When is maternity benefit calculated based on the minimum wage?

If the employee had no earnings at all for the 2 years preceding the year she went on maternity leave, the benefit is calculated based on the minimum wage (clause 11(1) of the Regulations on the specifics of the procedure for calculating benefits, approved by Decree of the Government of Russia dated June 15, 2007 No. 375).

The following formula is used for this:

(minimum wage x 24: 730) x DO

24 - the number of months over two years during which the benefit is calculated;

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

730 is a fixed value equal to the number of days in two years;

DO - number of days of maternity leave.

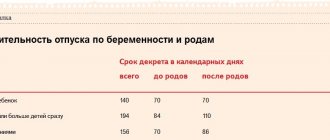

The duration of leave under the BiR depends on how many children were born and how the birth itself went:

- 140 days - during pregnancy with one child and uncomplicated childbirth;

- 156 days - during pregnancy with one child and complicated childbirth;

- 194 days - when pregnant with two or more children.

Benefits for citizens with children

Families with an income below the subsistence level established in the region have the right to apply for benefits, which are assigned from birth until adulthood for each child separately. In some cases, the child's age can be up to 23 years.

Maternity benefits are paid monthly, and the amount of the benefit is set in each region separately, taking into account the regional coefficient.

For mothers (fathers) raising children without a second parent, the benefit amount has been increased. To apply for benefits, you need to contact the UMSZ or a multifunctional center. The amount of the benefit is determined by each region independently.

Example:

The family collectively receives 24,000 rubles.

There are three people in the family.

The cost of living is 9,470 rubles.

The family is considered low-income: 24,000/3 = 8,000 rubles.

In this case, benefits for up to three years are assigned and paid monthly.

In addition to payments, women can count on labor benefits. For example, if working conditions for a pregnant woman are too difficult or have a negative impact on health, then she has the right to write an application to the employer for a transfer to another position or a reduction in output. The employer is obliged to maintain the wages that the woman previously received. No changes are made to the work book.

Important! The employer does not have the right to fire a pregnant woman, and is also obliged to provide annual paid leave upon request, even if it does not fit into the approved vacation schedule.

An example of calculating maternity benefits based on the minimum wage

Let's consider several situations.

Example 1

Lawyer Stepanova A.S. is pregnant with her first child. Worked in the organization for 7 months. I had no earnings in 2021 or 2021. The birth took place without complications.

Example 2

The conditions are the same, but the employee is pregnant with twins, and the birth was complicated.

Example 3

The employee is pregnant with one child, the birth was without complications. In 2021 and 2021, I worked under an employment contract and had a small income:

In this case, the benefit must be calculated in two ways:

Then choose the largest benefit amount.

Since maternity leave according to the minimum wage is greater than the benefit calculated based on average earnings, the employee will receive 55,831.23 rubles.

The following articles will help you calculate benefits in other situations:

When is the minimum B&R benefit paid?

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The minimum amount of the benefit will be if the employee worked for less than six months before going on sick leave according to the BiR (we are talking about the total length of service).

Benefits should also be calculated from the minimum wage in cases where the average daily earnings are lower than the minimum possible.

In other situations, the payment is assigned according to the average daily income, and its size does not depend on the length of service (as with the payment of regular sick leave), but is limited by the maximum limit (more information about the maximum benefit amount is here).

Example of calculating maternity benefits

The accountant calculated the benefit based on the employee’s average earnings:

The woman will receive the entire accrued amount in her hands, since this type of benefit is not subject to income tax.

Minimum maternity payments in 2021 should be assigned without taking into account the percentage of payments based on length of service. If a woman with 2 years and 3 months of experience were accrued regular sick leave, the average daily income in the calculations would only be partially taken into account (in the amount of 60%), but for maternity benefits this rule does not work - 100% of the average income is always taken.

Minimum wage from 01/01/2019 for 140, 156 and 194 days of maternity leave

The B&R minimum benefit is a maternity leave payment provided to those pregnant employees who do not have sufficient income to receive higher pay.

This amount is a guaranteed minimum payment that a woman will receive if she does not have sufficient work experience or income.

