Documenting

The employee must submit his request for payment for studies in a free form.

An agreement with an educational institution (organization carrying out educational activities) may be concluded by:

- the employee himself;

- the organization in which the student works.

In the first case, the organization compensates the employee for the cost of training. In the second case, the organization itself will conclude an agreement for the provision of educational services to the employee and pay their cost. In such a situation, the manager issues an order to pay for the employee’s education at the expense of the organization’s own funds.

All facts of the economic life of the organization must be confirmed by primary documents that contain the details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Such documents, for example, could be:

- agreement with an educational institution;

- act on the provision of educational services.

Accounting

In accounting, training costs not related to the production activities of the organization (in the interests of the employee) should be reflected as part of other expenses (clause 11 of PBU 10/99).

If the organization pays for the employee’s studies directly to the educational institution, reflect this with the following entries:

Debit 91-2 Credit 76

– employee training costs are reflected;

Debit 76 Credit 51

– payment for employee training is transferred.

Educational services of educational organizations are not subject to VAT (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation). Therefore, there is no input tax in the payment documents presented by such organizations.

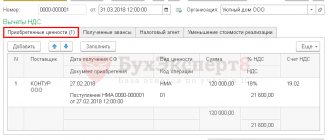

Educational services of commercial organizations providing training are subject to VAT at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation). Reflect the tax amount allocated in the settlement documents by posting:

Debit 19 Credit 76

– VAT is taken into account on the cost of services of a commercial organization providing training.

If the organization deducts training costs (or part of them) from an employee’s salary, make the following entries in your accounting:

Debit 73 Credit 76

– expenses (part of the expenses) for training are attributed to the employee;

Debit 70 Credit 73

– part of the training costs is deducted from the employee’s salary.

The cost of training can be deducted from an employee’s salary only upon his written request. The list of cases when the administration of an organization, on its own initiative, can withhold amounts from an employee’s salary is given in Articles 137 and 238 of the Labor Code of the Russian Federation. There are no deductions for tuition fees.

An example of how employee training costs are reflected in accounting. The training is carried out in the interests of the employee under an agreement between the employer and the educational institution. The organization deducts part of the educational expenses from the employee’s salary.

Cashier of Alfa LLC A.V. Dezhneva is studying at the law faculty of the university. The agreement with the educational institution was concluded on behalf of Alpha. In August, the organization paid for Dezhneva’s tuition for the first semester. The cost of educational services is 6,000 rubles. The university is an educational organization, therefore its services are not subject to VAT.

According to the employee, 20 percent of the cost of study is withheld from her salary.

The following entries were made in the organization's records.

In August:

Debit 76 Credit 51 – 6000 rub. – Dezhneva’s tuition was paid for in the first semester;

Debit 73 Credit 76 – 1200 rub. (6000 rubles × 20%) - attributed to settlements with the monetary part of training costs;

Debit 70 Credit 73 – 1200 rub. – deducted from the salary The monetary portion of training expenses.

At the end of the first semester:

Debit 91-2 Credit 76 – 4800 rub. (6,000 rubles – 1,200 rubles) – Dezhneva’s training expenses are written off.

If an employee first paid for his studies himself, and the organization compensates him for expenses, then reflect this operation with the following entries:

Debit 91-2 Credit 73

– employee training costs are reflected;

Debit 73 Credit 50

– the employee is compensated for training expenses.

Labor Code of the Russian Federation

As enshrined in the Labor Code of the Russian Federation, the need for professional training and retraining of personnel for their own needs is determined by the employer himself. And if the forms of professional training, retraining and advanced training of employees, the list of required professions and specialties are determined by the employer independently, then the advanced training of employees is primarily dictated by the norms of federal laws and other regulatory legal acts of the Russian Federation. For example, according to the Customs Code of the Russian Federation, customs clearance specialists are required to undergo training every two years under federal advanced training programs (clause 3 of Article 147 of the Customs Code of the Russian Federation), or, for example, advanced training for railway transport workers. Workers whose production activities are directly related to the movement of trains and shunting work on public railway tracks, and who are responsible for loading, placing, securing cargo in wagons, containers and unloading cargo (clause 4 of Art. 25 of the Federal Law of January 10, 2003 N 17-FZ “On Railway Transport in the Russian Federation”).

