Calculation of the amount of accrued excise tax

Calculate the amount of accrued excise tax for each transaction and for each type of tax rate (clauses 4, 5 of Article 194 of the Tax Code of the Russian Federation) using the formula:

| Excise tax to accrue = Tax base × Excise tax rate |

Determine the tax base in accordance with Articles 182, 187, 189–191 of the Tax Code of the Russian Federation. The procedure for determining the tax base depends on the type of tax rates established for various excisable goods.

For more information on determining the object of taxation for specific transactions, see:

- How to calculate excise tax on operations with straight-run gasoline;

- How to calculate excise tax on transactions with denatured ethyl alcohol;

- How to calculate excise tax on the sale of excisable goods;

- How to calculate excise tax under a contract for the processing of customer-supplied raw materials;

- How to pay excise tax when using goods within an organization.

Determine the total amount of accrued excise tax for all transactions, the date of which relates to the current tax period - month (Clause 5 of Article 194, Article 192 of the Tax Code of the Russian Federation).

Use the formula:

| Excise tax to be charged | = | The amount of excise tax calculated at a fixed rate (subclause 1, clause 2, article 187 of the Tax Code of the Russian Federation) | + | The amount of excise tax calculated at the combined rate (subclause 4, clause 2, article 187 of the Tax Code of the Russian Federation) |

Customs excise tax rate

How to find out whether you need to pay excise duty on your products or not and how much? To do this, you need to correctly determine the unique digital code of the product using a special classifier of the Commodity Nomenclature of Foreign Economic Activity of the EAEU (TN FEA). Using this digital code, determine in the Unified Customs Tariff of the Eurasian Economic Union (UCT EAEU) whether excise duty needs to be paid and, if necessary, how much?

Example 1: Import of malt beer in vessels with a capacity of less than 10 liters, in bottles, with an ethyl alcohol content of less than 8.6%. We find the ten-digit product code “2203000100”; the excise tax rate for it is 21 rubles/liter. Example 2: Import from Spain of natural grape wines with the addition of plant or aromatic substances, in vessels with a capacity of 2 liters or less, with an actual alcohol concentration of less than 18%. We find the product code “2205101000”, the excise tax rate for wine is 18 rubles/liter. If a batch of imported goods includes excisable goods with different excise rates, then the excise tax is calculated for each group separately (Article 194, paragraph 6 of the Tax Code of the Russian Federation).

Imported goods placed under customs procedures are exempt from excise tax:

- Customs transit

- Processing for domestic consumption

- Free customs zone

- bonded warehouse

- Processing outside the customs territory

- Free warehouse

- Duty Free Shop

- Processing in customs territory

- Destruction

- Refusal in favor of the state

- Re-export

Calculation of excise tax payable

An organization can reduce the total amount of tax by the amount of excise tax accepted for deduction.

Calculate the amount of excise tax payable to the budget using the formula:

| Excise tax payable = Excise tax accrued – Excise tax accepted for deduction |

Such rules are established in paragraph 1 of Article 202 of the Tax Code of the Russian Federation.

For information on paying excise duty when importing goods into Russia, see How to calculate excise duty when importing excisable goods.

Excise tax deduction

To confirm the right to deduct excise taxes, refiners of petroleum products must prepare the following documents:

- certificate of registration of a person processing oil and petroleum products (copy);

- contract for the supply of petroleum raw materials on a property basis;

- contract for the provision of services related to the processing of petroleum raw materials;

- invoices from the supplier of petroleum raw materials;

- documents confirming the transfer of oil raw materials for processing (copies of invoices for the transfer of raw materials to production, limit cards, etc.).

The listed documents are submitted to the tax authority along with the declaration in due time.

Deadlines for paying excise duty

As a general rule, the calculated amount of excise tax must be transferred to the budget no later than the 25th day of the month following the tax period (clause 3 of Article 204 of the Tax Code of the Russian Federation). So, for example, excise tax for March must be paid no later than April 25.

There are exceptions to this rule. When performing certain transactions, excise tax must be paid at a later date.

1. No later than the 25th day of the third month following the reporting tax period, organizations that (if they have the appropriate evidence) carry out transactions with straight-run gasoline (benzene, paraxylene, orthoxylene, aviation kerosene), denatured ethyl alcohol and middle distillates must pay excise tax (Clause 3.1 of Article 204 of the Tax Code of the Russian Federation).

For example, an organization that processes straight-run gasoline and has a certificate for the production of petrochemical products transfers the excise tax calculated for March to the budget no later than June 25.

2. For the transactions listed below, excise duty must be paid no later than the 25th day of the sixth month following the tax period in which these transactions were made:

2.1. Sales of middle distillates to foreign companies in Russia:

- Russian organizations included in the register of bunker fuel suppliers;

- Russian organizations licensed to conduct loading and unloading activities (in relation to dangerous goods in railway transport, inland water transport, and seaports);

- Russian organizations that use facilities for bunkering (refueling) of water vessels on the basis of agreements with companies included in the register of bunker fuel suppliers.

2.2. Sales outside Russia of middle distillates purchased as property and placed under the customs export procedure. At the same time, the buyers of this product are foreign companies that:

- entered into agreements with a Russian organization - the owner of a license to use a subsoil plot of the continental shelf of the Russian Federation or with a contractor engaged by a user of subsoil for the creation, operation, use of installations and structures specified in subparagraph 2 of paragraph 1 of Article 179.5 of the Tax Code of the Russian Federation;

- on the basis of these contracts, perform work (provide services) related to geological study, exploration and (or) production of hydrocarbons on the continental shelf of the Russian Federation.

