Products released from main production: at what cost are they valued?

According to PBU 5/01 (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n), finished products are part of the enterprise’s inventories (clause 2), and they must be reflected in accounting at the actual cost of production (clause 5). However, such a cost price for products produced during the month is not yet formed at the time of release, since the month of production has not ended, and the volume of product costs does not include those expenses that can only get there after the month closes. Moreover, these costs are not always indirect. For example, depreciation of fixed assets directly involved in the production of a certain type of product will also be accrued only after the end of the month.

Meanwhile, the production of products that are the main one for the enterprise is carried out continuously, and not only their release from production, but also shipment to customers can occur several times a month. Both manufactured and shipped products must be taken into account not only in quantitative terms, but also in cost terms (clause 203 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). At what cost is it assessed if data regarding the actual value of this indicator has not yet been compiled?

In this case, an interim assessment (accounting price) is applied, the possible options of which are cost (clause 204 of the Guidelines):

- normative;

- negotiated;

- any other.

At the end of the month, the result of the interim assessment must be adjusted to the actual values (clause 206 of the Guidelines). At the same time, it is allowed to continue to reflect products in the interim assessment, taking into account the formed deviations in a separate analytical article for this, and not for specific types of product, but for their groups (paragraphs 204-206 of the Guidelines).

Some features of accounting for finished products

Above, the general principles of the formation of the cost of production enterprises based on actual expenses and their reflection in account 43 during a normal production cycle were clearly demonstrated.

But deviations from the norm do occur. It is impossible to foresee and analyze all cases within the framework of one article. We will describe only the most common situations.

If manufactured products are planned to be used for the needs of the enterprise and this is known, then it is advisable to capitalize them not on account 43, but on materials account 10.

Then the wiring will be done:

- Dt 10 Kt 20 - according to the generated actual cost of such product-material.

The release of these materials will occur according to the accounting option for their evaluation.

Depending on what specific needs the capitalized materials will be used for, they can be written off to accounts 20 or 25, 26.

Accounting for manufactured products at standard cost

What kind of wiring should be used to reflect the standard cost of manufactured products? For the posting carried out at the time of release - finished products are released from the main production - there are two options for its correspondence (the choice of these options is reflected in the accounting policy):

- with a direct correlation between the main production cost account (account 20) and account 43, intended for accounting for finished products;

- using an interim account 40, which operates only during the month and must be closed after its completion.

In the first case, the posting will look like Dt 43 Kt 20, and in the second - Dt 43 Kt 40. That is, in the first option, writing off during the month will lead to intermediate red balances on account 20. The second option does not affect account 20.

In any of the options, each type of created product at the standard cost (or other accounting price) and in the actual quantitative assessment will be reflected in account 43. In the case of shipment in the month of production, based on these indicators, the debit of account 90 will show the cost of products sold: Dt 90 Kt 43.

Finished products in warehouse: invoice and accounting rules

Recording of transactions involving finished products is carried out using 43 accounts. Debit balances on it indicate that the enterprise has a certain stock of products released from production. Credit turnover shows the disposal of consignments. Analytics separates accounting data by storage location.

When finished products are delivered to the warehouse, the posting looks like:

D43 – K20 (23, 29).

The entry is made on the basis of the invoice. The transfer of products from the warehouse is formalized by crediting account 43 in correspondence with debiting 45, 80, 44. If shortages are detected, account 94 will be debited for their amount.

For example, Faya LLC produces kefir. In January, 2500 liters of kefir product were produced. At the same time, expenses were incurred by the main production department in the amount of 17,500 rubles, and by the auxiliary unit - 8,000 rubles. At the end of the technological cycle, the finished products were delivered to the warehouse. Reflection of all transactions in accounting:

- D20 – K10 (70, 69) – the amount of basic production expenses is shown in the amount of 17,500 rubles.

- D23 – K 10 (70, 69) – expenses incurred by the auxiliary workshop are reflected: 8,000 rubles.

- D20 - K23 - costs of the auxiliary workshop are included in the production cost estimate of 8,000 rubles.

- Finished products are credited to the warehouse - postings are made between D43 and K20 in the amount of 25,500 rubles. (17,500 + 8,000).

Due to what actions will the products be reflected at actual cost?

Adjustment of the standard cost to the actual cost at the end of the month is carried out by writing off from account 20:

- On account 43 (if the intermediate account 40 is not used) - the magnitude of deviations (positive or negative) from the amounts already written off from account 20, which are divided as a percentage by the products sold during the month (due to their value, the cost of production included in the account is immediately adjusted 90) and for the remainder in the warehouse.

- On account 40 - the entire amount of actual costs incurred in creating products released during the month, which leads to the formation of both standard (credit) and actual (debit) costs on this account. The result of comparing the resulting figures gives the value of the deviations, which are also subject to distribution to the products sold (account 90) and products remaining in the warehouse (account 43).

An increase in actual cost compared to standard costs leads to the need to increase, due to deviations, the amounts shown on accounts 43 and 90, and this is reflected by direct postings to the amount of these deviations:

- Dt 43 Kt 20 and Dt 90 Kt 43 - if account 40 is not used in accounting transactions;

- Dt 43 Kt 40 and Dt 90 Kt 40 - if count 40 is used.

When the actual cost generated is lower than the standard cost, then exactly the same entries are applied to the deviations, but with a negative sign (reversing).

