The UPD is a complex combined document that performs several functions at once, so its design should be approached with special care. What documents are included in the universal transfer document? Who signs the UPD? In this material we will analyze the rules and procedure for signing the UPD, as well as who signs.

Also see:

- How to use the universal transfer document (UTD)

- Replacing the certificate of completion and invoice with UPD

What is UPD used for?

It is not by chance that the universal transfer document got its name. It is called “universal” because it combines several documents. The purpose of such a merger is to reduce document flow. After all, for the same operation, 2 different documents were previously drawn up - a waybill (or act) + an invoice. The functions of these documents are different, but the data almost completely repeated each other.

Therefore, since 2013, a new document was introduced into circulation - UPD. It combines the functionality of a primary document and an invoice.

Naturally, in this case we are talking about those who apply the general taxation system. Organizations and individual entrepreneurs in special regimes are exempt from preparing invoices. Therefore, for them, the use of UTD is often not justified, although it is not prohibited .

Examples of completed forms

When performing work and providing services

When shipping goods

The second example of filling out the UPD is when shipping goods. To fill out a universal transfer document instead of a consignment note (TORG12), you need to change the status from “1” to “2”, and also leave the lines Consignor and his address (3) and Consignee and his address (4) empty.

Legal documents

- Government Decree No. 1137

- Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137

- Federal Law of December 6, 2011 No. 402-FZ

- Civil Code of the Russian Federation

Details without which the UPD is invalid

As such, the primary document is intended to reflect the fact of economic life in the accounting accounts, as well as to record expenses incurred as expenses.

IMPORTANT!

Requirements for primary accounting are given in Federal Law dated December 6, 2011 No. 402-FZ on accounting.

An invoice is needed to confirm the right to deduct VAT. The description of this document is given in the Tax Code of the Russian Federation.

By combining both of these documents, the UPD also incorporates the requirements for them. Thus, the list of mandatory UPD details is quite extensive.

As you can see, in the UPD, the signatures of the parties are mandatory requirement.

Place of signatures in the UPD

The basis for the UPD form was the invoice form. In 2021, it has undergone minor changes.

IMPORTANT!

The UPD form was proposed in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

The current UPD form according to the Federal Tax Service can be downloaded for free from the link below:

Mandatory signatures in the UPD are placed in two blocks:

- invoice

- primary

The UPD can act not only as a combined document, but also as only a primary document . To differentiate, you should indicate the status in the upper left corner of the UPD:

- “1” – combined document;

- “2” – only primary (special regime officers can use UPD with this status).

Who signs the UPD on the buyer’s side is uniform, regardless of the status of the document. But the signatures in the UPD on the part of the seller may differ with the corresponding status.

The general rules for affixing signatures to the UPD are as follows:

- indicate the position of the signatory, his full name. and, in fact, the autograph itself;

- The use of a facsimile signature is unacceptable - both in the part related to the invoice and in the primary part.

Required and optional fields

You do not have to fill in the following fields:

- Line 9 is optional, but the details of the transport documentation indicated in it will allow you to confirm the delivery of the goods.

- Line 12 is completed if there is additional information that needs to be shown.

- Field 17 indicates the occurrence of claims from the buyer during receipt of the order.

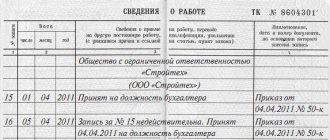

Lines 1a – 7 and the remaining fields of the invoice are intended for entering the details of the seller and buyer, data on payment documents, and the type of currency for settlements. They are filled out by organizations that pay VAT. The photo shows a sample of filling out the UTD for individual entrepreneurs with VAT.

Read more: Artemenko Yuri Valerievich arbitration manager

In the section of the invoice with status 1, the signatures of the manager and chief accountant must be present; for individual entrepreneurs, details must be indicated. Sometimes a document may be endorsed by several persons. Status 2 does not require signatures in these fields.

Buyer's signatures

As you know, there is no buyer's signature on the invoice. Therefore, the signer of the UTD must be determined by the same rules as the signer of the primary document.

The buyer must have 2 signatures:

Who is responsible and accepts the cargo is determined by the local acts of the organization. If this is the same person, then in line 18 it is enough to indicate the position and full name. There is no need to re-sign .

How to fill out a universal transfer document for an individual entrepreneur

In order to reduce document flow and reduce the likelihood of errors, a new document has been put into circulation - a universal transfer document (UTD). It was developed on the basis of the invoice form, as well as previously required forms of primary accounting documents (No. TORG-12, M-15, OS-1, commodity section of TTN).