Moreover, if a regional coefficient has been established in the region , then it must be reduced by the minimum maternity benefit established for the year the maternity leave began.

The minimum wage depends on the minimum wage and is calculated using the formula:

Min.average daily wages = Minimum wage * 24 months. /730 [/stextbox]

- Min.average daily wages — this is the minimum average daily earnings, calculated from the minimum wage;

- days of maternity leave - the number of days of maternity leave, according to the sick leave (three options are possible: 140, 156 or 194);

- 24 months — this is the number of months in the billing period for calculating maternity benefits;

- 730 - the number of days in the billing period, which is taken to calculate the minimum benefit.

In 2021, the minimum maternity payment is calculated as follows:

Min. allowance for BiR in 2021:

- for 156 days = 370.85 * 156 = 57852.60 rubles;

- for 194 days = 370.85 * 194 = 71944.90 rubles.

All employed women are entitled to 140 days of maternity leave during normal pregnancy.

156 days of maternity leave are granted to pregnant women whose childbirth was complicated; 16 days are added to the standard duration upon discovery of relevant circumstances.

194 days are provided for pregnancy with twins, triplets or more.

New payments, benefits and bonuses for pregnant women in 2021

The innovations that pregnant women should study in 2019 are due, in particular, to the increase in the minimum wage, which will be officially changed on January 1, 2021. Due to the fact that the amount of benefits directly depends on the minimum wage, the amount of child benefits will change.

The changes apply to the following categories of state support, which will be discussed in more detail below:

- Cash as maternity benefits.

- One-time financial support for the birth of a baby.

- A benefit that is due to those women who registered in the early period.

- Care allowance, which is provided for one and a half years after the birth of the child.

It was indicated above what payments are due to pregnant women in 2021, and which of them will be subject to changes, however, it is necessary to remember about indexation, which, among other things, will affect this segment of state support.

Indexation will be carried out in February and will affect the following types of payments:

- One-time payment after the birth of the baby.

- Monthly allowance.

- Benefit for those registered early.

From the beginning of the year until indexation, women will be paid amounts similar to benefits in 2018.

Also, in some regions of the federation, a factor such as the regional coefficient may have an influence.

Below we will analyze each type of payment in 2021 for pregnant and childbirth women.

Child care allowance for up to 1.5 years

The presented payment format is given to a family on a monthly basis, and can only be received by one of the child’s parents, or any other relative or guardian.

The amount is set by the employer for an employee who takes care leave. The vacation itself can last up to three years.

In 2021, the payment amount will be 40% of the employee’s monthly salary. To carry out calculations, the amount of earnings that is relevant for the employee during the period of leave is used.

In some cases, it happens that the amount of monthly earnings is less than the minimum subsistence level established in the state. In such a situation, another type of calculation is used, which involves the use of the minimum wage. Thus, the amount of money received for care for 1 child will be 40% of the minimum wage.

Thus, if we take as a basis the subsistence minimum established in 2021 - 11,280 rubles - then the smallest amount of benefits will be exactly 4,512 rubles.

Benefit for those who registered in the early stages of pregnancy

These payments to pregnant women in 2021 are provided once for the entire period of pregnancy.

It is important to note that, as in previous years, only those women who are full-time employees of the company have the right to receive these funds.

The basic benefit amount is 300 rubles - however, based on the calculation coefficient used, the amount increases annually. In 2018, as well as in 2021 before the indexation period, the amount of the benefit provided will be 628 rubles 47 kopecks.

The new amount will be known only after the indexation and the coefficient itself are announced.

One-time benefit for the birth of a child

One-time benefits for pregnant women have not yet changed in 2021. According to preliminary data, as of January 1, 2021, their amount will be the same as last year - that is, 16,759 rubles 9 kopecks.

However, this value may be affected by indexation, which means the amount may change after February 1, 2021.

It is also possible to recalculate taking into account the regional coefficient.

Maternity benefits in 2021

This type of benefit is also paid as a lump sum by the employer for the entire vacation period, which can be:

- 140 days in a normal pregnancy.

- 194 days for multiple births.

- 156 days in case of any complications during childbirth.

