Home / Taxes / What is VAT and when does it increase to 20 percent? / Declaration

Back

Published: 08/09/2017

Reading time: 6 min

0

160

In accordance with the Federal Tax Service Law of June 28, 2013 No. 134-FZ, taxpayers in the general taxation system who pay VAT, as well as those who are tax agents and submit a VAT declaration to the regulatory authority, are required to submit such a declaration to the territorial authority from the 1st quarter of 2014 tax office only in electronic form. This list also includes taxpayers who are exempt from the obligation to pay tax, but who issue invoices with the indicated amount of VAT - so that the inspectorate can control the accepted deductions of their counterparties.

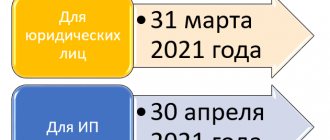

From the 1st quarter of 2021, the declaration must be submitted in the form according to the latest edition of the above law dated December 20, 2016, quarterly until the 25th day of the month following the reporting quarter.

- Federal Tax Service website service

- Operator services for electronic document management

- Procedure for electronic delivery Select a telecom operator and enter into an agreement with it

- Get an electronic signature

- Buy the software

Submitting electronic VAT reporting: is there an alternative?

VAT reporting must be submitted by all payers of this tax - individual entrepreneurs and legal entities - electronically through a specialized operator. This procedure presupposes that the taxpayer has:

- electronic digital signature with a valid certificate;

- access to the software through which declarations are sent to the Federal Tax Service;

- Internet access.

If at least one of the above conditions is not met, VAT reporting will not be sent electronically. But the occurrence of such a situation is quite likely: the digital signature certificate may expire or be canceled for one reason or another, the program for sending documents will freeze or become infected with a virus, and failures in access to Internet resources are not uncommon even in the largest cities.

If you have access to ConsultantPlus, find out who, where, when and in what way should submit a VAT return. If you don't have access, get a free trial online access.

What should a taxpayer do in this case?

There is only one option - to submit reports through a proxy. For some time, taxpayers took advantage of the opportunity to submit a declaration in paper form, while paying a fine for reporting not in the form in the amount of 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). However, since 2015, in paragraph 5 of Art. 174 of the Tax Code of the Russian Federation clearly states that a declaration on paper is considered not submitted. And these are completely different fines.

IMPORTANT! If no activity was carried out, then instead of a zero VAT declaration, you can submit a single simplified declaration. It is not subject to the requirement to submit reports electronically under the TKS.

Electronic reporting through a representative

An option to get out of the situation when it is not possible to quickly issue an electronic signature, but a VAT return must be submitted, may be to submit a report through an authorized person who has the necessary electronic signature. He will provide VAT reporting to the Federal Tax Service in electronic form, that is, the requirement will be met.

A corresponding power of attorney is issued to the representative. The individual entrepreneur must have such a power of attorney certified by a notary. Legal entities issue this document signed by the director and the seal of the organization - this is sufficient assurance.

The power of attorney must be submitted to the tax office, and only after that the representative will be able to submit tax reports on it for the principal. You can do this in person, that is, simply bring the power of attorney to the Federal Tax Service. It is also possible to transmit it via electronic communication channels, however, in this case, the scanned document must also be signed electronically, moreover, by the principal himself, and if the latter does not have an electronic signature, this option is a dead end. So, in order to avoid problems with reporting in the future, you still need to visit the inspection.

The reporting itself, submitted to the Federal Tax Service electronically in this way, will have certain specifics. On the title page of all declarations without exception there is a field entitled “I confirm the accuracy and completeness of the information specified in this declaration.” It indicates the value “1” if the report data is certified by the director of the company or the individual entrepreneur himself. For a representative submitting a report under a power of attorney for a third party, the value “2” is indicated, and in addition, the field “Name of the document confirming the authority of the taxpayer’s representative” is filled in - it indicates the date and number of the executed power of attorney.