From this article you will learn:

• when to set UPD

• how to fill out the UPD

Urgent news for all entrepreneurs: Banks have changed the rules for working with individual entrepreneurs

. Read more in the magazine “Simplified”

When to set UPD

According to the provisions of the law, an invoice should be issued no later than five calendar days from the date of shipment of goods (performance of work, provision of services, transfer of property rights), and the primary document should be drawn up at the time of the transaction or immediately after its completion.

Accordingly, it is best to draw up a UPD when a fact of economic life occurs or immediately after it (that is, at the time of shipment, delivery of work (services), etc.).

How to fill out the UPD

The procedure for registering a UPD depends on how it will be used in the future. If as a single document, then enter the number 1 in the “Status” column and fill in all the details provided in it. In this case, you will not need to issue a separate invoice.

If the UPD will be used as a primary accounting document, then the number 2 is entered in the “Status” column, and dashes are placed in line 5 and columns 6, 7, 10, 10a, 11.

Next, we will tell you what needs to be indicated in each line and column of the UPD.

On line 1

The serial number and date of preparation of the document are indicated.

According to line 1a

The serial number of the correction made to the UPD and the date of its introduction are entered. If this did not take place, a dash is placed in line 1a.

On line 2

The full name of the entrepreneur is entered, in line 2a - his address of residence, and in line 2b - TIN.

If the merchant is a tax agent, then in the indicated lines he accordingly enters the name of the seller (his full name), address of location (address of residence), IPP and KPP (if any).

Lines

3

and

4

and address of the sender and recipient of the goods. Moreover, these indicators can be supplemented with information about the tax identification number and checkpoint of the indicated persons. If the seller and the consignor, the buyer and the consignee are the same person, then in lines 3 and 4 you can write “The same person.”

If there was an advance payment when selling goods, performing work or providing services, then in line 5

you should indicate the details of the payment document or cash receipt that confirm it.

To line 6

the entrepreneur enters the full or abbreviated name of the buyer in accordance with the constituent documents, in

line 6a

- the address of the buyer’s location in accordance with the constituent documents, and in line 6b - the buyer’s INN and KPP.

On line 7

The name of the settlement currency and its OKV code are indicated.

On line 8

information is reflected that identifies the emerging relationship between the parties (for example, details of contracts, agreements).

On line 9

details of transport documents (bill of lading, waybill), instructions to forwarders, warehouse receipts, clarifying information about transportation, if any, are entered.

Lines

10

and

15

, the position, surname and initials of the person responsible for the shipment or delivery of work (services) or for receiving cargo or accepting the results of work (services). Also in these lines is the signature of this person.

The actual date of shipment of goods, provision of services, transfer of results of work performed, transfer of property rights is entered in line 11

, and the actual date of receipt of the goods (cargo), acceptance of the results of the work performed, receipt of property rights by the buyer - in

line 16

.

On line 12

Links to other related information are provided. For example, in this line you can specify information about passports and certificates. But such passports and certificates must be attached to the UPD.

On line 13

indicates the position, surname and initials of the person responsible for the correct execution of the transaction on the part of the seller, and in

line 18

- on the part of the buyer. Also in these lines the signature of the indicated persons is placed. If these persons were indicated on lines 10 and 15, then in lines 13 and 18 you can only enter their positions, surname and initials.

Lines

14

and

19

are intended to indicate the name of the economic entity that drew up the document on behalf of the seller and buyer, respectively. But individual entrepreneurs can put a dash in these lines, since, as a rule, they keep records on their own.

On line 17

any additional information about the receipt and acceptance of goods is indicated. In particular, on this line you can enter the essence of the claim, if any. In this case, the documents used to formalize this claim will need to be attached to the UPD.

The tabular part of the UPD is filled out as follows.

In column A

The serial number of the entry in the table is indicated.

To column B

The merchant enters the article number of the goods or the code of the type of activity within which work is performed or services are provided, according to OKVED and OKUN.

In column 1

the subject of the transaction is indicated, namely: the name of the goods supplied (shipped) (description of work performed, services provided), transferred property rights.

In column 2

the entrepreneur, if necessary, enters the unit of measurement, and in

column 2a

- the corresponding symbol according to OKEI.

The quantity (volume) of goods supplied (shipped) (work performed, services rendered, property rights transferred) is entered in column 3

.

In column 4

the price (tariff) of the goods (work performed, service rendered) and the transferred property right per unit of measurement excluding VAT is indicated. The exception is cases of application of state regulated prices (tariffs), which include VAT.

