Normative base

Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against accidents at work and occupational diseases”

Resolution of the Government of the Russian Federation No. 551 of June 17, 2016 “On amendments to the Rules for classifying types of economic activity as occupational risk”

Order of the Federal Social Insurance Fund of the Russian Federation No. 231 dated April 25, 2019 “On approval of the Administrative Regulations for the provision by the Social Insurance Fund of the Russian Federation of state services to establish a discount to the insurance tariff for compulsory social insurance against industrial accidents and occupational diseases”

Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds”

Order of the Federal Insurance Fund of the Russian Federation No. 381 dated September 26, 2016 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as for expenses for payment of insurance coverage and the Procedure for filling it out”

Insurance premium rates in 2021

The current FSS rate according to OKVED 2021 for accidents ranges from 0.2 to 8.5% of the amount of employee benefits. For the same period, all previously valid benefits will remain in effect. We are talking about reducing contributions to 60% if they are paid for employees who are disabled people of groups I, II or III. This norm works for both companies and individual entrepreneurs, even if they are not members of public all-Russian organizations of disabled people.

On September 18, 2020, bill No. 1027747-7 was introduced into the State Duma, according to which it is planned to extend the above rates and benefits until 2023.

Legislative framework

Mandatory payments to the Social Insurance Fund also include insurance premiums for accidents - funds accumulated in Social Insurance are used for employee compensation in terms of compensation for damage to health. Such payments are mandatory for all insurers - entrepreneurs and legal entities using the labor of hired specialists (Law No. 125-FZ of July 24, 1998).

The employer is obliged to monthly calculate insurance premiums for injuries in 2021 to the Social Insurance Fund from the amounts of accrued income in favor of employees (under employment contracts). The following factors directly influence the amount of payments:

- tariffs for contributions approved at the legislative level;

- main type of activity of the subject;

- the right to apply tariff benefits in the reporting year;

- compliance with the procedure for applying benefits.

Depending on the degree of potential traumatic activity of the organization, the rate of contributions to the Social Insurance Fund (NS and PZ) in 2021 according to OKVED varies from 0.2 to 8.5%. Officials have provided for certain benefits and relaxations by type of activity. For example, an educational institution has the right to apply a tariff of 0.2%, and an enterprise with harmful (hazardous) production will pay from the income of employees at the maximum rate (8.5%).

The right to the benefit must be confirmed by submitting an appropriate application to the Social Insurance Fund. There are separate deadlines for the procedure. And if they are violated, the institution will not receive a relaxation in the next year and will pay contributions to the maximum.

ConsultantPlus experts discussed how to calculate insurance premiums against industrial accidents and occupational diseases. Use these instructions for free.

Who is required to pay insurance premiums for injuries?

Employers pay monthly insurance premiums for injuries to the Social Insurance Fund. These are payments to employees as compensation for harm caused to health while performing work duties.

Any type of work worsens the health of workers and provokes the development of occupational diseases. Accidents at work are also no exception. The employer is obliged to compensate for these negative consequences. Compensations are not paid directly to hired employees, but are accumulated in a separate off-budget fund. And when an insured event occurs, Social Insurance pays compensation benefits.

Consequently, all Russian employers are required to pay insurance premiums for injuries in 2021. Moreover, the legal status of the employer does not matter. That is, organizations (legal entities), individual entrepreneurs, individuals in private practice, and ordinary citizens - individuals are required to pay. The key condition is that they all act as an employer, which means they are policyholders.

How is the tariff determined?

Order of the Ministry of Labor of the Russian Federation No. 851n dated December 30, 2016 established occupational risk classes for types of economic activity according to OKVED, there are 32 of them in total. Depending on the occupational risk class, the law sets the tariff.

The official website of the Social Insurance Fund contains a table of insurance premium rates for injuries in 2021, indicating the class and tariff.

