How to properly report money

When issuing cash to report on a cash receipt order, the accountant must adhere to certain rules established by the procedure for conducting cash transactions (clause 6 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

Let's consider the main steps when issuing money:

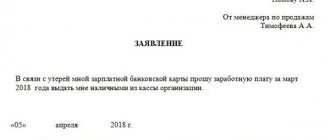

- An application is accepted from the employee, which contains a request for the payment of a certain amount for a specified period, written in free form addressed to the manager. The manager's decision, signature and date are checked. Instead of an application, a completed administrative document (instruction/order) can be submitted to the accounting department. Such a statement (instruction/order) serves as the basis for issuing money for reporting.

ATTENTION! From November 30, 2020, an administrative document can be drawn up for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

IMPORTANT! From August 19, 2017, the absence of debt on accountable amounts is not a limitation for receiving a new advance (clause 1.3 of instruction No. 4416-U).

- Next, a cash receipt order is issued in a single copy. Signed by an accountant or manager (if there is no accountant and he (the manager) combines the position of accountant and manager).

- The completed RKO, together with the application, is handed over to the cashier, who checks all items of the consumables for correct filling, and checks them with the document - the grounds for issuance.

- The cashier prepares the money, verifies the identity of the accountant using the passport received from him, and hands him the cash register for signature.

- After the employee signs the cash order, the cashier issues the money and puts his signature in the cash register.

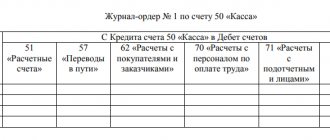

- An entry is then made in the cash book.

IMPORTANT! Individual entrepreneurs, in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U, from 06/01/2014 may, at their own discretion, not issue receipts and expenditure orders and not maintain a cash book.

Basic rules for filling and application

Expense cash order (hereinafter referred to as RKO) is a primary document used by an individual entrepreneur to reflect cash expenses in accounting. In fact, it is drawn up for each transaction of expenditure (payment) of funds from the cash desk of the enterprise in cash.

The procedure for conducting cash transactions at enterprises and, accordingly, the use of expense orders in accounting are enshrined at the legislative level. Such a regulatory legislative act is the Directive of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions of individual entrepreneurs”, last edition 03/11/14.

Let's consider the main rules for registering cash settlements.

Filling out an expense cash order can be assigned to:

- for the chief accountant - if available on staff;

- to the cashier of the enterprise;

- for a manager/individual entrepreneur – in the absence of the above positions on staff.

RKO is issued for a certain period. The validity period is one day, that is, funds must and can be received on the day it is drawn up. If this requirement is not met, a new order must be issued; actions to correct the date in the old one are not allowed.

The cash receipt order must be drawn up in a single copy.

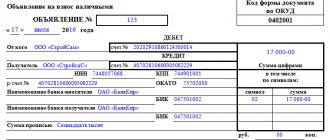

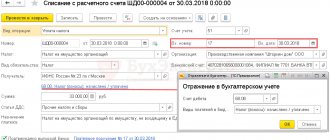

Sample cash settlement form for individual entrepreneurs (example):

A correctly executed order must include the signatures of officials of the enterprise.

Who should and can sign the cash settlement agreement depends on the staff of the enterprise, namely:

- accountant and cashier;

- manager and cashier - in the absence of an accountant on staff;

- manager/individual entrepreneur – in the absence of an accountant and cashier on staff.

According to the Directive of the Central Bank, the order can be issued either in paper form or submitted in electronic form.

RKO in electronic form can be signed by an individual entrepreneur using an electronic signature.

When executed on paper, an expense cash order can be filled out manually or using software and hardware (computers). Filling by hand is rarely used as it is a fairly lengthy process. But it cannot be avoided in the event of a computer breakdown or a lack of power supply at the enterprise.

The sequence of actions that must be carried out by a cashier when issuing funds from the cash register under cash settlement:

Check the presence of all necessary signatures on the document and compare them with sample cards

Sample cards must be kept at the register at all times. Check that the amount indicated in numbers corresponds to the amount indicated in words and there are no errors. Pay attention to the actual presence of additional documents, if they are indicated in the RKO. Reconcile the data of the cash recipient: last name, first name, patronymic and passport details must match those indicated in the cash register. If there are no comments, the cashier issues funds from the cash register. Together with the issuance of cash, he passes the order to the recipient for signature, then puts his own and certifies with a stamp (seal). The cashier is obliged to make an entry for each cash register issued in the individual entrepreneur's cash book. Attention! Correction of dates, names, signatures in RKO is unacceptable

