Classification of work: repair or modernization

Replacement of components in a computer can occur during its repair or modernization.

Since repair and modernization operations are reflected differently in accounting and taxation, it is important to classify them correctly. This can be done based on the purpose of repair and modernization. The main purpose of repair work is to eliminate faults that make it impossible to operate the main asset. Unlike repairs, modernization is carried out in order to improve the characteristics and change the purpose of the fixed asset (paragraph 2, paragraph 2, article 257 of the Tax Code of the Russian Federation). Therefore, replacing a failed computer element is considered a repair. If the replacement is associated not with the physical wear and tear of components, but with moral wear and tear, this is modernization. For example, if instead of outdated components, more modern ones with better characteristics were installed. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated November 6, 2009 No. 03-03-06/4/95, dated May 27, 2005 No. 03-03-01-04/4/67 and dated December 1, 2004. No. 03-03-01-04/1/166.

Situation: can the replacement of failed components in a computer with more modern ones with better characteristics be considered as repairs?

Yes, you can, provided that after replacing the components, the functionality of the computer has not changed.

One of the main conditions for classifying the replacement of components as repair is a computer malfunction. However, if the computer's performance has improved, then replacing components can be considered an upgrade. In this case, when distinguishing between modernization and repair, it is necessary to determine whether the improvement in characteristics has led to a change in the functional purpose of the computer. For example, before replacing components, which led to improved performance, the computer was used as a workstation, and after replacement, it was used as a server to maintain normal network operation. In this case, the replacement of components during a tax audit can be recognized as modernization (paragraph 2, paragraph 2, article 257 of the Tax Code of the Russian Federation). If the functionality of the computer has not changed, then the replacement of components is considered a repair. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated October 9, 2006 No. 03-03-04/4/156 and dated May 27, 2005 No. 03-03-01-04/4/67.

Arbitration courts share this position. In their opinion, replacing faulty parts of a fixed asset with more powerful (advanced) ones is not modernization. If, as a result of such a replacement, the technological or production purpose of the facility has not changed, then, despite the improvement in its operational characteristics, the costs of replacing faulty components (assemblies) should be qualified as the cost of repairing a fixed asset (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated 23 July 2008 No. KA-A40/6654-08, dated August 14, 2006 No. KA-A40/7489-06, Ural District dated June 17, 2008 No. F09-4293/08-S3, dated June 7, 2006 No. Ф09-4680/06-С7, North-Western District dated August 21, 2007 No. A56-20587/2006).

Computer repair: types and differences

One of the most important tasks of an accountant is the correct execution of accounting transactions related to the repair and modernization of computer equipment. Before you begin to display computer repair operations, you need to consider a number of factors:

- Type of repair: current or major (modernization);

- Repair work is carried out using the organization itself or through the services of specialized companies.

These points in accounting are very important, since the order in which these transactions are displayed in tax accounting and in accounting are radically different. A correctly set goal for repairs can help in resolving this issue:

- Elimination of problems that have arisen that make it difficult or even impossible to further operate this fixed asset;

- Improving the characteristics and changing the purpose of this fixed asset.

That is, if the inherent physical wear and tear of a part is a breakdown of a computer element, then this will be considered a routine computer repair. If a computer part changes due to obsolescence, then this will be its modernization.

The modernization of this non-current asset includes the following types of work:

- Increased the amount of RAM or hard drive;

- Replacing with a faster and more powerful processor;

- Replacing the motherboard and video card with a faster one;

- Replacing the monitor with a model that has a larger diagonal.

Accounting: repairs

In accounting, reflect repair costs in the reporting period to which they relate. They are included in expenses for ordinary activities (clause 27 of PBU 6/01, subclauses 5, 7 of PBU 10/99). Therefore, reflect the write-off of components when repairing a computer with wiring:

Debit 20 (23, 25, 26, 29, 44...) Credit 10-5

– components written off for computer repair.

This procedure is provided for in paragraph 67 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: is it necessary to draw up a report in form No. OS-3 when replacing faulty components in a computer?

