What and how to be guided by

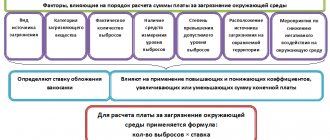

The NVOS fee rates in 2021 are determined by Resolution of the Cabinet of Ministers of Russia No. 913 dated September 13, 2021, as last amended on June 29, 2018, which is valid from 2021 (hereinafter referred to as Resolution No. 913).

The main feature is that the payment rates for NVOS for 2021 are set the same as in 2021 (by Decree of the Government of the Russian Federation of June 29, 2018 No. 758). The only thing is that in addition to other coefficients it is necessary to apply a coefficient of 1.04.

Also see “Who pays the environmental fee from 2021: clarification”.

In general, the NVOS rates are provided for by Resolution No. 913 for three situations:

- For emissions of pollutants into the air from stationary sources (159 positions).

- For discharges of pollutants into water bodies (159 items).

- When placing waste (5 positions).

| Types of pollutants | Payment rates for 1 ton of pollutants/production and consumption waste | |

| 2018 and 2021 | ||

Payment deadlines for environmental pollution in 2020

The deadline for payment for environmental pollution in 2021, with the exception of small and medium-sized businesses, is no later than the 20th day of the month following the reporting quarter. For the fourth quarter of 2021, payment does not need to be transferred.

Advance payment for each quarter of 2021 = ¼ of the payment amount for the previous year.

Let's give an example. The payment amount for 2021 was 170,000 rubles. Based on paragraph 3 of Article 16.4 of the Law of January 10, 2002 No. 7-FZ, it is necessary to transfer advance payments in this amount within the following terms:

- for the 1st quarter - no later than April 20, 2021 - 42,500 rubles;

- for six months - no later than July 20, 2021 - 42,500 rubles;

- for 9 months - no later than October 20, 2021 - 42,500 rubles.

Based on clause 3 of Art. 16.4 of Law No. 7-FZ of January 10, 2002, the total amount of payment for negative environmental impact for 2021 must be transferred to the budget no later than March 1, 2021.

This payment procedure led to overpayments of tax.

According to amendments to Law No. 7-FZ, which was supposed to come into effect on January 1, 2018, individual entrepreneurs or organizations obligated to pay quarterly fees for NVOS have the right to choose which of three ways to calculate and pay the amount of the quarterly advance payment:

- 1/4 of the amount of the tax assessment fee paid for the previous year.

- 1/4 of the amount of payment for the NEE, calculated on the basis of established standards for permissible emissions, discharges of pollutants, temporarily agreed upon emissions, temporarily agreed upon discharges and limits on the disposal of production and consumption waste.

- Equal to the amount of payment for environmental impact assessment calculated for the actual negative impact on the environment in the past quarter based on industrial environmental control data.

In the declaration of payment for the tax assessment, you will need to indicate which of the three payment and payment methods is chosen by the individual entrepreneur or organization.

And after two years of waiting for these much-needed changes, on December 27, 2019, Federal Law No. 450-FZ was adopted, which amended Article 16.4 of Federal Law No. 7-FZ “On Environmental Protection”.

Article 16.4 of this law looks like this:

Article 16.4. Procedure and deadlines for paying fees for negative environmental impact

Persons obligated to pay a fee have the right to choose one of the following methods for determining the amount of the quarterly advance payment for each type of negative environmental impact for which a fee is charged:

1. In the amount of one-fourth of the amount of the fee for negative impact on the environment payable (taking into account the adjustment of the amount of the fee carried out in accordance with paragraphs 10 - 12.1 of Article 16.3 of this Federal Law) for the previous year.

2. In the amount of one-fourth of the amount of payment for negative impact on the environment, in the calculation of which the payment base is determined based on the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards, temporarily permitted emissions, temporarily permitted discharges, limits on disposal of production and consumption waste.

3. In the amount determined by multiplying the payment base, which is determined on the basis of industrial environmental control data on the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of disposed production and consumption waste in the previous quarter of the current reporting period, by corresponding rates of payment for negative impact on the environment using the coefficients established by Article 16.3 of this Federal Law.”

Therefore, now it is possible to choose the appropriate option and avoid overpaying funds.

Small and medium-sized businesses do not calculate or make advance payments for the tax assessment. For this category of business, a one-time payment deadline has been determined until March 1, 2020 for 2021.