The cost of the entire quantity (volume) of goods supplied (shipped) (work performed, services rendered), transferred property rights without VAT is reflected in column 5

.

In column 6

the amount of excise tax on excisable goods is paid. If there is no indicator, the entry “Without excise tax” is made.

In column 7

the VAT rate or “Without VAT” is indicated, and in

column 8

- the amount of VAT charged to the buyer of goods (work performed, services rendered) and transferred property rights.

The cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, including VAT, is entered in column 9

.

In column 10

The digital code of the country is entered according to OKSM, and in

column 10a

- its short name.

In column 11

enter the customs declaration number for goods whose country of origin is not the Russian Federation.

Sample of filling out the UPD

Source: https://www.26-2.ru/art/346105-kak-ip-zapolnit-universalnyy-peredatochnyy-dokument-

Seller's signatures

On the seller’s side, there can be much more signatories if the UPD is compiled with status “1”. As we remember, status “1” indicates that the UPD acts as both an invoice and a primary document. Therefore, you must sign it:

- director and chief accountant of the organization (or other authorized persons) - regarding the invoice;

- the employee who shipped the goods (handed over the work, services) and the person responsible for registering the fact of ownership. worker’s life – in the primary part – lines 10 and 13.

Who these persons are is determined by the local acts of the organization. This is also true in terms of authorized persons who sign invoices.

It is not necessary to duplicate the same signature in all lines .

there is no need to put signatures on the part of the invoice .

A sample of how to sign a UPD can be viewed and downloaded for free at the following link:

SAMPLE OF SIGNATURE OF UPD

Who is required to sign the UPD on the part of the supplier?

Should an organization have sample signatures so that it is not denied VAT deduction?

10.30.2020Russian tax portal

Answer prepared by:

Expert of the Legal Consulting Service GARANT

Koreneva Olga

The answer has passed quality control

Often, UPDs received from counterparties are signed not by the general director and chief accountant, but by other employees by proxy.

Should an organization have samples of the signatures of these persons so that it is not denied VAT deduction?

Having considered the issue, we came to the following conclusion:

Tax legislation does not provide for the taxpayer’s obligation to request from counterparties certified copies of powers of attorney and sample signatures of persons who are authorized to sign an invoice for the director or chief accountant.

In order to ensure that the UPD complies with the requirements of the law, as well as the exercise of due diligence and caution in choosing a counterparty, we consider it advisable to check the powers of the persons acting on behalf of the supplier. To do this, we recommend requesting certified copies of powers of attorney, with sample signatures of persons authorized to sign the UPD. This will confirm the organization’s awareness of the proper powers of counterparty representatives when carrying out legally significant actions.

Rationale for the conclusion:

Federal Law No. 163-FZ of July 18, 2017 introduced Art. 54.1, which regulates the limits of the exercise of rights to calculate the tax base and the amounts of taxes and contributions. In accordance with paragraphs. 2 p. 2 art. 54.1 of the Tax Code of the Russian Federation, one of the conditions for a lawful reduction of the tax base and (or) the amount of tax payable is the fulfillment of the obligation under a transaction (operation) by a person who is a party to the agreement concluded with the taxpayer and (or) by the person to whom the obligation to fulfill the transaction (operation) transferred by agreement or law. Moreover, if the primary accounting documents were signed by an unidentified or unauthorized person, this cannot be considered as an independent basis to recognize the taxpayer’s reduction of the tax base and (or) the amount of tax payable as unlawful (Clause 3 of Article 54.1 of the Tax Code of the Russian Federation).

Mandatory details of shipping invoices are listed in clause 5 of Art. 169 of the Tax Code of the Russian Federation, advance payments - in clause 5.1 of Art. 169 of the Tax Code of the Russian Federation, adjustment ones - in clause 5.2 of Art. 169 of the Tax Code of the Russian Federation.

According to paragraph 6 of Art. 169 of the Tax Code of the Russian Federation, an invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization. At the same time, the current legislation does not establish a ban on signing an invoice by one person authorized to sign on the basis of a power of attorney, both for the head and the chief accountant of the organization (letter of the Ministry of Finance of Russia dated July 24, 2019 N 03-07-11/55067, dated 10/21/2014 N 03-07-09/53005).

In 2013, the Federal Tax Service of Russia took the initiative to replace invoices and acts with a universal transfer document (UDD), drawn up on the basis of an invoice form, supplemented with the necessary details (letter of the Federal Tax Service of Russia dated October 21, 2013 N ММВ-20-3/96). Such a document received from the supplier can serve both as confirmation of the invoiced VAT amount and as confirmation of the fact of delivery. The UPD form, communicated by letter of the Federal Tax Service of Russia dated October 21, 2013 N ММВ-20-3/ [email protected] , is advisory in nature.