This is stated in paragraph 3.2 of Article 204 of the Tax Code of the Russian Federation.

If an organization carries out transactions with different deadlines for paying excise duty and maintains separate records of these transactions, transfer the amount of excise duty for each type of transaction separately within the time limits established by the Tax Code of the Russian Federation. This follows from the provisions of Article 204 of the Tax Code of the Russian Federation.

If the 25th falls on a non-working day, then pay the excise tax no later than the first working day following the non-working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

There is an exception to this rule - payment of tax on updated declarations. If, as a result of an error, the tax base for the excise tax was underestimated, before submitting updated returns for these periods, you must pay the full amount of additional tax and penalties for the entire period of delay.

For information on the deadlines for paying excise duty when importing goods into Russia, see How to calculate excise duty when importing excisable goods.

Who pays excise taxes and for what transactions?

Excise tax payers are represented by the following groups:

- Legal entities – both Russian and foreign companies;

- Individual entrepreneurs;

- Carriers of excisable goods across the customs border.

The main transactions for which you pay excise tax appear in Article 182 of the Tax Code as objects of taxation.

In these most common situations, you have an obligation to pay excise tax:

| Operation | A comment |

| Sales of excisable products by the manufacturing company | You will not be able to bypass the excise tax, even if you gave your products as a gift or paid for them. In the eyes of the law, this is also a “realization”, that is, the transaction is subject to excise tax. Example . You sell the cigarettes you make to wholesale buyers |

| Transfer of products by the manufacturing company to the person who provided customer-supplied raw materials | If your company has the necessary equipment for the production of excisable goods, you can contract, that is, carry out work on the order of a third party - from his own materials. Example . Your customer has brought several tons of grapes, you make wine from them for a fee under the contract and return the finished product to your employer - upon the fact of transfer, an obligation to the state to pay excise duty appears |

| Moving excisable goods within the company for the manufacture of non-excisable products | The raw materials produced by the organization do not leave its borders, but are put into further work to produce the final product. “Inside the company” – not necessarily within the same building. These may be other branches, workshops, departments, sections, sectors, representative offices. Example . You handed over the liqueur you made to the confectionery shop to produce sweets with liqueur filling. You pay excise tax upon the fact of movement |

| Internal use | Example. You donate part of the gasoline you produce to refuel your company's vehicles. |

| Import of excisable goods | Example . You are importing motor oil from another country. You pay excise tax to the customs authority when declaring the goods |

Important! When moving excisable products within a company, there are exceptions when excise tax is not paid (clause 8, clause 1, article 182 of the Tax Code). These include:

- Transfer of straight-run gasoline for further processing for the purpose of producing petrochemical products. But provided that the organization has a certificate to carry out operations with straight-run gasoline.

- Transfer of denatured ethyl alcohol for further processing to produce products that do not contain alcohol. The organization must also have the appropriate certificate, but for carrying out operations with denatured alcohol.

- Transfer of products from raw alcohol, rectified ethyl alcohol, for the purpose of further production of alcoholic or excisable products containing alcohol.

- Transfer of ethyl alcohol for the production of perfumes and cosmetics, as well as those used in household chemicals containing alcohol. These products must be packaged in a metal container with an aerosol.

If, in the production cycle, products go through several stages of processing and are transferred to more than one structural unit of the company, then, for tax purposes, each such transfer is considered separately. In this case, excise tax is charged only on the production of non-excisable goods from excisable raw materials. This rule also applies if, as a result of processing, the final product for sale is not obtained.

Any movement of products must be accompanied by documents: invoices, limit cards, acts of acceptance and transfer of raw materials, both for processing and in the case of movement within the company, to its structural divisions.

In other cases, if excisable products are moved within the company, from one structural unit to another, and the final product, in this case, will be excisable goods, then these operations are subject to excise taxes without fail.

In some cases, a special procedure is applied that exempts from paying excise duty.

It includes such standard operations from Article 183 of the Tax Code as:

- You sell excisable goods abroad, that is, you export them from the country under the customs export procedure;

- You transfer the excisable goods of one division of the company to another division for the production of also excisable goods. For example, you produced ethyl alcohol and transferred it to another workshop for the production of vodka. Exemption from excise duty is possible only when maintaining separate records of operations for the production and sale of excisable goods;

- You are importing excisable goods into the territory of the Russian Federation, which you will transfer into the possession of the state. According to the logic of this paragraph, if you import cars with the aim of donating them to the state, you do not have the right to demand payment of excise tax.

- Transfer of excisable goods to a structural unit of the company to check its quality in compliance with GOST conditions. In this case, the inspection is considered mandatory and is part of the technological process of production of the final product (letter of the Federal Tax Service No. 03-3-09-1222 dated June 28, 2006)

- Other operations reflected in Article 183 of the Tax Code.

