What is a payment order

A payment order is an order drawn up in a document of a certain form from the account owner to the bank servicing this account to write off a specific amount of money to the recipient’s account opened with the same bank or other financial institution. The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. It is used to transfer funds:

- for delivered (performed, rendered) goods (work, services);

- to budgets of all levels, as well as the social insurance fund;

- for the purpose of returning/placing credits (loans), deposits and paying interest on them;

- for other purposes provided for by law or agreement.

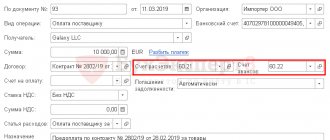

The payment order form and a sample of how to fill it out can be found here.

What design errors lead to and how to avoid them

If one of the fields of the tax payment document is filled in incorrectly, there is a risk of non-fulfillment of the tax obligation. Even if all bank details are filled out correctly, the funds will not be credited as intended within the prescribed period. This entails the accrual of penalties (not fines).

To ensure that the payment order in field 106 (payment basis) is filled out correctly, it is recommended to use specialized accounting programs. Creating new documents using the correct source is highly likely to eliminate errors. An additional check to ensure that the payment form is filled out correctly will take place in the remote banking system. If fields 106 and 107 contain errors, settlement documents will be rejected until all comments are corrected.

Legal documents

- “Regulations on the rules for transferring funds” (approved by the Bank of Russia on June 19, 2012 No. 383-P)

- Order of the Ministry of Finance No. 107n

Procedure for filling out a payment order

The content of the payment order and its form must comply with the requirements prescribed by law. The document regulating the procedure for filling out the fields of payment orders is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, which describes in detail the algorithm for filling out each field.

You can find samples of filling out payment forms for different types of taxes in the Ready-made solution from ConsultantPlus. Try K+ for free and get samples from the experts.

For information about which details are basic for a payment order, read the article “Basic details of a payment order”. And how the list of details to fill out depends on who the transferred funds are intended for, read here.

If you still have questions about filling out payment forms, ask them on our forum. For example, you can find out how to fill out a payment order for a fine on the thread.

Field 107 “Tax period” in the payment order for 2020–2021

Let us consider in detail the rules for filling out the tax period in the payment order (field 107 “Tax period”) in 2020–2021.

Check whether you have correctly determined the tax period for your case, with the help of explanations from ConsultantPlus experts. Get trial access to K+ for free.

This field is filled in when generating payment orders for the payment of taxes and contributions:

- To indicate the period for which the tax (contribution) is paid.

- To indicate a specific payment date - in exceptional cases established by law.

Field 107 has 10 characters, 8 of them are indicated in a specific order, and the remaining 2 are used for separation and are filled with periods. Signs 1 and 2 indicate the frequency of tax (contribution) payment, which can take the following values:

- menstruation (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AH).

The 4th and 5th digits of the indicator correspond to the number of the selected period:

- for monthly payments, the number of the month of the reporting period is indicated - such a number can take a value from 01 to 12 according to the number of months in the year;

- for quarterly payments, the quarter number is given - the number takes a value from 01 to 04 according to the number of quarters;

- for a half-year, the half-year number is indicated, it has 2 values: 01 and 02;

- for payments made once a year, zeros are entered.

The 3rd and 6th characters correspond to the “dot” symbol and are separating characters.

Characters 7 to 10 are reserved for indicating the reporting year. If the law specifies the exact date for tax payment, then this date is indicated in the “Tax period” field of the payment order.

The “Tax period” field can be filled in for payments not only of the current year, but also of past periods, if the taxpayer himself has discovered errors in the reports already submitted and independently pays additional tax (contribution). In this case, field 107 should reflect the tax period in which the changes were made.

There are a number of situations in which a specific date is indicated in the “Tax period” field . This occurs when the associated Payment Basis field 106 has a specific encoding. A specific date in such situations means for the basis of payment:

- TP - payment deadline established by the tax authority;

- RS - date of payment of part of the installment tax amount, based on the existing installment schedule;

- FROM - the date when the deferred payment ends;

- RT - date of payment of part of the restructured debt based on the existing restructuring schedule;

- PB - the end date of the procedure that is applied in a bankruptcy case;

- PR—end date of suspension of collection;

- IN - date of payment of part of the investment tax credit.

In the event that payment is made for a debt identified during a tax audit or according to a writ of execution, a zero value is indicated in the “Tax period” field.

In case of advance payment of tax, field 107 indicates the tax period for which payment is made.

Please note that when making payments to customs, field 107 is filled in completely differently.

ConsultantPlus experts provided detailed comments on filling out all fields of the payment order for the payment of taxes. If you don't have access to K+, get it for free and follow the directions.

Attention: latest clarification from the Ministry of Finance 2019

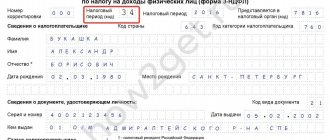

In field 107 of the personal income tax payment, you need to reflect the month, and not the exact date when the withheld tax is transferred. This follows from the letter of the Ministry of Finance dated June 11, 2019 N 21-08-11/42596.

This detail has 10 characters and is used to indicate the frequency or specific date of tax payment.

The frequency can be monthly, quarterly, semi-annual and annual. In this regard, in the first two characters of the details it is necessary to indicate, respectively: MS, KV, PL, GD.