In order to carry out an objective calculation of the amount that the expectant mother is entitled to, it is necessary to take as a basis the average amount of earnings for the billing period - that is, the two years that precede going on maternity leave.

However, the average amount of earnings is limited by the maximum average daily earnings:

If maternity leave began on 01/01/2019 or later, then the minimum average daily earnings will be 370.849315 rubles. (RUB 11,280 x 24/730).

To calculate, the resulting amount is multiplied by the number of maternity days.

So, the maximum amounts a woman can receive are:

- RUB 51,918.90 (370.849315 × 140 days) – in the general case;

- RUB 71,944.76 (370.849315 x 194 days) – in case of multiple pregnancy;

- RUR 57,852.49 (370.849315 x 156 days) – for complicated childbirth.

If the employee’s earnings are less than the minimum wage, the presented indicator is used for calculation - the same as in the case of calculating care benefits.

What is the minimum maternity benefit, labor and sick leave?

There is a minimum daily average earnings limit for calculating maternity benefits. Use it if the employee has no earnings during the billing period or is less than the minimum wage as of the start date of maternity leave.

This is important to know: Hiring while on sick leave

Take monthly earnings for the billing period as equal to one minimum wage per month, the formula is as follows:

Minimum average daily earnings = minimum wage as of the start date of maternity leave x 24: 730

If in the area where a woman works, regional coefficients are established by law, then when calculating maternity benefits based on the minimum wage, take such coefficients into account.

An example of determining the minimum limit of average daily earnings for calculating maternity benefits

Employee of Gazprom LLC E.V. Ivanova brought a sick leave certificate confirming her maternity leave. The vacation period is 140 calendar days - from July 17 to December 4, 2021 inclusive. Ivanova’s insurance experience is more than six months.

The billing period is 2017–2018. The number of calendar days in the billing period is 730.

The employee works full time, Gazprom LLC is located in the Krivosheinsky district of the Tomsk region, where the regional coefficient is set at 1.3.

An exception is the situation when there was no earnings in the billing period or the actual average monthly earnings turned out to be lower than the minimum wage for an employee for whom a part-time working regime was established at the time of the insured event. In this case, the average salary from the minimum wage for calculating benefits must be determined in proportion to the employee’s working hours.

This procedure follows from the provisions of Part 1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ, paragraph 15.3 of the Regulations approved by Government Decree of June 15, 2007 No. 375.

Minimum, Maximum amount of maternity benefits, benefits for Pregnancy and Childbirth (B&R) 2021

The total amount of the maternity benefit in 2021 should be in the range from the minimum maternity benefit to the maximum amount of the B&R benefit:

Maximum maternity payments for pregnant mothers in 2021

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Knowing the maximum allowance per day, we will obtain the maximum maternity allowance in 2021 for normal childbirth with a leave duration of 140 days:

For women and expectant mothers whose insurance period does not exceed six months, the minimum wage is taken as the basis for the amount of maternity benefits.

The minimum maternity pay in 2021 will be:

Depends on the minimum wage - the minimum wage for the calculation period

Unlike regular sick leave, maternity leave is always paid 100% of the average salary, regardless of length of service.

How child benefits increased in Simferopol (Crimea) in 2021

Every year, child benefits are indexed (increase in amount depending on the level of inflation in the country). The exception is maternity (family) capital - this largest payment is not subject to indexation from 2021 (its value was “frozen” until 2021, however, there is no talk of resuming indexation yet). The procedure for indexing and recalculating child benefits is described in detail in Article 4.2 of the Federal Law of May 19, 1995 No. 81-FZ. Thus, indexation is carried out annually on February 1 in accordance with the consumer price growth index for the previous year. Subject to indexation:

- Maternity benefits (except for payments under the BiR for women subject to compulsory social insurance in case of maternity and temporary disability).

- One-time payment upon registration at the antenatal clinic in the early stages of pregnancy (up to 12 obstetric weeks).

- A one-time benefit for the birth of a newborn.

- A one-time benefit when placing a child in a foster family.

- A one-time benefit for the pregnant wife of a conscript.

- Monthly child care allowance (all – both at the place of employment and as a social benefit).

- Monthly allowance for the child of a conscript.

