When to apply the new FSBU 6/2020

By Order of the Ministry of Finance of Russia dated September 17, 2021 No. 204n, the federal accounting standard FSBU 6/2020 “Fixed Assets” was approved.

It defines the requirements for the formation in accounting of information about the organization’s fixed assets. FSBU 6/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, which was put into effect in the Russian Federation by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

As is clear, the new standard replaces the Accounting Regulations (PBU 6/01) “Accounting for fixed assets”.

In connection with the adoption of this standard, from January 1, 2022, the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance dated October 13, 2003 No. 91n.

to adopt FSBU 6/2020 from January 1, 2022 . That is, from the financial statements for 2022 . However, you can decide to use it now.

A number of new concepts have been introduced

FSBU 6/2020 introduced certain new concepts and normatively established a number of concepts that have traditionally been used in practice. Among them:

| CONCEPT | EXPLANATION |

| Book value is the original cost of an asset reduced by accumulated depreciation and impairment. | Previously the definition was not formulated |

| A group of fixed assets is a collection of fixed assets of the same type, combined based on the similar nature of their use | Previously the definition was not formulated |

| Investment property is real estate intended to be provided for temporary use for a fee and/or to generate income from an increase in its value. | Previously, the concept of investment real estate was absent. OS intended exclusively for provision for a fee for temporary possession and use or for temporary use for the purpose of generating income were reflected as part of income-generating investments in tangible assets. In connection with the introduction of the concept of “investment real estate”, the concept of “profitable investments in material assets” is not used in relation to OS. |

| Liquidation value is the amount that an organization would receive in the event of disposal of an asset (including the cost of material assets remaining from disposal) after deducting the estimated costs of disposal. Moreover, the fixed asset object is considered as if it had already reached the end of its useful life and was in a state characteristic of the end of its useful life | The concept was not previously used |

| Elements of depreciation - the useful life of an asset, its salvage value and the method of calculating depreciation | The concept was not previously used |

| Revalued value - the value of an asset after its revaluation | Previously – current (replacement) cost |

| Impairment is the condition of an asset such that its carrying amount exceeds the amount that could be received from using the asset or from selling it. | The concept was not previously used |

Objects of fixed assets have been specified

FSBU 6/2020 clarifies the characteristics characterizing fixed assets. In the standard these include:

| SIGN | EXPLANATION |

| The presence of a material form | Not previously formulated |

| Intended for use by an organization in the normal course of business in the production and/or sale of its products (goods), when performing work or providing services, for environmental protection, for temporary use for a fee, for management needs, or for use in non-profit activities organization aimed at achieving the goals for which it was created | Previously there was no indication of the possibility of use for environmental protection |

| Intended for use by an organization for a period greater than 12 months or a normal operating cycle greater than 12 months | Previously, there was also an indication that the organization does not envisage the subsequent resale of the object |

| Able to bring economic benefits (income) to the organization in the future (ensure that the non-profit organization achieves the goals for which it was created) | – |

Long-term assets for sale (previously taken into account as part of fixed assets) are excluded from the scope of application of FAS 6/2020 Since 2021, this type of assets has been taken into account in accordance with PBU 16/02 “Information on discontinued activities” (approved by order of the Ministry of Finance dated July 2, 2002 No. 66n).

As part of the operating system, investment real estate objects are separately taken into account and reflected in the financial statements.

Accounting for fixed assets and intangible assetsYulia Tryashchenko, 2021

Accounting Regulations. PBU6/01

The second most important regulatory document is the accounting provisions or PBU

Based on the Law “On Accounting”, the Accounting Regulations (PBU) have been developed. PBU is a more complete analogue of the Law “On Accounting”. PBU determines the procedure for organizing and maintaining, drawing up and presenting financial statements by legal entities, as well as the organization’s relationship with external consumers of accounting information.

Accounting Regulations (PBU) establish the principles, rules and methods for organizations to maintain records of business transactions, preparation and presentation of financial statements and are the most important regulatory documents of the second level of the system of regulatory regulation of accounting in Russia, established by the Federal Law “On Accounting”.

