Accounting for business transactions for the purposes of the simplified tax system in the 1C: Accounting 8 program (rev. 3.0) is based on the use of the following accumulation registers and information:

- Expenses under the simplified tax system;

- Registered payments of fixed assets (STS);

- Registered payments for intangible assets (STS);

- Book of accounting of income and expenses (section I);

- Book of accounting of income and expenses (section II);

- Book of accounting of income and expenses (IMA);

- Book of accounting of income and expenses (section IV);

- Other calculations;

- Decoding KUDiR;

- Calculation of tax under the simplified tax system.

Other calculations

The accumulation register “Other settlements” is intended to account for mutual settlements on wages, taxes and accountable persons for the purposes of the simplified tax system (Fig. 6). The occurrence of receivables in the register is reflected by incoming entries, and the repayment of receivables by expense entries. The occurrence of accounts payable in the register is reflected in expense entries, and the repayment of accounts payable is reflected in receipt entries.

Figure 6.

Register entries are used to control payment and determine the amount of expenses taken into account when determining the tax base for the taxable object “income reduced by the amount of expenses.”

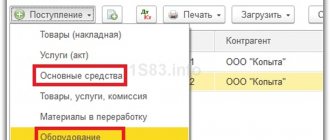

Entries in the accumulation registers of the simplified tax system subsystem are formed when posting documents that record the facts of the economic life of the organization.

How tax accounting is implemented in 1C Accounting 8.3

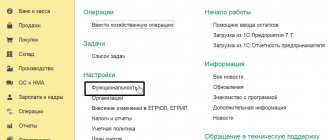

In accounting configurations 1C 8.3, to implement this formula, a special register is used, in which each value has its own resource (Fig. 1).

Fig.1

It is not necessary for the user to understand the structure of the registers in detail, but for a deeper understanding of the mechanism for calculating tax transactions, it is worth having at least a general understanding of the internal “kitchen”. Moreover, the connection between the register and postings is obvious.

In 1C transactions, instead of one amount, 4 may appear at once (according to the number of values from the above formula). In Fig. 2 we see different amounts of depreciation for accounting and tax accounting. The difference between them (83.34) forms a temporary difference and is located in the line with the abbreviation “ BP ”.

Fig.2

When posting documents, the program itself calculates the required amounts for accounting and accounting records, and also controls the equality of accounting and accounting records using a formula. After the period is closed, the base we need is formed based on these values.

The chart of accounts in 1C also has its own characteristics. All accounts on which income tax accounting is kept have the “NU” flag checked (Fig. 3). For example, accounts 20, 23, 25 take part in generating profit, but account 19 does not affect profit; the “NU” flag is not selected for it.

Fig.3

Because of this, some tax accounting entries may contain either a debit or a credit amount. In Fig. 4 we see that in the entry for accrual of contributions in the lines for NU there is an amount for debit, but there is no amount for credit.

Fig.4

The fact is that account 68.01 does not apply to tax accounts. The “NU” sign has not been established for it (Fig. 5).

Fig.5

For intermediate calculations of income tax, account 68.04.2 is used, which is not in the standard chart of accounts; this sub-account was added by the 1c developers (Fig. 6). Posting Dt 68.04.2 Kt 99.09 in the amount of 0.15 rub. needed to round the tax amount to whole numbers.

Fig.6

Calculation of tax under the simplified tax system

In the information register “Calculation of tax under the simplified tax system,” the program, when performing the same-named regulatory operation of closing the month, saves information about the calculation of the amount of the advance payment for tax under the simplified tax system (for the corresponding reporting period), as well as the amount of tax under the simplified tax system (for the corresponding tax period) (Fig. . 8).

Figure 8.

Dear readers! You can get answers to questions about working with 1C software products on our 1C Consultation Line. We are waiting for your call!

Finding and eliminating errors in calculating income tax

Despite the fact that almost all income tax calculations in the program are performed automatically, errors may occur. They arise especially often when entering manual transactions.

For control, the report “Analysis of income tax accounting” is used (Fig. 7).

Fig.7

You can double-click each section of the report to find the erroneous document. “Suspicious” sections are highlighted with a red outline (Fig. 8).