Of course, this applies not only to the VAT return, but to any other report submitted by the representative.

How to submit a VAT return through a representative: nuances

The main condition for using the considered option of sending a VAT return to the tax office is the execution of a power of attorney for the representative. For an individual entrepreneur, it must be notarized; legal entities draw up a power of attorney without the participation of a notary.

The power of attorney must be in the tax office before submitting the declaration (clause 1.11 of the Methodological Recommendations approved by Order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398). Otherwise, there is a risk that the declaration will be refused. This was indicated by the Federal Tax Service in a letter dated November 9, 2015 No. ED-4-15/ [email protected]

Read more here.

Note! From the report for the 4th quarter of 2021, it is necessary to use the updated form, as amended by the Federal Tax Service order No. ED-7-3 dated August 19, 2020 / [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Technically, this can be done in 2 ways:

- Take or mail a paper copy of the executed power of attorney to the Federal Tax Service in advance.

- Also send a copy of the power of attorney via TKS in advance. The scanned image must be signed by the principal's UKEP. The representative cannot do this. There is no need to provide an additional paper copy of the power of attorney to the tax authorities.

Service information

Regulatory regulation of electronic reporting and document flow

Methodological recommendations for organizing electronic document management when submitting tax returns (calculations) in electronic form via telecommunication channels (approved by Order of the Federal Tax Service of Russia dated July 3, 2014 No. ММВ-7-6/ [email protected] ) (hereinafter referred to as Methodological Recommendations).

Order of July 2, 2012 No. 99n “On approval of the administrative regulations of the Federal Tax Service for the provision of public services for free information (including in writing) to taxpayers, fee payers and tax agents about current taxes and fees, legislation on taxes and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and obligations of taxpayers, payers of fees and tax agents, the powers of tax authorities and their officials, as well as for accepting tax returns (calculations).”

Basic safety rules you need to know

Our company is always ready to support you in any situation. But for this you definitely need to know the basics of security that guide our company. 1) We do not participate in gray schemes and do not use your data for purposes not included in the agreement between you as a client and our company. 2) We do not transfer data and documents for issuing a cloud electronic signature without your consent and payment. Therefore, for the period of service, you only have the power of attorney/electronic signature that was issued earlier. There are no others in our system. 3) If you have any doubts, your electronic signature certificate form has a unique fingerprint/serial number that is recorded when signing each document. The same fingerprint is displayed on the printed form of the report. The same fingerprint is recorded by the certification center as a link to documents that were received specifically through our company. Therefore, we take full responsibility and are not interested in compromise. 4) All reports submitted through our company and under executed powers of attorney/electronic signatures are displayed in the service’s personal account. You can always track what was submitted. 5) If it turns out that an unknown person sent a declaration for you, we recommend that you contact the management of your Federal Tax Service to clarify the circumstances. It is the Federal Tax Service Inspectorate that has information about who and in what way submitted reports unknown to you. If this was a report submitted by proxy, then the Federal Tax Service (ERUZ) system will display the certificate of the authorized person. If the report was submitted using an electronic signature that you did not order or receive, then the Federal Tax Service system will display the certificate itself with specific characteristics (date of issue, unique fingerprint of the certification center). When contacting the Federal Tax Service, we recommend that you have a valid certificate form with you in order to compare the prints. Only after this, upon your application to the Federal Tax Service, you can block a certificate unknown to you, and also contact the certification center for the revocation of a certificate unknown to you.

How to submit reports through the Federal Tax Service website

Dear Clients. If you want to submit reports yourself electronically, without using the services of an operator, then there is the best option. To do this, you need to obtain an electronic signature certificate. Next, register on the Federal Tax Service website in a special service for submitting tax and accounting reports, download special software and configure your computer to work with the program and cryptography tools. All necessary instructions are provided on the Federal Tax Service website. One of the advantages of submitting reports from the Federal Tax Service website is that it is free to use. Significant disadvantages include periodic unavailability of the service due to ongoing technical work, software that is difficult for an inexperienced user to understand, and the inability to submit a VAT return electronically. If you have small amounts of reporting and a minimal budget, then this option may suit you. If you are accustomed to quickly solving all issues and not taking up personal time to solve problems in which you are not competent, then our service is always at your service.