Accounting for fixed assets is regulated by PBU6/01, which establishes the rules for the formation in accounting of information about the fixed assets of an organization. An organization is further understood as a legal entity under the laws of the Russian Federation (with the exception of credit organizations and state (municipal) institutions).

PBU 6/01 does not apply to:

- machines, equipment and other similar items listed as finished products in the warehouses of manufacturing organizations, as goods - in the warehouses of organizations engaged in trading activities;

— items handed over for installation or to be installed that are in transit;

— capital and financial investments.

An asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

b) the object is intended to be used for a long time, i.e. a period exceeding 12 months or the normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future.

A non-profit organization accepts an object for accounting as fixed assets if it is intended for use in activities aimed at achieving the goals of creating this non-profit organization (including in business activities carried out in accordance with the legislation of the Russian Federation

The useful life is the period during which the use of an item of fixed assets brings economic benefits (income) to the organization. For certain groups of fixed assets, the useful life is determined based on the quantity of products (volume of work in physical terms) expected to be received as a result of the use of this object.

Fixed assets include: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer equipment, vehicles, tools, production and household equipment and supplies, working, productive and breeding livestock, perennial plantings, on-farm roads and other relevant objects.

The following are also taken into account as part of fixed assets: capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets; land plots, environmental management objects (water, subsoil and other natural resources).

Fixed assets intended exclusively for provision by an organization for a fee for temporary possession and use or for temporary use for the purpose of generating income are reflected in accounting and financial statements as part of profitable investments in tangible assets.

Assets in respect of which the conditions stipulated by PBU6/01 are met and the value is within the limit established in the organization’s accounting policy, but not more than 40,000 rubles per unit, may be reflected in accounting and financial statements as part of inventories. In order to ensure the safety of these objects in production or during operation, the organization must organize proper control over their movement.

The accounting unit for fixed assets is an inventory item. An inventory item of fixed assets is an object with all its fixtures and accessories, or a separate structurally isolated item intended to perform certain independent functions, or a separate complex of structurally articulated items that constitute a single whole and are intended to perform a specific job. A complex of structurally articulated objects is one or more objects of the same or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

If one object has several parts, the useful lives of which differ significantly, each such part is accounted for as an independent inventory item. An item of fixed assets owned by two or more organizations is reflected by each organization as part of fixed assets in proportion to its share in the common property.

Another important document is the Methodological Guidelines for Accounting for Fixed Assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, dated November 27, 2006 No. 156n, dated October 25, 2010 No. 132n, dated December 24, 2010 No. 186n). The guidelines determine the procedure for organizing accounting of fixed assets in accordance with the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n (registered with the Ministry of Justice of the Russian Federation on April 28, 2001 g., registration number 2689). Based on these Guidelines, organizations develop internal regulations, instructions, and other organizational and administrative documents necessary for organizing the accounting of fixed assets and monitoring their use. The following documents can be approved:

— forms of used primary accounting documents for receipt, disposal and internal movement of fixed assets and the procedure for their registration (drawing), as well as document flow rules and technology for processing accounting information;

— a list of officials of the organization who are responsible for the receipt, disposal and internal movement of fixed assets;

— the procedure for monitoring the safety and rational use of fixed assets in the organization.

To calculate the amount of depreciation of fixed assets (FPE), it is necessary to establish not only the depreciation method, but also to determine the useful life of a particular object. This period, as a general rule, is determined by the Government-approved Classification of fixed assets included in depreciation groups. Since 01/01/2017, the updated Classifier has been in effect (clause 2 of Government Decree No. 640 dated 07/07/2016). The need to change it was caused by the entry into force of the new OKOF on January 1, 2017. In the Tax Classifier, types of fixed assets are classified into depreciation groups in accordance with their OKOF codes. Then changes to the Classifier were made by Decree of the Government of the Russian Federation of April 28, 2018 N 526. And although they were approved only in April, they apply to legal relations that arose from January 1, 2018.

The procedure for accounting for low-value items has been changed

FAS 6/2020 establishes a general approach to the definition of low-value assets that have signs of fixed assets, but which can not be taken into account as fixed assets: objects are considered for accounting purposes as low-value based on the materiality of information about them (previously, the value of such assets did not exceed 40,000 rubles for a unit). Based on this approach, the organization independently sets a limit on the value of low-value assets.