Important! From February 1, 2021, “Putin benefits”, maternity benefits, as well as monthly benefits for child care up to one and a half years old will be indexed by 4.3% (the amount of the mentioned payments is calculated based on the minimum wage, which was increased in 2021 year).

Sick leave for pregnancy and childbirth

One of the types of temporary disability certificate is maternity leave (Maternity Sick Leave). The document is needed so that a woman can apply for maternity leave and maternity benefits .

- Sick leave determines the start and end date of the period of incapacity for work in connection with the birth of a child.

- of maternity payments depends on the number of days indicated on the sheet .

First of all, sick leave is needed by working women who are insured against temporary disability. It also needs to be completed for women:

- those in the public service (in the internal affairs bodies, the penetration service, customs and other organizations);

- those who lost their jobs due to the liquidation of an enterprise and registered with the employment service within a year after that (for the period of incapacity for work, they are accrued maternity benefits, and unemployment payments are temporarily suspended);

- individual entrepreneurs (IP) who voluntarily joined the compulsory social insurance system and pay insurance contributions to the Social Insurance Fund (SIF).

Monthly allowance for child care up to 1.5 years in Simferopol: basic information

The child's monthly allowance is paid to the family member who actually takes care of the baby - this can be either the mother, father or grandparents. The payment is provided to all families with children, without exception, regardless of their level of wealth . Working mothers receive payment at their place of work, non-working mothers – in the minimum amount in the SZN:

| No. | Basic information | Details |

| 1 | Benefit amount | 40% of average earnings for the previous 24 months, but not more than 26,152.27 rubles. |

| Minimum allowance: ● 3,277.45 rubles – for the first baby in the family, ● 6,554.89 rubles – for the second and any of the subsequent ones. | ||

| 2 | Who is eligible to receive | ● A woman who works under an agreement/contract. ● Any relative who cares for the child (employed and unemployed). ● An employee who lost her job due to the liquidation of the company. ● Women military personnel (contract soldiers). ● Students. ● Parent who works from home and part-time. |

| 3 | Conditions of receipt | Appointed to all families with children without any restrictions. |

| 4 | Payout time | Will be credited starting next month. ● Employees receive payment on the day their salary is issued. ● Non-working ones arrive in your bank account from the 21st to the 30th of the month, sometimes with delays of up to 10 days. |

| 5 | Where to contact | ● Workers contact the accounting department at their place of work. ● Non-working – in SZN, MFC, Social Insurance Fund, State Services. |

| 6 | Documentation | ● Application for payment; ● birth/adoption certificate of a child under 1.5 years of age; ● birth/adoption certificates of other children (if available); ● certificate of salary from previous places of work (if the parent changed jobs within 2 years); ● a certificate from the second parent about non-receipt of benefits (if employed). |

How is sick leave paid?

One of the two main purposes of sick leave is to become the basis for calculating social insurance benefits. Each day of incapacity for work according to the BiR is paid in the amount of 100% of the woman’s average earnings for two calendar years before going on maternity leave.

Calculation and payment of sick leave are carried out according to Russian legislation from contributions to the Social Insurance Fund . Even if the employer transfers benefits to the woman’s account, then he writes an application for reimbursement , and the funds are compensated to him by the Fund.

- Most other disability benefits are paid jointly by the employer and the Social Insurance Fund (the former pays for three days in the beginning, the fund for the rest of the time).

- For Russian women and foreign citizens working in the Russian Federation under an employment contract and insured against disability, sick leave under the BiR is paid the same.

How many days of maternity leave are payable?

Formally, maternity leave consists of two parts - prenatal and postnatal . Their duration varies depending on the circumstances of pregnancy and childbirth. According to Art. 10 of Law No. 255-FZ of December 29, 2006, a woman insured against temporary disability is paid:

- 70 days of sick leave according to BiR before childbirth (84 days for multiple pregnancy);

- 70 days - after the birth of the baby (86 - for postpartum complications, 110 - for the birth of several children at the same time).

This is important to know: Sick leave for two weeks

Days are counted from the conditional date of the expected birth. If they move in one direction or the other, the total number of days of maternity leave is still paid for the entire period of maternity leave:

- 140 days - in general;

- 156 days - if complications occurred during childbirth;

- 194 - when twins are born.