Personal income tax and insurance premiums

Situation: is it necessary to withhold personal income tax from the cost of training for an employee (employee’s children)? The training is carried out in the interests of the employee (his children), but at the expense of the organization.

The answer to this question depends on whether the conditions listed in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are met.

Namely, the educational institution (organization carrying out educational activities) in which the employee (his children) studied has a license for educational activities or the corresponding status for a foreign educational institution. If these conditions are met, do not withhold personal income tax (clause 21, article 217 of the Tax Code of the Russian Federation). Moreover, the fact that the training was in the interests of the employee (his children) does not matter. It also does not matter who pays for the studies (the organization itself or the employee, and the organization reimburses him for the costs). Please note that the organization must have documents confirming the expenses incurred (training agreement, which indicates the license number or status of the educational institution, type of study and payment procedure, payment documents).

If the conditions established in paragraph 21 of Article 217 of the Tax Code of the Russian Federation are not met, study in the interests of the employee (his children) refers to income in kind, which is subject to personal income tax (subclause 1, paragraph 2, Article 211 of the Tax Code of the Russian Federation).

Similar conclusions follow from letters of the Ministry of Finance of Russia dated October 4, 2012 No. 03-04-06/6-295, dated April 2, 2012 No. 03-04-06/6-88.

Regardless of the taxation system applied, contributions to compulsory pension (social, medical) insurance, as well as contributions to insurance against accidents and occupational diseases, must be assessed on the cost of training in the interests of the employee.

This is explained by the fact that this payment is considered as payment for employee services. The employer makes such payments within the framework of the employment contract; in addition, they are not included in the closed list of amounts not subject to insurance premiums (including for accidents and occupational diseases). This conclusion can be drawn from Part 1 of Article 7 and Article 9 of the Law of July 24, 2009 No. 212-FZ, as well as Part 1 of Article 20.1 and Part 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ.

The procedure for calculating other taxes depends on what taxation system the organization uses.

Types of employer expenses for training

The conditions under which tuition fees are paid are recorded in the following documents:

- Collective agreement.

- Additional agreement to the employment contract.

- Separate training agreement.

The obligation to record the conditions of training is prescribed in Articles 196 and 199 of the Labor Code of the Russian Federation.

Employee training, paid for by the employer, is divided into three main types:

- Basic professional.

- Additional.

- Professional education.

This classification is specified in articles 10, 73, 76 of Federal Law No. 273. The type of training determines the calculation of compensation, as well as the guarantees provided to the employee. Studying can be carried out without interruption from work. Otherwise, the employer retains the employee’s average salary and position. If the place of study is located in another area, the organization accrues travel allowances to the employee according to the standard scheme (Article 187 of the Labor Code of the Russian Federation).

The guarantees provided to a student employee are listed in Articles 173-176, 187 of the Labor Code of the Russian Federation:

- Payment for additional leave provided during training.

- Reimbursement of transportation costs associated with travel to an educational institution.

- The employee retains his average salary.

Each operation related to registration and payment of training must be confirmed by primary documentation (Part 1 of Article 9 of Federal Law No. 402). It is also necessary to confirm the fact that the educational service was received. An act signed by the employer and a representative of the educational institution is suitable for this. The main requirement for a supporting document is the presence of all details. Education documents are proof of the provision of services. For example, a diploma.

What amounts should be compensated (paid) to an employee with whom a student agreement ?

BASIC

Costs of study that are not related to basic or additional professional education or professional training of an employee and are carried out not in the interests of the organization, but in the interests of the employee, cannot be taken into account when calculating income tax (subclause 23, clause 1, article 264 and clause 1 Article 252 of the Tax Code of the Russian Federation).

Since employee training expenses do not reduce taxable profit, accrue a permanent tax liability in accounting (clauses 4 and 7 of PBU 18/02).

An example of how employee training expenses are reflected in accounting and tax purposes. The organization applies a general taxation system. The training is carried out in the interests of the employee under an agreement between the employer and the educational institution

Cashier of Alfa LLC A.V. Dezhneva is studying at the Faculty of Law of a university that has a license for educational activities. The agreement with the educational institution was concluded on behalf of Alpha. The organization calculates income tax monthly using the accrual method. The tariff for calculating insurance premiums for accidents and occupational diseases is 0.2 percent. The organization charges insurance premiums for compulsory pension (social, medical) insurance at general rates.