Where to transfer excise tax

As a general rule, excise tax must be paid at the place of production of excisable goods (clause 4 of article 204 of the Tax Code of the Russian Federation). However, there are exceptions to this rule. They relate to some of the operations presented in the table:

| Operation | Where to pay excise tax | Base |

| Obtaining denatured ethyl alcohol by an organization that has a certificate for the production of non-alcohol-containing products | At the place of receipt of goods | para. 2 clause 4 art. 204 Tax Code of the Russian Federation |

| Purchase of ownership of straight-run gasoline by an organization that has a certificate for processing straight-run gasoline | At the location of the taxpayer | para. 2 clause 4 art. 204 Tax Code of the Russian Federation |

| Incorporation of straight-run gasoline produced as a result of the provision of services to the organization for processing raw materials (materials) | ||

| Acquisition of benzene, paraxylene or orthoxylene by an organization that has a certificate to carry out transactions with these goods | ||

| Capitalization of benzene, paraxylene or orthoxylene produced as a result of the provision of services to the organization for processing raw materials (materials) | ||

| Acquisition of ownership of middle distillates by a Russian organization that has a certificate to carry out operations with middle distillates | ||

| Sales of middle distillates to foreign companies in Russia: – Russian organizations included in the register of bunker fuel suppliers; – Russian organizations licensed to carry out loading and unloading activities (in relation to dangerous goods in railway transport, inland water transport, and seaports); – Russian organizations that use facilities for bunkering (refueling) of water vessels on the basis of agreements with companies included in the register of bunker fuel suppliers | At the location of the taxpayer and (or) at the location of separate divisions | para. 3 p. 4 art. 204 Tax Code of the Russian Federation |

| Sales outside Russia of middle distillates purchased as property and placed under the customs export procedure. At the same time, the buyers of this product are foreign companies that: – entered into agreements with a Russian organization - the holder of a license to use a subsoil plot of the continental shelf of the Russian Federation or with a contractor engaged by a subsoil user for the creation, operation, use of installations and structures specified in subparagraph 2 of paragraph 1 of Article 179.5 of the Tax Code of the Russian Federation; – on the basis of these contracts, perform work (provide services) related to geological study, exploration and (or) production of hydrocarbons on the continental shelf of the Russian Federation |

For information on transferring excise duty when importing goods into Russia, see How to calculate excise duty when importing excisable goods.

How to determine the place of payment of excise tax

For excisable goods (PT), excise duty is paid at the following place:

- capitalization of purchased PT - if transactions were completed in accordance with subparagraph. 20 clause 1 art. 182 Tax Code of the Russian Federation;

- location of the taxpayer - if the transactions provided for in subparagraph 21, 23–29 paragraph 1 art. 182 Tax Code of the Russian Federation;

- location of the taxpayer and/or its separate divisions - if they carry out operations in accordance with subparagraph. 30, 31 clause 1 art. 182 Tax Code of the Russian Federation;

- PT production - in other cases.

When importing imported PT, as a general rule, excise duty is paid at customs (Article 205 of the Tax Code of the Russian Federation, Article 84 of the Labor Code of the Customs Union). An exception is the import of PT that is not subject to mandatory labeling into the territory of the EAEU. In this case, the payment of excise tax is controlled by tax authorities (clause 13 of Appendix No. 18 to the Treaty on the EAEU). Excise duty on goods subject to labeling is paid at customs (Clause 1, Article 186 of the Tax Code of the Russian Federation).

Excise tax on natural gas is paid at the place where the taxpayer is registered with the tax authority, unless otherwise established by international treaties of the Russian Federation (clause 7 of Article 205.1 of the Tax Code of the Russian Federation).

Find out how to determine the place of payment of taxes in the Russian Federation from the materials posted on our portal:

- “Where to pay VAT and how and where to find the correct details for payment?”;

- “General procedure and terms for payment of personal income tax”;

- “Advance payments under the simplified tax system: calculation, payment terms, BCC”.

Processing payment orders

Execute payment orders for the transfer of excise tax in accordance with the Regulations of the Bank of Russia dated June 19, 2012 No. 383-P and the Rules approved by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. For more information about this, see How to correctly fill out a payment order for the payment of taxes and contributions.

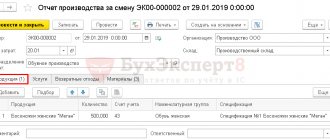

An example of calculating the amount of excise tax to be paid to the budget

In January 2021, Alpha LLC sold 500 0.5-liter bottles of beer with a volume fraction of ethyl alcohol of 6.5 percent. The excise tax rate for beer with an alcohol content by volume from 0.5 to 8.6 percent is set at 20 rubles. for 1 liter. Alpha had no other operations subject to excise tax this month.

The accountant calculated the amount of excise tax to be paid to the budget for January: 500 but. × 0.5 l × 20 rub. = 5000 rub.

To transfer the tax, the accountant drew up a payment order.

In accounting, Alpha's accountant made the following entries.

In January:

Debit 90-4 subaccount “Excise taxes” Credit 68 subaccount “Calculations for excise taxes” - 5000 rubles. (500 bottles × 0.5 l × 20 rubles) – excise tax is charged on the sale of beer.

25 February:

Debit 68 subaccount “Calculations for excise taxes” Credit 51 – 5000 rub. – excise tax is transferred to the budget.

Another comment on Art. 202 of the Tax Code of the Russian Federation

Article 202 of the Tax Code provides that the amount of excise tax payable by a taxpayer carrying out transactions recognized as an object of taxation in accordance with Chapter 22 of the Tax Code is determined at the end of each tax period as reduced by tax deductions provided for in Article 200 of the Tax Code, the amount of excise tax determined in accordance with with Article 194 of the Tax Code.

