When and in what amount can I receive a deduction?

You can apply to the tax authorities for a deduction after registering ownership of a residential building purchased or newly built on this site.

Thus, you can receive a deduction for a land plot in two cases:

- when purchasing a plot of land with a residential building located on it;

- when purchasing a plot of land with subsequent construction and registration of a residential building.

You should contact the tax authorities for deductions at the end of the calendar year in which the residential building was registered as your property. Or, without waiting for the end of the calendar year, you can receive a deduction from your employer - more about this in our article Obtaining a property deduction from your employer).

The edition of the Tax Code, which was in force until January 1, 2010, did not contain information about tax deductions for expenses for the acquisition of land. In this regard, only those citizens who registered ownership of the residential building located on it after January 1, 2010 have the opportunity to include in the deduction the costs of acquiring a land plot.

In this case, it is the date of registration of ownership rights to a residential building that is important, since it is considered the moment the right to deduction arises. The date of the purchase and sale agreement for the plot and other documents does not matter. Reason: Letter of the Federal Tax Service dated April 13, 2012 No. ED-4-3/ [email protected] , Letters of the Ministry of Finance of Russia dated December 1, 2011 No. 03-04-05/7-981, dated May 21, 2010 No. 03-04-05/9 -278.

Example: In 2021 Ivanov I.I. bought a plot of land with a residential building located on it. Ivanov has the right to a property tax deduction in the amount of expenses for purchasing a house and land. Apply for deduction to the tax authority Ivanov I.I. maybe after the end of the 2021 calendar year, that is, in 2021.

Example: In 2010 Petrov S.S. bought a plot of land, built a residential building on it and registered its ownership in 2020. Petrov can receive a deduction in the amount of expenses for building a house and purchasing a plot of land. Petrov can submit documents for deductions to the tax authority in 2021.

Example: Sidorov V.V.

bought a plot of land for the construction of an individual residential building, but did not build anything on it. Sidorov will not be able to receive a deduction for the specified land plot until he builds a residential building on it.

Tax deduction when purchasing a plot

Every officially working citizen of the Russian Federation pays a tax on his salary in the amount of 13%. Direct deductions and transfers to the state budget are made by employers. This tax on income received can be returned when purchasing certain real estate, thereby reducing your transaction costs.

According to the Tax Code of the Russian Federation, real estate buyers - individuals have the full right to property deductions (Article 220).

Land plots are classified as property from which deductions can be obtained. The main requirement for them is their purpose for personal residential construction, that is, for the construction of their own home for living. This fact is noted in the certificate for the site. The presence or absence of a building does not play a special role. A tax deduction for a land plot without a house is provided on the basis of the existing right to it with an indication of individual housing construction. In case of purchase of other categories of land, it is not used.

To make a refund, you must submit to the Federal Tax Service:

- statement and declaration;

- certificate from the employer 2-NDFL;

- copies of passport and TIN;

- copies of documentation of ownership and payment documents.

Property tax deductions for the purchase of land are subject to certain restrictions. Its full amount is 13% of the amount of money spent on the purchase of property. At the same time, Russian legislation has also established a limitation on the maximum possible return.

In accordance with the Tax Code of the Russian Federation, actual expenses for the purchase of a land plot, accepted for calculating the property deduction, cannot be more than 2 million rubles (clause 2, clause 1, article 220).

Example 1:

You bought a plot of land for 1.9 million rubles. Since this amount is less than 2 million, the refund will be made from it:

1,900,000 x 13% = 247,000

Example 2:

You paid 2.5 million rubles for the land plot. The amount given exceeds the maximum possible. Therefore, you will only get back 260 thousand rubles:

2000000 x 13%

There is no limitation period for property deductions on land. This means that you can get it at any time, regardless of the date of purchase, even after 15-20 years. There are only 2 points to consider:

- 1) the maximum deduction amount depends on the date of purchase;

- 2) only 3 years preceding the year of the deduction application are taken into account.

For land purchased before 2009, the maximum return amount is 130 thousand rubles, that is, from 1 million. For land acquired after January 1, 2009, this limit is doubled - 260 thousand.

