Regardless of what taxation system the organization uses, maternity benefits are fully reimbursed by the Federal Social Insurance Fund of Russia (Part 1, Article 3 of Law No. 255-FZ of December 29, 2006).

The procedure for paying for the first three days of incapacity at the expense of the organization does not apply to maternity benefits. Pay the benefit from the funds of the Federal Social Insurance Fund of Russia for all the days that the employee was on maternity leave. This follows from Part 1 of Article 3 of the Law of December 29, 2006 No. 255-FZ.

A collective and (or) employment agreement may provide for additional payments to maternity benefits up to the actual average earnings of the employee (Article 9 of the Labor Code of the Russian Federation). This amount is not a benefit (Article 8 of the Law of May 19, 1995 No. 81-FZ, Article 14 of the Law of December 29, 2006 No. 255-FZ). The organization pays it from its own funds.

An example of how to determine the sources of payment of maternity benefits

Cashier of the organization A.V. Dezhneva submitted a sick leave certificate to the accounting department confirming her maternity leave. The duration of the vacation is 140 calendar days (from January 15 to June 3, 2021 inclusive).

The collective agreement of the organization provides for additional payments up to the actual average earnings for the period of maternity leave. In this case, the actual average earnings are calculated based on the period of 365 days preceding maternity leave.

Dezhneva’s earnings in 2014 amounted to 630,000 rubles, contributions to the Social Insurance Fund of Russia were paid from an amount equal to 624,000 rubles. And in 2015, Dezhneva was accrued earnings in the amount of 680,000 rubles, contributions to the Social Insurance Fund of Russia in 2015 were paid from an amount equal to 670,000 rubles.

The employee worked in full for 2015. Thus, her actual average earnings (for calculating the additional payment for maternity benefits) for the period from January to December 2015 inclusive is equal to: 680,000 rubles. : 365 days = 1863.01 rub./day.

The calculation period for calculating benefits includes 2014 and 2015.

The number of calendar days in 2014–2015 is 730.

Ivanova did not have any calendar days excluded from the billing period.

The average daily earnings for calculating benefits were: (624,000 rubles + 670,000 rubles): 730 days. = 1772.60 rub./day.

The amount of maternity benefits reimbursed by the Russian Social Insurance Fund is: 1,772.60 rubles/day. × 140 days = 248,164 rub.

And the benefit, calculated based on Dezhneva’s average earnings for the last year preceding the insured event, is: 1863.01 rubles/day. × 140 days = 260,821.40 rub.

Thus, the organization pays an additional 12,657.40 rubles from its own funds. (RUB 260,821.40 – RUB 248,164).

Accounting: accrual and payment

In accounting, record the accrual and payment of maternity benefits with the following entries:

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 70

– maternity benefits accrued;

Debit 70 Credit 50 (51)

– a maternity benefit was issued to an employee.

An example of how to reflect maternity benefits in accounting

Secretary of Alpha LLC E.V. Ivanova went on maternity leave from April 14 to August 31 inclusive.

The organization paid Ivanova maternity benefits in the amount of 107,956.52 rubles.

The accountant made the following entries in the accounting:

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 70 - 107,956.52 rubles. – maternity benefits accrued;

Debit 70 Credit 51 – 107,956.52 rub. – the benefit was transferred to Ivanova’s bank card.

Accounting: additional payment before actual earnings

A collective or employment agreement may provide for payment of maternity leave based on the actual average earnings of the employee (Article 9 of the Labor Code of the Russian Federation). That is, the amount of benefits reimbursed from the Russian Social Insurance Fund is not in this case the upper limit of the amount of the payment. Such additional payments are not benefits; they are paid at the expense of the organization (Article 8 of the Law of May 19, 1995 No. 81-FZ, Article 14 of the Law of December 29, 2006 No. 255-FZ). So reflect them like this:

Debit 20 (23, 25, 26, 44...) Credit 70

– an additional payment has been accrued to maternity benefits up to the actual average earnings;

Debit 70 Credit 50 (51)

– an additional payment was issued to the maternity benefit up to the actual average earnings.

An example of how to reflect in accounting an additional payment to maternity benefits up to the actual average earnings

Secretary of Alpha LLC E.V. Ivanova went on maternity leave from April 14 to August 31 inclusive.

The Alpha collective agreement provides for an additional payment to maternity benefits up to the actual average earnings.

The organization accrued to Ivanova during her maternity leave: – benefits at the expense of the Federal Social Insurance Fund of Russia in the amount of 159,179.63 rubles; – additional payment at your own expense in the amount of 7002.25 rubles.