If the location of the computer does not change during repair, then there is no need to draw up a report in Form No. OS-3.

This is explained by the fact that the preparation of this act is mandatory when accepting and delivering fixed assets from the customer to the contractor (instructions for filling out form No. OS-3, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2001 No. 7). For example, if the computer was handed over to a contractor or an organization's repair service for repair.

If during the repair the location of the object does not change (i.e. it was not transferred to the contractor or to the repair service), then the acceptance and transfer of the fixed asset does not occur. However, in this case, the replacement of components in the computer must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ). To do this, you can draw up an act on the replacement of spare parts in a fixed asset object.

Advice: to simplify document flow, acts on the replacement of computer components can be drawn up at the end of the month for each performer of work.

See also equipment repair in accounting

For accounting purposes

According to the clarifications of the Ministry of Finance of Russia, in accounting, when the initial cost of an item of fixed assets increases as a result of modernization and reconstruction, depreciation should be calculated based on the residual value of the item, increased by the costs of modernization and reconstruction, and the remaining useful life (letter of the Ministry of Finance of Russia dated June 23, 2004 No. 07-02-14/144).

Consequently, after the modernization, the cost must be calculated, which will serve as the basis for further depreciation. It is defined as follows:

The amount received is reflected in the “Remaining” column. cost (BU)". In our example, this amount will be 20,166.68 rubles. (20,000 - 999.99 - 333.33 + 1,500).

When carrying out the “OS Modernization” document, the residual value and remaining useful life are remembered. In our example, the remaining useful life is 56 months. (60 - 4).

The new value and the new useful life for calculating depreciation are applied starting from the month following the month in which the modernization was carried out.

In our example, starting from June 2005, the amount of depreciation charges for accounting purposes will be 360.12 rubles. (20,166.68:56).

Accounting: modernization

The costs of modernization are taken into account in account 08 “Investments in non-current assets” with subsequent inclusion in the initial cost of the fixed asset (clause 42 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). To ensure the possibility of obtaining data on types of capital investments, it is advisable to open a subaccount “Modernization Expenses” for account 08.

In accounting, write off components when upgrading a computer using the following wiring:

Debit 08 subaccount “Modernization expenses” Credit 10-5

– components for upgrading the computer were written off.

After replacing components during modernization, you need to draw up a report in form No. OS-3. It is approved by the head of the organization and transferred to the accountant. Information about the modernization is reflected in the computer inventory card according to form No. OS-6 (OS-6a) or in the inventory book according to form No. OS-6b (intended for small enterprises) (clause 40 of the Guidelines approved by order of the Ministry of Finance of Russia dated October 13 2003 No. 91n). In accounting, make the following entry:

Debit 01 Credit 08 subaccount “Modernization expenses”

– the initial cost of the computer has been increased by the cost of components.

This procedure is established in paragraph 42 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

For information on how to calculate depreciation after upgrading a computer, see How to reflect the modernization of fixed assets in accounting.

Situation: how to write off in accounting the costs of upgrading a computer, the cost of which was taken into account at a time? It does not exceed 40,000 rubles, and according to the organization’s accounting policy, objects with such a cost are reflected as part of the inventory.

Modernization costs can also be written off as a lump sum.

The organization has the right to account for assets that fully correspond to the characteristics of fixed assets, but costing no more than 40,000 rubles, as inventories in account 10 (clause 5 of PBU 6/01, Instructions for the chart of accounts). This means that when taking into account the cost of such objects, one should be guided by the norms of PBU 5/01. This regulatory act does not provide for an increase in the cost of inventories after work on the modernization of facilities is carried out. Therefore, regardless of the amount, all costs for upgrading a computer previously included in the inventory can be taken into account as expenses at a time.