Example 3:

You bought a plot to build a house in 2007 for 1.4 million rubles. This amount is more than 1 million. You are entitled to a maximum return: 1,000,000 x 13% = 130 thousand.

Example 4:

In 2010, you purchased a plot of land for 1.6 million rubles. The tax base will be the full cost, since it is less than 2 million:

1600 000 x 13% = 208 thousand.

When claiming a deduction, it is important to know that the refund will be made no earlier than for the last 3-year period.

Example 5:

You purchased land to build a cottage in 2011. You decided to receive the deduction in 2021. The tax base will be calculated starting from 2013. You need to take certificates of income received for the last years: 2013-2015.

The full period during which the personal income tax is refunded depends on the size of the income received by the buyer. Not always the entire amount can be returned within 1-2 years. The higher the salary, the more personal income tax is deducted and the faster the deduction occurs. The remaining amount of the refund in the next period is carried over to the following years until it is fully reimbursed.

Example 6:

The cost of the land plot purchased in 2015 is 1,350 thousand rubles. Total refund amount:

1350,000 x 13% = 175,500

For 2015, your personal income tax amounted to 60,000 rubles. In 2021 you will return them. The remaining amount will be carried over to the next period:

175 – 60 = 115 (thousand)

Example 7:

In 2014, you bought a plot for 1.3 million rubles. The property deduction will be in the amount of: 1300,000 x 13% = 169,000

Personal income tax for 2014 amounted to 80 and for 2015 – 110 thousand rubles. Total: 190 thousand. In 2021, you will get back the entire amount due (169,000) because it exceeds the tax paid.

All Russian citizens have the right to tax deductions. There are no restrictions here. The main conditions for receiving it:

- purchase of a land plot for a special purpose - individual housing construction;

- official earnings.

Deduction amount

Since the deduction for the purchase of land is not a separate type of deduction, its size is regulated by the standard deduction rates for the purchase of housing. Read more in the article “Tax deduction amount”.

The total amount of the deduction, including expenses for the purchase of land, purchase or construction of a house, cannot exceed 2 million rubles (260 thousand rubles to be refunded).

Example: Korolev A.A.

bought a plot of land for 3 million rubles and built a house on it for 5 million rubles. Despite the fact that the total expenses for purchasing land and building a house amounted to 8 million rubles, Korolev will be able to deduct only 2 million rubles and return 260 thousand rubles.

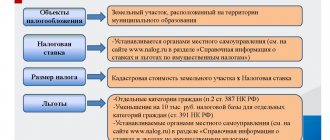

Maximum land tax rates for 2017 according to the Tax Code of the Russian Federation

Federal legislation sets limits that cannot be exceeded when determining the percentage tax rate. Thus, permissible sizes are regulated by Article 394 of the Tax Code of the Russian Federation. They depend on the parameters discussed above, and also partly on the category of the payer. Let's look at them in more detail.

| Basic land tax rates in 2017 | |

| Size | Explanation |

| According to the Tax Code of the Russian Federation, the interest rate on land tax cannot exceed 0.3% of its cadastral value | The site is usually used for: · construction of residential real estate; · farming; · growing plants or animals, etc. Similar land tax rates in 2021 apply to lands intended for customs purposes, protection of the state and its security. |

| The maximum land tax rate for individuals and legal entities in 2021 is 1.5% | The acquired land area can be used for: · production; · construction of trading platforms; · offices. It is important to understand that taxes are paid only on your own property. When an enterprise has entered into a land lease agreement, tax deductions continue to be made by its owner. A similar tax rate is relevant in all other cases. |

When engaged in agricultural activities, the amount of land tax cannot be more than 0.3%.

Local authorities should be guided by the indicators presented in the table above, since they do not have the right to exceed the land tax rates established by the Tax Code.

Purpose of the site for obtaining a deduction

Land plots vary depending on their intended use. For example, land for individual housing construction (IHC) is intended for the construction of residential buildings on it, but the intended use of a site intended for gardening does not provide for this possibility.

However, for the purposes of obtaining a tax deduction, the key condition is not the purpose of the land plot, but the presence of an individual residential building on this plot (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated December 10, 2012).