Thus, the unlawful use of tax deductions does not automatically lead to the formation of arrears of the same amount and cannot be qualified as unpaid (not fully paid) tax to the budget.

Excise tax refundable

If the amount of tax deductions in any tax period exceeds the amount of accrued excise duty, do not pay the tax in this tax period (clause 5 of Article 202 of the Tax Code of the Russian Federation). The specified amount of excise tax can be used to offset the taxpayer's debt to the budget or returned to the organization in the manner prescribed by Article 203 of the Tax Code of the Russian Federation.

For more information on the procedure for offset (reimbursement) of the excise tax amount, see When excise tax can be offset or returned from the budget.

Commentary on Article 202 of the Tax Code of the Russian Federation

The amount of excise tax on excisable goods subject to payment is determined at the end of each tax period as the amount of excise tax determined in accordance with Art. 194 of the Tax Code of the Russian Federation, reduced by tax deductions.

Thus, the calculation of the amount of excise tax taking into account tax deductions is carried out using the following formulas:

a) for excisable goods for which specific rates are established:

C = O x A - B,

where C is the amount of excise tax;

O - tax base (volume of products sold) in physical terms;

A - excise tax rate (in rubles and kopecks per unit of measurement of goods);

B - the amount of tax deductions;

b) for excisable goods for which ad valorem rates are established:

C = O x A: 100% - B,

where C is the amount of excise tax;

O — tax base (cost of products sold, determined for each type of excisable goods);

A - excise tax rate (as a percentage of the cost);

B - the amount of tax deductions;

c) for excisable goods for which combined rates are established:

C = (Oc x Ac) + (Oa x Aa: 100%) - B,

where C is the amount of excise tax;

Os - tax base (volume of products sold) in physical terms;

Oa — tax base (cost of products sold, determined for each type of excisable goods);

Ас — specific excise tax rate (in rubles and kopecks per unit of measurement of goods); Aa is the ad valorem excise tax rate (as a percentage of the cost);

B is the amount of tax deductions.

If the amount of tax deductions in any tax period exceeds the total amount of excise tax calculated on excisable goods sold, then no excise tax is paid in this tax period.

The amount of excess tax deductions over the total tax amount is subject to offset against current and (or) upcoming tax payments in the next tax period.

Let's consider possible schemes for the sale of petroleum products and determine who, in each specific case, should be charged and paid excise taxes.

1. The organization produces petroleum products from its own raw materials and sells them to a wholesale organization, which, in turn, transfers these petroleum products to the retail network (at gas stations). All listed persons (including the gas station owner) do not have a certificate.

In the above situation, the object of taxation arises at the first stage - at the manufacturer.

2. An organization that has a certificate produces petroleum products from its own raw materials, which it sells to a wholesale organization that does not have a certificate. The latter, in turn, transfers these petroleum products to the retail network (at gas stations) to a person who also does not have a certificate.

In this case, as in the first, the excise tax payer will be the manufacturer, since he has an object of taxation. Since the wholesale organization does not have a certificate, the manufacturer is not entitled to tax deductions. The procedure for calculating and paying excise tax is similar to the procedure set out in the first situation.

3. An organization that has a certificate produces petroleum products from its own raw materials and sells them to a wholesale organization that also has a certificate. The latter, in turn, transfers the specified petroleum products to the retail network (at gas stations) to a person who does not have a certificate.

In this situation, the manufacturer charges excise tax upon receipt of finished products. The manufacturer does not include excise tax in the price of the product (even if the excise tax is charged in one tax period and deductions are made in another).

A wholesale organization that has a certificate, when receiving petroleum products, charges excise tax and pays it to the budget, since it does not have the right to tax deductions when shipping petroleum products to a person who does not have a certificate.

When selling petroleum products to gas stations, the wholesale organization includes excise tax in the price, since in paragraphs. 3 p. 4 art. 199 of the Tax Code of the Russian Federation provides that the amount of excise tax calculated by the taxpayer for the transactions specified in paragraphs. 3 p. 1 art. 182 of the Tax Code of the Russian Federation, in the case of transfer of excisable petroleum products to a person who does not have a certificate, it is included in the cost of the transferred petroleum products. The gas station does not charge excise tax and does not pay it to the budget.

4. An organization that has a certificate produces petroleum products from its own raw materials and sells them to a wholesale organization that does not have a certificate. The latter, in turn, transfers the specified petroleum products to the retail network (at gas stations) to a person who has a certificate.

In this case, the manufacturer charges excise tax and pays it to the budget, since the shipment was made to a person who does not have a certificate. Consequently, the excise tax amount is included in the price of petroleum products sold.

When purchasing petroleum products, a wholesale organization does not charge or pay excise tax, since it does not have a certificate.

The owner of a gas station who has a certificate, when purchasing petroleum products, must charge excise tax (since he has an object of taxation) and pay it to the budget, since a person who has a certificate for retail sales does not have the right to a tax deduction.

Thus, in the latter situation, the effect of double taxation arises, since the obligation to pay excise tax falls on both the manufacturer and the owner of the gas station.