- If complications arise during childbirth or a multiple pregnancy is established, the medical organization where the birth took place issues additional sick leave for 16 or 54 days, respectively. They must also accrue and pay benefits for them.

- In the case where the payment has already been transferred to the woman for 140 days, a recalculation .

Several additional days of sick leave are also paid by law for women living or working in areas contaminated after the accident at the Chernobyl nuclear power plant, or the dumping of waste into the Techa River.

- Pregnant women from these regions go on leave according to BiR at 27 weeks .

- Before giving birth, they are paid for 90 (rather than 70) days, and maternity leave generally lasts 160 paid days .

Is maternity sick leave subject to personal income tax?

Personal income tax - personal income tax (income tax). In fact, maternity benefits, like payments for any other sick leave, are considered the recipient’s income . It is taken into account when applying for a subsidy and is indicated in income certificates for 3, 6 months or another period.

However, the fundamental difference between sick leave for illness or child care and sick leave for BiR is that payments for the first are subject to personal income tax, but for the second they are not. The law has a special clause in this regard.

Early registration benefit

Regardless of whether a woman works, she is entitled to payment of benefits for early registration with a medical organization. The benefit is paid if a woman consults in the first trimester, before 12 weeks of pregnancy.

Funds are paid from the regional fund. The size depends on the regions, on average 500-1000 rubles. around the country.

Required documents

In order to receive benefits, you need to collect a minimum package of documents:

- passport;

- certificate from the antenatal clinic;

- statement;

- an extract from the employment center stating that benefits were not paid there;

- extract from the house register;

- a copy of the personal bank account where the benefit will be transferred (account number, not card number);

- a copy of the work book or a certificate from the employment center about the status of unemployed.

You can apply to write an application at “My Documents” (multifunctional centers) in the region of residence or at the place of registration (registration) at the Department of Social Protection of the Population

Important! The benefit for registration in the early stages of pregnancy is paid only at the place of permanent registration. If a woman registers at her place of temporary registration, her right to receive benefits is lost. This change came into force in 2016.

If a woman is employed, then such benefits are paid to her by the employer. You must submit an application, passport and a certificate from the antenatal clinic about early registration.

Rules for filling out sick leave

The current sick leave form in Russia was introduced in 2011 (Order of the Ministry of Health and Social Development No. 347n dated April 26, 2011). It is equipped with many degrees of protection against possible counterfeiting. The first part of the sick leave is filled out at a medical institution.

- It is recommended to fill out the form using printing media (printer). This speeds up the process and eliminates errors due to handwriting characteristics.

- When filling out manually, do not use a ballpoint pen. You can only use gel, pen or ink with black ink.

- Only printed capital Cyrillic letters are allowed.

- Filling out is done in Russian.

- Errors, blots and cross-outs are not permitted. The damaged form must be replaced with a new one.

- Letters are written in special cells, starting from the first cell in each line. You cannot go beyond the boundaries of the cell.

Filling out a certificate of incapacity for work by the employer

The second part of the sick leave according to the BiR is filled out by the employer.

- All the rules listed above regarding ink color, capital letters, and the features of filling cells must

- The employer checks that the doctor has filled out the form correctly. After all, the Social Insurance Fund may refuse to pay if the organization accepted sick leave with errors .

- The name of the organization can be indicated in full or in an abbreviated version in accordance with the constituent documents. There are only 29 cells provided for this on the sick leave. If there is no abbreviated name, and the full name does not fit, you can cut it off arbitrarily. The main thing is not to go beyond the cells. Dots, dashes, quotation marks, and other punctuation marks can be written or omitted.

- You need to fill in the column with the registration number of the policyholder, by which you can identify the latter. The number and code of subordination is taken from the report in Form 4-FSS.

- The employer must indicate the total amount of benefits paid and other required data (after calculation by the accounting department).

- The insurance period is indicated on the day of maternity leave. What matters here is whether the woman worked for the employer for more or less than six months.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The employer must remember that minor flaws when filling out sick leave on the part of him or the doctor cannot be grounds for re-issuing the document.