Costs for the acquisition and creation of such assets are recognized as expenses of the period in which they were incurred (previously, these assets were reflected as part of inventories). At the same time, the organization is obliged to ensure proper control of their availability and movement.

The procedure for determining inventory objects has been clarified

The traditional approach to determining inventory items of fixed assets is supplemented by recognition as an independent inventory item:

| AN OBJECT | EXPLANATION |

| Each part of one fixed asset, the cost and useful life of which differ significantly from the cost and useful life of the object as a whole | Earlier - with a significant difference only in the useful life |

| Significant expenses of the organization for repairs, technical inspection, maintenance of OS facilities with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months | Previously – included in period expenses |

IV. Restoration of fixed assets

26. Restoration of a fixed asset object can be carried out through repair, modernization and reconstruction.

27. Costs for the restoration of fixed assets are reflected in the accounting records of the reporting period to which they relate. At the same time, the costs of modernization and reconstruction of a fixed asset object after their completion increase the initial cost of such an object if, as a result of modernization and reconstruction, the initially adopted standard performance indicators (useful life, power, quality of use, etc.) of the object are improved (increased) fixed assets. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

28. Point deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Tax reporting on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

Depreciation rules changed

Here are the main innovations in matters of depreciation of fixed assets according to FAS 6/2020:

| NEW | EXPLANATION |

| Non-profit organizations charge depreciation of fixed assets in the general manner | Previously, depreciation was not accrued, but depreciation amounts were accrued in off-balance sheet accounting |

| Depreciation calculation | Begins from the moment the object is recognized in accounting and stops from the moment it is deregistered (previously – depreciation began on the 1st day of the month following the month the object was recognized in accounting, and stopped on the 1st day of the month following the month the object was written off from accounting). The previously used approach to determining the point at which depreciation begins and ends is also acceptable. Not suspended in cases of downtime or temporary cessation of use of the OS (previously suspended during the conservation of the object for a period of more than 3 months, as well as for the period of restoration of the object, the duration of which exceeded 12 months). Suspended when the liquidation value of the asset becomes equal to or exceeds its book value. If subsequently the liquidation value of such an object becomes less than its book value, depreciation on it is resumed ( previously, depreciation was accrued until its value was fully paid off or it was written off from accounting). |

| General requirements have been established for the method of depreciation of fixed assets chosen by the organization | Previously, the requirements were not formulated. The chosen depreciation method should:

|

| When applying the reducing balance method of depreciation, the organization independently determines the formula for calculating the amount of depreciation for the reporting period. In this case, the formula should ensure a systematic reduction of this amount as the useful life of this object expires | Previously, the annual amount of depreciation was determined based on the residual value of the object at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this object and the coefficient established by the organization in an amount not exceeding 3 |

| For the depreciation method proportional to the quantity of products (volume of work in kind), a ban on determining the amount of depreciation for the reporting period based on the amount of receipts (revenue or other similar indicator) from the sale of products (work, services) produced (performed, provided) using this OS | Previously the ban was not formulated |

| Depreciation elements of an asset are subject to verification for compliance with the conditions of use of this object. Such a check is carried out at the end of each reporting year, as well as upon the occurrence of circumstances indicating a possible change in the elements of depreciation. Based on the results of the inspection, if necessary, a decision is made to change the relevant depreciation elements. | Previously, the method of calculating depreciation and the useful life, as a rule, were not subject to change |

| The basis for calculating the amount of depreciation for the reporting period has been changed: this amount is calculated based on the book value of fixed assets, remaining useful life, and adjusted liquidation value | Previously – based on the original cost of the fixed asset and the total useful life |

| The amount of depreciation of an asset for the reporting period is determined in such a way that by the end of the depreciation period the book value of this asset becomes equal to its liquidation value | Previously – equal to zero |

III. Depreciation of fixed assets

17. The cost of fixed assets is repaid through depreciation, unless otherwise established by these Regulations.

For objects of fixed assets used for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization, which are mothballed and not used in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use, depreciation is not charged. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Depreciation is not charged for fixed assets of non-profit organizations. Based on them, information on the amounts of depreciation accrued in a straight-line manner in relation to the procedure given in paragraph 19 of these Regulations is compiled on the off-balance sheet account. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