Fig.8

Let’s expand the section “Other sales costs...”. Below (Fig. 9) we see the documents on the basis of which these amounts were obtained.

To display documents, you need to enable the “By documents” checkbox

Fig.9

We correct the errors and get a “beautiful” report (Fig. 10).

Fig.10

Purpose

Accounting registers are very similar to accumulation registers: they can also have an arbitrary set of dimensions, in the context of which indicators are accumulated, as well as additional details in which arbitrary information about records is stored.

Any accounting register must be associated with one of the charts of accounts, which, with its settings, affects the storage of results (we will talk about this in more detail in the following articles). The storage structure of the accounting register records is mainly influenced by both the structure of the register itself (dimensions, resources, details) and its settings (whether correspondence is included, division of totals, etc.), and the settings of the accounts used (signs of accounting for accounts and subcontos, type of account and etc.).

What are accounting registers

Information from the official website .

Accounting registers are application configuration objects. They are used in the accounting mechanism and allow for multi-level and multi-dimensional analytical accounting, accounting for several charts of accounts, optional maintenance of quantitative, total and currency accounting for individual analytical sections, etc.

In appearance, the accounting register resembles an accumulation register: it can have a set of changes , in the context of which numerical values of resources . It may also contain a set of details for storing additional information associated with register entries.

The accounting register is associated with one of the used charts of accounts, and stores accounting results in accordance with its structure. Information in the accounting register is stored in the form of records, the structure of which is built dynamically by the system, depending on the settings of various accounting elements made when editing the chart of accounts. For example, a record may contain fields for entering offsetting accounts, amounts, subaccounts, quantities, currency types, and currency amounts.

Now we will look at the storage structure of the most common accounting register configuration (see screenshot at the beginning of the article), and also determine what topics will be discussed next.

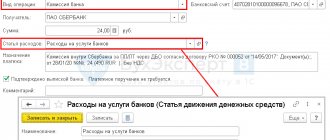

Filling procedure

Let's look at the procedure for filling out the basic register data.

Type of movement

There are two types of movement: Incoming and Outgoing .

- Receipt - indicates the occurrence of accounts receivable or the repayment of accounts payable for wages, taxes and contributions; the list is indicated by “+”. Documents forming receipt records: Cash issuance;

- Debiting from the current account;

- Payment card transaction;

- Retail sales report - Cashless payment .

- Expense - indicates the occurrence of accounts payable or the repayment of receivables for wages, taxes and contributions, indicated in the list by “-”. Documents that form expense records: Advance report;

- Sick leave;

- Payroll;

- Receipt to the current account - Receipt via payment cards .

Registrar

The document during which records were generated in the register.

List of documents that form entries in the register Other calculations :

- Advance report

- Sick leave;

- Payroll;

- Cash withdrawal;

- Payment by payment card;

- Vacation;

- Debiting from the current account,

- etc.

The full list of documents can be found here PDF

Organization

In the Organization the name of our Organization is indicated. The name from the registrar document is automatically inserted into the directory.

If only one organization is registered the Organization the Organization is not displayed in the registrar document, but when creating records in the register, the name of our Organization is recorded automatically.

Account

In the Accounting account , the accounts of the accounting group for settlements with employees of the organization and accountable persons are indicated:

- 57 — sales by payment cards;

- 70 — settlements with personnel regarding wages;

- 71 - settlements with accountable persons;

- 73 — settlements with personnel for other operations;

- 76 - settlements with various debtors and creditors;

- 68 — calculations of taxes and fees;

- 69 - calculations for social insurance and security.

Other Calculations register is one of the few tax accounting registers that contains data from accounting accounts in its records. It is against the specified accounting accounts of this register that additional analytics is tracked: according to payment documents to monitor the status of settlements and debts of employees or organizations for wages, taxes and contributions.

Counterparty

The Counterparty field is filled in from the settlement document and is of a composite nature. The data in it can take on the values of directories:

- Counterparties - for accounting accounts 57, 76;

- Individuals - for accounting accounts 70, 71, 73.

For accounting groups 68 and 69, the Counterparty is not filled in.