Postings for upgrading a computer

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| Routine computer repair (in-house) | ||||

| 23 | 70 | 45 000,00 | Salary was accrued to the system administrator who carried out routine computer repairs | Payroll |

| 23 | 69 | 13 500,00 | Insurance premiums for the salary of the system administrator have been calculated | Payroll |

| 23 | 10-01 | 7 800,00 | Spare parts necessary for computer repair have been written off. | Invoice |

| Routine computer repair (involvement of outside organizations) | ||||

| 23 | 60.1 | 12 711,86 | Computer repair service provided (excluding VAT) | Certificate of completion |

| 19 | 60.1 | 2 288,14 | VAT allocated for computer repair services | Invoice |

| 60.1 | 51 | 15 000,00 | Payment for services of a repair organization 12711.86 + 2288.14 = 15000.00 rubles. | Payment order |

| Upgrading your computer | ||||

| 02-01 | 01.09 | 20 000,00 | The share of depreciation charges is written off | Depreciation sheet, accounting certificate |

| 91-02 | 01.09 | 7 200,00 | The residual value of retiring parts has been written off | Write-off act, accounting certificate |

| 91.02 | 23 | 1 500,00 | Costs associated with equipment dismantling are written off | Accounting information |

| 60.01 | 51 | 12 980,00 | Purchased components necessary to upgrade the computer | Payment order |

| 10.01,10.05,10.06 | 60-01 | 11 000,00 | The materials necessary for the modernization of this fixed asset have been capitalized (the cost is indicated without VAT) 12980.00 - 18% VAT (RUB 1980.00) = RUB 11000.00. | Invoice |

| 19 | 60.01 | 1 980,00 | VAT is charged on the amount of spare parts received | Invoice |

| 08.03 | 10.01,10.05,10.06 | 11 000,00 | The materials necessary for upgrading the computer have been written off | Invoice, accounting certificate |

| 08.03 | 23 | 7 500,00 | The production costs that occurred during the modernization of this asset were written off | Accounting information |

| 01 | 08.03 | 18 500,00 | The initial cost of the computer was increased by the cost of the modernization: RUB 11,000.00 + 7,500.00 = RUB 18,500.00. | Accounting information |

Accounting: use of old components

After replacement, old components may be suitable for further use. For example, an organization can sell them or use them to repair other computers. In this case, upon receipt of replaced components, an invoice is filled out in form No. M-11 (clause 57 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Situation: how to reflect in accounting the receipt and use of components replaced when upgrading or repairing a computer. Are the components suitable for further use?

Receive receipt of dismantled components as part of other income. Old components may be suitable for further use, for example, for repairs.

The organization can be guided by the provisions of paragraph 79 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n. It states that usable parts, assemblies and assemblies of disposed fixed assets are accounted for at current market value. Receive receipts of such components as part of other income. In this case, market value refers to the amount of money that can be received by an organization as a result of the sale of computer components (clause 9 of PBU 5/01).

When computer components arrive at the warehouse, make the following wiring:

Debit 10-5 Credit 91-1

– used computer components were capitalized (based on the invoice requirement in form No. M-11.

Sometimes, in order to bring replaced components into a usable condition, organizations repair them. In this case, the cost of refurbished components must include repair costs (clause 11 of PBU 5/01).

If the components are sold in the future, make the following entry in accounting:

Debit 91-2 Credit 10-5

– the cost of components sold is written off as selling expenses.

If in the future the components will be used to repair other computers, make the following entries in accounting:

Debit 20 (23, 26, 25, 29, 44...) Credit 10-5

– components written off for computer repairs.

Income tax: renovation

In tax accounting, computers are recognized as fixed assets if they cost more than 100,000 rubles. (Clause 1 of Article 257 of the Tax Code of the Russian Federation).

Therefore, if components are used to repair such a computer (fixed asset), include their cost in other expenses based on paragraph 1 of Article 260 of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation does not provide for a special procedure for accounting for expenses for repairing a computer that is not a fixed asset. Therefore, the organization has the right to take into account the costs of repairing such property as other expenses in accordance with subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. This conclusion can be drawn from the explanations of the Ministry of Finance of Russia, given in letter dated June 30, 2008 No. 03-03-06/1/376.

Organizations that use the accrual method reduce the tax base as components in the computer are replaced (clause 5 of Article 272 of the Tax Code of the Russian Federation). If an organization uses the cash method, the tax base decreases as components are replaced and paid to the supplier (clause 3 of Article 273 of the Tax Code of the Russian Federation).