The letter of the Federal Tax Service of Russia dated October 21, 2013 N ММВ-20-3/ [email protected] states that filling out all UPD details established as mandatory for primary documents Art. 9 of Law N 402-FZ “On Accounting” and for invoices Art. 169 of the Tax Code of the Russian Federation, allows you to use it simultaneously for the purpose of calculating income tax (as a primary document) and settlements with the budget for VAT (as an invoice) (document status “1”). At the same time, for the purpose of calculating and paying VAT, the rules for registration and execution of UTD coincide with the rules for execution and registration of invoices. See letter of the Federal Tax Service of Russia dated April 21, 2014 N GD-4-3/7593.

In accordance with paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, errors in invoices and adjustment invoices that do not prevent the tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of the goods (work, services), property rights, their value, as well as the rate and amount of tax are not grounds for refusal to deduct VAT.

Tax legislation (Chapter 21 of the Tax Code of the Russian Federation) does not provide for the taxpayer’s obligation to request certified copies of powers of attorney and sample signatures of persons who are authorized to sign an invoice (UPD) for the director or chief accountant. In response to the taxpayer’s question about the need to conduct a handwriting examination, the Ministry of Finance of Russia, in a letter dated April 23, 2010 No. 03-02-07/1-187, indicated that all business transactions must be documented with supporting documents. The reliability of the data contained in such documents is ensured by the persons who compiled and signed these documents.

However, inspectors may doubt both the powers of these persons and whether the signature on the document corresponds to the signature of the person to whom the right was transferred by proxy, and to engage an expert to conduct tax control (clause 11, clause 1, article 31, clause 1 Article 95 of the Tax Code of the Russian Federation), including within the framework of a desk tax audit (resolution of the AS of the West Siberian District dated March 14, 2016 N F04-28823/2015, West Siberian District dated February 13, 2006 N F04-185/2006(19515- A67-25). At the same time, evidence of falsification of documents submitted by the taxpayer can only be used taking into account the fact that the examination cannot be considered as independent and sufficient evidence of a tax violation (letter of the Federal Tax Service of Russia dated October 31, 2017 N ED-4-9/ [ email protected] ) Since clause 3 of Article 54.1 of the Tax Code of the Russian Federation provides for several criteria that cannot independently serve as a basis for filing tax claims: signing of primary accounting documents by an unidentified or unauthorized person; violation of tax laws by the counterparty; the possibility of the taxpayer obtaining the same result of economic activity when performing other transactions (operations) not prohibited by law. These criteria are enshrined in Art. 54.1 of the Tax Code of the Russian Federation in order to exclude the possibility of tax authorities filing formal claims against taxpayers.

According to the legal position set out in paragraph 3 of the definition of the Constitutional Court of the Russian Federation dated February 15, 2005 N 93-O, the obligation to confirm the legality of tax deductions with primary documentation lies with the taxpayer - the buyer of goods (work, services), since it is he who acts as the subject applying when calculating the final the amount of tax payable to the budget, deduction of tax amounts accrued by the supplier. At the same time, as mentioned above, documents confirming tax deductions must reflect reliable information. The Constitutional Court of the Russian Federation, in its ruling dated October 16, 2003 N 329-O, explained that the interpretation of Art. 57 of the Constitution of the Russian Federation in systematic connection with other provisions of the Constitution of the Russian Federation does not allow us to conclude that the taxpayer is responsible for the actions of third parties. At the same time, paragraph 10 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53 determines that a tax benefit may be recognized as unjustified if the tax authority proves that the taxpayer acted without due diligence and caution, and he should have been aware of the violations admitted by the counterparty.

In judicial practice, there are refusals to deduct on the grounds that invoices were signed by unauthorized persons (resolution of the Court of Justice of the West Siberian District dated December 25, 2015 N F04-28466/15 in case N A03-1434/2015). In this case, the taxpayer’s argument to submit to the tax authority all the necessary documents as confirmation of the validity of the application of tax deductions was rejected by the court of cassation, since in order to receive a tax benefit, it is not enough just to submit all the documents provided for by law; it is necessary that the listed documents meet the criteria of accuracy, completeness and consistency, and the actions of the taxpayer - the criterion of economic justification and prudence. The company did not ensure compliance with the requirement for the reliability of primary documents, thereby did not show due diligence and caution, therefore, it should have foreseen adverse consequences in the form of refusal to apply tax deductions for VAT on documents drawn up on behalf of disputed counterparties. The court considered that the Company had to not only check the legal capacity of the counterparties, but also evaluate the terms of the transaction, check the business reputation and solvency of the counterparties, the risk of non-fulfillment of their obligations, and also make sure that the signing of documents on behalf of the counterparties is carried out by authorized representatives, the documents themselves contain reliable information.