Rates for air emissions from stationary sources

1. Nitrogen dioxide 138.82. Nitrogen oxide 93.53. Nitric acid 36.64. Ammonia 138.85. Ammonium nitrate (ammonium nitrate) 206. Barium and its salts (in terms of barium) 1108.17. Benz(a)pyrene 5472968.78 .Boric acid (orthoboric acid) 2759. Vanadium pentoxide 2736.810. Suspended particles PM1093.511. Suspended particles PM2.5182.412. Suspended substances 36.613. Hydrogen bromide (hydrobromide) 56.114. Arsenic hydrogen (arsine) 2736.815.V hydrogen phosphorous (phosphine) 5473.516. Hydrogen cyanide 547.417. Sulfur hexafluoride 0.318. Dialuminum trioxide (in terms of aluminum) 442.819. Dioxins (polychlorinated dibenzo-p-dioxins and dibenzofurans) in terms of 2,3,7,8- tetrahlordibenzo-1,4-dioxin1340000000020. Diectilet (in terms of mercury) 18244.121. Trichloride yield (in terms of iron) 1369.722. Solid fuel zools15,123. Mazeta TPP (in terms of vanadium) 221424. its compounds 14759.325. Sodium carbonate (disodium carbonate) 138.826. Terephthalic acid 5473.527. Cobalt and its compounds (cobalt oxide, cobalt salts in terms of cobalt) 442828. Nickel, nickel oxide (in terms of nickel) 5473.529. Nickel soluble salts (in terms of nickel) 27364.830. Magnesium oxide 45.431. Manganese and its compounds 5473.532. Copper, copper oxide, copper sulfate, copper chloride (in terms of copper) 5473.533. Methane 10834. Methyl mercaptan, ethyl mercaptan 54729, 735. Arsenic and its compounds, except arsenic hydrogen 1823.636. Ozone 182.437. Inorganic dust containing silicon dioxide in percentage: above 70 percent 109.570 - 20 percent 56.1 below 20 percent 36.638. Mercury and its compounds, except diethylmercury 18244.139 .Lead and its compounds, except tetraethyl lead (in terms of lead) 18244.140. Hydrogen sulfide 686.241. Carbon disulfide 1094.742. Sulfuric acid 45.443. Sulfur dioxide 45.444. Tellurium dioxide 1094745. Tetraethyl lead 136824.246. Carbon oxide1 ,647.Phosgene1823, 648. Phosphorus anhydride (diffosphorus pentaccis) 109,549. Gaseous fluorids (hydrofactoride, tetraftoride silicon) (recalculating to fluorine) 1094.750. Hardfront. Solid fluoride181.651.fluorous hydrogen, soluble fluorides547,452. Chalor181.653. -chlorous hydrogen 29,954. Chloroprene 2736.855. Chromium (Cr+6) 3647.256. Saturated hydrocarbons C1 – C5 (excluding methane) 10857. Saturated hydrocarbons C6 – C100.158. Saturated hydrocarbons C12 – C1910.859. Cyclohexane 3.260. Amylenes (mixture of isomers) 3.261.Butylene 6.762.1,3-Butadiene (divinyl) 6.763.Heptene 93.564.Propylene 1.665.Ethylene 1.666.Alpha-methylstyrene 138.867.Benzene 56.168.Dimethylbenzene (xylene) (mixture of meta-, ortho- and para-isomers) 29.969. Isopropylbenzene (cumene) 392.570. Methylbenzene (toluene) 9.971. Furniture solvent (AMP-3) (toluene control) 9.972.1,3,5-Trimethylbenzene (mesitylene) 56.173. Phenol 1823.674. Ethylbenzene 27575. Ethylenebenzene (styrene) 27 36, 876. Naphthalene 1823,677. Bromobenzene 182,478.1-Bromoheptane (heptyl bromide) 547,479.1-Bromodecane (decyl bromide) 547,480.1-Bromo-3-methylbutane (isoamyl bromide) 547,481.1-Bromo-2-methylpropane (isobutyl bromide)5 47,482.1-Bromopentane (amyl bromide )547,483.1-Bromopropane (propyl bromide)547,484.2-Bromopropane (isopropyl bromide)547,485.Dichloroethane10,886.Dichlorofluoromethane (freon 21)21,687.Difluorochloromethane (freon 22)0,588.1,2-Dichloropropane47,58 9. Methylene chloride 2.290. Tetrachlorethylene (perchlorethylene) 93.591.Tetrafluoroethylene13.492.Trichloromethane (chloroform)181.693.Trichlorethylene10.894.Tribromomethane (bromoform)45.495.Tetrachloromethane (carbon tetrachloride)9.996.Chlorobenzene56.197.Chloroethane (ethyl chloride)29 .998.Epichlorohydrin 29.999.Hydroxymethylbenzene (cresol, mixture of isomers : ortho-, meta-, para-) 275100. Amyl alcohol 547.4101. Butyl alcohol 56.1102. Isobutyl alcohol 56.1103. Isooctyl alcohol 36.6104. Isopropyl alcohol 9.9105. Methyl alcohol 13.4106. Propyl alcohol 20107. Ethyl alcohol y1.1108. Cyclohexanol 93.5109. Terephthalic acid dimethyl ether 547.4110. Dinyl (mixture of 25% diphenyl and 75% diphenyl oxide) 547.4111. Diethyl ether 16112. Methylal (dimethoxymethane) 36.6113. Ethylene glycol monoisobutyl ether (butyl cellosolve) 2011 4.Butyl acrylate (butyl ether of acrylic acids) 365.8115. Butyl acetate 56.1116. Vinyl acetate 36.6117. Methyl acrylate (methylprop-2-enoate) 442.8118. Methyl acetate 80.1119. Ethyl acetate 56.1120. Acrolein 181.6121. Butyraldehyde 365.8122. Acetaldehyde 547.4123. Formaldehyde 1823.6124 .Acetone 16.6125. Acetophenone (methyl phenyl ketone) 1823.6126. Methyl ethyl ketone 56.1127. Wood alcohol solvent grade A (acetone ether) (acetone control) 46.5128. Wood alcohol solvent grade E (ether acetone) (acetone control) 80.1129. Cyclohex anon138 ,8130. Maleic anhydride (vapor, aerosol) 106.8131. Acetic anhydride 181.6132. Phthalic anhydride 56.1133. Dimethylformamide 181.6134. Epsilon-caprolactam (hexahydro-2H-azepin-2-one) 93.5135. Acrylic acid (prop. -2-enoic acid) 138.8136. Valeric acid 547.4137. Caproic acid 1094.7138. Butyric acid 547.4139. Propionic acid 365.8140. Acetic acid 93.5141. Formic acid 45.4142. Isopropylbenzene hydroperoxide a (cumene hydroperoxide) 365.8143. Propylene oxide 69.4144. Ethylene oxide 181.6145. Dimethyl sulfide 69.4146. Aniline 181.6147. Dimethylamine 1094.7148. Triethylamine 40.1149. Nitrobenzene 686.2150. Acrylonitrile 181.6151. N, N1-Dimethylacetamide 934 ,5152.Toluene diisocyanate 275153.Gasoline (petroleum, low sulfur in in terms of carbon) 3.2154. Shale gasoline (in terms of carbon) 109.5155. Kerosene 6.7156. Mineral oil 45.4157. Turpentine 6.7158. Solvent naphtha 29.9159. White spirit 6.7Rates for discharges of pollutants into water bodies