For housing assets that are accounted for as part of profitable investments in material assets, depreciation is calculated in accordance with the generally established procedure. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

Objects of fixed assets whose consumer properties do not change over time are not subject to depreciation (land plots; environmental management facilities; objects classified as museum objects and museum collections, etc.). (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

18. Depreciation of fixed assets is calculated in one of the following ways:

linear method;

reducing balance method;

method of writing off value by the sum of the numbers of years of useful life;

method of writing off cost in proportion to the volume of products (works).

The use of one of the methods of calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group.

Paragraph - Deleted. (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

19. The annual amount of depreciation charges is determined:

with the linear method - based on the original cost or (current (replacement) cost (in case of revaluation) of an object of fixed assets and the depreciation rate calculated based on the useful life of this object;

with the reducing balance method - based on the residual value of the fixed asset item at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this item and a coefficient not higher than 3, established by the organization; (as amended by Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 N 147n)

when writing off the cost by the sum of the numbers of years of the useful life - based on the original cost or (current (replacement) cost (in case of revaluation) of an object of fixed assets and the ratio, the numerator of which is the number of years remaining until the end of the useful life of the object, and the denominator is the sum of the numbers of years of the useful life of the object.

During the reporting year, depreciation charges for fixed assets are accrued monthly, regardless of the accrual method used, in the amount of 1/12 of the annual amount.

For fixed assets used in organizations with a seasonal nature of production, the annual amount of depreciation charges on fixed assets is accrued evenly throughout the period of operation of the organization in the reporting year.

When writing off the cost in proportion to the volume of production (work), depreciation charges are calculated based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial cost of the fixed asset item and the estimated volume of production (work) for the entire useful life of the fixed asset item.

An organization that has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, can: (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

accrue the annual amount of depreciation at a time as of December 31 of the reporting year or periodically during the reporting year for periods determined by the organization; (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

charge depreciation of production and business equipment at a time in the amount of the original cost of objects of such assets when they are accepted for accounting. (as amended by Order of the Ministry of Finance of the Russian Federation dated May 16, 2016 N 64n)

20. The useful life of an item of fixed assets is determined by the organization when accepting the item for accounting.

The useful life of a fixed asset item is determined based on:

the expected life of the facility in accordance with its expected productivity or capacity;

expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

regulatory and other restrictions on the use of this object (for example, rental period).

In cases of improvement (increase) of the initially adopted standard indicators of the functioning of a fixed asset object as a result of reconstruction or modernization, the organization revises the useful life of this object.

21. Accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting.

22. The accrual of depreciation charges for an object of fixed assets ceases from the first day of the month following the month of full repayment of the cost of this object or the write-off of this object from accounting.

23. During the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months, as well as during the period of restoration of the object, the duration of which exceeds 12 months.

24. Accrual of depreciation charges on fixed assets is carried out regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period to which it relates.

25. The amounts of accrued depreciation on fixed assets are reflected in accounting by accumulating the corresponding amounts in a separate account.

Revaluation rules changed

After recognition, an item of fixed assets can be reflected in accounting at a revalued cost. At the same time, the value of such an object is regularly revalued so that it is equal to or does not differ significantly from its fair value ( previously , the object was revalued at its current (replacement) cost).

Fair value is determined in the manner prescribed by IFRS 13 “Fair Value Measurement”, put into effect in Russia by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

All have the right to revaluate their assets ( previously only commercial organizations).

Revaluation is carried out as the fair value of fixed assets changes ( previously - no more than once a year at the end of the reporting period). At the same time, it is permissible to decide to conduct a revaluation no more than once a year (as of the end of the reporting year).

When carrying out a revaluation, along with a proportional recalculation of the original cost and accumulated depreciation of an asset, a method is acceptable in which the initial cost is first reduced by the amount of depreciation accumulated on it on the date of revaluation, and then the resulting amount is recalculated so that it becomes equal to the fair value of this object ( previously - only proportional recalculation).