Settlement document

In the Settlement document , fill in the document on the basis of which the settlement with an individual or counterparty is made. It could be:

- Sick leave;

- Cash withdrawal;

- Issuance of monetary documents;

- Payroll;

- Vacation;

- Debiting from the current account,

- etc.

The data of the Registrar and the Settlement Document may not coincide, as, for example, when conducting an Advance report .

In this case:

- Registrar - the document itself Advance report , during which records were generated in the register;

- Settlement document - document Cash issuance , according to which settlement is made with an individual or counterparty.

The full list of documents can be found here PDF

Counterparty agreement

The Counterparty Agreement field is filled in from the settlement document for accounting accounts 57 and 76. For accounting accounts 70, 71, 73, 68, 69, the field is not filled in.

Sum

The amount of calculations for expenses, such as wages, taxes, contributions, reporting, etc.

Purpose of the register

The accumulation register Other calculations is an auxiliary register of the simplified taxation system, which tracks write-offs of funds to organizations that are not directly related to the payment of inventories, works or services. The uniqueness of the register is that it stores additional analytics, which is used in cases where there is not enough data from accounting.

For example, when:

- settlements with accountable persons;

- payment through a payment agent (retail payment cards);

- wages;

- payment of taxes and contributions.

The register is responsible for offsetting payments when creating expenses accepted or not accepted under the simplified tax system. Using the register data, you can find out the current state of payments and control the debt of employees or organizations for wages, taxes and contributions.

Recognition of expenses for wages, taxes and contributions to KUDiR occurs precisely according to the records of tax, and not accounting registers, therefore, correct recording of data in tax registers is the key to correct completion of KUDiR.

Formation of entries in the register

The register tracks the write-off of funds in the organization that are not directly related to the payment of inventories, works or services, and is responsible for offsetting payments when creating expenses accepted or not accepted under the simplified tax system.

Scheme for attributing unallocated payments to expenses

Undistributed payment is included in the Other calculations when creating expenses for accountable amounts, wages, taxes and contributions.

Scheme for attributing undistributed payment to income

The unallocated payment is entered into the Other Settlements upon receipt of payment by payment card.

Using the register Other calculations when reflecting labor costs in KUDiR

General scheme for generating entries in the register Other calculations for salaries, taxes and contributions.

When paying wages:

- in the register Other calculations a final credit entry is generated to pay off the balance of the organization's debt to the employee.

- in the Expenses register under the simplified tax system, the payment status of the expense under the simplified tax system is established: Not paid (Expense)

Explanation by type of expense is provided on the Explanation KUDiR .

In case of incomplete payment of wages or transfer of taxes and contributions to KUDiR, expenses will be recognized only for the paid (transferred) part.

Recognized expenses for wages, taxes and contributions will be reflected in the report Book of Income and Expenses of the simplified tax system : section Reports - simplified tax system - book of income and expenses of the simplified tax system.

To quickly check whether the conditions for recognizing expenses for wages, taxes and contributions are met, Accounting Expert8 advises using the Universal Register Report setting:

- Expenses under the simplified tax system

- Other calculations.

Other Calculations register is the presence of the Accounting Account in its records. Therefore, it is very convenient to use it to control mutual settlements for wages, taxes and contributions, comparing register data with the SALT accounting report for accounts 70 (71, 73, 76, 68, 69).

SALT count 70.

Analysis of salary calculations by register Other calculations

See also:

- The procedure for recognizing expenses for the purchase of goods (OU)

- Checking the inclusion of labor costs, taxes and contributions in KUDiR

- Checking the filling in the cost of goods sold in KUDiR

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- A universal report for checking labor costs in the income and expense ledger. The income and expense ledger is an important tax register used...

- Setting up accounting policies for NU in 1C: USN If an organization uses the simplified tax system, the procedure for recognizing expenses in its tax...

- Register of Expenses under the simplified tax system In this publication, we will consider the accumulation register of expenses under the simplified tax system. Having studied...

- Statuses of payment of simplified taxation system expenses In this publication we will consider the statuses of payment of simplified taxation system expenses. After reading the article...