1. Acrylonitrile (acrylic acid nitrile) 73553.22. Aluminum 18388.33. Alkylbenzylpyridinium chloride 8499604. Alkyl sulfonates 1192.35. Ammonium ion 1190.26. Ammonia 14711.77. Aniline (aminobenzene, phenylamine) 5950387.48. Sodium acetate 1842.39. Acetaldehyde 1982. 910. Acetone (dimethyl ketone, propanone) 14711.711. Acetonitrile 85012. Barium 85013. Beryllium 1983592.814. Benz(a)pyrene 7355340315. Benzene and its homologues 1473.816. Boron 43267.417. Boric acid 43267.418 .Bromodichloromethane 19835,319.Bromide anion 667, 520. Butanol 19835.321. Butyl acetate 1982.922. Butyl methacrylate 735534.323. Vanadium 735534.324. Vinyl acetate 73553.225. Vinyl chloride 7438003226. Bismuth 7355.927. Tungsten 743800.32 8. Hexane 1473.829. Hydrazine hydrate 1983592.830. Glycerin (propane-1,2,3- triol) 736.931. Dibromochloromethane 19835.332.1,2-Dichloroethane 7355.933.1,4-Dihydroxybenzene (hydroquinone) 735534.334.2,6-Dimethylaniline 19835.335. Dimethylamine (N-methylmethanamine) 14711736. Dimethyl mercaptan (di methyl sulfide)7355340337.2,4-Dinitrophenol735534038.Dimethylformamide1982, 939.o-Dimethylphthalate (dimethylbenzene-1,2-dicarbonate)1190,240.1,2-Dichloropropane14711,741.Cis-1,3-dichloropropene14711742.Trans-1,3-dichloropropene73553,243.2,4-Dichlorophenol (hydroxydichlorobenzene)7355340 44. Dodecylbenzene735534045.Dichloromethane (methylene chloride)73.746.Iron5950.847.Cadmium147106.348.Potassium16.649.Calcium3.250.Caprolactam (hexahydro-2H-azepin-2-one)73553.251.Urea (urea) 9.952.Cobalt 73553.253 Silicon (silicates) 73.754 acids736,958.Lignosulfonates736,959.Lithium7436,960.Magnesium14,961.Manganese73553,262.Copper735534,363.Methanol (methyl alcohol)7355,964.Methyl acrylate (methylprop-2-enoate, methyl acrylic acid ester)735534,365 . Methanethiol (methyl mercaptan) 367926066. Methyl acetate 1982.967. Metol (1-hydroxy-4-(methylamino) benzene) 991727.368. Molybdenum 612946.669. Monoethanolamine 73553.270. Arsenic and its compounds 14711.771. Sodium 6.772. Naphtha lin183882.973. Petroleum products (petroleum) 14711.774. Nickel 73553.275. Nitrate anion 14.976. Nitrite anion 743977. Nitrobenzene 73553.278. Tin and its compounds 5313.679.1,1,2,2,3-pentachloropropane 735534.380. Pentachlorophenol 7355 3.281.Pyridine73553 ,282.Polyacrylamide 7436.983.Propanol 1982.984.Rodanide ion 5950.885.Rubidium 7355.986.Mercury and its compounds 7355340387.Lead 99172.188.Selenium 297518.489.Silver 14711.790.Carbon disulfide 7 36,991.ASPAV (anionic synthetic surfactants )1192.392.CSAS (cationic synthetic surfactants)1192.393.NSAS (non-ionic synthetic surfactants)1192.394.Turpentine 3679.395.Styrene (ethenylbenzene, vinylbenzene)7355.996.Strontium 1488.297.Sulfate -anion (sulfates) 698. Sulfides 119007.499. Sulfite anion 313.2100. Antimony 14711.7101. Thallium 7355340102. Tellurium 