The amount of accumulated revaluation can be written off to the organization’s retained earnings in one of two ways :

- One-time when writing off an overvalued asset.

- As depreciation accrues on such an object.

Previously - only at a time when an object is written off.

Revaluation of investment real estate is carried out in a manner different from the procedure for revaluation of other fixed assets. Main differences:

- revaluation is carried out at each reporting date;

- the initial cost of the object (including previously revalued) is recalculated so that it becomes equal to its fair value;

- revaluation or depreciation of an object is included in the financial result of the organization’s activities as income or expense of the period in which the revaluation of this object was carried out;

- revalued objects are not subject to depreciation.

An entity that decides to value investment property at a revalued value must apply this valuation method to all investment properties.

PBU 6/01

7. Fixed assets are accepted for accounting at their original cost.

8. The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, excluding value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The actual costs for the acquisition, construction and production of fixed assets are:

amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use (paragraph supplemented starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see .previous edition);

amounts paid to organizations for carrying out work under construction contracts and other contracts;

amounts paid to organizations for information and consulting services related to the acquisition of fixed assets;

the paragraph was excluded starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see the previous edition;

customs duties and customs fees (the paragraph has been supplemented since the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see the previous edition);

non-refundable taxes, state duty paid in connection with the acquisition of fixed assets (paragraph supplemented starting from the 2006 financial statements by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition);

remunerations paid to the intermediary organization through which the fixed asset was acquired;

other costs directly related to the acquisition, construction and production of fixed assets (paragraph as amended, put into effect starting from the 2006 financial statements by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition).

General and other similar expenses are not included in the actual costs of acquisition, construction or production of fixed assets, except when they are directly related to the acquisition, construction or production of fixed assets.

The paragraph has been excluded from the financial statements since 2007 by Order of the Ministry of Finance of Russia dated November 27, 2006 No. 156n. – See previous edition.

9. The initial cost of fixed assets contributed to the contribution to the authorized (share) capital of the organization is recognized as their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

10. The initial cost of fixed assets received by an organization under a gift agreement (free of charge) is recognized as their current market value on the date of acceptance for accounting as investments in non-current assets (the clause has been supplemented since the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n – see previous edition).

11. The initial cost of fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of the assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

If it is impossible to determine the value of assets transferred or to be transferred by the organization, the value of fixed assets received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar fixed assets are acquired in comparable circumstances.

12. The initial cost of fixed assets accepted for accounting in accordance with clauses 9, 10 and 11 is determined in relation to the procedure given in clause 8 of these Regulations (clause as amended, put into effect starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n, - see previous edition).

13. Capital investments in perennial plantings and for radical land improvement are included in fixed assets annually in the amount of costs related to the areas accepted for operation in the reporting year, regardless of the completion date of the entire complex of works.

14. The cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by the legislation of the Russian Federation and these Regulations.

A change in the initial cost of fixed assets, in which they are accepted for accounting, is allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets (paragraph supplemented, starting with the financial statements of 2002, by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n, - see previous edition).

15. A commercial organization may no more than once a year (at the beginning of the reporting year) revalue groups of similar fixed assets at current (replacement) cost (paragraph as amended, put into effect starting with the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 year No. 147n, - see previous edition).

When making a decision on revaluation of such fixed assets, it should be taken into account that subsequently they are revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

Revaluation of an object of fixed assets is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object (the paragraph was additionally included starting from the financial statements of 2002 by Order of the Ministry of Finance of Russia dated May 18, 2002 year No. 45n).

The results of the revaluation of fixed assets carried out as of the first day of the reporting year are subject to reflection in accounting separately. The results of the revaluation are not included in the financial statements of the previous reporting year and are accepted when generating the balance sheet data at the beginning of the reporting year (the paragraph was additionally included starting from the financial statements of 2002 by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n).

The amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous reporting periods and attributed to the account for accounting for retained earnings (uncovered loss), is credited to the account for accounting for retained earnings (uncovered loss) (paragraph as amended, put into effect starting from the financial statements 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition).