In August, the organization paid for Dezhneva’s studies in the first semester. The cost of educational services is 6,000 rubles. The university is an educational organization, therefore its services are not subject to VAT. Dezhneva’s salary is 12,000 rubles. The employee does not have rights to deductions for personal income tax.

According to the employee, 20 percent of the cost of training is withheld from her salary.

The act on the provision of educational services for the first semester was signed in January of the following year.

The following entries were made in the organization's records.

In August:

Debit 76 Credit 51 – 6000 rub. – Dezhneva’s tuition was paid for in the first semester;

Debit 26 Credit 70 – 12,000 rub. – Dezhneva’s salary for August was accrued;

Debit 73 Credit 76 – 1200 rub. (RUB 6,000 × 20%) - attributed to settlements with the monetary portion of training costs;

Debit 70 Credit 73 – 1200 rub. – the monetary portion of training expenses is withheld from the salary;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1,560 rubles. (RUB 12,000 × 13%) – personal income tax is withheld from Dezhneva’s income;

Debit 26 Credit 69 subaccount “Settlements with the Pension Fund” – 3696 rubles. ((RUB 12,000 + RUB 4,800) × 22%) – pension contributions have been accrued (for the amount of the employee’s salary and the cost of training, paid for by the organization);

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 487.20 rubles. ((RUB 12,000 + RUB 4,800) × 2.9%) – social insurance contributions in the event of temporary disability and in connection with maternity are accrued in the Federal Social Insurance Fund of Russia (for the amount of the salary and the cost of training for the employee, paid at the expense of the organization);

Debit 26 Credit 69 subaccount “Settlements with FFOMS” – 856.80 rubles. ((RUB 12,000 + RUB 4,800) × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund (for the amount of the salary and the cost of training for the employee, paid for by the organization);

Debit 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 33.60 rubles. ((RUB 12,000 + RUB 4,800) × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated (for the amount of the salary and the cost of training for the employee, paid for by the organization).

In January:

Debit 91-2 Credit 76 – 4800 rub. (6,000 rubles – 1,200 rubles) – Dezhneva’s training expenses are written off.

The organization's expenses for Dezhneva's training do not affect the calculation of income tax. Therefore, accounting reflects a permanent tax liability:

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 960 rubles. (RUB 4,800 × 20%) – a permanent tax liability has been accrued on training expenses that do not reduce taxable profit.

Advice: it is possible to take into account the costs of training in the interests of the employee as expenses when calculating income tax, if they are classified as remuneration in kind.

Labor costs include any accruals to employees in cash and (or) in kind, provided for by Russian legislation, labor agreements (contracts) and (or) collective agreements. This is stated in Article 255 of the Tax Code of the Russian Federation.

In order to be able to attribute the cost of study in the interests of an employee to expenses under Article 255 of the Tax Code of the Russian Federation, it is clearly stated in the employment (collective) agreement that these payments are a form of remuneration in kind. In addition, it is necessary to take into account that the amount of payments in kind should not exceed 20 percent of the employee’s accrued monthly salary (Article 131 of the Labor Code of the Russian Federation).

Similar conclusions follow from paragraph 2 of the letter of the Ministry of Finance of Russia dated December 21, 2011 No. 03-03-06/1/835. Although this letter focuses on paying for the education of employees' children, the explanations provided in it can be applied to this situation.

It should be noted that if an organization qualifies study expenses in the interests of an employee as remuneration in kind, then personal income tax will have to be withheld from the specified amount (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation).

An employee’s studies in his interests are not related to the activities of the organization. Therefore, write off the VAT charged by commercial organizations providing training as expenses without reducing taxable profit (Clause 1, Article 170 of the Tax Code of the Russian Federation).

In accounting, make the following entry:

Debit 91-2 Credit 19

– VAT is written off at the expense of the organization’s own funds.

Special cases

Higher education

Traditionally, the close attention of inspectors is drawn to the amounts transferred to the accounts of universities when employees receive higher education. The reason is that the wording “higher education” is absent in both Article 264 of the Tax Code of the Russian Federation and Article 217 of the Tax Code of the Russian Federation. From this, tax authorities conclude that the organization that paid for the employee’s education should not take this amount into account in expenses and is obliged to withhold personal income tax.