198352.8103.1,1,1,2-Tetrachloroethane 73553.2104. Tetrachlorethylene (perchlor ethylene) 3676.6105. Carbon tetrachloride (carbon tetrachloride) 147 3.8112.Triethylamine 736.9113.Trichlorobenzene (sum of isomers) 735534, 3114.1,2,3-Trichloropropane147117115.2,4,6-Trichlorophenol7355340116.Trichlorethylene73553,2117.Acetic acid73553,2118.Phenol, hydroxybenzene735534,3119.Formaldehyde (methanal, formic alde guide) 7355.9120. Phosphates (phosphorus) 3679.3121 .Fluoride anion 982.6122. Furfural 73553.2123. Free, dissolved chlorine and organochlorine compounds 73553403124. Chlorate anion 14711.7125. Chlorobenzene 735534.3126. Chloroform (trichloromethane) 147117127. Chlorophenols 735534012 8. Chloride anion (chlorides) 2.4129. Trivalent chromium 8499, 6130. Hexavalent chromium 29751.8131. Cesium 736.9132. Cyanide anion 14711.7133. Cyclohexanol 735534.3134. Zinc 73553.2135. Zirconium 8499.6136. Ethanol 73553.2137. Ethyl acetate 2976.51 38.Ethylbenzene735534,3139.Ethylene glycol (glycol, ethanediol-1,2 )2942.3140.Aldrin (1,2,3,4,10,10-hexachloro-1,4,4a, 5,8,8a-hexahydro-1,4-endoexo-5,8-dimethanonaphthalene)73553403141.Atrazine (6-chloro-N-ethyl-N'-(1-methylethyl)-1,3,5-triazines-2,4-diamine) 147106.3142. Hexachlorobenzene 735534.3143. Hexachlorocyclohexane (alpha, beta, gamma isomers) 73553403144.2,4-D (2,4-dichlorophenoxyacetic acid and derivatives)7369.2145. Dildrin(1,2,3,4,10,10-hexachloro-exo-6,7-epoxy-1,4,4a,5,6,7,8,8a-octahydro-1,4-endo, exo- 5,8-dimethanonaphthalene)73553403146.Dioxins73553403147.Captan (3a, 4, 7,7a-tetrahydro-2-[(trichloromethyl)thio]-1n-isoindole-1,3(2n)-dione)991727,3148.Carbophos ( diethyl (dimethoxyphosphinothionyl)thi butanedione)73553403149.4,4′-DDT (p,p'-DDT, 4,4′-dichlorodiphenyltrichloromethylethane)73553403150.4,4′-DDD (p,p-DDD, 4,4-dichlorodiphenyldichloroethane)73 553403151. Prometrin (2,4-Bis(isopropylamino)-6-methylthio-sim-triazine) 14711,7152. Simazine (6-chloro-N, N'-diethyl-1,3,5-triazines-2,4-diamine) 367926153. Polychlorized bifeniles (PHB 28, PHB 52, PHB 74, PHB 99, PHB 101, PHB 105, PHB 110, PHB 153, PHB 170) 73553403154.REFLURALIN (2.6-Dinitro-N, N [-Diperpil-4 -(trifluoromethyl)aniline)2451780.9155.THAN (sodium trichloroacetate, TCA)21015.6156.Fozalone (O,O-diethyl-(S-2,3-dihydro-6-chloro-2-oxobenzoxazol-3-ylmethyl) -dithiophosphate) 24517803.7157. BOD total. 243158. Suspended solids 977.2159. Dry residue 0.5 Note The rate of payment for discharges of suspended solids is applied using a coefficient defined as the reciprocal of the amount of the permissible increase in the content of suspended solids when discharging wastewater to the background of the reservoir and background concentration of suspended substances in the water of a water body, adopted when establishing standards for maximum permissible discharges of pollutants.Comments