The amount of depreciation of an item of fixed assets as a result of revaluation is credited to the account of retained earnings (uncovered loss). The amount of depreciation of an object of fixed assets is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this object carried out in previous reporting periods. The excess of the amount of depreciation of an object over the amount of its revaluation, credited to the organization's additional capital as a result of revaluation carried out in previous reporting periods, is charged to the account of retained earnings (uncovered loss). The amount attributed to the account of retained earnings (uncovered loss) must be disclosed in the organization’s financial statements (paragraph as amended, put into effect starting from the 2002 financial statements by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n - see previous edition ).

When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings.

16. The item has been excluded from the financial statements since 2007 by Order of the Ministry of Finance of Russia dated November 27, 2006 No. 156n. – See previous edition.

The composition of the information disclosed in the reporting has been clarified

FSB 6/2020 supplemented the list of information about fixed assets disclosed in accounting reports with data on:

- the book value of investment property at the beginning and end of the reporting period;

- the result of disposal of fixed assets for the reporting period;

- as a result of revaluation of fixed assets included in income or expenses of the reporting period, capital in the reporting period;

- as a result of impairment of fixed assets and reversal of impairment included in expenses or income of the reporting period; the amount of impairment allocated in the reporting period to reduce the accumulated revaluation result; other information on impairment of fixed assets provided for by IAS 36 “Impairment of Assets”;

- the book value of suitable but not used fixed assets, when this is not related to the seasonal characteristics of the organization’s activities, as of the reporting date;

- the book value of fixed assets in respect of which there are restrictions on property rights, including fixed assets pledged, as of the reporting date;

- methods of valuing fixed assets (by groups);

- elements of depreciation and their changes ( previously - only about useful life and methods of calculating depreciation);

- recognized as income in profit (loss) is the amount of compensation for losses associated with the depreciation or loss of fixed assets provided to the organization by other persons.

additional disclosure have been established for fixed assets measured at revalued amounts In particular:

- date of the last revaluation;

- information about engaging an independent appraiser;

- methods and assumptions adopted in determining fair value, incl. information on the use of observed market prices;

- the book value of the revalued groups of fixed assets, which would be reflected in the accounting records if they were assessed at their historical cost, as of the reporting date;

- methods for recalculating the initial cost of revalued groups of fixed assets;

- the amount of accumulated revaluation of fixed assets not written off to retained earnings, indicating the method of its write-off.

Filling out reports using examples

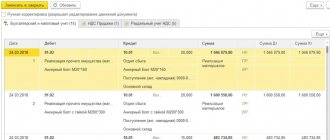

Let's look at an example of how to divide and report deferred tax that does and does not affect accounting profit or loss.

The fixed asset was accepted for accounting in December 2021. The initial cost is 12,000 thousand rubles, the useful life is 60 months.

For 12 months of 2021, depreciation in the amount of 2,400 thousand rubles was accrued in accounting. The residual value as of December 31, 2021 amounted to RUB 9,600 thousand.

In tax accounting, an expense was recognized in the form of a depreciation bonus - 360 thousand rubles. and for the year they accrued depreciation in the amount of 2328 thousand rubles. Residual value as of December 31, 2021 – 9312 thousand rubles.

As of December 31, 2021, the organization carried out a revaluation in accounting, as a result, the amount of the revaluation amounted to 960 thousand rubles. After revaluation, the initial cost of the fixed asset in accounting is equal to 13,200 thousand rubles, accrued depreciation is 2,640 thousand rubles.

Data for the facility as of December 31, 2021 are presented in the table below.

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 9600 | 9312 | – | 288 |

| Revaluation amount | 960 | – | – | 960 |

Let's assume that the organization calculates the current income tax based on the declaration. UR (UD), PNR, PND does not form. Deferred taxes are reflected in account 99:

Debit 99 subaccount “Deferred income tax” Credit 77

- RUB 57,600 (RUB 288 thousand × 20%) – ONO was formed;

Debit 83 subaccount “Additional valuation of fixed assets” Credit 77

- 192,000 rub. (960 thousand rubles × 20%) - ONO was formed.

In the statement of financial results, the organization will reflect IT in two amounts - 57.6 thousand rubles. and 192 thousand rubles. If the first amount, together with the current tax, will reduce profit before tax, then the second amount will reduce the total financial result.