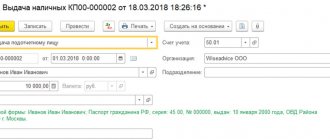

An example of how to reflect in accounting and taxation the replacement of components when repairing a computer. The organization applies a general taxation system

In February, the power supply failed on a computer installed in the accounting department of Alpha LLC. To replace it, the organization purchased a new power supply at a price of 2,360 rubles. (including VAT - 360 rubles). The old power supply cannot be restored. In the same month, a report was drawn up to replace the power supply. Alpha uses the accrual method and pays income tax on a monthly basis. The organization does not perform operations that are not subject to VAT. The organization keeps records of materials without reflecting them on accounts 15 and 16.

In February, Alpha's accountant made the following entries:

Debit 10-5 Credit 60 – 2000 rub. (2360 rubles – 360 rubles) – a power supply was purchased;

Debit 19 Credit 60 – 360 rub. – VAT is taken into account on the cost of the power supply;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 360 rub. – accepted for VAT deduction;

Debit 60 Credit 51 – 2360 rub. – money was transferred for the power supply;

Debit 26 Credit 10-5 – 2000 rub. – the cost of the power supply is written off for the organization’s current expenses.

When calculating income tax for February, Alpha’s accountant took into account the cost of a power supply unit in the amount of 2,000 rubles as part of the cost of repairing fixed assets.

Modernization of computer equipment

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 15 of 50Next ⇒

Modernization is a set of works to improve an object of fixed assets, leading to an increase in the technical level and economic characteristics of the object, carried out by replacing its structural elements and systems with more efficient ones (Guidelines for the application of the classification of operations of the public administration sector, given in the Letter of the Ministry of Finance of the Russian Federation dated 02/05/2010 N 02-05-10/383 (hereinafter referred to as Letter N 02-05-10/383)). From the explanations of financiers regarding work that changes the operational characteristics of a computer (and replacing any part of a computer, including a monitor and a system unit, usually leads to an improvement in its operational characteristics), it follows that replacing individual elements with new ones due to their obsolescence is an upgrade of the computer (Letter Ministry of Finance of the Russian Federation dated November 6, 2009 N 03-03-06/4/95).

The purchase of inventories for computer equipment (monitors, system units, keyboards, mouse-type manipulators, connecting cables, etc.) is reflected in Article 340 “Increase in the cost of inventories” of KOSGU, regardless of what type of work (modernization) or repair) they are purchased (Letter N 02-05-10/383). The acquisition of these inventories will not constitute an inappropriate use of budget funds. The conclusion about the application of Article 340 and not 310 of KOSGU in this case is based on the following.

Firstly, the attribution of expenses for the purchase of spare and (or) components for computer equipment (monitors, system units, keyboards, mouse-type manipulators, connecting cables, etc.) to Article 340 of KOSGU is directly stated in Letter N 02-05-10/383.

Secondly, this letter indicates under which articles and sub-articles of KOSGU expenses for the modernization of fixed assets that are state (municipal) property, received for rent or for free use are reflected. Thus, when concluding a state (municipal) contract, the subject of which is the modernization of unified functioning systems (such as security and fire alarms, local area network, telecommunications center, etc.), which are not one inventory item of fixed assets, expenses are reflected :

- in terms of payment for the supply of fixed assets necessary for modernization - under Article 310 of KOSGU;

- in terms of payment for services for the development of documentation, as well as work on installation, installation of equipment, its interface - under subarticle 226 “Other work, Note” of the act on acceptance and delivery of repaired, reconstructed, modernized fixed assets.

