Invoice for individual entrepreneurs: with or without tax?

VAT payers cannot issue tax-free invoices to the counterparty - regardless of who the buyer is (individual entrepreneur or company).

It also does not matter that the buyer is not a VAT payer (for example, applies a simplified tax regime). Although in such a situation, if certain conditions are met, invoices may not be issued if the buyer is a VAT non-payer and the parties have agreed not to issue invoices. Tips for drafting a non-invoicing agreement can be found here .

You can find a ready-made sample agreement on non-issuance of invoices when selling goods under a supply agreement in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

If you are not a VAT payer or are exempt from tax, you can issue VAT-free invoices for individual entrepreneurs or companies:

- at their request;

- due to the requirements of tax legislation.

According to paragraph 5 of Art. 168 of the Tax Code of the Russian Federation, exempt from VAT under Art. 145 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up invoices without highlighting the amount of tax, but with the inscription or stamp “Without tax (VAT)”.

Important! ConsultantPlus warns As a general rule, there is no need to issue invoices for transactions that are listed in paragraphs 1 - 3 of Art.

149 of the Tax Code of the Russian Federation (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation). An invoice will have to be issued in two cases: For details, see K+. Trial access to the system is free.

Who may not issue an invoice?

Depending on the taxation procedure chosen by the individual entrepreneur, payment of VAT may not be provided for; accordingly, the question objectively arises about the need to issue invoices to those who are exempt from the quitrent.

According to the Tax Code of the Russian Federation, tax is not paid:

- working in retail trade;

- employed in public catering;

- providing services for cash only;

- operating in the securities market and selling shares and bonds;

- selling goods to consumers who use preferential tax regimes.

Details are provided in Articles 168 and 169 of the Tax Code, which reflect nuances depending on the chosen taxation system.

Under the special regime, tax is not paid, which is reflected in the reporting provided. Special regimes include simplified taxation system, UTII, unified agricultural tax.

However, according to paragraphs 11 and 26 of Article 346, individual entrepreneurs can generate and issue invoices without indicating the amount of value added tax.

“Closing” documents without an invoice are a delivery note or an act of acceptance and transfer of goods (services).

If an invoice is generated incorrectly, namely indicating VAT in it, if the individual entrepreneur is not a tax payer, it will be necessary to pay it and report to the Federal Tax Service.

What do sample invoices without VAT look like?

Let's look at two examples.

Example 1

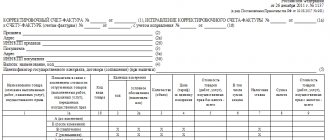

Individual entrepreneur Elmir Gilmutdinovich Kasimov, who uses OSNO, entered into an agreement for the supply of 420 kg of beets with simplified Producer LLC. At the request of the entrepreneur, Producer LLC compiled and handed over an invoice to him. The company filled out the invoice in the usual manner, except for columns 7 and 8, dedicated to the rate and amount of VAT. In these columns, instead of numerical values, Manufacturer LLC put the inscription “Without VAT”.

This is what a sample invoice for an individual entrepreneur without VAT might look like:

Example 2

An entrepreneur using the simplified tax system, Nabiullin Timur Rudolfovich, provided a service to the company using the general system of Trading LLC. At her request, on May 20, 2020, the entrepreneur issued an invoice in the amount of RUB 54,150. without VAT.

What a sample invoice from an individual entrepreneur looks like without VAT, see below:

You can find out whether invoices without VAT need to be registered in the sales book in the Ready-made solution from ConsultantPlus by receiving free trial access to the system.

Invalid wording of column 7

Column 7 of the invoice indicates the tax rate. If this document comes from a VAT non-payer, this column does not contain numerical values. An invoice without tax is also called zero - this means that according to such a document:

- the seller does not have an obligation to pay tax to the budget;

- The buyer does not have the opportunity to claim a deduction.

What's special about column 7 of the zero invoice? The fact is that you cannot indicate “0” in it. Entering this figure by an entrepreneur will most likely result in negative consequences. Tax authorities will consider that he:

- carried out a transaction taxed at a rate of 0% and will be required to submit a VAT return;

- erroneously indicated a zero rate for goods (works, services) taxed at 20 or 10%, and will offer the individual entrepreneur to pay tax to the budget.

To prevent such misunderstandings from arising, in column 7 of the invoice, an individual entrepreneur (not recognized as a tax payer) must indicate “Without VAT.” With this formulation, the entrepreneur who issued it does not have any obligations (neither reporting nor payment).

Whether it is necessary to issue invoices to individuals, find out here .

When is it necessary to write out?

Although tax legislation does not require legal entities and individual entrepreneurs using the simplified tax system to draw up such documents, it does not prohibit them either.

At the same time, there are situations when simplifiers are required to issue invoices:

- when importing goods into the Russian Federation;

- if transactions are carried out under a simple partnership agreement or within the framework of trust management;

- when goods are purchased from foreign companies located in the Russian Federation and not tax residents;

- when assets are leased or purchased from the state or municipality.