In the balance sheet, the organization will reflect the total amount of IT at the end of the reporting period. At the same time, it will reduce the amount of revaluation by 192 thousand rubles. – the amount of IT arising in connection with the revaluation. Consequently, under the item “revaluation” the organization will reflect the balance in account 83.

In accounting for 2021, the company accrued depreciation in the amount of 2,640 thousand rubles, excluding revaluation - 2,400 thousand rubles. The residual value as of December 31, 2021 amounted to 7,920 thousand rubles, excluding revaluation - 7,200 thousand rubles.

In tax accounting for 2021, depreciation was accrued in the amount of 2,328 thousand rubles. The residual value as of December 31, 2021 amounted to RUB 6,984 thousand.

Data on the object as of December 31, 2021:

| Indicator, thousand rubles. | Cost in accounting | Cost in tax accounting | Deductible temporary difference | Taxable temporary difference |

| OS cost excluding revaluation | 7200 | 6984 | – | 216 |

| Revaluation amount | 720 | – | – | 720 |

The organization reduced IT with postings:

Debit 77 Credit 99 subaccount “Deferred income tax”

- 14,400 rub. (RUB 288 thousand – RUB 216 thousand) – IT was reduced;

Debit 77 Credit 83 subaccount “Additional valuation of fixed assets”

- 48,000 rub. (960 thousand rubles – 720 thousand rubles) – IT has been reduced.

In the financial results report, the organization will reflect IT in two amounts - 14.4 thousand rubles. and 48 thousand rubles. This time, the change in IT will be with a “+” sign, since you are reducing the previously generated indicators.

In the balance sheet, the amount of IT at the end of the reporting period will decrease by 62.4 thousand rubles. (14.4 thousand rubles + 48 thousand rubles). At the same time, the amount of revaluation will increase by 48 thousand rubles. compared to the previous period. In the future, an increase in revaluation will occur annually by the same amount as a result of a decrease in the previously formed IT and in three years will reach a value of 960 thousand rubles. It was precisely this amount of revaluation that was initially reflected in accounting as a result of the revaluation of fixed assets.

A number of other rules have been clarified

FSBU 6/2020 also clarified a number of rules for accounting for fixed assets:

| WHAT IS SPECIFIED | EXPLANATION |

| Prospective reflection of the consequences of changing the method of assessing fixed assets is provided - that is, without recalculating data for previous periods | Previously – not provided |

| The procedure for reflecting changes in the amount of the estimated liability for future dismantling, disposal of an asset and restoration of the environment, taken into account in the initial cost of this object, has been changed | A change in this amount (without taking into account interest) increases or decreases the original cost of the object. At the same time, if an object is accounted for at a revalued value, then the accumulated revaluation for it (if any) is adjusted by the amount of the change in its initial value. The amount of such adjustment is included in the comprehensive financial result without inclusion in profit or loss. Previously , a change in the amount of an estimated liability was attributed to the financial result of the period and did not change the initial cost and the result of the revaluation. |

| The list of cases of disposal of fixed assets and its inability to bring economic benefits in the future has been supplemented | These are the following cases:

Previously – not formulated |

Composition of temporary differences

The Ministry of Finance has expanded the list of situations that result in temporary differences. In particular, they now directly include estimated liabilities, which are formed only in accounting, or reserves, which are only in tax accounting (clause 8 of PBU 18/02 as amended in 2021).

It makes a difference when an organization:

- revalues assets;

- creates reserves according to rules that differ in accounting and tax accounting;

- recognizes estimated liabilities.

Please note the peculiarity of accounting for differences in the revaluation of non-current assets. If, as a result of revaluation, we reflect in accounting for the first time a depreciation of a fixed asset or an intangible asset, then we make entries in correspondence with account 91. And this amount gives us a permanent difference. When we compare the book value of a non-current asset after revaluation and its tax value, another difference appears. We must view it as temporary. That is, as a result of markdown, we will have two differences at once - both permanent and temporary.

The amount of the initial revaluation of fixed assets is charged to account 83 “Additional capital”. In this case, a permanent difference does not arise: there is no income either in accounting or tax accounting. A temporary difference will appear when comparing the book value of the overvalued object and the tax value.