However, participants in the petroleum products market can choose schemes that will avoid double taxation. Since in practice there are often cases when buyers of petroleum products work both with suppliers who have a certificate and with suppliers who do not have it, it is not advisable to refuse the received certificate. If a person who has a certificate receives a petroleum product from a person who does not have a certificate, an agency agreement can be concluded under which the petroleum product is sold without acquiring ownership of it. If the petroleum product is purchased from a person who has a certificate, it is more advisable to conclude a purchase and sale agreement. Then the petroleum product will be purchased at a price without excise tax.

For petroleum products produced from customer-supplied raw materials, the excise tax payer can be either the processor or the owner of the raw materials. It depends on whether the owner of the raw materials has a certificate. The fact that the processor of customer-supplied raw materials has a certificate does not matter.

If the owner of the raw material does not have a certificate, the processor pays the excise tax. He bills the owner of the raw material for payment of the amount of excise tax he paid along with the processing costs. The owner of raw materials includes the amount of excise tax in the price of the finished goods he sells, since in paragraphs. 2 clause 4 art. 199 of the Tax Code of the Russian Federation provides that the amount of excise tax calculated by the taxpayer for the transactions specified in paragraphs. 4 paragraphs 1 art. 182 of the Tax Code of the Russian Federation, is included by the owner of petroleum products in the cost of excisable petroleum products.

The owner of the raw materials charges and pays excise tax if he has a certificate. Accordingly, the processor is not an excise tax payer.

Advance payment for excise duty

In accordance with paragraph 8 of Article 194 of the Tax Code of the Russian Federation, producers of alcoholic and excisable alcohol-containing products are required to pay an advance payment of excise tax.

Advance payment of excise tax is made until:

- purchasing ethyl (including raw ethyl alcohol) alcohol produced in Russia;

- transfer within the structure of one organization of produced ethyl alcohol for further production of alcoholic, excisable alcohol-containing products or transfer of raw ethyl alcohol for the production of rectified ethyl alcohol used by the organization for the production of alcoholic, excisable alcohol-containing products.

The date of sale or transfer of excisable goods is defined as the day of shipment of goods to the buyer or their transfer to a structural unit (clause 2 of Article 195 of the Tax Code of the Russian Federation).

The procedure and deadlines for paying advance excise duty payments, and the conditions for exemption from its payment are established by paragraphs 6–17 of Article 204 of the Tax Code of the Russian Federation.

The amount of the advance payment of excise tax is not taken into account in the cost of alcoholic and excisable alcohol-containing products and is subject to deduction within the amount of excise tax calculated on the actually used excisable goods (clause 5 of Article 199, clause 16 of Article 200 of the Tax Code of the Russian Federation).

The role of the country's tax system

Definition 2

The tax system is an instrument of state power, based on the principles of legal relations in society, formed regarding the establishment and collection of taxes.

Taxes have existed since the emergence of statehood. With their help, the needs of the administrative apparatus are financed, and the social needs of society are compensated. Taxes form a centralized budget, thanks to which the state can perform the functions assigned to it.

Finished works on a similar topic

- Coursework: Procedure and deadlines for paying excise tax 460 rubles.

- Abstract Procedure and deadlines for paying excise tax 230 rubles.

- Test work Procedure and terms of payment of excise tax 230 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

Note 1

The state budget serves as the main financial system of the country. The budget is an economic relationship aimed at the centralized accumulation and distribution of the country’s financial resources.

The functions of the budget are as follows:

- Ensuring and maintaining the activities of the state administrative apparatus.

- Implementation of regional and municipal policies.

- Creating conditions for economic growth and development.

- Redistribution of financial resources between regions, industries, business entities.

- Creation and maintenance of the functioning of socially significant objects.

The revenue side of the budget is formed from tax and non-tax revenues. The tax part consists of taxes and fees, as well as mandatory payments of individuals and legal entities established by the legislation of the country.

Tax policy is not only a tool for replenishing the budget. It also acts as a tool for indirect regulation of economic relations in the country. A market economy assumes a limited role for government intervention. However, the management apparatus retains the ability to regulate economic processes. This need is due to the fact that the market gives rise to imperfect competition, which cannot ensure the uninterrupted functioning of the built-in market mechanism. With the help of government intervention, fair distribution of income is ensured, competition is supported, and conditions are created for the development of socially significant types of business.

Do you need to select material for your study work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Note 2

The tax system is a means of filling the budget, as well as an instrument of government influence on economic processes in society.

Advance payment calculation

Calculate the amount of the advance excise tax payment based on the total volume of alcohol purchased or transferred within the organization and the corresponding excise tax rate. In this case, determine the excise tax rate:

- or on the date of transfer of the advance payment;

- or on the date of presentation of the bank guarantee (if the organization is exempt from the advance payment).

This procedure follows from the provisions of paragraph 5 of paragraph 8 of Article 194 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated March 6, 2012 No. 03-07-15/1/4.

Example of transfer of advance excise tax payment

In August, Alpha LLC plans to purchase 100 liters of ethyl alcohol for the production of alcoholic beverages with a volume fraction of ethyl alcohol of 6.5 percent. The excise tax rate for alcoholic products with an alcohol content of up to 9 percent by volume is set at 400 rubles. for 1 liter. Alpha has no other operations subject to excise tax.

The accountant calculated the amount of the advance payment of excise tax for August, payable to the budget in July: 100 l × 400 rubles. = 40,000 rub.

The accountant transferred the amount of accrued excise tax to the budget on July 14, 2016.

In accounting, Alpha's accountant made the following entries.