The accountant made the following entries in the accounting:

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 70 – 159,179.63 rubles. – maternity benefits accrued;

Debit 26 Credit 70 – 7002.25 rub. – an additional payment to the benefit has been accrued up to the actual average earnings;

Debit 70 Credit 51 – 166,181.88 rub. (RUB 159,179.63 + RUB 7,002.25) – the benefit was transferred to Ivanova’s bank card along with an additional payment.

Calculation of maternity benefits: cheat sheet for an accountant

Now benefits for temporary disability, pregnancy and childbirth, as well as child care benefits up to one and a half years old are calculated in accordance with the new Regulations. At the same time, the rules for calculating benefits apply to legal relations that arose from January 1, 2007. Read more about the calculation features in the article.

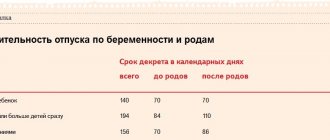

A. Savina Benefits within the framework of the law The procedure for calculating and receiving maternity benefits is stipulated in the Federal Law of the Russian Federation of December 29, 2006 No. 255-FZ “On providing benefits for temporary disability, maternity benefits to citizens subject to compulsory social insurance " The very same Regulation on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance, was approved only by Decree of the Government of the Russian Federation of June 15, 2007 No. 375. According to Russian legislation, a woman has the right to maternity leave and vacation for child care up to one and a half or three years. During this period, she retains her place of work, and the time spent on these vacations is included in the total and continuous length of service (Article 256 of the Labor Code). Payment of benefits is carried out by the employer at the place of work of the insured person. If a woman works for several employers, benefits are assigned and paid by each employer. According to Article 10 of Federal Law No. 255-FZ, maternity benefits are paid to the insured woman in total for the entire period of maternity leave lasting 70 (in the case of multiple pregnancies - 84) calendar days before childbirth and 70 (in the case of complicated births - 86 , at the birth of two or more children - 110) calendar days after birth. If, while the mother is on maternity leave before the child reaches the age of one and a half years, she begins maternity leave, she has the right to choose one of two types of benefits paid during the periods of the corresponding leave. It is important to remember that maternity benefits are granted if the application is made no later than six months from the date of the end of maternity leave. When applying for benefits after a six-month period, the decision to assign benefits is made by the territorial body of the Federal Social Insurance Fund of Russia only if there are good reasons for missing the deadline for applying for benefits. The basis for payment is sick leave . To assign maternity benefits, it is necessary to provide to the accounting department of the organization in which the woman works, a certificate of incapacity for work issued by the medical institution where she was observed. To pay benefits, the accountant, in turn, submits the following documents to the territorial body of the Federal Social Insurance Fund of Russia: certificate of incapacity for work; information about earnings from which the benefit should be calculated; documents confirming insurance experience. The employer is obliged to assign maternity benefits within 10 calendar days from the date of application. Payment of benefits is carried out on the day closest to the date of payment of wages after the assignment of benefits. Rules for calculating benefits The amount of maternity benefits is 100 percent of average earnings, but cannot exceed the maximum amount. Today, both for temporary disability benefits and for maternity benefits, the maximum payment amount is 16,125 rubles for a full calendar month. It is planned that by autumn this benefit will increase to 23,400 rubles. If a woman works for several employers, the amount of maternity benefit cannot exceed the specified maximum amount for each place of work. Average daily earnings for calculating maternity benefits are determined by dividing the amount of accrued earnings by the number of calendar days falling within the period for which wages are taken into account. The amount of maternity benefit is determined by multiplying the amount of the daily benefit by the number of calendar days falling on maternity leave. If the amount of maternity benefit exceeds the maximum amount of this benefit, it is paid within the specified maximum amount. The benefit is calculated based on the employee’s average earnings, calculated for the last 12 calendar months preceding the month of maternity leave. In this case, according to the regulations, all payments provided for by the wage system are taken into account, on which a single social tax is charged. An insured woman with less than six months of insurance coverage is paid maternity benefits in an amount not exceeding the minimum wage established by federal law for a full calendar month. Some nuances According to paragraph 14 of the Regulations, bonuses that are paid for more than one month (based on the results of work for the quarter, for the year, for length of service, etc.) are fully taken into account when calculating average earnings. Monthly bonuses, when calculating average earnings, are included in the salary of the month for which they are accrued. Salary increases are also taken into account when calculating benefits. The amount of average earnings is recalculated from the moment of its increase (clause 12 of the Regulations). If the billing period has not been fully worked out, then when calculating benefits, both accrued amounts and the time of vacation, illness or business trip are excluded from the billing period. It is not uncommon for an employee, while on maternity leave for up to one and a half or three years, to go on a new maternity leave. Since she will not have any accruals in the billing period, the amount of the benefit is calculated based on the established tariff rate or official salary. Overpaid benefits are not . Resolution No. 375 was approved only on June 15, 2007. However, all benefits accrued since January 1, 2007 must be recalculated in accordance with its norms. If the amount of the recalculated benefit is greater, the employee must pay the missing amount of the benefit. But if the benefit turns out to be less, then, according to paragraph 4 of Article 15 of Federal Law No. 255-FZ, the amounts of excessively paid benefits can no longer be recovered. The only exceptions are cases of counting error and dishonesty on the part of the recipient. The author is Deputy General Director of 1st Consulting Center LLC