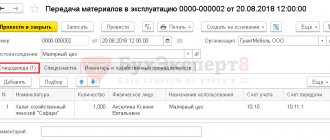

The correspondence of invoices to reflect contract computer upgrade operations will be as follows:

| Contents of operation | Debit | Credit | A document base |

| Spare materials for the computer are purchased by the customer | |||

| Spare parts supplied for computer upgrading were accepted for accounting | 1(2) 105 06 340 | 1(2) 302 22 730 | Consignment note, receipt order |

| Paid for supplied spare parts | 1(2) 302 22 830 | 1 304 05 340 2 201 01 610 (18) | Waybill, invoice, agreement (contract) |

| An advance was paid to the modernization contractor under the agreement (contract) | 1(2) 206 09 560 | 1(2) 302 09 730 | Invoice, agreement (contract) |

| The materials necessary for modernization were transferred to the contractor | 1(2) 105 06 340 | 1(2) 105 06 340 | Request-invoice |

| Work carried out by a contractor | 1(2) 106 01 310 | 1(2) 302 09 730 | Certificate of completion of work, certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

| The advance has been offset | 1(2) 302 09 830 | 1(2) 206 09 660 | Agreement (contract), invoice, certificate of completion of work |

| Final payment for contractor services has been made | 1(2) 302 09 830 | 1 304 05 225 2 201 01 610 (18) | |

| Spare parts used during modernization have been written off | 1(2) 106 01 310 | 1(2) 105 06 440 | Act on write-off of inventories |

| The upgraded computer was put into operation | 1(2) 101 04 310 | 1(2) 106 01 410 | Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

| The subject of the contract is computer modernization (the contractor purchases spare parts independently). Let's assume that there was no advance payment under the contract | |||

| Accrued expenses of the customer (budgetary institution) for the work done on modernization | 1(2) 106 01 310 | 1 302 19 730 | Certificate of completion of work, certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

| Paid for work performed by the contractor | 1(2) 302 19 830 | 1 304 05 310 2 201 01 610 (18) | Agreement (contract), invoice, certificate of completion of work |

| The upgraded computer was put into operation | 1(2) 101 04 310 | 1(2) 106 01 410 | Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets |

Modernization expenses reduce the tax base for income tax of the reporting period in the amount of depreciation charges for the modernized fixed asset and depreciation bonus (if the taxpayer exercised the right granted to him).

The depreciation bonus is included in expenses when calculating income tax if the following conditions are met:

— the possibility of using bonus depreciation must be specified in the accounting policy of the organization (Articles 259 and 313 of the Tax Code of the Russian Federation);

— the modernized fixed asset is used in income-generating activities (Article 252 of the Tax Code of the Russian Federation);

— the depreciation bonus is applied to all capital investments in fixed assets (acquired using funds received from income-generating activities) or not applied at all.

According to para. 2 p. 3 art. 272 of the Tax Code of the Russian Federation, expenses in the form of capital investments are recognized as indirect expenses of that reporting (tax) period for which, in accordance with Chapter. 25 of the Tax Code of the Russian Federation accounts for the start date of depreciation (the date of change in the original cost) of fixed assets in respect of which capital investments were made, that is, from the first day of the month following the month of putting the modernized facility into operation. Let us remind you that the facility is put into operation on the basis of an act of acceptance and delivery of repaired, reconstructed, modernized fixed assets.

The taxpayer has the right to include in the expenses of the reporting (tax) period the costs of upgrading a computer in the amount of 10% of the amount of expenses incurred (clause 9 of Article 258 of the Tax Code of the Russian Federation).

In case of sale earlier than five years from the date of commissioning of a modernized fixed asset, in respect of which a depreciation bonus was applied, the amounts of expenses included in the expenses of the next reporting (tax) period are subject to restoration and inclusion in the tax base.

Note that the depreciation bonus is not taken into account when calculating the amount of depreciation charges (paragraph 4, paragraph 2, article 259 of the Tax Code of the Russian Federation). The calculation of the depreciation amount will include the amount of modernization costs minus the depreciation bonus, which in our case is 10%.