| Occupational risk class | Rate |

| 1 | 0,2 |

| 2 | 0,3 |

| 3 | 0,4 |

| 4 | 0,5 |

| 5 | 0,6 |

| 6 | 0,7 |

| 7 | 0,8 |

| 8 | 0,9 |

| 9 | 1,0 |

| 10 | 1,1 |

| 11 | 1,2 |

| 12 | 1,3 |

| 13 | 1,4 |

| 14 | 1,5 |

| 15 | 1,7 |

| 16 | 1,9 |

| 17 | 2,1 |

| 18 | 2,3 |

| 19 | 2,5 |

| 20 | 2,8 |

| 21 | 3,1 |

| 22 | 3,4 |

| 23 | 3,7 |

| 24 | 4,1 |

| 25 | 4,5 |

| 26 | 5,0 |

| 27 | 5,5 |

| 28 | 6,1 |

| 29 | 6,7 |

| 30 | 7,4 |

| 31 | 8,1 |

| 32 | 8,5 |

Since the rate of insurance premiums for injuries is determined according to OKVED, documents must be sent to the Social Insurance Fund annually to confirm the main type of activity:

- application for confirmation of the main type of economic activity;

- certificate confirming the main type of economic activity.

If this is not done, then FSS employees will single out the type of activity with the highest risk class from all OKVEDs that are registered in the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs, and the company will have to overpay a percentage of the contribution. The Fund determines how much interest to pay to the Social Insurance Fund for injuries in 2021: based on the current OKVED or based on the main type of activity confirmed by the organization (Government Decree No. 551 of June 17, 2016).

Other tax benefits

At the federal level, there are no tax breaks on corporate property tax, transport and land taxes for legal entities that employ disabled employees.

At the same time, the legislative bodies of the constituent entities of the Russian Federation may provide for various benefits when establishing transport tax and corporate property tax. The same powers are vested in the representative bodies of municipalities when establishing land taxes.

D.M. Radonova, tax consultant

| Practical encyclopedia of an accountant All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents. Find out more |

www.buhgalteria.ru

This is the amount of money received by the employee, on the basis of which the required value is calculated. The legislation does not provide for any restrictions on the amount. The calculation is made as follows: B = Paymentstd/gpd – Paytyn/o Where: Paymentstd/gpd – funds paid to an individual according to an employment (civil law) contract. Payments/o – non-contributory payments. Note: when payments are made to a person in kind, contributions are calculated for the amount of money specified in the agreement. VAT and excise taxes are also taken into account. EXAMPLE Travel agency "Prestige" offers vacationers excursion tickets, as well as places to stay and vehicles. OKVED – 63.30.2. In February 2018, employees were paid a salary in the total amount of 3 million 500 thousand rubles, including financial assistance of 32 thousand rubles. Determine the amount of insurance contributions to the Social Insurance Fund.

Insurance premiums for disabled people in 2021

Important

If a citizen with a disability has established an individual entrepreneur, but at the same time has another official employment, or is among the founders of a third-party enterprise, he must pay contributions in full. The same applies to citizens whose ability to work is temporarily lost. Tax benefits Mentioned above are benefits for individual entrepreneurs on disability, exempting them from payments to the Pension Fund and insurance funds.

Info

In addition to them, the provisions of the law define several other types of benefits. Thus, individual entrepreneurs with disabilities of group 2 can count on benefits in paying personal income tax. Its amount is 500 rubles for each individual month.

This standard also applies to citizens with disability group 3, and helps entrepreneurs quickly “get on their feet” and occupy their niche. Disabled employee: insurance premiums

State institution - Moscow regional regional branch of the Social Insurance Fund of the Russian FederationPress centerAnnouncements 02/01/2018 Individual entrepreneurs who do not make payments or other remuneration to individuals, lawyers, members of peasant (farm) households, individuals not recognized as individual entrepreneurs (notaries engaged in private practice , other persons engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation), in the event of voluntary entry into a relationship under compulsory social insurance in case of temporary disability and in connection with maternity, acquire a guaranteed right to receive benefits for temporary disability and in connection with maternity.

Online magazine for accountants

The pension is paid regularly, its size does not depend on whether a disabled person works, opens an individual entrepreneur, or is listed as unemployed, since this payment relates to mandatory social support measures. Discounts on transport tax apply to specially equipped cars for disabled people, as well as vehicles issued by social security authorities. The amount of the tax benefit (and the possibility of its application) is determined by local authorities.

Disabled people also have benefits for advanced training, retraining and training, including in higher education institutions. Universities and other institutions have quota-funded places for persons with disabilities; in addition, such citizens have a priority right to enroll in a university and receive state scholarships. List of benefits for people with disabilities for 2021

For them, a quota has been established at the legislative level to attract unemployed disabled people to work in the amount of from 2 employees to 4% of the average number of employees. For example, the quota for hiring disabled people in Moscow and the Moscow Region is 2% of the average number of employees. It is not enough to hire a person with disabilities; it is also necessary to create conditions for him to perform his job duties.