July:

Debit 19 sub-account “Excise taxes” Credit 68 sub-account “Calculations for excise taxes” - 40,000 rubles. (100 l × 400 rub.) – an advance payment of excise tax on purchased ethyl alcohol for the production of alcoholic beverages has been accrued.

the 14 th of July:

Debit 68 subaccount “Calculations for excise taxes” Credit 51 – 40,000 rubles. – advance payment of excise tax to the budget is transferred.

In what tax period is excise duty paid?

The period in which excise duty must be paid to the budget depends on the type of excisable goods and the transaction performed. Consolidated information on the deadlines for paying excise duty in certain cases is presented below in the form of a table.

| Operation | Payment deadline | Example |

| General procedure | Until the 25th of the next tax period | Beer sold 17,320 bottles of beer in September 2021. Sokol will pay the tax on 10/08/16 (until 10/25/16). |

| Processing of straight-run gasoline, denatured alcohol, middle distillates | Until the 25th day of the 3rd month of the next tax period | Nefteprom JSC is engaged in the processing of straight-run gasoline. 07/27/16 Nefteprom accepted 12,410 tons of gasoline for processing. Nefteprom paid the excise tax for July on 10/04/16 (until 10/25/16). |

| Sales of middle distillates in favor of foreign companies in the Russian Federation | Until the 25th day of the 6th month of the next tax period | JSC Glavmash, a supplier of bunker fuel, sold Czech goods in September 2016 (in the Russian Federation). Glavmash transferred the excise tax for this supply on 03/12/17 (until 03/31/17). |

| Sales of middle distillates in favor of foreign companies outside the Russian Federation | Until the 25th day of the 6th month of the next tax period | JSC Nedra has a license to use the subsoil of the continental shelf of the Russian Federation. In April 2021, Nedra will sell excisable goods from a Finnish company, the goods are placed under the customs export procedure. Excise tax on goods was transferred to the budget on 10/17/17 (until 10/25/17). |

Payment of excise tax is accompanied by filing reports with the tax authority. The deadline for submitting an excise tax declaration depends on the type of excisable goods and the transaction performed and is similar to the deadline for paying tax to the budget. In this regard, we consider it advisable to first submit reports to the tax office, and then transfer the specified amount of tax to the budget.

Advances on excise taxes: calculation, payment, terms

For a number of excise transactions, a procedure has been established according to which the company is obliged to make prepayments for excise tax. You are required to pay excise tax in advance if:

- Your company operates in the production of alcoholic and/or alcohol-containing products;

- the company purchases raw materials - ethyl alcohol, raw alcohol, which is subsequently used for the production of excisable goods.

Also, excise tax will have to be paid in advance by those companies that transfer alcohol-containing raw materials for processing to other divisions (branches, departments, representative offices) within the organization.

To calculate the advance amount, use the following indicators:

- the volume of alcohol purchased (transferred within the organization) within the tax period (month);

- tax rate.

The advance amount is determined as a derivative of the above values.

The advance payment for excise duty on the next month's purchases must be made before the 15th of the current tax period. The question arises: how to calculate the advance amount if the purchase of alcohol is only planned, but has not yet been carried out. In this case, you can take as a basis not the actual, but the planned indicator. For example, if the supply of alcohol has not been carried out, but its volume is specified in the contract, you can calculate the advance amount based on the indicator specified in the agreement.

Example No. 1.

On 11/10/16, a contract for the supply of alcohol (share 6.5%) - 118 liters was concluded between JSC Spirprom and JSC Solnechnaya Dolina. The delivery of alcohol to the Solnechnaya Dolina warehouse is planned on December 28, 2016.

In order to pay the excise tax advance on time (by November 15, 2016), the Solnechnaya Dolina accountant made the following calculation:

118 l * 400 rub. (established rate) = 47,200 rub.

The amount was transferred to the budget on 11/12/16. The Sun Valley accounting records reflect the following:

| date | Debit | Credit | Operation description | Sum | A document base |

| 12.11.16 | 19 Excise taxes | 68 Excise taxes | The accrual of the amount of advance excise tax for the upcoming supply of alcohol from JSC "Spirtprom" is reflected | 47,200 rub. | Accounting certificate-calculation |

| 12.11.16 | 68 Excise taxes | 51 | The amount of the excise tax advance was transferred to the budget | 47,200 rub. | Payment order |

The accountant of Solnechnaya Dolina confirmed the transferred advance amount by providing the following to the tax office:

- a copy of the payment order;

- a copy of the bank statement;

- notice of advance payment (4 copies, including 1 in electronic form).

All of the above documents were provided by Solnechnaya Dolina within the established deadline – November 13, 2016 (before the 18th of the current tax period).

Deadline for payment and confirmation of advance payment

Transfer the advance excise tax payment no later than the 15th day of the current month (tax period) based on the total volume of alcohol, the purchase or transfer of which will be carried out by the organization in the next month (clause 6 of Article 204 of the Tax Code of the Russian Federation).

After paying the advance excise tax payment, the organization is obliged no later than the 18th day of the current month to submit the following documents to the tax authority at the place of registration (clause 7 of Article 204 of the Tax Code of the Russian Federation):

- a copy of the payment document confirming the transfer of funds to pay the amount of the advance payment of excise tax, indicating in the column “Purpose of payment” the words “Advance payment of excise tax”;

- a copy of a bank statement to confirm the debiting of the specified funds from the current account of the manufacturer of alcoholic or excisable alcohol-containing products;

- notice of advance payment of excise duty in four copies (one of them in electronic form) (clause 9 of article 204 of the Tax Code of the Russian Federation).