Signs 3 and 6 are dividing signs; a dot is placed in them.

The 4th and 5th characters indicate: the month number (from 01 to 12) , or the quarter number (01 - 04), or the half-year number (01 or 02), or, for the annual payment, two zeros.

The 7th to 10th digits indicate the year for which the payment is made.

For example: MS.02.2013; KV.01.2013; PL.02.2013; GD.00.2013.

In the case of transferring amounts for previous tax periods, the details indicate the period for which the additional payment is made.

Examples of filling out field 107

Let's look at the rules for filling out the “Tax period” field in the 2021 payment order using examples.

Example 1

The organization transfers an advance payment for property tax for the 3rd quarter of 2021, therefore, in field 107 it will be indicated: KV.03.2020.

Example 2

An individual entrepreneur pays tax in connection with the application of the simplified tax system for 2021, in accordance with the declaration submitted to the tax authority; field value 107 - GD.00.2020.

Example 3

The organization pays the monthly personal income tax payment for September 2020; field value 107 - MS.09.2020.

Example 4

The organization pays tax at the request of the tax authority, which contains a specific deadline for payment - 09.26.2020; field value 107 - 09/26/2020.

Filling out line 107 when paying insurance premiums

Since the beginning of this year, the tax office has become the administrator of insurance premiums. In this regard, when registering payment slips for the transfer of contributions, column 107 in the payment order is filled out in the standard format - MS.XX.YYYY. If contributions for injuries are paid, 0 is entered in this field.

Similar articles

- Order of payment in a payment order

- Payment type in payment order 2017

- How to correctly fill out field 109 in a payment order?

- Reason for payment 106 explanation

- Basis of payment

Consequences of incorrectly filling out field 107

Filling out field 107 “Tax period” incorrectly does not result in the payment to the budget being recognized as not transferred. Consequently, the payer can clarify the payment provided that he independently discovers the error (clause 7 of Article 45 of the Tax Code of the Russian Federation).

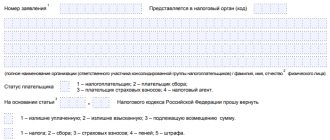

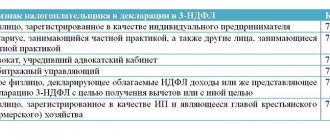

To clarify the payment, you must submit to the Federal Tax Service a statement of the error, drawn up in any form, and attach a copy of the payment order to it. If necessary, a joint reconciliation of paid taxes is carried out, based on the results of which a report is drawn up. Based on this act and a written statement about the error, the tax authority makes a decision to clarify the payment.

How to fill out

The cell provides a ten-digit code format “ХХ.ХХ.ХХХХ”, where the first two letters mean:

- “MS” – payment per month. Prescribed if it is necessary to pay personal income tax and excise taxes.

- “Q” – quarterly payment. Apply when the order will be used to pay UTII and VAT.

- “PL” – payment for 6 months. Indicate if the person pays the unified agricultural tax.

- “GD” – payment for the year. Refers to environmental fees.

Next, after the dot you need to enter two numbers.

If payment is for a month, then indicate the serial number of the month (01-12). When it comes to a payment order for the quarter, therefore, they write 01-04. As for the half-year, there are only two recording options: 01 or 02. For those amounts that are transferred once a year, indicate 00.

The final 4 digits make up the reporting year. Specifics are required for taxes and advance payments on transfers for the current reporting period.

Another point when the year should be indicated is that the taxpayer identified inaccurate information in the data specified in the declaration and, without waiting for information from the tax authorities, decided to voluntarily correct the inaccuracy and pay additional tax.

For example, if a person decided to pay personal income tax for August 20XX, then the entry in cell “107” will look like “MS.08.20XX”. The quarterly payment in the “Tax period” column will be reflected in the following form: “QW.02.20XX”.

Results

A payment order is a document used to transfer funds to the recipient. Field 107 “Tax period” is filled in when paying taxes or contributions and contains key information about the period for which the payment is made. The accuracy of identification of the payment by the regulatory authority and, as a consequence, the unambiguity of its assignment to the corresponding tax period depends on the correctness of filling out this field.

Sources:

- Tax Code of the Russian Federation

- Regulation of the Bank of Russia dated June 19, 2012 N 383-P

- Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When should field 106 be filled in?

What to do if the “Base of payment” field (106) is not filled in? Practicing accountants know very well that this cannot be done.

Column 106, both on paper and in an electronic document, is filled out using codes.

Let's look at what code values are used to fill out the "Basis of payment" field -106 (decoding):

- TP - payment in the current period;

- TR, ZD, AP - payments on demand, voluntary and according to an act of the Federal Tax Service;

- IN - repayment of investment loan;

- RS, OT - repayment of installments or deferred debt;

- RT - calculations according to the restructuring schedule;

- AR - repayment of debt under a writ of execution;

- PR - repayment of debt suspended for collection;

- PB, TL, ZT - designations used when making payments as part of the bankruptcy procedure;

- “BF” is a current payment of an individual paid from his bank account.

In the letter of the Federal Tax Service dated April 26, 2018 No. KCh-3-8/2721, the tax authorities once again clarify that this field indicates the details of the basis for the payment, and all columns of the document are filled out in accordance with Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.