Conditions may be different - it all depends on the nature of the person’s disease and the rehabilitation program. Administrative liability is provided for all legal entities that neglect this requirement. The amount of the fine for refusing to hire a disabled person or create the necessary working conditions is 5-10 thousand rubles.

Tax benefits for individual entrepreneurs with disabilities

As for other types of insurance premiums, you may find the article “Changes in insurance premiums from 2021” useful. Subscribe to the accounting channel in Yandex-Zen!

- 1 What the law says

- 2 What is the object of taxation

- 3 What are the rates for insurance premiums for injuries?

- 4 How to find out your tariff

- 5 How much to transfer

- 6 New data for discounts and allowances in 2021

- 7 What are the benefits for insurance premiums for injuries?

- 8 Foreigners: insurance premiums for injuries in 2021

- 9 What's new

What the law says Contributions for injuries are funds sent through the Social Insurance Fund to an employee as compensation for harm to health caused in the performance of their work functions.

Voluntary insurance: how to pay insurance premiums correctly in 2021

Also in 2021, benefits for entrepreneurs who pay contributions for disabled people of groups I, II and III will remain unchanged. Such individual entrepreneurs pay contributions in the amount of 60% of generally established insurance rates. How to find out your rate To determine your rate of insurance premiums for injuries in 2018, you must confirm the type of economic activity for the past period. That is, 2017. The policyholder must no later than April 16, 2021 (April 15 falls on a Sunday) send to the Social Insurance Fund:

- statement confirming the main type of activity;

- confirmation certificate;

- an explanatory note to the balance sheet for the past year (representatives of small businesses are relieved of this obligation).

In case of failure to submit the listed documents, the fund does not charge fines, however, FSS specialists will set the tariff independently.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. <... Compensation for unused vacation: ten and a half months go in a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169). But sometimes these 11 months are not so spent. <...

This right is granted to them by Order of the Ministry of Health and Social Development of Russia No. 55 of 2006. Moreover, they will choose the highest risk class from the codes specified in the Unified State Register of Legal Entities for your enterprise. Such a decision is not always beneficial for the policyholder, so we recommend regularly and timely confirming the main type of activity.

Please pay special attention: it is impossible to challenge the maximum tariff assigned by the FSS (see Resolution of the Government of the Russian Federation No. 551). In this part, nothing has changed in 2021 regarding insurance premiums for injuries. Also see “Confirming the main type of activity in the Social Insurance Fund in 2021: step-by-step instructions.”

How much to contribute Employers must calculate personal injury insurance premiums monthly for 2021, taking into account accruals for the past 30 (31) days. This can be done using the formula: CONTRIBUTIONS = B x TARIFF Where: B is the base for contributions for injuries.

Benefits for FSS contributions 2021 for disabled people

What is the object of taxation? The deductions in question are made provided that the following is concluded with the employee:

- employment contract (always);

- civil contract (when such a condition is stipulated).

The employer pays insurance premiums for injuries in 2018, regardless of whether or not subordinates have citizenship of our country. Within the framework of the relationship under consideration, the insurer is the Social Insurance Fund, and the policyholder is:

- legal entities (regardless of the type of ownership);

- owner of his own business;

- an individual who has signed an employment agreement with another person.

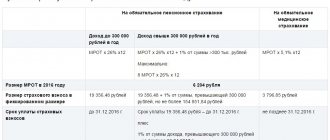

Deductions to the Social Insurance Fund for injuries come from different types of income: salaries, allowances, bonuses, compensation for unclaimed leave, as well as when paying wages in products. Tariff Pension (in the Federal Tax Service) 22% (from the amount of accruals within the approved maximum base value) 10% (from the amount by which the maximum base is exceeded) Medical (in the Federal Compulsory Compulsory Medical Insurance Fund) 5.1% For the period of incapacity and maternity 2.9% ( from the amount of accruals within the maximum base) 0% (from the amount by which the maximum insurance base is exceeded) Contributions for accident insurance Insurance contributions for insurance against accidents occurring during the working day and diseases associated with the performance of official duties are made by managers organizations in relation to disabled employees of groups 1, 2 and 3 at the rate:

- 60% of the tariff approved by law for the general case (both for LLC and individual entrepreneur).