An invoice without errors: where can you expect trouble?

It happens that, at the request of a partner, you issued an invoice indicating in column 7 “Without VAT”. All other lines and columns are also filled out without errors in accordance with the requirements of tax legislation. And then you started having minor and major troubles with the tax authorities.

This happens when your partner, when filling out a payment order to transfer money to him, indicates the phrase “Including VAT” in the “Purpose of payment” column. What to do if such an error occurs? The first person who might notice this error will be you. You shouldn’t wait for the tax authorities to react, namely when they:

- will require explanations (clause 3 of Article 88 of the Tax Code of the Russian Federation);

- will be called to the inspection (subparagraph 4, paragraph 1, article 31 of the Tax Code of the Russian Federation);

- the account will be blocked (clause 3 of Article 76 of the Tax Code of the Russian Federation);

- they will make a demand for payment of penalties and fines (Articles 75, 122 of the Tax Code of the Russian Federation) or write off the collection tax specified in the payment order.

To avoid possible problems, notify your partner of the error as soon as possible and ask him to contact the bank to correct the erroneous wording in the payment purpose.

How to correct the wording on the purpose of payment in a payment order is described here .

It should be noted that tax authorities do not have the right to charge additional taxes based only on the phrase in the payment order and their own assumptions. Other evidence supported by documents is needed (for example, for the position of the judicial authorities, see the resolution of the FAS ZSO dated March 28, 2011 No. A45-12006/2010).

In what cases is a subject recognized as a VAT payer under the simplified tax system?

In accordance with paragraph 3 of Article 346.11 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs do not pay VAT on the simplified tax system. They do not have to present this tax to counterparties when selling goods and services, so they do not issue invoices. After all, this document serves as the basis for the seller to accept the amount of input VAT for deduction - it has no other functions.

There are cases when the duties of the VAT payer are imposed on the “simplified” person. Including if he:

- imports goods into the territory of the Russian Federation, with the exception of those listed in Article 150 of the Tax Code of the Russian Federation;

- recognized as a tax agent for VAT (a typical example is the rental of municipal premises);

- carries out transactions within the framework of a partnership agreement, trust management of property and some others.

Should I include an invoice without VAT from an individual entrepreneur using the simplified tax system in the purchase book?

As a general rule, the buyer records invoices received from sellers in the purchase ledger. Based on these records, he determines the amount of VAT deduction. In a zero invoice situation, the buyer does not receive a deduction. Do such invoices need to be reflected in the purchase ledger?

We will not find direct wording that invoices received from sellers with the inscription “Without VAT” do not need to be reflected in the purchase book in the Rules for maintaining a purchase book (approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

But there are many indirect clues there. In particular, from these Rules it follows that:

- the purpose of the book is to register invoices for the purpose of determining VAT deductions (clause 1);

- invoices are registered in it as the right to deduction arises (clause 2 of the Rules);

- Clause 19 contains a closed list of situations when an invoice should not be registered in the purchase book.

As a result, the conclusion suggests itself: since a zero invoice does not increase the amount of VAT deduction, there is no particular point in registering it in the purchase book. It is possible, for example, not to reflect in the purchase book an invoice received from an individual entrepreneur using the simplified tax system without VAT.

There is no penalty for such failure to be reflected in the law. Although there is arbitration practice to challenge tax authorities’ claims for incorrect maintenance of purchase books by VAT payers. But the courts are against the fine (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated June 30, 2006 No. A79-15564/2005).

Do I need to take it into account in the declaration?

When issuing an invoice, the seller is obliged to generate a VAT return based on it and pay the accrued tax. The declaration is submitted to the Federal Tax Service only in electronic form.

VAT returns are due by the 25th day of the month following the end of the quarter. However, all this (registration of an invoice, declaration) does not give organizations and individual entrepreneurs with a simplified taxation system the status of a VAT payer and does not grant the right to apply tax deductions. Therefore, issuing VAT invoices at the request of buyers and customers can lead to loss of funds due to the need to pay tax and loss of time for drawing up and submitting a declaration to the tax office.

Results

Individual entrepreneurs recognized as VAT payers are required to issue invoices with the allocated tax amount.

Entrepreneurs who do not pay VAT are not obliged, but can, at the request of the counterparty, issue an invoice. At the same time, in columns 7 and 8, dedicated to the tax rate and amount, they should put the inscription or stamp “Without VAT”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Issuing invoices under the simplified tax system

At the same time, the Tax Code does not prohibit the issuance of invoices under the simplified tax system with VAT allocated in it. Moreover, the Code defines the consequences of issuing a simplified invoice.

Despite numerous explanations from regulatory authorities, the issuance of invoices indicating the amount of VAT by companies using the simplified tax system is not so rare. This is mainly done at the insistent request of buyers who ask the “simplified people” to send them VAT invoices in order to save on taxes. And this, in turn, leads to additional responsibilities for the “simplified” person and can create difficulties.

Use the online calculator to calculate VAT