Accrual procedure

The full amount of the benefit must be accrued and reflected in accounting within 10 days after the employee brings the documents necessary to calculate the benefit. Such documents are a completed sick leave certificate and, if necessary, certificates of earnings from previous places of work for the last two years (Part 1 of Article 15, Part 5 of Article 13 of the Law of December 29, 2006 No. 255-FZ).

The benefit must be paid after it has been assigned within the earliest period established for the payment of wages (Part 1, Article 15 of the Law of December 29, 2006 No. 255-FZ).

Apply for maternity leave and reflect it

To register an employee’s presence on the leave in question, you must enter the following in the “Sick Leave” tab on the “Basic” tab:

- Organization (available if payroll calculations are carried out in IS for several companies);

- Month of enrollment of sick leave benefits;

- Number of the certificate of incapacity for work (can be entered manually from the keyboard, downloaded from the Social Insurance Fund or downloaded from their file);

- Select the reason for disability code – (05) Maternity leave;

- Specify the time period for release from work. For the type of leave under consideration, it can be 140 days for a normal pregnancy, 156 for a complicated pregnancy and 194 days for a multiple pregnancy;

We will set up maternity leave accounting. We provide guarantees for services!

- To take into account the earnings of previous employers (if any), you need to activate the corresponding checkbox;

- If the vacation begins after the beginning of the month in which the benefit is credited or the period of incapacity for work begins in the month following the month of enrollment, then the “Calculate salary for...” checkbox becomes available. If the checkbox is enabled, then in addition to benefits, wages for the days worked before the start of absence will be credited.

Fig. 3 Arrange for maternity leave and reflect it

- Other fields (payment, payment date).

After filling out all the fields in the “Accrued”, “Withheld” and “Average Earnings” sections, the results of maternity leave calculations will be displayed in the “Accrued” section, and the “at the expense of the employer” field will be empty.

The full amount of the calculation result will be shown in the “At the expense of the Social Insurance Fund” field. In the “Average Earnings” section, you can click on the pencil and when opening the “Data Entry for Calculating Average Earnings” form, change the calculation, for example, add the missing data from your previous place of work.

Fig.4 Entering data to calculate average earnings

On “Payment” (on sick leave) you must enter (Fig. 5):

- The period for calculating maternity benefits (if the corresponding box is not enabled, the benefit will not be accrued);

- The start date of maternity leave is set automatically by the first date of the period of release from work of this sheet or the sheet of which this sick leave is a continuation;

- The percentage of payment is set automatically in accordance with the length of service for sick pay and can be changed;

- The benefit limit is set automatically in accordance with legal requirements, but can be changed manually;

- Other fields (apply benefits, benefit restrictions without benefits, percentage of payment without benefits, violation of regime from, payment start date of 50%).

Fig.5 “Payment” (on sick leave)

The “Accrued (detailed)” tab will show accruals, their results, how many days were paid for each accrual, period and basis. If the vacation lasts more than a month, then for each month there will be a separate line on the tab:

Get advice from an expert on processing maternity leave in 1C:ZUP

- Accrual of “Maternity leave”, but if on the “Payment” tab the “Assign benefit from... to...” checkbox is not checked, then – “Maternity leave without pay”;

- Result of accrual;

- Days worked (paid);

- Period (start, end).

After filling out the sick leave and checking the correctness of the calculations, you need to click on “Record and post.”

To print the “Order for the provision of leave” using the standard interindustry form T-6 from the sick leave sheet using the “Print” button, you must check the “T-6 for maternity leave” checkbox (Settings-Personnel records). When forming it from the document “Hospital”, section “A. Main leave” – is not filled out. Information about maternity leave is displayed in section “B.”

Changing sick leave

If an employee has another child while on parental leave, then it is necessary to terminate the current parental leave and register a new one - for maternity leave.

To terminate parental leave early, you must enter the document “Return from parental leave”, where you must select:

- Organization (if information security keeps records for several companies);

- An employee who returns from care leave;

- The document with which the vacation was issued (filled out automatically if entered on the basis);

- The “Order establishes monthly accruals” checkbox can be left unchecked.

In order to register for maternity leave after the termination of maternity leave, you must also enter the “Sick Leave” document.

Let's set up maternity leave accounting

We will set up maternity leave accounting.

We provide a guarantee for services! from 2,600 rub.

To learn more