For example, if the tariff for a company is approved at 0.6%, then for disabled employees the company will pay contributions at a tariff equal to 0.36%, that is, 0.6% x 60%.

redtailer.ru

A very frequently asked question from individual entrepreneurs with disabilities about the benefit for paying fixed contributions to pension and health insurance “for oneself.” Unfortunately, no benefits are provided for disabled individual entrepreneurs to pay these contributions at this time. Also, the Ministry of Finance has repeatedly and consistently opposed the introduction of such relief. This year alone there were two information letters from the Ministry of Finance which presented an argument against any preferences for individual entrepreneurs with disabilities. The last letter is very recent, dated 09/01/2017 N 03-15-03/56139. So, what the Ministry of Finance reports in its letter: Payment of insurance premiums by individual entrepreneurs is carried out regardless of age, disability, type of activity performed and the fact of receiving income from it in a specific billing period.

How to get a discount on the tariff

Order of the Social Insurance Fund No. 231 dated April 25, 2019 approved the rules for applying for a discount on the insurance tariff for compulsory social insurance against industrial accidents and occupational diseases and the procedure for their consideration.

The application must be submitted no later than November 1 in the prescribed form. The appeal is sent to the territorial bodies of the Social Insurance Fund at the place of registration:

- personally;

- by mail;

- through the MFC;

- through the government services portal (personal account) - in electronic form.

Among the conditions that applicants must meet:

- conducting business for at least 3 years;

- absence of arrears, unpaid fines and penalties;

- no fatal accidents.

The maximum period for consideration of entrepreneurs' applications is until December 1. But there are also special cases. If the applicant’s accrued insurance premiums last year do not exceed 15,000 rubles, Fund employees will consider the application within 10 working days. If more than 15,000 - within 18 working days. In both cases, the applicant is sent a decision within 5 calendar days from the date of its adoption.

We will separately list the documents required when applying. Order No. 231 emphasizes that it is impossible to demand any data other than what is provided in the application. But if an error is discovered, the FSS has the right to demand confirmation of the information provided. When applying in person, you will need a passport and a document confirming your authority.

Please note that the Fund will not consider your application if you submit it later than November 1 or use another form (for example, a previously valid one). They will also refuse if the application submitted in electronic format is signed with an invalid electronic qualified signature.

Example of filling out 4 fss with sick leave

07/05/2017. Article topic:

An example of filling out Form 4-FSS for the first half of 2021

All companies, whether they have employees or not, must pass

report 4-FSS on contributions for injuries. Entrepreneurs submit such a report only if they have employees.

The deadline for submitting the report is the 20th (on paper) or 25th (electronically) of the month following the end of the quarter.

Organizations and merchants face a fine

.

Its size is 5%

of the amount of contributions calculated for the last three months. This fine must be paid for each full or partial month of delay.

The total amount of the fine for the entire period of delay cannot be more than 30% of the amount of contributions. Minimum fine

—

1,000 rub

. (Clause 1, Article 26.30 of Law No. 125-FZ).

Sheet 001 (form 4-FSS. Title page)

Sheet 002 (Form 4-FSS. Table 1)

Sheet 003 (Form 4-FSS. Table 2)

Sheet 004 (Form 4-FSS. Table 5)

There are six tables in the 4-FSS 2021 form

.

1. 1.1, 2, 3, 4, 5. All of them are intended for calculations of injury and accident insurance costs. All companies and entrepreneurs must submit

a title page and tables:

- “Calculation of the base for calculating insurance premiums”;

- “Calculations for compulsory social insurance against accidents at work and occupational diseases”;

- “Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

The remaining tables are filled out and presented only if the corresponding indicators are available.

Table 1.1

filled out by employers who temporarily send their own employees to work in other organizations.

Table 3

should be filled out if in January-June 2021, companies or individual entrepreneurs paid benefits for work-related injuries or incurred other expenses that can be offset against injury contributions.

Table 4

must be passed if there were industrial accidents in the first half of 2021.

Source: Glavbukh magazine

An example of filling out a report form to the Social Insurance Fund, for the 1st quarter, half a year, year

4-FSS EXAMPLE OF COMPLETION for “injuries”, NS and PZ 2017

Filling out 4 FSS for pregnancy and childbirth is currently not performed.

Organizations that pay insurance premiums report only for “injuries” (NS and PZ) will have to submit reports to the FSS authorities in Form 4-FSS for 2021 . The report form was approved by the Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016.