Typically, taxpayers are able to defend the costs. To do this, it is enough to submit an agreement with the university, a copy of the educational institution’s license and an order, or another internal document on the basis of which the company paid for training. These documents prove that the costs are economically justified and documented.

The situation with personal income tax is more complicated. According to inspectors, higher education has nothing to do with general education or professional programs. Therefore, the fee paid by the employer for the employee to receive higher education is subject to personal income tax on a general basis.

True, the judges take a different point of view. Thus, one organization from Vladivostok transferred money for the training of its chief accountant in the specialty “Accounting, Analysis and Audit”. The tax authorities, followed by the first and appellate courts, came to the conclusion: since the chief accountant received a diploma of higher education, the employer is obliged to withhold and transfer personal income tax to the budget. But the company won in the cassation court. The main argument was Article 196 of the Labor Code, which gives the employer the right to independently determine the need for training and education of personnel. This right fully applies to cases of higher education. And if the director decides that the company is interested in the chief accountant receiving higher education, then the latter does not have taxable income (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated February 14, 2013 No. F03-44/2013).

Master's degree

Until recently, taxation of amounts spent by an employer on an employee’s education in a master’s program was associated with certain difficulties. Ministry of Finance specialists did not allow vacation pay issued to an employee during additional study leave to be included in expenses.

The officials' arguments were as follows. Guarantees and compensation for employees combining work with training are provided if education of the appropriate level is received for the first time (Article 177 of the Labor Code of the Russian Federation). And a master's degree belongs to the same educational level as a bachelor's degree, namely the level of higher professional education. This follows from paragraph 3 of Article 12 of the Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation” (hereinafter referred to as Law No. 273-FZ) *. This means that when receiving a bachelor’s degree, the student has already passed this educational level, and the master’s degree is a repeat completion of this level. Therefore, the guarantee in the form of additional vacation is no longer required, and vacation expenses cannot be taken into account when taxing profits. The Russian Ministry of Finance outlined this position, in particular, in letter dated August 31, 2012 No. 03-03-06/1/454 (see “The Ministry of Finance explained in which cases it is impossible to take into account the costs of paying for an employee’s educational leave”).

But now this ban has lost its relevance. On September 1, 2013, a new version of Article 173 of the Labor Code came into force. And from now on, it clearly states that additional study leave is granted not only when studying in a bachelor’s program, but also when studying in a master’s program. As a result, vacation pay can be safely expensed.

Postgraduate studies

An organization that paid for its employee to attend graduate school risks attracting increased attention from tax authorities. From their point of view, such training is carried out solely in the personal interests of the student, and the cost of study must be included in his taxable income.

Inspectors try to defend this position in court, but, as a rule, they fail. One of the key arguments in defense of the employer is the fact that postgraduate study, the goal of which is to obtain a PhD degree, is one of the main professional educational programs. This is enshrined in Article 3 of Law No. 273-FZ**.

Accordingly, the exemption from personal income tax provided for in subparagraph 21 of Article 217 of the Tax Code of the Russian Federation can be applied here. The main thing is that obtaining an academic degree is directly related to the professional activity of the employee at this enterprise. Such conclusions were reached, in particular, by the Federal Antimonopoly Service of the Moscow District in its resolution dated June 27, 2011 No. KA-A40/6199-11.

simplified tax system

The tax base of simplified organizations does not reduce the cost of training an employee in his interests.

For organizations that pay a single tax on income - because when calculating the tax, they do not take into account any expenses at all (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses - because when calculating the single tax, they can only take into account the costs of professional training and retraining of employees in the interests of the organization. Such organizations cannot take into account the cost of training an employee in his own interests. This follows from subparagraph 33 of paragraph 1 of Article 346.16, paragraph 3 of Article 264, paragraph 1 of Article 252 and paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation.

Advice: organizations that pay a single tax on the difference between income and expenses have the opportunity to take into account the costs of training an employee (in his interests) in expenses if they qualify them as remuneration in kind.

Simplified organizations that pay a single tax on the difference between income and expenses can include labor costs as part of their costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). At the same time, they take into account these expenses in the same manner as organizations on the general taxation system, that is, according to the rules of Article 255 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). According to this article, labor costs include any accruals to employees in cash and (or) in kind, provided for by the norms of Russian legislation, labor agreements (contracts) and (or) collective agreements.