The procedure for submitting notices to interested parties is specified in paragraph 10 of Article 204 of the Tax Code of the Russian Federation.

No later than three days before the date of purchase of ethyl or cognac alcohol, the buyer of the alcohol transfers one copy of the notice with a mark from the tax authority to the seller. The second copy remains with the buyer. The third copy and an electronic copy are kept by the tax authority.

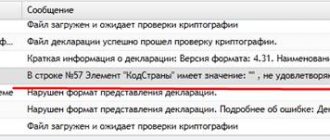

Types of excise tax declarations

Alcohol can be considered the most common type of excisable product. Order of the Federal Tax Service of the Russian Federation dated August 27, 2020 No. ED-7-3/ [email protected] approved the form of declaration for excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products, as well as on grapes.

Order of the Federal Tax Service of the Russian Federation dated January 12, 2016 No. ММВ-7-3/ [email protected] contains the form and procedure for filling out a declaration on fuel (gasoline, oils, natural gas, etc.). There is no need to prepare a separate excise tax declaration for middle distillates; all information on distillates is also included in the fuel declaration. Starting with reporting for February 2021, a new declaration form is used, approved by Order of the Federal Tax Service dated October 13, 2020 No. ED-7-3/ [email protected]

A well-known type of excisable product is tobacco. The updated tax return on excise taxes on tobacco (tobacco products), tobacco products, electronic nicotine delivery systems and liquids for electronic nicotine delivery systems (let's call it a tobacco return) is valid as of July 16, 2018.

Why report excise taxes?

Excise taxes were developed as a taxation tool. All producers of consumer goods are required to pay this internal indirect tax. The calculated excise tax is included in the final cost of the product. Excise goods include:

- alcohol;

- tobacco products;

- petrol;

- some imported goods.

Manufacturers are required not only to calculate and pay the excise tax, but also to report on the state of mutual settlements with the budget. Tax reporting on excise duties is submitted to the Federal Tax Inspectorate at the place of registration of the manufacturer. If excisable goods are produced and sold by an individual entrepreneur, he must submit the register to the Federal Tax Service at his place of residence.

The excise declaration is submitted monthly, but only in case of sale of manufactured products. If an enterprise manufactured but did not sell an excisable product, there is no need to submit a report.

Step-by-step instructions for filling out the form

Step 1. Filling out the title page does not cause any special problems - on this page you indicate the full name of the accountable person, INN and KPP (which are automatically duplicated for the entire report). Next comes line-by-line filling.

| Cover Sheet Cell | Filling procedure |

| Correction number | If the declaration is initial, then the value 0 is entered. If an adjustment is provided, then its number is indicated in order (01, 02, etc.). |

| Taxable period | In an alcohol return, the tax period is a month. The serial number of the reporting month corresponds to the tax period. For our example, the reporting month is 06. |

| Reporting year | The year the report was submitted is indicated. In our case, this is 2020. |

| Tax authority code | Coding of the Federal Tax Service at the location of the taxpayer. |

| Location code | 213 - at the place of registration of the largest taxpayer. 214 - at the location of other Russian organizations. |

| Form and Taxpayer Identification Number (TIN) of the reorganized organization | Indicated only in case of reorganization of the reporting entity and submission of information by the successor. |

| Contacts | A telephone number for contacting the contractor is indicated. |

| Total number of pages | The total number of pages in the declaration is entered. |

| Taxpayer attribute | 1 - the taxpayer himself. 2 - his representative who acts by proxy. |

| FULL NAME. taxpayer representative | The surname, name and patronymic of the head of the organization, his representative or individual entrepreneur must be indicated in full. |

| date | Reporting day. |

Step 2. Go to section 1 “Amount of excise duty”.

| Line number | Filling procedure |

| 010 | Taxpayer OKTMO code. |

| 020 | Budget classification code according to which excise duty is paid. For beer products KBK - 182 1 0300 110. |

| 030 | Encoding of the payment deadline. In our case, the value should be set to 03 - for payments that are made before the 25th. |

| 040 | The calculated amount of excise duty. |

| 050 onwards | They are filled out in a similar way for each type of excise product separately. |

Step 3. Fill out section 2 “Calculation of the excise tax amount”.

| Line number | Filling procedure |

| 010 | Code of the type of excisable goods. For our example, the code is 320 (beer with an alcohol content from 0.5% to 8.6%). All codes are given in Appendix No. 2 to Order No. ММВ-7-3/ [email protected] , which approves the procedure for filling out the excise tax declaration on alcohol. |

| Section 2.1 “Operations performed with excisable goods on the territory of the Russian Federation” | |

| Box 1 | Indicator code. Sales of beer products in Russia are marked with code 10001. The general list of codes is presented in Appendix No. 3 to Order No. MMV-7-3 / [email protected] |

| Column 2 | Code for the application of the excise tax. For our example, this is 4. All codes are presented in Appendix No. 4 to the Order. |

| Column 3 | The base calculated by the taxpayer for the reporting period is entered. |

| Column 4 | Amount of contribution to the budget. |

| Section 2.2. “Operations for the sale of excise goods outside the Russian Federation” | The order of filling in the columns is similar. |