No. 381. This order also approved the Procedure for filling out the form with an example and explanations . Below is an example of filling out 4-FSS for 2021.

The FSS report form has become smaller. The tables that are filled out for the tax office were removed from it, leaving only the calculation for “injuries.”

Now this report focuses only on contributions to compulsory social insurance against industrial accidents and occupational diseases.

The procedure for accrual, payment and reporting for this type of contributions is established by Law No. 125-FZ of July 24, 1998.

The article will help you learn how to correctly make a single calculation for insurance premiums to the tax office starting in 2021. Where to report, when to pay premiums for the insurance year.

Table 5 has also undergone changes; now it reflects information on the results of a special assessment of workplaces and is called “Information on the results of a special assessment of working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

Note. This is due to the entry into force in 2014 of the Federal Law of December 28, 2013. No. 426-FZ, according to which, instead of certifying workplaces, employers must conduct a special assessment of working conditions.

The changes affected, among other things, the codes of insurance premium payers in the category of insurance premium payers under code 101.

Note. INSURANCE CODE 4-FSS A directory of codes for policyholders of insurance contributions to the Social Insurance Fund is provided for filling out form 4-FSS.

Changes have been made to Form 4-FSS for policyholders who provide personnel to other organizations or individual entrepreneurs

The FSS reporting form has been supplemented with a new table No. 1.

1, which will have to be filled out by those insurers who temporarily send their employees under a contract for the provision of personnel to work in other organizations or individual entrepreneurs.

Order of the Social Insurance Fund dated July 4, 2016 No. 260 with corresponding changes to the calculation form was registered by the Ministry of Justice on July 20, 2016, and will come into force on August 1, 2021.

4-FSS for pilots: new rules for filling out

Starting from the first quarter of 2021, policyholders must submit 4-FSS using a new form. In this regard, Social Insurance approved the procedure for filling out the updated calculation by participants in the pilot project.

Source: https://buhnalogy.ru/primer-zapolneniya-4-fss-s-bolnichnym.html

Current benefits in 2021

In addition to the main tariff relaxations, officials have provided special types of benefits. Such privileges are available to all policyholders, without exception, in relation to payments in favor of disabled people of groups I, II and III.

The benefit is provided regardless of the legal form of the entity and the chosen taxation regime. The source of funding and the category of remuneration also do not matter.

IMPORTANT!

Individual entrepreneurs have the right to take advantage of benefits on insurance premiums.

If your organization employs disabled people (groups I, II, III), then contributions to the FSST for injuries in favor of these categories of workers are 60% of the total rate.

For example, an organization has a tariff of 8%. This means that when calculating payments to disabled people, it is allowed to reduce the rate to 4.8% (60% of the current rate).

Special benefits for injury insurance premiums

In addition to professional risk classes, policyholders have the right to take advantage of special benefits and privileges. Thus, officials have identified categories of payers who have the right to pay contributions for injuries in the amount of 60%. These should include:

- Any Russian organizations and individual entrepreneurs that make payments of remuneration for labor in favor of disabled people (disability groups 1, 2 and 3). The benefit applies only to payments to persons with disabilities, and not to all accruals in the state.

- Public organizations and public unions of disabled people. An important condition: disabled people and their legal representatives are 80% or more of all members of the organization or union.

- Organizations whose authorized capital is entirely formed from contributions from public organizations and (or) unions of disabled people. Key requirements: disabled people make up at least 50% of the average number of employees, and salaries in their favor are at least 25% of all payments.

- Specialized institutions created to provide a certain type of (educational, sports, legal, social) services to disabled people, disabled children and their parents. Important requirement: the owner of the institution’s property is a public organization of disabled people.

Please note that these benefits were valid not only in 2021. Officials have foreseen their effect for 2021 and 2021.

Accrual base

The object of taxation of insurance premiums for NS and PZ in 2021 are all types of payments as employee remuneration for labor. These types of payments are specified in the employment contract. Consequently, all income accrued to an employee under an employment agreement is subject to taxation.

IMPORTANT!

It is permissible to include remuneration under civil contracts in the tax base if the contract itself stipulates a condition for the payment of insurance premiums for injuries.

But some categories of payments should be excluded from taxation:

- state benefits, sick leave, child birth benefits, etc.;

- payments and severance pay in case of company liquidation or staff reduction;

- financial assistance (certain types, there are exceptions);

- payment for courses, advanced training;

- certain types of payments for work in particularly difficult (dangerous) conditions.