Thus, the possibility of obtaining a deduction when purchasing a land plot directly depends only on the possibility of obtaining a deduction for a residential building located (built) on this plot.

Example: Krasilnikov V.V. bought a plot of land and built a country house on it (not a residential building). Krasilnikov will not be able to receive a property deduction, since the deduction is provided only for a residential building. However, if a country house is recognized as a residential building, in addition to the deduction for the house, it will have the right to include in the deduction the costs of purchasing a land plot.

Who has the right to return personal income tax on purchased land?

A tax refund when purchasing a land plot is available only if all established conditions are fully met. Violation of even one rule will result in the deduction request being rejected.

The following can take advantage of this benefit:

- citizens of the Russian Federation who have resided on the territory of the state over the past six months;

- the applicant must have official income subject to taxation at 13%;

- the applicant must not have the status of an individual entrepreneur, unemployed or registered with the Employment Center.

The main condition for a tax deduction is that a citizen must officially pay the generally accepted tax rate.

Documents for receiving a deduction

To apply for a property tax deduction when purchasing land you will need:

- identification document;

- declaration 3-NDFL and application for tax refund;

- documents confirming ownership of land and a residential building: certificate of registration of ownership or extract from the Unified State Register of Real Estate;

- documents confirming expenses for the purchase of land/house: sales contracts, payment documents;

- documents confirming the paid income tax (certificate 2-NDFL).

You can find a detailed list of documents here: Documents for property tax deduction .

Limit amount for property tax deduction

The maximum amount with which you can return income tax on the purchase of land plots made before January 1, 2014 is 6 million rubles. For all transactions made after this date, the limit is 2 million rubles.

There are also special cases in which the purchase of a land plot was made using loan funds issued by the bank. In this case, the taxpayer is obliged to pay interest to the bank for using the loan. This situation implies that the maximum amount of income tax compensation will be 4 million rubles. If a taxpayer is trying to obtain a tax deduction on loan interest, payments will be made in accordance with the payment of the loan in the bank where the funds were taken.

What Putin said about land tax

On December 14, 2021, a large-scale press conference of Vladimir Putin took place. Among other things, the issue of land tax was raised.

A journalist from Pskov asked the President a reasonable question about the fact that over the past 1.5 years in Russia the cadastral value of land has sharply increased, which has led to an increase in land taxes. And this affected, first of all, ordinary people - owners of dachas, garden plots and those who live in villages and villages. For example, in the Pskov region, the land tax has increased more than 10 times. She noted that in Pskov gardeners even went to rallies. After them, regional authorities recommended that municipalities reduce rates, but in general the problem has not been resolved. Is it possible to resolve this issue definitively?

Vladimir Putin o.

“First of all, of course, this is the way it works all over the world, and this is natural: the owners of certain property maintain it and pay taxes. This goes without saying. And the cadastral value is the market value. And this is also quite natural and correct.

But what's wrong? These levels of cadastral payment tariffs should, in general, be based on some realities. They should be based on real incomes of the population. This cannot be divorced from life. You cannot carry out shock therapy, as in the 90s. This is simply unacceptable.

Now let’s not swear here at those who made the relevant decisions. And at the beginning of this path, people often paid attention to this, but the initiators of this process always said that these would be balanced decisions. What you said clearly suggests that the decisions turned out to be unbalanced.

We have preferential categories of citizens who receive a deduction from property worth 10 thousand rubles. But the land plots that you mentioned, these so-called six hundred square meters, in many regions of the country are more expensive than 10 thousand rubles, in the overwhelming majority.

You said about Pskov, but what can we say about the Moscow region, Leningrad region, other regions of the Russian Federation around cities with a population of over a million? Therefore, I think that in the very near future - I am grateful to you for this question - I will definitely give such an instruction to the Government.

So that the Government, together with the deputies of the State Duma, make a decision according to which all those preferential categories of citizens who received a cash deduction of 10,000 rubles received a benefit in kind and did not pay any taxes at all for all these six hundred square meters. That is, those categories that have a benefit of 10,000 rubles.