The results of the handwriting examination, along with other circumstances, formed the basis for the court’s decision to refuse to apply tax deductions for VAT in the decisions of the Arbitration Court of the West Siberian District dated December 20, 2018 N F04-6132/18 in case N A67-10104/2017, Eleventh AAS dated 12/30/2016 N 11AP-16074/16, FAS of the West Siberian District dated 11/20/2012 N A03-5023/2012, East Siberian District dated 10/18/2012 N A10-4600/2011).

There are cases when taxpayers manage to prove that the presence of a signature of an unidentified person on a document is not a reason for refusing a deduction (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 N 17684/09, FAS Central District dated 12/04/2012 N A54-1087/2012, FAS Ural District dated June 1, 2012 N F09-4042/12, North Caucasus District dated March 15, 2012 N A32-25584/2010).

The fact that checking the powers of persons acting on behalf of the counterparty indicates the exercise of due diligence follows, for example, from the decisions of the Court of Justice of the West Siberian District dated May 16, 2019 N F04-1392/2019 in case No. A03-10836/2018, AS Ural District dated 02.02.2018 N F09-8782/17 in case N A60-25288/2017, however, with the exception of those cases where measures were taken to create the appearance of lawful behavior of the taxpayer (resolution of the Moscow District Court dated 06.10.2017 N F05-12206 /2017 in case No. A40-175066/2016).

It should be taken into account that formal claims against the taxpayer’s counterparties in the absence of facts disproving the reality of the counterparty’s transactions and operations declared by the taxpayer are not an independent basis for refusal to account for expenses and tax deductions for transactions (operations) (letter of the Federal Tax Service of Russia dated April 22, 2020 N SD-19-2/99).

The task of an economic entity is to observe a certain kind of caution and diligence when choosing counterparties, since if it fails to show such and fails to fulfill its obligation to ensure compliance with the requirement of reliability of primary documents, on the basis of which it claims the right to receive tax benefits or tax deductions, it, by virtue of Art. . 2 of the Civil Code of the Russian Federation carries the risk of adverse consequences of this kind of inaction (resolution of the Fifteenth AAC dated 03/08/2020 N 15AP-24319/19 in case N A53-10663/2019).

Based on the foregoing, in order to ensure the execution of UPD (invoices and primary accounting documents) to the requirements of the law, as well as the exercise of due diligence and caution in choosing a counterparty, we consider it advisable to check the powers of the persons acting on his behalf, the head and chief accountant of the organization. For this purpose, we recommend requesting certified copies of powers of attorney with sample signatures of persons authorized to sign the UPD. This will confirm the organization’s awareness of the proper powers of counterparty representatives when carrying out legally significant actions.

However, if the tax authority has claims against the organization regarding its receipt of an unjustified tax benefit, then its existence must be confirmed by a body of evidence. A conclusion about the unreliability of UTD (invoices and invoices) signed by an unauthorized person cannot independently, in the absence of other facts and circumstances, be considered as a basis for recognizing a tax benefit as unjustified (Resolution of the Eleventh AAS dated March 19, 2014 N 11AP-2040/14 , Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 20, 2010 N 18162/09).

Post:

Comments

Electronic UPD

UPD in electronic form can be issued subject to certain conditions:

- Compiled in the format approved by order of the Federal Tax Service of Russia dated December 19, 2018 No. ММВ-7-15/820.

- An agreement on the exchange of UTD in electronic form has been reached and signed with the counterparty.

Signs an electronic document:

1. Selling side:

- enhanced qualified electronic signature of the manager (authorized person);

- electronic signature of the person responsible for the operation.

2. Acquiring party:

- reinforced by a qualified signature of the person responsible for registration of the fact of ownership. life;

- electronic signature of the person responsible for the operation.

Let's sum it up

The UPD is signed by both parties to the transaction - the seller (performer) and the buyer (customer). This is done by the persons responsible for conducting the transaction and for correctly reflecting the fact of economic life.

The UPD with status “1” is signed on the part of the seller by the manager and the chief accountant or authorized persons. If the signatory is the same person, there is no need to copy signatures on all lines: there is only one signature left on the document, and in the remaining fields you just need to put down your position and full name.

Read also

28.05.2020