well as the amount of the penalty. Make the calculation according to the new rules (clause 3 of article 75 of the Tax Code of the Russian Federation, part 5 of article 9 of the Federal Law of November 27, 2018 N 424-FZ).

Please note that a fine can only be avoided if the errors are corrected before the Federal Tax Service inspectors find out about them. For example, until the moment when the Federal Tax Service issued a demand for payment of arrears and tax penalties. Or before scheduling a desk audit by the Federal Tax Service for the corresponding period.

An example of calculating a personal income tax fine for a tax agent

Information is included in the calculation of 6-NDFL for the 1st quarter of 2021.

The tax and late fees were paid to the budget only on April 10.

Answers to frequently asked questions

Question No. 1. The organization calculated and withheld personal income tax from wages, but transferred it to the budget with a delay of several days. Can the tax office impose a 20% fine for late payment of taxes, or must it first issue a demand for payment of arrears?

Answer: Issuing a requirement is not mandatory. The employer may be held liable for late payment of a fine under Art. 123 of the Tax Code of the Russian Federation for violating the deadlines for transferring taxes to the budget system.

Question No. 2. What income is not included in the tax base for personal income tax?

Answer: Among them are:

- state capacity;

- scholarships;

- pension payments;

- childbirth benefits;

- inheritance or gift;

- interest income from deposits;

- prize items not exceeding 4 tr;

- certificate for maternal capital.

Responsibility for non-payment of personal income tax

For violation of the procedure for calculating and paying personal income tax, liability is provided for both tax agents (employers) and for individuals themselves who independently received a profit. If personal income tax is not paid on time, a tax liability arises, which must be transferred to the budget. The overdue amount is subject to a penalty, which is a kind of reimbursement of the Treasury's costs for the fact that the taxpayer did not fulfill his obligations on time.

Failure to pay or not pay in full personal income tax, which arose due to an understatement of the tax base, may be punished in the form of a penalty. Collection in this case is possible in the amount of 20% of the debt amount or 40% if the taxpayer committed these actions intentionally. An understatement of the tax base is possible if the taxpayer indicates in the declaration those deductions that he is not entitled to apply.

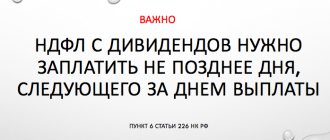

Important! In 2021, there are no penalties for late payment of taxes, but penalties are accrued for each day of delay.