View all Next »

Ulyana 05/16/2017 at 07:29 # Reply

Thank you for such an informative and at the same time “short” (“no water”) article, everything is clear. this information helped me a lot in my work

ostapx1 05/16/2017 at 14:03 # Reply

It's nice to hear gratitude. Thank you. We are trying.

06/30/2017 at 01:13 pm # Reply

clothing industry

Good afternoon, please tell me, do you need to pay taxes for sewing production for environmental pollution and negative impact on the environment? Thank you very much

07/01/2017 at 14:34 # Reply

Good afternoon. According to (clause 1 of Article 16.1 of the Law of January 10, 2002 No. 7-FZ), you are not a tax payer for environmental pollution and for negative impacts on the environment.

07/20/2017 at 09:49 # Reply

Company.

Good morning! Please tell me whether it is necessary to pay for the negative impact if we only own 2 cars. Thank you!

ostapx1 07/20/2017 at 07:40 pm # Reply

Good afternoon. There is no charge for negative impacts from the use of mobile objects, which are your cars. Explanations are available in the letter of the Ministry of Natural Resources dated July 23, 2015 No. 02-12-44/17039).

07/20/2017 at 10:47 am # Reply

Advance payment

Tell me, if the advance payment for the 2nd quarter of 2021 is paid later than July 20, 2021, will this be a violation?

12/28/2017 at 01:38 pm # Reply

SNT

Hello, please tell me, should SNT pay for the NVOS? We have a waste site, but we only collect it and a specialized organization removes it. We don't store anything...

01/16/2018 at 14:45 # Reply

Good afternoon. According to paragraph 3, clause 5 of the Rules for calculating and collecting Fees for NVOS, approved. fast. Government of the Russian Federation dated March 3, 2017 No. 255, when disposing of solid municipal waste, payers are regional operators and operators involved in such disposal.

01/03/2018 at 14:05 # Reply

OOO

Should I pay a negative impact fee for a retail store?

01/16/2018 at 15:01 # Reply

Good afternoon. The following categories of entrepreneurs who carry out: - emissions of pollutants into the air from stationary sources must pay for the negative impact on the environment; — discharges of pollutants into water bodies; — storage, disposal of production and consumption waste. In all likelihood, you have solid household waste, regarding which Rosprirodnadzor, in its letter dated February 21, 2017 No. AS-06-02-36/3591), explained that entrepreneurs who only have solid municipal waste are not required to pay a fee for pollution .