But I think this is not enough. Plus, the list needs to be expanded to include all old-age pensioners. Because, firstly, these people already have benefits associated with apartments and houses, and adding to this list with old-age pensioners will be logical and fair. The state will not suffer from this.”

This position of the President of Russia gave immediate impetus to legislators to develop appropriate amendments to the norms of the Tax Code of the Russian Federation on land tax. And they didn’t have to wait long. Moreover, for the sake of a new deduction for land tax for pensioners, the bill was supplemented, which initially only concerned clarification of the rules for taxing the profits of controlled foreign companies. The deputies even changed its name to a more general one - “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.”

Features and examples of calculations for different situations

The basic way to determine the amount of land tax is to calculate it manually, according to the established formula. It is worth considering several examples of calculations for this indicator, both in a normal situation and in the presence of certain features:

Standard settlement terms

The basic formula for land tax (LT) is as follows:

ZN = KS * P, where

KS is the cadastral value of the land plot that is the object of taxation, and P is the tax rate established for it by local representatives of the legislative branch.

This formula is applied if no additional factors influence the calculations.

It is worth considering the order of calculations based on the following data:

- cadastral value of the plot - 213 thousand rubles;

- The current tax rate is 0.8%.

In this case, the tax amount will be:

ZN = 213,000 * 0.8% = 1,704 rubles.

Since there is no other additional data in this situation, the total amount payable to the budget will be 1,704 rubles.

Determination of tax for an incomplete tax period (year)

Let's assume that in the example discussed above, the plot was purchased by the payer during the tax period, for example, May 11.

In such a situation, he will be required to pay tax taking into account the correction factor, which will be: K = 8/12 = 2/3 (or 0.66666667)

For calculations in this case, the number of months per year during which the owner actually owned the land is taken (in this case it is 8), and the total number of months per year. In this case, the month in which the land was acquired is still taken into account in full in the calculations, regardless of the exact date of the transaction (that is, it can be either May 1 or May 31). The amount of tax in this case will be:

ZN = 213,000 * 0.8% * 2/3 = 1136 rubles.

Thus, for 8 months of ownership of the plot by the owner, he will pay land tax to the budget in the amount of 1136 rubles. A similar situation will occur with settlements when selling land during the year.

If the plot is sold even in the first days of the month, the tax for this period is paid in full.

Tax calculation for partial month

In this case, the order of calculations will not differ in any way from the situation considered in the previous example, since the specific date and completeness of the month do not affect this in any way.

The month will be taken into account when determining the adjustment factor as a full month.

In addition, the procedure for calculating land tax may be influenced by some other additional factors:

- the presence of certain benefits for the payer (in particular, allowing for a slight reduction in the tax base);

- change in the cadastral value of a plot during the tax period (in some cases, the tax is recalculated immediately after the corresponding changes are documented);

For example, if the payer has a tax benefit in the form of reducing the base by 10 thousand rubles. The tax calculation for our example will look like this:

ZN = (213,000 – 10,000) * 0.8% = 1,624 rubles.

Thus, the tax savings will be 80 rubles. (1704 – 1624 rubles). A more significant discount may be provided if the benefit is presented in another form (for example, in the form of a 50% discount on tax), which may be established by local legislation. In this case, the salary will be halved and amount to 852 rubles. (RUB 1,704 * 50%).

Also, the tax amount will be different in a situation where the land is in common joint or shared ownership.

In this case, each owner will pay only that part that corresponds to his share of the property.

For example, if in our example the plot belongs to two citizens in shares of 1/3 and 2/3, then the tax amount for each of them will be:

ZN1 = 213,000 * 0.8% * 1/3 = 568 rub.

ZN1 = 213,000 * 0.8% * 1/3 = 1136 rub.

In a situation where specific shares of a plot are not allocated, it is considered that it belongs to the owners in equal parts (that is, ½ share for each of them). Therefore, the distribution of the tax will also be equal, that is, its value will be the same for both owners and will be 852 rubles. (1704/2). This method allows you to distribute tax obligations as fairly as possible among all property owners.

Do you need to know how to buy land at cadastral value from the administration? Then our article will help you! Do you need to draw up an additional agreement to the lease agreement? In our article you can read useful design tips. How to properly renew a lease? Find out about it here.