Thus, the posting—reflecting the actual cost of the finished product—regardless of which of the accounting correspondence options is used, is created by two operations:

- on calculating standard costs;

- for accounting for deviations.

The first of them is done at the time of release, and the second - after the close of the month.

Functions of a finished goods warehouse

Finished product warehouses are designed to store products produced by production shops. In these premises, products are accepted, their quantitative records are maintained, and unloading operations from vehicles are carried out. The finished product warehouse of an industrial enterprise must be equipped with all the necessary equipment to maintain the climatic conditions necessary for storing products. The main tasks of warehouse workers:

- when finished products are delivered to the warehouse from production, the storekeeper accepts them with mandatory verification of the quantity, articles, color of the products in fact with the data from the invoice, this operation is reflected in accounting;

- ensuring the safety of all received products;

- packaging of products, broken down by consumer properties;

- selection of products from storage for shipment to customers;

- implementation of the labeling and packaging process.

Results

To reflect the receipt of finished products at the warehouse and their sale in the month of production (i.e. until data on the actual cost is generated), prices are used that reflect the interim assessment of the created product. After the month is closed, the interim estimate is adjusted to the actual estimate, and the cost of both the products shipped in the month of production and the products remaining in the warehouse are subject to such adjustment.

The formation of intermediate and actual costs in accounting can be carried out in two ways: without using account 40 and with its use.

In the first case, the intermediate cost and deviations from it (both positive and negative) are reflected by the posting Dt 43 Kt 20; at the same time, for deviations arising from shipped products, an additional write-off is made to account 90 (Dt 90 Kt 43). In the second case, the intermediate cost is fixed by posting Dt 43 Kt 40, and the actual cost - by posting Dt 40 Kt 20, i.e. the amount of deviations appears on account 40 and is credited from it to the shipped (Dt 90 Kt 40) and remaining in the warehouse (Dt 43 Kt 40) products. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting entries to account 43

Account 43 corresponds with many other accounts, but the following entries are most often used:

| Debit accounts | Credit accounts | the name of the operation |

| 43 | , , | Finished goods arrived at the warehouse from the production line |

| 79 | Finished products arrived from the enterprise division | |

| 98 | Products taken into account as a discount for the buyer | |

| 80 | Receipt of goods into the authorized capital | |

| 45 | 43 | Shipment of products to other enterprises |

| 80 | Transfer of products under a simple partnership agreement | |

| 94 | Write-off of identified shortages | |

| 44 | Consumption of products for commercial purposes | |

| 97 | The cost of finished goods written off against future expenses. The goods are used for the company's own needs |

The actual cost of finished products can only be determined at the end of a certain period, when all costs are accounted for and combined.

***

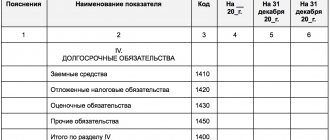

Whatever method of assessing finished products is adopted in the accounting policy, its balances as part of accounts 43 and 45 are recorded in the assets of the balance sheet as of the reporting date and are included in the amount of the enterprise's inventories, for the reflection of which line 1210 of these statements is allocated.

Similar articles

- General production costs, calculation formula

- Production cost

- Reflection of main production in the balance sheet

- Full cost

- The concept and composition of inventories in accounting

Another nuance of reflecting the finished product

When exporting or transferring for sale under GP commission agreements, the time of sale does not coincide with the time of shipment of the goods. Therefore, it must be recorded for these transactions on account 45 “Goods shipped”.

As a result of the shipment, the following posting occurs:

- Dt 45 Kt 43 - at the actual cost of the shipped GP.

At the time of recognition of sales revenue, the following entry must be made:

- Dt 90 Kt 45 - for the amount of the actual cost of the sold GP.

Balances on account 45 are also reflected in line 1210 of the balance sheet, thereby forming an idea of the location of the finished product.

Product sales volume in the balance sheet: line

There is no separate line for revenue from sales of products in the balance sheet. And this is not surprising. After all, the balance sheet reflects the assets and liabilities of the organization as of the reporting date (clause 18 of PBU 4/99). And the sold products are no longer an asset. Information on financial results, which includes information on revenue, is given in the profit and loss statement (clause 21 of PBU 4/99).

However, in some cases, a line can be defined for revenue from sales of products in the balance sheet. This applies to cases where the finished products sold were not paid for by the buyer. Let us recall that revenue from the sale of finished products is usually reflected in the following accounting entry (Order of the Ministry of Finance dated July 2, 2010 No. 66n):

Debit of account 62 “Settlements with buyers and customers” - Credit of account 90 “Sales”, subaccount “Revenue”

Consequently, unpaid receivables from customers, which are equal to sales revenue, will be reflected in line 1230 “Accounts receivable” of the balance sheet. But here it is important to take into account that the revenue in line 1230 will be taken into account together with VAT, while the income statement indicates net revenue, i.e. reduced by the amount of VAT accrued on revenue.

For profit from sales of products, line 1370 “Retained earnings (uncovered loss)” is used in the balance sheet. In this case, in this line, profit from the sale of products will be taken into account in total with the financial results from other operations, both for ordinary activities and for other activities, as well as with the profit (loss) of previous years.

Every year, companies prepare financial statements. Using data from the balance sheet and profit and loss report, you can determine the effectiveness of the organization’s activities, as well as calculate the main planned indicators. Provided that management and the finance department understand the meaning of terms such as profit, revenue and sales on the balance sheet.