The results of those operations that do not fall into account 99 are a new type of difference. Differences are formed according to them if these transactions do not form an accounting profit or loss, but are taken into account when taxing profits in another or other reporting periods. For example, these are transactions that are reflected in accounting in account 83 or 84 “Retained earnings (uncovered loss).”

Here are some other cases when the result of a transaction is not reflected in the profit of the current period:

- revaluation of fixed assets and intangible assets, if there was no depreciation before, or their depreciation in subsequent years if there is an revaluation (account 83);

- exchange differences that arise when translating the financial statements of a foreign subsidiary;

- correction of a significant error in accounting after approval of the financial statements (account 84);

- changes in accounting policies that entail retrospective recalculation (account 84).

As a result of such transactions, the carrying amount of assets and liabilities changes, and the adjustment is applied to account 83 or account 84. When comparing the carrying amount

There will be a temporary difference between such assets and liabilities and their tax value.

Simplified methods of accounting for fixed assets

Organizations that, in accordance with the legislation of the Russian Federation, have the right to use simplified methods of accounting, can:

- not to apply the procedure for adjusting the initial cost of fixed assets in connection with a change in the amount of the estimated liability for future dismantling, disposal of the facility and environmental restoration, provided for by FAS 6/2020;

- refuse to test fixed assets for impairment - that is, evaluate them at their book value as of the reporting date;

- disclose information about fixed assets in accounting reports to a limited extent.

Transitional provisions

As the Ministry of Finance notes, the consequences of changes in the accounting policies of an organization in connection with the start of application of FAS 6/2020 are reflected retrospectively - that is, as if this standard had been applied from the moment the facts of economic life affected by it arose.

To facilitate the transition to the new procedure for accounting for fixed assets in the financial statements, starting from which FAS 6/2020 is applied, the organization may not recalculate comparative indicators related to fixed assets for periods preceding the reporting period. To do this, you need to make a one-time adjustment to their book value at the beginning of the reporting period (the end of the period preceding the reporting period). For the purposes of such an adjustment, the carrying value of fixed assets should be considered their original cost (taking into account revaluations), recognized before the application of FAS 6/2020 in accordance with the previously applied accounting policy, less accumulated depreciation.

In this case, accumulated depreciation is calculated in accordance with FAS 6/2020 based on the specified initial cost, liquidation value and the ratio of the expired and remaining useful life, determined in accordance with FAS 6/2020.

The chosen method of reflecting the consequences of changes in accounting policies is disclosed in the first financial statements prepared using FAS 6/2020.

Source: information message of the Ministry of Finance dated November 3, 2020 No. IS-accounting-29.

Read also

30.01.2019

Examples of calculating ONA and ONO on accounts 83 and 84

When correcting significant errors, a temporary difference can only arise if two conditions are met simultaneously: the error exists only in accounting and it was corrected through account 84.

For example, an organization incorrectly determined the useful life of a fixed asset in accounting and incorrectly calculated depreciation on it during the past year. Instead of 1000 thousand rubles. for the year, depreciation was accrued only for 600 thousand rubles.

The accountant corrected the error in accounting by posting:

Debit 84 Credit 02

- 400,000 rub. – additional depreciation accrued for the previous year.

There were no errors in tax accounting. Consequently, due to the correction of the error, a deductible difference will arise, on the basis of which the accountant will form IT:

Debit 09 Credit 84

- 80,000 rub. (400 thousand rubles × 20%) - ONA was formed.

In the future, the organization reduces IT by posting to the debit of account 99 and credit 09. This amount of IT will still go to account 84, but the accountant will not have to make a separate calculation for calculating temporary differences.

Apply the same principle when retrospectively recalculating due to changes in accounting policies. Temporary differences will arise if the recalculation concerns only accounting and affects account 84. For example, now organizations will reflect those deferred taxes that they must complete in connection with the new rules. Reflect them by counting 84.

Please note that if an organization has the right to choose the method of generating current tax, then for deferred taxes the accounting procedure does not provide any alternative. That is, in relation to revaluation, deferred taxes should be reflected in account 83, and when correcting errors or in case of retrospective recalculation - in account 84.