Attention! Correction of dates, names, and signatures in RKO is unacceptable. There is a list of possible expense transactions at the enterprise, which involve the registration of cash and cash settlements

For example, this could be the payment of a monthly salary, stipends, the issuance of funds for reporting to an employee for a business trip, the issuance of cash to a separate branch (division) of the enterprise. Payment of monthly salary according to cash settlement services is carried out on the basis of the accrued salary statement

There is a list of possible expense transactions at an enterprise that require the registration of cash and cash settlements. For example, this could be the payment of a monthly salary, stipends, the issuance of funds for reporting to an employee for a business trip, the issuance of cash to a separate branch (division) of the enterprise. Payment of monthly salary according to cash settlement services is carried out on the basis of the accrued salary sheet.

Sample of filling out cash settlement for salary (example):

The organization of the storage process of paper or electronic cash registers is carried out by the head of the enterprise.

The responsibilities of a manager also include:

- Providing the cashier with a stamp or seal (hereinafter referred to as seal). The stamp is affixed to the order when cash is issued. Also, the seal must be made properly with the obligatory indication of details.

- Ensure that sample signatures are available at the cash desk. Sample signatures of persons authorized to sign cash documents must be provided.

An individual entrepreneur can put his seal on the RKO, but its affixing is not regulated by law, i.e. not necessary.

Sample RKO for issuance for reporting: what does the document consist of?

Looking at the cash receipt order form, we can roughly divide it into three main parts:

- the first indicates the details of the document;

- in the second it is written for what purposes and to whom the money is given, with corresponding accounts and signatures of responsible persons;

- in the third, the procedure for issuing cash with the signatures of the performers is formalized.

Here you can issue a cash order in form KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Let's look at a sample of line-by-line filling of RKO for a sub-report - what information should be entered into it and how.

| Line name | Content |

| Organization | The name is written as indicated in the constituent documents |

| According to OKPO | The code received upon registration in the statistics department is entered |

| Structural subdivision | If there is such a unit, the line is filled in; if not, a dash is placed |

| Document Number | The next RKO number is indicated |

| Date of preparation | The date of issue of money is written in the report |

| Structural unit code | Enter the assigned code for the existing branch |

| Corresponding account | In case of issuance, a score of 71 is entered into the report. |

| Analytical accounting code | The code assigned to a specific accountant is written |

| Credit | The score is set to 50 |

| Amount, rub., kopecks | The amount issued is indicated in numbers |

| Issue | Enter the full name of the accountable person |

| Base | In the case of issuing a report, the following is written: “under report”, the purpose is indicated, for example, “for the purchase of goods” or “for travel expenses”, and the document is “employee application” |

| Sum | Rubles are written in capital letters, kopecks are written in numbers, an empty space on the line is crossed out |

| Application | The document is indicated: the employee’s statement and the date of its preparation |

| Supervisor, Chief Accountant | Responsible persons sign with full name and full name. |

| Received | The accountant indicates the amount in capital letters and makes a dash in the empty space, then enters the date of receipt of funds |

| Signature | The accountant signs to confirm receipt of funds. |

| By | Enter the details of the identity document of the employee to whom the cash is issued |

| Issued by the cashier | The employee who issued the money signs and makes a full transcript of his full name. |

When completing cash transactions, be sure to follow the rules. Exactly what rules are established for cash discipline were explained in detail by ConsultantPlus experts. Get trial access to the legal reference system and switch to the Ready Solution for free.

Corrections when filling out RKO are not allowed. The document must be drawn up without errors or blots. In an organization, a manager can perform the functions of an accountant and cashier. In this case, it is recommended to issue an administrative document assigning accountant responsibilities to the manager.

To find out what documents regulate the rules for filling out an expense cash order, read the article “How to fill out an expense cash order?” .

Further procedure

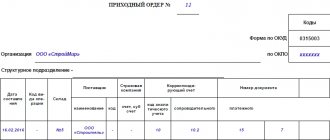

The approved application for the issuance of money on account is transferred to the accounting department. On its basis, funds are issued to the “accountable”:

- in cash - with the execution of an expense cash order (form No. KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88);

- in non-cash form - with filling out a payment order to transfer money to a bank card.

For the information of individual entrepreneurs who maintain tax records of income or income and expenses, as well as physical indicators. In accordance with paragraph 2, clause 4.1 of Instructions No. 3210-U, they may not draw up cash documents.

Warn the recipient not to transfer the accountable money to another person. Although the legislation does not establish a ban on such actions, at the same time, the procedure for transfer is not regulated. Therefore, to avoid disputes with tax authorities, do not allow employees to transfer accountable amounts to their colleagues

Within 3 working days after the expiration of the period for which the money was issued on account (indicated in the application), the employee must report on his expenses (paragraph 2, clause 6.3 of Instructions No. 3210-U). For these purposes, he uses an expense report. In accordance with Part 4 of Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ, the company has the right to independently develop the form of this document or use a unified one (Form No. AO-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 5).

The employee attaches all supporting documents to the advance report. If it turns out that he spent more than he received, then the organization (IP) is obliged to reimburse him for the amount of overexpenditure. If the “accountable” has unspent money, then he must return it to the enterprise. When returning the balance in cash, a cash receipt order is issued (form No. KO-1, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88).

>Application for issuance of accountable amounts sample

Basis in RKO when issuing for reporting

As we have already found out, money can be issued on the basis of an issued administrative document or a statement from the accountant signed by the manager. The application can be written either by hand or submitted in printed form. It might look something like this:

To the Director of Rassvet LLC

M. M. Shipovalov

from the driver Yu. V. Zvyagintsev

Statement

Please give me 1,000 rubles. 00 kop. (one thousand rubles) for a period of 10 calendar days for the purchase of fuel and lubricants for a company car.

______________ Yu. V. Zvyagintsev 05/11/20XX

I allow

Director ______________ M. M. Shipovalov 05/11/20XX

When registering RKO, in the line to indicate the basis, write “under report” and indicate the document (“application”) with the date of its preparation. It is also recommended that the application form be approved by order on accounting policies as an annex to the regulations on settlements with accountable persons.

IMPORTANT! From 06/01/2014, on the basis that an employee of an organization is considered to be a person working under both an employment and a civil law contract, money on account can also be issued to persons who have entered into a civil law contract with the organization.

Do you want to know when a director can receive money to report? Then read the article “How to properly report money to the director?” .

Correct design

To fill out, you should use the unified form KO-2 - this RKO form has been in effect for a long time, despite the abolition of the obligation to use unified documents. OKUD of this form 0310002.

When issuing a sum of money for reporting, the following fields must be filled in:

- OKPO - enterprise code according to the territorial directory.

- Company name in full or abbreviated form.

- The department, if necessary, from which cash is spent on reporting.

- Number - is entered in chronological order in accordance with the current numbering in the organization, reflected in the cash book.

- Date – the day the order is filled out corresponds to the moment the money is issued to the accountable person.

- The department code must be filled out if any are entered in the organization.

- The accounting account in which the accountable amount is debited (account 71).

- The analytical accounting code is filled in when maintaining analytics for this account.

- Credit – account 50, intended for recording cash transactions.

- Amount – the amount of money issued for the report is filled in with numbers.

- Issue - the full name of the employee of the accountable person to whom the money is issued for reporting is filled in in the dative case.

- Reason – the basis and purpose of issuing cash (for example, issuing a report for payment of office supplies according to invoice No. 11 dated).

- The amount is written in words in the nominative case with a capital letter, kopecks in numbers, below the same amount is repeated in numbers.

- An appendix is a documentary basis for the payment of funds against an employee; this can be a statement from an accountable person or an order.

- Signatures of responsible persons - manager and chief accountant.

- Received – the amount of money received by the accountable person from the cash register, date of receipt and signature.

- By – passport details of the accountable person.

- Issued - signature and full name of the cashier who issued the money for reporting from the cash register.

What basis should I indicate in form KO-2?

In the “Appendix” line, you must indicate the documents that serve as the basis for the cashier to issue funds to the accountable person.

As a rule, an application or statement is drawn up from the employee addressed to the manager, where the required amount of money is filled out, the purpose of its spending.

On the application, the manager puts an approval visa.

A visa application is sufficient grounds for the cashier to issue a sum of money from the cash register.

Issuance is also possible on the basis of an order from a manager, which states an order to pay a certain amount of money to a specific person.

In the line “Base”, enter a phrase starting with the words “Issue on account...”, then it is explained what exactly the money will be spent on.

filling

filling out an expense cash order for reporting – word.

Results

It must be remembered that before starting to fill out the cash register accountant, the accountant must receive from the employee his own handwritten application, endorsed by the manager. You need to draw up an expense cash order carefully; you must not make mistakes or make corrections. To do this, we advise you to download our sample and always have it at hand.

An internal document describing the procedure for settlements with accountable persons can help you follow the procedure for issuing funds on account and control their intended use.

Such a document can be found in the article “Regulations on settlements with accountable persons - sample”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

RKO form

To issue cash from the organization's cash register, an expense cash order is issued. From January 1, 2013, in connection with the entry into force of the Law on Accounting No. 402-FZ, the approved forms of the State Statistics Committee of the Russian Federation are not mandatory for use. But there are exceptions for documents that are approved by authorized bodies in accordance with other federal laws (Information of the Ministry of Finance of Russia No. PZ-10/2012). Thus, the exception includes forms of cash documents, the use of unified forms of which is prescribed in Directive No. 3210-U.

Form RKO 0310002 was approved by the State Statistics Committee of the Russian Federation in Resolution No. 88 and is mandatory for use for processing cash expense transactions.

Cash receipt form

Download

Expense cash order (form KO-2): cash register form, filling rules, sample of filling out cash register

Compliance with cash discipline is one of the most important responsibilities of any legal entity engaged in business activities. To do this, he has to fill out special documents that record both the receipt and expenditure of money at the cash desk.

Such documentation includes incoming and outgoing cash orders (PKO and RKO), cash books.

The procedure for filling them out is strictly standardized and if it is not followed sufficiently, you can run into trouble with the inspection authorities. So that entrepreneurs can avoid this and fully understand what they are dealing with, the following information is provided.

How to fill out a cash order in banking

The instructions of the Bank of Russia dated July 30, 2014 No. 3352-U establish the forms of documents involved in cash transactions, which are mandatory for use by Russian credit institutions. Among these is an expense cash order, which is assigned the number 0402009 in OKUD. This document is generally similar to what is used by legal entities and individual entrepreneurs in the general case - in the KO-2 form. Instructions No. 3352-U also contain instructions for filling out the “banking” version of cash settlement services.

The wording contained in Directive No. 3352-U reflects the specifics of filling out form 0402009 in correlation with the requirements of banking legislation. For example, in the structure of this form there is a “Symbols” item, in which you need to enter parameters that record the assignment of monetary amounts to one or another category. There is no such item in the KO-2 form.

The form of expense cash orders is approved by law and is mandatory for use by all business entities. An exception is made only for individual entrepreneurs - subject to a number of conditions. Banking organizations have their own form of cash settlement.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

How to fill out the RKO form correctly

The consumable must be filled correctly and carefully. This procedure is carried out in compliance with special requirements and knowledge. Quite often, specialists neglect the rules and make serious mistakes.

RKO is filled out as follows:

Issuance of money on account

- The company name is written in full. If this is an individual entrepreneur, it is allowed to indicate the name and patronymic with initials. For example, Ural LLC or Individual Entrepreneur Bolgarin A.Yu.

- The line “structural unit” implies the corresponding designation. If it is absent, it is recommended to put a dash.

- The code according to OKPO is required.

- Consumable number in order. It must match the mark in the registration log. Numbering is carried out from the beginning of the year.

- The date of registration must correspond to the time of issue. You cannot prescribe consumables in advance. It may look like this: 03.02.2016

- The corresponding debit and credit accounts are entered below. The loan will always have a score of 50.

- The amount of the expense transaction is entered in a number.

- To whom the funds are given is written in the dative case. For example, Anatoly Sergeevich Kurochkin.

- In the “basis” column, it is written down in detail: for what and on what paper the expenditure is made. Something like this, issuing a report on an application dated March 15, 2021.

- In the “amount” line, rubles must always be written in letters. Kopecks are numbered. After the amount, to the end of the line, you must put a dash.

- The line “attachment” indicates the attached papers.

- Usually endorsed by RKO with the signatures of the director and chief accountant. If you have a foundation document with a manager’s visa, the absence of a signature in the RKO is allowed.

- The “received” line is filled in by hand by the person receiving the finance. In this case, the amount is written in words, kopecks can be entered in numbers. There is a dash before the end of the line.

- Date, month and year of receipt of finance and recipient's visa.

The identification details of the person receiving the funds must be filled in.

Usually this is a passport. Therefore, the RKO registers: series, number, date and place of issue. This information is written in the “By” line. The cashier stamps his visa and transcript after the expense procedure.

RKO for report. Sample

Let's look at the example of filling out cash registers in a sub-report.

LLC "Company" sends manager Pyotr Aleksandrovich Vasechkin on a business trip. Based on Order No. 110 dated on sending on a business trip, the employee must be given money for travel expenses in the amount of 5,000 rubles.

RKO can be filled out by hand or using software and hardware:

- document number and date;

- name of the organization and its structural unit;

- FULL NAME. the employee to whom the funds are issued;

- basis for issuance;

- amount to be disbursed;

- identification document of the recipient;

- accounting and analytical accounts.

When receiving funds, the employee must fill out the amount received by hand, sign and date it received.

Sample of filling out RKO in a report

Download