Results

VAT reporting can only be submitted to its payers in electronic form. If the company cannot do this on its own, you can send the tax return through a representative. To do this, you need to issue a power of attorney and give it to the tax authorities.

Sources:

- Tax Code of the Russian Federation

- Methodological recommendations approved by order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Generating a value added tax return in Online Sprinter

There are three ways to fill out a VAT return in Online Sprinter:

First way:

- Click on the “Create” button and in the window that opens, click “Create VAT set”.

- In the window that appears, select the option that is convenient for you.

If you downloaded the file from an accounting program, click and select the file with sections 1–7 of the VAT return (the file name begins with “NO_NDS_...”). If you created or uploaded a master file previously and it is in the Drafts section, you can select it by clicking . In the window that appears, you must select the desired declaration from the list.

If you have not yet completed sections 1–7, you can do so directly in the Online Sprinter. To do this, click , select the required year and period, click - Choose your preferred method for adding sections 8–12 to your bundle.

If you downloaded files from an accounting program, click on the button and select them. If you filled out or uploaded files earlier and they are in the “Drafts” section, click on the button, select the required documents and click

If you want to fill out additional sections in the Online Sprinter, click on and select the desired section. Once completed, click . You can add multiple sections of different types. - Once the set is complete, click .

- After successfully completing the verification, you can submit a report by clicking .

- The set will be displayed in the “Federal Tax Service” – “Sent” section. Until the sending is complete, do not close the page or interrupt your Internet connection.

Second way:

- Go to the document creation page by clicking ;

- Select the form and reporting period, click “Create”;

A document will be created containing sections 1 to 7 of the VAT report (use the menu on the left to navigate between them). Complete all required sections sequentially. To add additional pages to “Section 2” and to “Appendix 1 to Section 3”, you must click “Add Page”: - To add sections 8–12, use the top menu “Add detail sections.”

To import a section, click “Load from file”.

When importing, you can use one of 2 types of files:- .xml (format downloaded from the accounting program);

- .xls (if you don't use accounting software).

Select the format you are interested in in the import window and, having selected the required file, click the “Open” button.

If the file meets the requirements, a notification will appear: After successful import, the file will be displayed in list form. To create a section manually, select the required form from the list.

A window for filling out the document will open:

- To add new elements (rows), use the "Add" button.

To navigate between elements, use tabs with line numbers:

Third way:

- If you downloaded the file from an accounting program, click and select the main VAT return file and detail section files, then click “Open.”

- After successful import, the files will be displayed in list form and automatically formed into a set.

- After successfully passing the verification, in the “Drafts” section, select the document and click “Submit”.

The set will be displayed in the “Federal Tax Service” – “Sent” section. Until the sending is complete, do not close the page or interrupt your Internet connection.

Attention!

We recommend logging out of the system only after you receive “Confirmation of the dispatch date from the special communications operator (Taxcom).” In this case, you can be completely sure that your reporting has been sent to the Federal Tax Service.

Submit reports on time and without errors

Go

We generate an electronic VAT return

The electronic format of the 2018 VAT return and its annexes was approved by Order of the Federal Tax Service No. ММВ-7-3/ The procedure for submitting a tax return in electronic form via telecommunication channels was approved by Order of the Federal Tax Service of the Russian Federation dated No. BG-3-32/169. At the same time, purchase/sale books generated in xls, xlsx or csv format can be downloaded using specialized operators for sending to the Federal Tax Service. These files will be automatically converted to xml format. The declaration must be signed with an enhanced electronic signature of the established form (Article 80 of the Tax Code of the Russian Federation).