| Section 2.3. “Amount of excise tax (advance) subject to tax deduction” | The fields are filled in with the characteristics that allow you to receive a tax deduction. For our example, there is no possibility to issue a deduction. |

| Section 2.4 “Amount of excise tax payable to the budget” | |

| Box 1 | Operation codes:

|

| Column 2 | The total amount, which must match line 040 of section 1. |

| Section 2.4.1 “Advance amount subject to payment to the budget or offset” | Similar data for advance payments. |

| Section 2.5 “Documented fact of sale of excisable goods outside the Russian Federation” | |

| Box 1 | Transaction codes from 50001 to 50011. You can view the identity of the codes in Appendix No. 3 to the Order. |

| Column 2 | Calculated tax base. |

| Column 3 | The calculated amount of the excise tax (the product of the base and the excise tax rate). |

| Columns 4 and 5 | Coding of the tax period of sale (month and year). |

Step 4. All attachments to the declaration are completed. If we are talking about the production and sale of beer products, then only Appendix No. 2 is filled out. In our example, the manufacturer does not sell goods abroad, so Appendix No. 2 is not compiled.

Here is a list of all attachments to the excise tax return for alcohol.

| Application number | Application Name |

| Appendix No. 1 | Calculation of the tax base by type of excisable goods. The calculation is made based on the volume produced for each product code separately. |

| Appendix No. 2 | Information on the sale of excisable goods outside the Russian Federation. Select the type of guarantee document - bank guarantee or surety agreement, fill in its details and the amount of the guarantee in rubles. Details are provided for each code of the product sold. |

| Appendix No. 3 | Information on the volumes of ethyl alcohol sold to the buyer. Decoding for each code of excisable products. |

| Appendix No. 4 | Information on the volumes of denatured ethyl alcohol received by the taxpayer. All delivery information is entered. |

| Appendix No. 5 | Information on the volumes of ethyl alcohol purchased and used in the tax period upon notification of payment of the excise advance. Detailed breakdown of all operations. |

| Appendix No. 6 | Information on the volumes of ethyl alcohol purchased and used in the tax period upon notification of exemption from excise advance payment. Detailed breakdown of all operations. |

IMPORTANT!

A separate declaration is submitted for each type of excisable product (alcohol, tobacco, gasoline). If a manufacturer sells beer and other alcoholic products, they are combined into one declaration for alcohol. In this case, a detailed breakdown of each alcohol code must be provided within the declaration itself.

Excise tax rates on petroleum products for 2018 – 2021

In 2021, the excise tax on gasoline and diesel fuel was reduced by 3,000 and 2,000 rubles, respectively. At the same time, petroleum products market entities must contain the market price of gasoline and diesel fuel for the end consumer.

In accordance with 301-FZ dated August 3, 2018, the excise tax rates on petroleum products for the period from July 1, 2021 to December 31, 2021 are set as follows:

| Name of excisable goods | Excise tax rate for 1 ton from 07/01/2018, rubles | Excise tax rate per 1 ton for 2021, rubles | Excise tax rate per 1 ton for 2021, rubles | Excise tax rate per 1 ton for 2021, rubles |

| Motor gasoline (grade 5) | 13 100,00 | 13 100,00 | 13 000,00 | 13 624,00 |

| Motor gasoline (not corresponding to class 5) | 8 213,00 | 12 314,00 | 12 752,00 | 13 262,00 |

| Diesel fuel | 5 665,00 | 8 541,00 | 8 835,00 | 9 188,00 |

| Engine oil | 5 400,00 | 5 400,00 | 5 616,00 | 5 841,00 |

| Aviation kerosene | 2 800,00 | 2 800,00 | 2 800,00 | 2 800,00 |

| Middle distillate | 6 665,00 | 9 241,00 | 9 535,00 | 9 916,00 |

| Straight-run gasoline | 13 100,00 | 13 100,00 | 13 100,00 | 13 100,00 |

| Benzene, paraxylene, orthoxylene | 2 800,00 | 2 800,00 | 2 800,00 | 2 800,00 |

For 2021, the same level of excise tax is provided for petroleum products, corresponding to the values of last year. Its accrual occurs when finished products are transported to a branch for the purpose of sale, use for their own purposes or for subsequent processing.

The formula for calculating the coefficient is as follows:

The excise tax is equal to the tax base multiplied by the tax rate minus the tax deduction.

The excise tax on petroleum products is calculated by the production company itself.

Who delivers and when?

The reporting persons are those who file the excise tax return. These include organizations and individual entrepreneurs paying excise taxes (Article 179 of the Tax Code of the Russian Federation). Those enterprises that transport products across the borders of the EAEU must also report.

Reports are submitted to the Federal Tax Service inspection at the location. If there are separate divisions, reporting is sent to the Federal Tax Service at the location of this division. The deadline for submitting an excise tax return is limited; documents must be submitted by the 25th of the next month. But only those organizations that actually pay excise tax to the budget after selling excisable products report monthly.

The delivery format is paper (if the number of employees allows) and electronic (for those who employ more than 100 people). The indirect tax return must be submitted by the 20th of the following month.

Accrued excise taxes are paid on the same dates - no later than the 25th of the next month. The reporting person is advised to file the return and make payments at the same time to avoid warnings and subsequent penalties.