An exhaustive list of cash payments excluded from the base for calculating insurance premiums for NS and PZ in 2021 is enshrined in Law No. 125-FZ. These amounts are subtracted from the total payments before applying the contribution rate to the FSS NS and PZ according to OKVED for 2021 and calculating the final contribution amount.

From what income are insurance premiums for injuries paid?

Law No. 125-FZ defines an exhaustive list of payments in favor of hired employees, from whom the employer is obliged to calculate and pay insurance coverage against accidents and occupational diseases in the current year. These include all categories of employee income received as remuneration for work. That is, wages and other payments accrued to an employee within the framework of an employment relationship are taxable.

A prerequisite is the existence of an employment contract or a civil contract, if this document stipulates the employer’s obligations to calculate and pay contributions for occupational diseases and accidents.

Examples of payments from which insurance premiums for injuries are paid in 2021 are:

- Official salary or tariff rate.

- Supplement for work on holidays or at night, payment for work on weekends.

- Incentives and bonuses.

- Payment for overtime or overtime.

- Territorial and district allowances.

- Payment for the next labor holiday.

Officials also provided a list of non-taxable payments. These include all types of benefits, additional payments and compensation that are due to the employee not for work. For example, you should exclude:

- Temporary disability benefits (paid sick leave).

- Maternity benefit.

- A one-time payment at the birth of a baby.

- Childcare benefits for children up to 1.5 years old.

- Parental days to care for a disabled child, paid according to average earnings.

- Compensation payments (additional payment for harmfulness or danger, reimbursement for utilities, travel, food).

- Severance pay for staff reduction or liquidation of an enterprise.

- State pensions and scholarships.

- Social benefits (for large families, low-income people, etc.).

IMPORTANT!

Some types of financial assistance are not subject to taxation. Financial assistance is paid as support to an employee in a difficult life situation, and not as remuneration for work.

An example of how to calculate the payment amount

The FSS systematically monitors the accuracy and completeness of the calculation of insurance coverage for NS and PP. There are fines for violating the accrual and payment rules. Let's determine how to correctly calculate the amount of contributions.

Pion LLC made accruals in favor of its employees in October 2021 in the amount of 1,000,000 rubles. Including disability benefits - 150,000 rubles, non-taxable financial assistance - 20,000, benefits for the birth of a child, child care - 180,000 rubles.

The company has the right to apply a preferential tariff of 0.2%.

We calculate the base for October: 1,000,000 – (150,000 + 20,000 + 180,000) = 650,000 rubles.

Contribution amount = 650,000 × 0.2% = 1300.00 rubles.

In total, Pion LLC, for which the Social Insurance Fund tariff for accidents according to OKVED in 2021 is 0.2%, is obliged to transfer a contribution for October 2021 to the Social Insurance Fund in the amount of 1,300 rubles.

Payment deadlines in 2021

The deadline for payment for all types of insurance premiums is the same - the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 of Law No. 125-FZ). If the due date falls on a holiday or weekend, the payment should be made on the next working day. Contributions for compulsory accident insurance are transferred to the territorial body of the Social Insurance Fund (Law No. 125-FZ).

Payment must be made within the following terms:

| Period | Payment deadlines |

| For December 2019 | No later than 01/15/2020 |

| For January 2020 | No later than 02/17/2020 |

| For February 2020 | No later than 03/16/2020 |

| For March 2020 | No later than 04/15/2020 |

| For April 2020 | No later than 05/15/2020 |

| For May 2020 | No later than 06/15/2020 |

| For June 2020 | No later than 07/15/2020 |

| For July 2020 | No later than 08/17/2020 |

| For August 2020 | No later than September 15, 2020 |

| For September 2020 | No later than 10/15/2020 |

| For October 2020 | No later than 11/16/2020 |

| For November 2020 | No later than 12/15/2020 |

| For December 2020 | No later than 01/15/2021 |

How to pay

To pay for insurance coverage, use a special payment document - a payment order. This document has a unified form OKUD 0401060. The form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012.

The recipient of the contribution is the territorial branch of Social Insurance in which the subject is registered. The payment order must indicate the treasury details of the FSS branch, namely:

- full name;

- TIN;

- checkpoint;

- checking account;

- BIC and information about the bank.

| Payment | KKB for injuries for employees |

| Contributions | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |