With whom can you enter into a GPC agreement?

Russian organizations may enter into a civil liability agreement with foreigners who:

- have reached the age of majority established in Russia;

- are in the country legally;

- have a work permit.

A document that confirms that a citizen has a work permit in Russia is:

- patent - for persons who entered the country under a visa-free regime (according to paragraph 16, paragraph 1, article 2 of Federal Law-115 of July 25, 2002, last edition dated April 24, 2021);

- admission - for persons who visited the country under general regime on an open visa (according to Article 2 of Federal Law No. 115).

On a note:

Obligations to obtain a patent or admission do not apply to foreigners staying in the country on the basis of a temporary residence permit, residence permit, or entering the Russian Federation as a refugee.

Concluding a GPC agreement with a foreigner who does not meet the conditions or does not have a work permit is a violation. For this, sanctions will be applied to the employer in accordance with clauses 1 and 4 of Art. 18.15 Code of Administrative Offenses of the Russian Federation. Fines will be imposed in the amount of:

- 2-5 thousand rubles. – for citizens and individual entrepreneurs;

- 25-50 thousand rubles. – for employees of the organization responsible for the violation;

- 250-800 thousand rubles. or suspension of activities for 14-90 days – of the company.

IMPORTANT:

An organization or individual entrepreneur, in order to conclude a civil process agreement with a foreign citizen, must have the appropriate permission to hire.

Sample GPC agreement with a foreign citizen

Contract No. 1

https://www.youtube.com/watch?v=upload

Krasnodar 04/01/2020

LLC "FRIGAT", hereinafter referred to as the "Customer", represented by the director Yu. V. Putintsev, acting on the basis of the charter, on the one hand, and citizen of the Republic of Armenia Damir Borisovich Agadzhyan, passport of the Republic of Kazakhstan 12RK 123412, issued on 12/02/2012 by the Ministry of Internal Affairs of the Republic of Kazakhstan Almaty, hereinafter referred to as the “Contractor”, on the other hand, collectively referred to as the “Parties”, have entered into this agreement as follows:

- Subject of the agreement

- The Contractor undertakes to carry out, according to the Customer’s instructions, painting the walls in the garage at the address: GSK “Kiparis”, No. 10, box 12.

- Work period: from 04/01/2020 to 04/15/2020. The contractor has the right to complete the work ahead of schedule.

- The work is considered completed after the Customer signs the acceptance certificate.

- Scope and payment of work

- Scope of work: approximately 16 sq. m.

- Price of work: 4000 rub. (250 rubles per 1 sq. m).

- Payment is made after the Customer signs the acceptance certificate for the work performed.

- Rights and obligations of the parties

- The Contractor undertakes to perform the work stipulated by the contract efficiently and on time.

- The Customer undertakes to pay for the work performed by the Contractor.

- Responsibility of the parties

- The parties to this agreement bear responsibility in accordance with the requirements of the legislation of the Russian Federation.

- Contract time

- This agreement comes into force from the moment it is signed and is valid until the parties fulfill their obligations.

- Details and signatures

Customer: LLC "FRIGAT"

Address: Moscow, st. Chelyuskina, 28-7

OGRN: 135976235

INN: 93056248657

Checkpoint: 25836914756

BIC: 0435102015

Current account: 40702810005566228469

Putintsev Yu. V. (signature)

Contractor: Agadzhyan Damir Borisovich

We invite you to find out how many parcels can be sent to a pre-trial detention center

passport of the Republic of Kazakhstan 12RK 123412,

issued on 12/02/2012 by the Ministry of Internal Affairs of the Republic of Kazakhstan for Almaty

Agadzhyan D. B. (signature)

Differences between an employment agreement and a GPC agreement

The differences between the two types of documents concluded with foreigners are presented in the table:

| Index | GPC | Contract of employment |

| Legislative regulation of the process of concluding a document. | Ch. 37, ch. 39 of the Civil Code of the Russian Federation. | Labor Code of the Russian Federation, letter of the Ministry of Labor No. 17-3 / OOG-900 dated December 5. 2014 |

| Parties | The customer is a Russian company or individual entrepreneur. The performer is a foreign citizen. | Employer organization and employee. |

| The essence of the document | Regulations of obligations and rights to perform one specific task. | Regulations for permanent labor cooperation. |

| Providing conditions for completing the task | Performer (except for tools and equipment). | Employer. |

| Wage | A fixed one-time remuneration or staged remuneration paid upon fulfillment of obligations. | Permanent remuneration, calculation, accrual and issuance of which occurs in accordance with the norms of Russian labor legislation. |

| Financial liability for refusal of obligations, poor quality performance, non-fulfillment or failure to meet deadlines. | Cases in which financial liability is provided and the amount of recovery are determined by the provisions of the document. In this case, the contents of the document must satisfy both parties. | The employer does not have the right to fine for failure to fulfill obligations (he can use disciplinary action or dismiss “under the article”). |

| Insurance coverage | From the performer’s earnings, contributions are deducted to:

| All mandatory contributions to funds, in accordance with the norms of the Labor Code. |

Documents required for drawing up a GPC agreement with foreigners

It is prohibited to register full-time employees under a GPC agreement. But an unscrupulous employer may replace the employment contract with a civil process agreement or offer the employee to register in such a way as to save on taxes.

If this is a one-time job, it is possible and necessary to draw up a GPC agreement.

Pros. To apply for a job, you only need three documents, and if something doesn’t work out or the work ends, you don’t need to wait two weeks and sign a bypass sheet on the X day.

An employee registered under a GPC agreement has the right to work at a time convenient for him, and not according to the staffing schedule. The employer also does not control him and does not interfere in the work process.

Minuses. The contractor pays for his own sick leave and vacations; he is not covered by labor guarantees and benefits, such as annual paid leave and severance pay in case of reduction or dismissal at the initiative of the employer.

We invite you to familiarize yourself with the traveling nature of the driver's work sample || Sample of traveling nature of driver's work

He is not entitled to a social package - a voluntary health insurance policy or compensation for the cost of a gym membership.

When registering under a GPC agreement, no entry is made in the work book. If the agreement is terminated due to the fault of the contractor, he pays the customer a penalty for failure to fulfill obligations under the contract, if such a condition is specified in it.

How to avoid risks when concluding a GPC agreement. Negotiate the terms of the agreement in advance and always have a written contract, no matter what the transaction amount is. Agree with the customer on prepayment and write down the prepayment and postpayment amounts in the document.

The provision on intermediate results will help the customer avoid troubles: write down what intermediate work you will accept and within what time frame. Do not use labor law terms such as “employee” and “wages” in the GPC agreement. Instead of them - “performer” and “reward”.

What documents will be required from a foreigner?

To conclude a civil liability agreement, a foreigner will need to provide a package of documents. Its composition depends on the status on the basis of which the citizen is in the Russian Federation.

Temporary stay

Required:

- foreign passport;

- SNILS or ADI-REG card;

- any document on existing education (if requested by the customer);

- a completed migration card - for those who entered the country under a special visa-free regime;

- open visa – for those entering the country according to the general procedure;

- a patent or permission to work (not needed for persons who are refugees, students who get a part-time job during the holidays, etc., the full list of exceptions is stated in clause 4 of article 13 of Federal Law-115).

Temporary residence

You must provide:

- foreign identification card;

- SNILS card (if missing, then ADI-REG);

- original temporary residence permit.

Permanent residence

Required:

- international passport;

- resident card;

- SNILS or ADI-REG.

Fixed-term employment contract with a citizen of Kazakhstan sample 2021

Moreover, if this document is missing, this cannot be a basis for refusing to employ such an employee.

Instead, the employer is obliged to ensure the production of a work book for this worker.

At the same time, a Kazakh citizen has the right to provide a Soviet work book, but a Kazakh similar document does not have legal force and cannot be used in labor relations.

- SNILS. As for citizens of the Russian Federation, residents of Kazakhstan must provide their employer with SNILS when applying for employment. If they have not previously worked on Russian territory, the preparation of this document is also the responsibility of the employer.

- Employment contract.

Concluding an employment contract with a foreigner - samples and popular questions

- a work book of a sample that has legal force on the territory of Russia (such samples directly include a work book of a national standard or a Soviet work book issued before 1974);

- a copy of the migration card with a mark from the border control service;

- educational documents confirming previously obtained work experience and qualifications of a potential employee;

- insurance certificate received from the state pension insurance authority.

How to conclude an employment (civil law) contract with a highly qualified foreign specialist It should be noted that a citizen of Kazakhstan can count on employment at an enterprise, legalized by an employment contract, for the period for which he can stay in the territory of the Russian Federation.

Employment contract with a foreign citizen: sample for 2021

The citizenship of the foreign worker may also be important. Thus, citizens of countries that are part of the Eurasian Economic Union (EAEU) - Russia, Belarus, Kazakhstan, Armenia and Kyrgyzstan - are not required to obtain work permits within the Union (from the Agreement on the Establishment of the EAEU, Article 97). The procedure for hiring a foreign worker depends on many of these factors.

Attention More precisely, the actions of a potential employee and employer at the stage preceding the conclusion of an employment contract.

Preliminary stage - obtaining permits The conclusion of an employment contract with a foreign citizen is preceded by obtaining the appropriate work permits and/or patents. They are necessary for foreigners who arrived in our country on a visa basis.

The employer must obtain permission to hire foreign workers, which is valid for one year.

Employment contract with a foreign citizen (sample)

- date of commencement of performance of labor functions;

- remuneration, additional compensation for the influence of hazardous factors;

- working conditions;

- rights and obligations of both parties;

- Migrant's SNILS;

- working hours, rest;

- additional information about the nature of the activity and the duration of the probationary period;

- information about the conditions for liability for disclosure of secrets;

- data from documents on the legal employment of a foreign person (residence permit, temporary residence);

- patent details for visa-free stays;

- option for providing medical services.

Duration of an employment contract with a foreigner The period for signing an employment contract with a migrant is equal to the duration of the permit.

Employment contract with a citizen of Kazakhstan

Labor Code of the Russian Federation. The norms of the labor legislation of the Russian Federation apply to them, but specific features can also be established. Thus, a foreigner can work in Russia as a general rule from the age of 18. An employer may enter into an employment contract if he has the right to employ foreigners in accordance with the law.

Art. 372.2 of the Labor Code of the Russian Federation requires additional information to be indicated in the employment contract with such an employee:

- about a work permit or patent when the law requires them;

- about the existing temporary residence permit or residence permit;

- about the employee’s voluntary medical insurance policy (its details) and the conditions for providing primary and specialized emergency medical care.

Here is a sample of a 2021 employment contract with a citizen of Kazakhstan.

Employment contract with a foreign citizen under a patent: sample 2021

Important Also, unlike hiring by invitation, the employer does not have the right to require medical insurance. It should be remembered that a work patent in 2021 is not required for citizens of Kazakhstan under any circumstances - moreover, the migration service will in no way be able to issue such a document to an employee.

Citizens of Kazakhstan can freely find employment throughout the entire territory of the Russian Federation, with the exception of certain legally limited areas, such as military camps. In addition, it is impossible to employ Kazakhstanis in government bodies until they receive full citizenship.

Citizens of Kazakhstan are also not required to take an exam on knowledge of the Russian language, history and legislation.

Employment contract with a foreign citizen: sample 2021

- Themes:

- Employment contract

- Civil contract

- Foreigners

From this article you will learn: • Why you need an employment contract with a citizen of Kazakhstan; • Features of drawing up an employment contract with a citizen of Kazakhstan; • What is the procedure for drawing up an employment contract with a citizen of Kazakhstan? • What documents are needed to draw up an employment contract with a citizen of Kazakhstan; • What taxes should a citizen of Kazakhstan pay when applying for a job at a Russian company under an employment contract? Any citizen of Kazakhstan has the right to count on employment at enterprises of the Russian Federation according to the rules established by legislation.

October 13, 2014hiring a citizen of Kazakhstan

Labor Code.

- Termination of the employment contract. There are certain nuances in the event of termination of employment relationships with foreigners. In particular, it is mandatory to notify the Ministry of Internal Affairs of the termination of a previously existing contract, and this notification must also be drawn up in the prescribed form and sent within three days from the date of dismissal of the employee. Upon dismissal, an employee also has the right, like a Russian, to receive severance pay, as well as all due wages and compensation for unused vacations.

- Documents required when hiring citizens of Kazakhstan in 2021 The employer, as in relation to Russians, when registering labor relations, is obliged to request a certain list of documents from employees.

According to the Agreement concluded between our countries, citizens of Kazakhstan are equal in rights to residents of Russia, and I can work for Russian companies by concluding a special employment contract, which will spell out the terms of cooperation, the amount of material remuneration for services rendered or products produced and other conditions for carrying out labor activities. To draw up this employment contract, a foreign citizen must visit the FMS services with a list of documents, a detailed list of which will be presented in the following sections of this article. Workers from Kazakhstan and Belarus: features of labor relations Features of drawing up an employment contract with a citizen of Kazakhstan Citizens of Kazakhstan can enter into an employment contract with an enterprise without the need to obtain a residence permit or a temporary residence permit in the territory of the Russian Federation.

Source: https://advocatus54.ru/srochnyj-trudovoj-dogovor-s-grazhdaninom-kazahstana-obrazets-2021/

How a contract is drawn up

The document is drawn up in free form. The legislation does not provide a unified form for this. However, its content must reflect 10 sections.

- Registration information: name of the document, number assigned to it, date and address of preparation.

- Personal information of the parties: Full name or name of the organization, passport data or extracts from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, legal status.

- Subject of the agreement: description of the task.

- List of essential conditions: time allotted for completing the work, algorithm for receiving the result, description of the stages and rules for their implementation (if required), other information included in the document by agreement of both parties.

- List of rights and obligations of the customer and contractor.

- Payment provisions: amount of remuneration, timing of funds transfer, algorithm for issuing prepayment and amount (if used), amount of compensation for expenses (if provided).

- Penalties for failure to fulfill obligations.

- Algorithm for resolving conflict situations and disputes.

- The validity period of the document, the algorithm for its early termination.

- Signatures of the parties.

ATTENTION:

The Civil Code of the Russian Federation prohibits concluding GPC agreements for an indefinite period, since this will already constitute an employment relationship. In the case of foreign citizens, the period of validity of the contract cannot exceed the period during which the person can legally stay in the territory of the Russian Federation or legally work (validity of a visa, temporary residence permit, patent or admission).

Sample agreement for work performance:

dogovor_na_ispolnenie_rabot.docx

Sample agreement for the provision of services:

dogovor_na_okazanie_uslug.docx

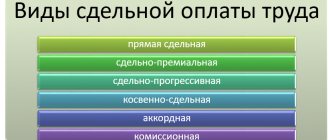

What types of GPC agreements are there?

To formalize work, a contract is usually used; for services, a contract for paid services is usually used.

A contract is when the contractor performs work on the instructions of the customer and transfers the results of the work to him, and the customer pays for them.

https://www.youtube.com/watch?v=ytdevru

Such an agreement is often concluded for repair and construction work, processing and manufacturing of furniture, jewelry or something else. It implies a material result of work that can be touched.

A contract for the provision of paid services implies the process of providing services; its result cannot be touched. Usually it is concluded on:

- consulting;

- informational;

- audit;

- medical;

- veterinary;

- educational and other services.

There is also a copyright agreement. It is concluded if the result of the work is a work: illustration, article, scientific research.

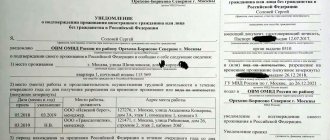

Notification of the Migration Service

A person who has entered into a civil liability agreement with a foreigner is obliged to notify the Federal Migration Service about this. This requirement is regulated in paragraph 8 of Art. 13 FZ-115.

To do this, the customer will need to draw up a special notice. To fill out, use the form specified in the appendix. 3 orders of the Ministry of Internal Affairs No. 363 dated June 4. 2021

The contents of the document indicate:

- the full name of the department of the Ministry of Internal Affairs to which the notification is sent;

- information about the organization, individual enterprise or individual acting as the customer (name or full name, registration number of their Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs or passport data, TIN number, customer status);

- the address of the place where the obligations under the agreement will be performed;

- information about the performer (full name, gender, current citizenship, date and place of birth, name of the personal identification document, its number and date of receipt);

- information about the profession or type of activity of the performer;

- date of conclusion of the GPC agreement;

- date of preparation of the notification and his handwritten signature.

Sample form used to draw up a notification:

obrazec_uvedomleniya_1.png

obrazec_uvedomleniya_2.png

obrazec_uvedomleniya_3.png

Sanctions for violating the notification rules

If the customer does not send a notification or does so without complying with the regulated deadlines, then he will be held accountable in accordance with Parts 3 and 4 of Art. 18.15 Code of Administrative Offenses of the Russian Federation. The following sanctions are possible:

- citizens - a fine of up to 5 thousand rubles;

- employees of the organization responsible for the violation - a fine of up to 50 thousand rubles;

- companies – a fine of up to 800 thousand rubles. or suspension of activities for a period of up to three months.

If the violation was committed in Moscow, St. Petersburg, the Moscow or Leningrad region, then the amount of fines increases:

- citizens – 5-7 thousand rubles;

- employees of the organization responsible for the violation - 35-70 thousand rubles;

- companies - 400-1000 thousand rubles. or suspension of activities for three months.

GPC agreement: taxes and contributions in 2019‑2020

The phrase “GPC agreement” stands for a civil agreement. It is usually used as an alternative to an employment contract when it comes to hiring an individual to perform work or provide services without registering him as a member of the organization.

In most cases, a GPC agreement is understood as a contract agreement (if an individual is entrusted with performing work that has a tangible result), or a contract for the provision of services for a fee (if an individual is entrusted with performing actions that do not have a tangible result). It is also possible to combine these types of contracts in one if the task involves both carrying out an activity and obtaining a specific result (clause 3 of Article 421 of the Civil Code of the Russian Federation).

Draw up and print a contract agreement for free using a ready-made template

IMPORTANT. The parties to the GPC agreement are called not “employer” and “employee”, but “customer” and “contractor” - in a work contract, or “customer” and “contractor” - in a service agreement. This must be taken into account when drawing up the contract and related documentation (applications, acts, etc.).

Also, in a civil contract there should be no mention of position, working hours, bonuses for holidays and other terms characterizing labor relations. Otherwise, such a contract may be reclassified as an employment contract. And this threatens the organization with a fine of up to 100,000 rubles. (Part 4, Article 5.

27 Code of Administrative Offenses of the Russian Federation) and additional tax charges.

Draw up and print a fee-based service agreement for free using a ready-made template

What taxes does the “employer” pay under a GPC agreement?

When paying remuneration to a contractor or performer, it is necessary to accrue and withhold personal income tax (clauses 1-4 of Article 226 of the Tax Code of the Russian Federation). According to the application of an individual who has entered into a GPC agreement, he needs to be provided with standard tax deductions, including for children (clause 3 of Article 218 of the Tax Code of the Russian Federation).

REFERENCE. A freelance employee can receive property and social deductions only through the tax office (clause 8 of article 220, clause 2 of article 219 of the Tax Code of the Russian Federation).

The entire amount of remuneration accrued under a “civil” contract (i.e., the amount taking into account personal income tax) is included by the “employer” on OSNO as part of labor costs (clause 21, part 2, article 255 of the Tax Code of the Russian Federation). The specified amount is also taken into account when calculating the single tax within the framework of the simplified tax system (subclause 6, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

Free accounting and preparation of income tax and personal income tax reports

Differences from taxation under an employment contract

Differences in the taxation procedure for payments under “civil” and employment contracts are related to the date of actual receipt of income.

When transferring payments under an employment contract, the following rule applies: if the employee does not quit, then income in the form of wages is considered to be actually received on the last day of each month (clause 2 of Article 223 of the Tax Code of the Russian Federation).

On this day, the employer must calculate wages and calculate income tax, which must be withheld and transferred to the budget. Accordingly, when paying wages for the first half of the month, personal income tax is not calculated or withheld.

The situation is different with remuneration under a civil contract. In this case, the rule established for all other income in cash applies (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Such income is recognized as received on the day of payment or transfer. This means that personal income tax must be calculated and withheld under a “civil” contract for each payment.

In this case, the type of payment (advance or final payment), as well as its date (beginning, middle or end of the month) does not matter.

ATTENTION. If the GPC agreement provides for the payment of an advance, then it may be necessary to adjust the personal income tax reporting for the period in which the advance payment was transferred. This can happen if the contractor returns the entire amount received or part of it due to the fact that he does not complete the work in full or on time (letter of the Ministry of Finance dated 08/28/14 No. 03-04-06/43135).

Keep personal income tax records in the web service, generate and submit 6‑personal income tax and 2‑personal income tax via the Internet

Insurance premiums for GPC in 2021

In terms of insurance premiums, a “civil” contract turns out to be more profitable than an employment contract. Moreover, according to two parameters at once.

Firstly, payments under the GPC agreement do not need to be charged insurance premiums in case of temporary disability and in connection with maternity (subclause 2, clause 3, article 422 of the Tax Code of the Russian Federation). This means that when using regular tariffs, the savings will be 2.9% (subclause 2, clause 2, article 425 of the Civil Code of the Russian Federation).

Secondly, as a general rule, payments under the GPC agreement do not need to be charged insurance premiums against industrial accidents and occupational diseases.

Contractors and performers are recognized as insured persons only if this is expressly stated in the contract (Clause 1, Article 5 of Federal Law No. 125-FZ of July 24, 1998). If there is no such clause, then there is no need to transfer contributions “for injuries”.

The amount of savings depends on the tariff established for the employer and can reach 8.5% (Article 1 of the Federal Law of December 22, 2005 No. 179-FZ).

Pension and medical contributions in respect of remuneration under civil contracts are accrued in the same manner and in the same amounts as under employment contracts (clause 2 of Article 425 of the Tax Code of the Russian Federation).

ATTENTION. If an advance payment is provided for under a “civil” contract, insurance premiums must be calculated and paid during the period of accrual of the corresponding amount, and not after signing the act.

This directly follows from the provisions of paragraph 1 of Article 421, paragraph 1 of Article 424, paragraphs 1 and 3 of Article 431 of the Tax Code of the Russian Federation. In this regard, we would not recommend following the explanations given in paragraph 2 of the letter from the Ministry of Finance dated July 21.

17 № 03-04-06/46733.

Fill out, check and submit insurance premium calculations online

Features of the GPC agreement and fines

When concluding a “civil” contract, several important nuances must be taken into account.

No labor discipline and personnel records

Persons working under a GPC agreement are not full-time employees and are not required to obey internal labor regulations.

This means, in particular, that they do not have to come “to work” every day, or at a certain time. They can also finish performing work or providing a service at any time and go about their business.

For such “workers” there are no lunch breaks, vacations or sick leave.

The organization, in turn, should not fill out a time sheet for freelance employees. Also, you should not draw up personnel documentation on them, including orders and work books. All this significantly reduces the non-productive burden on the “employer”.

Compose HR documents using ready-made templates for free

Payment of remuneration and fines

The freelance status of persons with whom GPC agreements have been concluded means that remuneration is paid to them not for their labor function, but for the fact of performing work or providing a service. Therefore, if the work or services are not performed in full, of poor quality or in violation of the deadline, the advance amount paid is subject to return.

The lack of the right of the performer (contractor) to a monthly salary also means that the customer does not have the obligation to transfer remuneration strictly every half month.

The fact that the relationship between a company and an individual is formalized by a GPC agreement makes it possible to have a flexible approach to the issues of establishing and paying appropriate remuneration. All these issues are resolved exclusively on a contractual basis. Therefore, various fines can be included in a civil contract if the work is completed in violation of the deadline or of poor quality.

For example, it is permissible to establish a condition on reducing remuneration for each day of delay in delivering the work. Or determine that the payment is reduced if the work is performed poorly. However, it is impossible to fine an “employee” under a GPC agreement for lateness, absenteeism and other labor violations.

After all, as we have already said, the work regime does not apply to freelance employees. At the same time, a fine for untimely start of work or provision of a service, if the start date (time) is directly indicated in the contract, is quite legal (clause 1 of Article 708, Article 783, clause 1 of Article 330 of the Civil Code of the Russian Federation).

Termination of an agreement

When terminating a civil contract, the protective mechanisms provided for by the Labor Code do not apply. And the Civil Code allows the inclusion of any termination rules in a civil contract (subclause 2, clause 2, art.

450 Civil Code of the Russian Federation). Moreover, the possibility of unilateral refusal to fulfill a contract for the provision of services at any time and without explanation is directly stated in Article 782 of the Civil Code of the Russian Federation.

Therefore, there are usually no problems with “dismissal” under a GPC agreement.

IMPORTANT. These rules apply in both directions. This, in particular, means that the “employee” can refuse further cooperation at any time without notifying the customer two weeks in advance. True, in this case, it will be possible to deduct losses incurred due to the early termination of the contract from the amount of remuneration (clause 2 of Article 782 of the Civil Code of the Russian Federation).

In conclusion, we note that any contract or service agreement that an organization has concluded with a non-entrepreneur individual may come under the close attention of regulatory authorities.

If inspectors find signs of an employment contract, this will result in a fine and arrears for insurance premiums for the “employer”.

To prevent this from happening, you need to correctly draw up the GPC agreement in 2020 and not include unacceptable conditions in it.

Source: https://www.Buhonline.ru/pub/beginner/2019/12/15299

How can the head of an organization conclude a contract with a foreigner?

Algorithm for concluding a GPC agreement, example of a manager’s actions:

- Checking the legality of a migrant’s presence in the country.

- Verification of the authenticity and integrity of the package of documents provided by foreigners.

- Drawing up the provisions of the contract in compliance with the number of sections.

- Coordination of the document with the contractor.

- Signing of the document by both parties.

- Drawing up a notification for the Federal Migration Service and sending it within 72 hours from the conclusion of the contract.

How to reclassify GPC into an employment contract

GPC can be reclassified into an employment contract by agreement of the parties, an order from the labor inspectorate, or through the court.

If the employer does not want to reclassify the GPC agreement as a labor agreement, the contractor can complain to the state labor inspectorate if there is reason to consider the GPC agreement to be a labor agreement.

https://www.youtube.com/watch?v=ytaboutru

If the GPC agreement has expired, the agreement can be reclassified and the relationship recognized as an employment relationship only through the court.

Taxation

All income received by a foreigner after fulfilling obligations under a civil liability agreement is subject to income tax in the amount of:

- 13% for: residents of the Russian Federation;

- persons with citizenship of a state that is part of the EAEU;

- refugees;

- citizens employed on the basis of a registered patent;

- persons who are highly qualified specialists;

- people who have been granted temporary asylum in Russia.

Personal income tax is withheld from the amount specified in the payment provisions in the contract. According to paragraph 6 of Art. 227.1 of the Tax Code, a foreign citizen can reduce the amount of income tax by an amount equal to the cost of the patent. To do this, he will need to draw up a corresponding application and send it to the Federal Tax Service.

Insurance premiums

A person or enterprise acting as a customer in an agreement is obliged to deduct insurance premiums from the income of the contractor under the agreement. The amount of payments depends on the status of the migrant. They are presented in the table:

| Status | Contributions to the formation of a pension | Social insurance contributions | Contributions for compulsory health insurance |

| Temporary residence | 22% from total earnings up to 1 million 292 thousand rubles. 10% – over 1 million 292 thousand rubles. | Not paid | At least 5.1% with no restrictions on the maximum contribution amount. |

| Permanent residence | |||

| A person with citizenship of countries that are members of the EAEU. | |||

| Refugee. | |||

| Temporary stay. | Not paid | ||

How does a GPC agreement differ from an employment contract?

The main differences are the parties and the subject of the agreement.

In the first case, the contract is concluded between the customer and the contractor, and the subject of the agreement is the result of the work or service. In the second, the contract is concluded between the employer and the employee, and the subject is a labor function - work according to position, staffing table and profession.

According to the employment contract, the employee is placed on staff and receives a salary. An employment relationship arises between him and the employer. And the employee has guarantees and compensation: sick pay and annual leave, payments upon dismissal or layoff.

In the GPC agreement

The performer is not registered as a staff member and does not make entries in the work book. To register, the performer needs a passport, INN and SNILS. Of the documents, the customer draws up only the agreement and the acceptance certificate

In the employment contract

An employee is registered as a member of the company using a work book. The employer signs the employment order and issues the employee’s personal card

In the GPC agreement

The contractor receives remuneration for the result of work or service provided

In the employment contract

An employee receives a salary twice a month, regardless of the amount of work performed.

In the GPC agreement

The customer withholds personal income tax from the contractor’s remuneration and usually pays contributions to the Pension Fund and the Compulsory Medical Insurance Fund for it.

In the employment contract

The employer withholds personal income tax from the salary, pays mandatory contributions to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund

In the GPC agreement

The contractor performs work, the results of which are described in the document

In the employment contract

The employee performs official duties

In the GPC agreement

It is always concluded for a certain period, but for how long is decided by the parties

In the employment contract

Concluded for an indefinite period or up to five years if it is a fixed-term employment contract

Place, time and working conditions

In the GPC agreement

The performer himself decides where, under what conditions and for how long to work, the main thing is the result. Equips his own workplace

In the employment contract

The employee works at a special workplace, according to the schedule and under the conditions determined for him by the employer.

Labor guarantees and benefits

In the employment contract

Annual paid leave - 28 calendar days, payment of sick leave and benefits, average daily earnings, if the employee is on parental leave for up to one and a half years. If the employer reduces or dismisses an employee on his own initiative, he pays him severance pay

https://www.youtube.com/watch?v=ytcreatorsru

Under the GPC agreement, the contractor can work on several projects and thus regulate his income and employment. According to labor, the employee works and earns exactly as much as is stated in the contract.

Common mistakes on the topic

Error: Concluding an agreement with a foreigner without checking his documents.

By concluding a GPC agreement with a foreign citizen who does not meet the conditions of legislative norms, the customer not only receives a fine, but also loses guarantees for the fulfillment of the obligations of the document, since it is legally invalid.

Error: Specifying the contract value in one amount

By distinguishing payment provisions for income, the cost of materials and equipment, depreciation expenses and other expenses, the customer can reduce the tax burden, namely, reduce the amount of the contractor’s personal income tax and the amount of insurance premiums payable.

What is the difference between a civil contract and an employment contract?

When hiring citizens of other states, the employer always faces a logical question: in what form is it better to conclude such an agreement - in the form of an employment contract or a civil law one? And here it is important to determine what the fundamental difference between these two types of contracts is.

Firstly, an employment contract concluded with a foreigner must be fixed-term , and its validity period cannot exceed the validity period of the work permit issued to such an employee.

As for the agreement in civil law form, it can be concluded for the duration of some paid work, for example, of a seasonal nature, or until the employee fully fulfills his obligations.

The second significant difference between the two agreements is that labor relations between a foreign employee and an employer, formalized by signing an agreement provided for by the Labor Code, should be regulated, accordingly, only by labor legislation.

In the event of concluding a civil contract, the resulting legal relations are not subject to the Labor Code.

If we talk about compliance with labor discipline and possible responsibility for it on the part of the employee, then the situation for the employee will be better if he signs a civil contract, since it will not be possible to bring him to disciplinary liability under the Labor Code, and a penalty can only be imposed in in accordance with civil law.

That is, if we consider the convenience or inconvenience of this or that type of agreement, we can say that civil law will be much more convenient for both the employer and the employee .

What is the general procedure for preparing and concluding civil contracts with foreigners invited to work?

Like any other similar document, a civil agreement has a number of stages that both the employee and the employer must go through so that such an agreement is not considered illegitimate.

First of all, both parties must prepare a package of documents clearly regulated by law, the list of which is mandatory to maintain the validity of the concluded agreement.

The key of these documents are permission to employ foreign citizens (if we are talking about the employer) and a work permit (directly for the employee). Without them, the legality of the signed document can be easily challenged, and parties who violate this legal requirement will suffer serious penalties.

The next step is to develop the text of the document itself, indicating the mandatory provisions, one of which is the validity period of the agreement being concluded.

After the contract has been developed and signed, the employee begins to perform his duties.

Civil contract with a foreign citizen, sample