01/16/2018 at 06:53 # Reply

Hello! We pay Vodokanal for receiving wastewater that exceeds the standards for permissible concentrations of pollutants, should we pay a fee for environmental pollution? Thank you!

01/16/2018 at 15:15 # Reply

Good afternoon. The answer to your question is given in the letter of Rosprirodnadzor dated February 20, 2015 N OD-06-01-31/2606 “On payment for wastewater discharges.” According to Federal Law dated December 29, 2014 N 458-FZ, Part 1, Art. 28 of the Law, which came into force on July 1, 2015, whether to pay the NVOS or not depends on the category of the subscriber. If an organization is subject to rationing, in accordance with Decree of the Government of the Russian Federation dated March 18, 2013 N 230, then it (the organization) must pay fees for the negative impact on the environment directly to the budgets of the budgetary system of the Russian Federation, and not to water supply and utility organizations. For the second non-standardized group of subscribers, Resolution No. 1310 of December 31, 1995 continues to apply, which determines that “executive authorities of the constituent entities of the Russian Federation determine the procedure for collecting fees for the discharge of wastewater and pollutants into the sewerage systems of populated areas from enterprises and organizations that discharge wastewater and pollutants into the sewerage systems of populated areas (hereinafter referred to as subscribers), providing for measures of economic sanctions for damage to the environment, including for exceeding the standards for the discharge of wastewater and pollutants.” Those. in this case, the tariff includes the amount of payment for the NVOS.

01/25/2018 at 01:02 pm # Reply

Good afternoon. Please tell me, we have retail shoe stores, do we need to pay taxes for environmental pollution and negative impact on the environment?

01/25/2018 at 15:36 # Reply

Good afternoon. When carrying out your activities, you must submit a 2-TP waste report by 02/01/2018 for 2021. If your enterprise is a small or medium-sized enterprise, you had to submit the SME report by January 15, 2018. If only solid municipal waste remains from your activities, then no environmental pollution fee is paid. For the negative impact on the environment, environmental users pay a fee; the store is not one of them.

02/08/2018 at 01:16 pm # Reply

cadastral activities.

Good afternoon Does an individual entrepreneur engaged in cadastral activities need to pay taxes for environmental pollution and negative impact on the environment? Thank you!

02/08/2018 at 18:39 # Reply

Good afternoon. If your enterprise is not a natural resource user, then you do not need to pay a fee for negative impact on the environment (the same as for environmental pollution). Individual entrepreneurs and LLCs that operate only at sites of hazard category IV are exempt from paying fees for negative impacts on the environment. Such facilities include: facilities with stationary sources of pollutant emissions, but the amount of emissions does not exceed 10 tons per year; there are no releases of radioactive substances; there are no discharges of pollutants that are formed when water is used for industrial needs, into sewers and into the environment (into surface and underground water bodies, onto the earth's surface). Therefore, your organization does not have to pay an impact fee. You had to provide reports - 2TP waste and SMEs (if you are not a micro-enterprise).

02/10/2018 at 11:57 pm # Reply

Dentistry

Good afternoon, we have a dental office, please tell us, for 2021 we need to submit both a declaration of fees and calculation of fees for negative impact on the environment? Thank you.

02/12/2018 at 05:15 pm # Reply

Good afternoon. The situation with payment for NVOS and the provision of Calculation of fees for NVOS when disposing of medical waste is currently not properly regulated. In the letter of the Ministry of Natural Resources No. 12-50/1025-OG dated February 12, 2015, it is explained that the provisions of the Law on Waste, as well as regulatory legal acts of the Russian Ministry of Natural Resources in the field of waste management, do not apply to medical waste. Therefore, until amendments are made to regulatory legal acts, no fee will be charged for the negative impact on the environment when disposing of medical waste. All that remains is not to miss when these amendments are made.

View all Next »

Waste disposal rates

1. Waste of hazard class I (extremely hazardous) 4643.72. Waste of hazard class II (highly hazardous) 1990.23. Waste of hazard class III (moderately hazardous) 13274. Waste of hazard class IV (low hazardous) (except for solid municipal waste of class IV hazard (low-hazard) 663.25. Hazard class V waste (virtually non-hazardous): mining industry 1.1 processing industry 40.1 other 17.3Also see “List of new fines of Rosprirodnadzor”.

Read also

14.10.2018