In order to be able to include the cost of training in the interests of an employee as an expense when calculating the single tax, it is clearly stated in the employment (collective) agreement that these payments are a form of remuneration in kind. In addition, it is necessary to take into account that the amount of payments in kind should not exceed 20 percent of the employee’s accrued monthly salary (Article 131 of the Labor Code of the Russian Federation).

Similar conclusions follow from paragraph 2 of the letter of the Ministry of Finance of Russia dated December 21, 2011 No. 03-03-06/1/835. Despite the fact that this letter is dedicated to paying for the education of employees’ children and is addressed to income tax payers, the explanations given in it can also be applied to the situation under consideration.

It should be noted that if an organization qualifies the costs of training an employee in his interests as remuneration in kind, personal income tax will have to be withheld from the specified amount (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation).

Do-it-yourself training

If employee training is carried out on its own, that is, in a personnel training center, then the organization’s expenses associated with the training and retraining of individuals on its staff can be included in expenses when calculating profits on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. In addition, if the training center will provide education to its employees, but not in the order of providing them with services as individuals under contracts concluded with them, but in order to improve their qualifications in the direction of the employer, then such expenses are accepted as part of other expenses as other justified expenses related to production and sales. In accounting, expenses for employee training are expenses for ordinary activities and are taken into account as part of the organization’s general business expenses on account 26 “General business expenses.”

OSNO and UTII

Organizations that combine the general tax system and UTII must keep separate records of income and expenses received from various types of activities (clause 9 of Article 274 of the Tax Code of the Russian Federation).

However, the costs of training an employee in his interests cannot be taken into account when calculating income tax (subclause 23, clause 1, clause 3, article 264, clause 1, article 252 of the Tax Code of the Russian Federation). The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). The organization's expenses do not affect the calculation of the tax base.

Thus, for the purposes of calculating income tax and UTII, there is no need to distribute expenses associated with an employee’s studies in his interests between different types of activities.

We send an employee to a seminar

As a general rule, costs for seminars can be included in the costs of training for basic and additional professional educational programs, professional training and retraining of workers (subclause 23, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2007 No. 03-03 -06/1/137), while expenses can only be taken into account if the conditions listed in clause 3 of Art. 264 of the Tax Code of the Russian Federation, namely:

— training must take place on the basis of an agreement with a Russian educational institution that has the appropriate license, or a foreign educational institution that has the appropriate status;

— employees who have entered into an employment contract with the company must undergo training;

— if the student is not on the company’s staff, then an agreement must be concluded with him, which stipulates that the employee must, no later than three months after training, enter into an employment contract with the company and work under it for at least one year.

In the absence of a license for educational activities, costs can be taken into account as expenses for consulting services (subclause 15, clause 1, article 264 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the Moscow District dated September 23, 2009 No. KA-A40/9373-09-2). In this case, an agreement with the organizer of the seminar, a plan for the seminar and an act of services rendered are sufficient (letter of the Federal Tax Service of Russia for Moscow dated June 28, 2007 No. 20-12/060987, resolution of the Federal Antimonopoly Service of the Moscow District dated July 15, 2011 No. KA-A40/7114-11 ), although the issuance by the organizer of the seminar of any certificates and the availability of training programs are not required (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 21, 2010 No. KA-A40/12309-10).

In addition, an order to send an employee to a seminar would not hurt (see sample).

Seminar abroad

When participating in a seminar abroad, costs can be included in expenses, even if it is conducted by a foreign educational institution (letter of the Federal Tax Service of Russia for Moscow dated February 17, 2006 No. 20-12/12674). Supporting documents may be (clause 3 of Article 264 of the Tax Code of the Russian Federation):

— agreement on holding a seminar;

— a document confirming the educational status of the organization conducting the seminar;

— seminar program;

— an order from the company to send an employee to a seminar;

— a certificate issued to the employee based on the results of the seminar;

- act of services rendered.

Documentation: official explanations and judicial practice

The fact of provision of services must be confirmed in any case, otherwise the tax authorities will not recognize the expenses. Such a document can be either a bilateral act drawn up in accordance with the terms of the agreement (letter of the Federal Tax Service of Russia for Moscow dated February 18, 2010 No. 16-15/017646) and in compliance with the requirements of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, or a document drawn up in accordance with the business customs of the foreign state in whose territory the services were provided and reflecting their essence (letter of the Ministry of Finance of Russia dated October 10, 2011 No. 03 -03-06/1/645, resolution of the Federal Antimonopoly Service of the Moscow District dated October 19, 2010 No. KA-A40/12291-10-P in case No. A40-35277/09-35-189).

In this case, documents drawn up in a foreign language must have a line-by-line translation into Russian (clause 1 of article 9 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, as well as 3, Article 284, Article 312 of the Tax Code of the Russian Federation). Such a translation can be done either by a professional translator or by a specialist from the organization itself (letters from the Ministry of Finance of Russia dated 04/20/2012 No. 03-03-06/1/202, dated 03/26/2010 No. 03-08-05/1, dated 11/03/2009 No. 03-03-06/1/725, Federal Tax Service of Russia for Moscow dated May 26, 2008 No. 20-12/050126, resolution of the Moscow District Federal Antimonopoly Service dated April 21, 2011 No. KA-A40/2152-11). The costs of translating documents by a third-party specialist can be classified as information services on the basis of subclause. 14 clause 1 art. 264 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia for Moscow dated May 26, 2008 No. 20-12/050126). The Russian Ministry of Finance insists on notarization of such a translation (letter dated December 17, 2009 No. 03-08-05), however, Chapter 25 of the Tax Code of the Russian Federation does not establish such an obligation for the taxpayer.

If the organization has not received a document confirming the status of a foreign educational institution, it can do without it (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 19, 2006 No. KA-A40/9887-06).

Attendance by the same employee of several seminars on similar topics should not cause claims from inspectors, since they should assess the validity of expenses only from the point of view of circumstances indicating the company’s intentions to obtain an economic effect (letter of the Ministry of Finance of Russia dated January 20, 2011 No. 03-03- 06/1/18).

Practical situations

If after the seminar the employee quits, there is no need to exclude such expenses from the tax base, since when calculating income tax, the possibility of taking into account expenses for the seminar does not depend on the period during which the employee worked in the company after the end of the seminar (resolution of the Federal Antimonopoly Service of the Ural District dated 11.05. 2010 No. Ф09-3203/10-С3).

The organization's expenses for paying for the participation of an employee working part-time on the basis of an employment contract in a seminar, the attendance of which helps to improve his professional level, are also included in expenses for ordinary activities (Articles 196, 287 of the Labor Code of the Russian Federation).

The cost of the seminar is not subject to personal income tax and insurance contributions to extra-budgetary funds in accordance with clause 3 of Art. 217 Tax Code of the Russian Federation.

If during the seminars meals are provided for participants, their entertainment, treatment or other services and the cost of such services is not separately allocated in the contract, then the subject of personal income tax and insurance contributions also does not arise (Articles 7, 9 of the Federal Law of July 24, 2009 No. 212- Federal Law (hereinafter referred to as Law No. 212-FZ), letters of the Ministry of Health and Social Development of Russia dated 08/06/2010 No. 2538-19, dated 08/05/2010 No. 2519-19, FSS of Russia dated 11/17/2011 No. 14-03-11/08-13985 “On payment of contributions"), since the organization does not have the opportunity to personify and evaluate the economic benefits received by the employee who took part in the seminar. Such expenses (as well as expenses for accommodation, provision of equipment, a conference room, transportation services) are taken into account when determining the tax base for income tax (letter of the Ministry of Finance of Russia dated January 20, 2011 No. 03-03-06/1/18, resolution of the Ninth Arbitration Court of Appeal dated 02.02.2011 No. 09AP-32031/2010-AK in case No. A40-31488/10-142-189).

If the cost of the above services is allocated and it is possible to reliably determine its size, it is included in the employee’s income. At the same time, the specified expenses in accordance with clause 43 of Art. 270 of the Tax Code of the Russian Federation are not taken into account when determining the tax base for income tax (letter of the Ministry of Finance of Russia dated May 13, 2011 No. 03-04-06/6-107).

Accounting

In general, when recording training costs, the following entries must be made:

Debit 60, 76 Credit 51

— tuition fees are transferred;

Debit 20, 23, 25, 26, 44, 91 Credit 60, 76

— the cost of employee training services is included in expenses (clauses 5, 6.1, 7, 16 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).