Revision of the useful life of the modernized facility. From the norms of Art. 258 of the Tax Code of the Russian Federation it follows that the taxpayer has the right to increase the useful life of an object of modernized fixed assets if, after the work has been carried out, their useful life has increased. This period should be increased within the range established for the depreciation group in which this fixed asset was previously included. Instruction No. 148n in this matter, unlike the Tax Code of the Russian Federation, is more categorical. According to its norms, in cases of improvement (increase) in the initially adopted standard indicators of the functioning of an object of non-financial assets as a result of modernization, the institution revises the useful life of this object (clause 15 of Instruction No. 148n). When reviewing the useful life of an object being modernized, one should take into account the provision that it can be increased only within the limits of the depreciation group to which it belongs. If the maximum useful life was initially established for the modernized object, the useful life is not revised. This norm is used extremely rarely in budgetary institutions, since according to established practice, when a depreciable object is accepted for accounting, the maximum useful life of this depreciation group is almost always established. For computers, the maximum useful life according to the Classification of fixed assets by depreciation groups is 3 years, or 36 months (the computer belongs to the second depreciation group).

Example.

A budgetary institution has upgraded its computer. The computer was purchased with funds received from income-generating activities and is used in the same. The cost of modernization work, taking into account the cost of spare parts, amounted to 18,000 rubles. The initial cost of the computer is 52,000 rubles. The depreciation bonus is 10%. When the computer was accepted for accounting (accounting and tax), it was given a maximum useful life for the depreciation group to which it belongs—36 months. During the upgrade, the performance characteristics of the computer improved. The service life of the computer is 25 months.

Since the maximum useful life of a computer was initially established, despite the improvement in its operational indicators that occurred after modernization, the useful life in tax and accounting is not revised.

The amount included at a time in expenses that reduce the taxable base when calculating income tax is 1,800 rubles. (RUB 18,000 x 10%).

The restored cost of equipment in tax accounting, subject to depreciation, is equal to 68,200 rubles. (52,000 + 18,000 – 1,800); in budget accounting - 70,000 rubles. (52,000 + 18,000).

Thus, after the modernization of a fixed asset item, only the amount of the residual (initial) value changed, the remaining indicators (useful life and depreciation rate) remained the same. Taking this into account, depreciation on fixed assets should continue, using the previous mechanism for calculating depreciation, until the changed original cost is fully repaid (Letter of the Ministry of Finance of the Russian Federation dated March 29, 2010 N 03-03-06/1/202).

In the example we are considering, the amount of depreciation charges both before and after depreciation amounted to 1,444.45 rubles. (RUB 52,000 / 36 months) per month. However, depreciation will be extended by 36 months.

Let's consider individual situations that arise when performing operations to modernize fixed assets.

Modernization of a fully depreciated fixed asset. There are clarifications from the Ministry of Finance on this situation, given in letters dated March 13, 2006 N 03-03-04/1/216, dated March 2, 2006 N 03-03-04/1/168. They say that after modernization of an object, the residual value of which for profit tax purposes is zero, the organization resumes depreciation on this fixed asset in accordance with the previously valid depreciation rate until its residual value is completely written off (equal to the amount of modernization costs). Thus, the depreciation rate is determined based on the useful life of the object accepted by the organization when putting it into operation.

Restoration of expenses when selling a modernized fixed asset item before the expiration of five years from the date of its commissioning after modernization. From paragraph 4, clause 9, art. 258 of the Tax Code of the Russian Federation, as well as Letter of the Ministry of Finance of the Russian Federation dated July 27, 2010 N 03-03-06/1/490, it follows that in the case of sale earlier than after five years from the date of commissioning of fixed assets in respect of which the right to apply was used depreciation bonuses in relation to the amount of capital investments in modernization, the amount of expenses (depreciation bonus) are subject to restoration and inclusion in the tax base for income tax.

Moreover, if at the time of sale the residual value of the fixed asset is less than the amount of depreciation bonus previously taken into account in expenses and the sale is carried out before the expiration of the five-year period provided for in paragraph. 4 paragraph 9 art. 258 of the Tax Code of the Russian Federation, the depreciation bonus must be restored as part of non-operating income in full.

The restoration of depreciation bonus amounts should be understood as an increase by taxpayers in the size of the income tax base during the period of sale of fixed assets by including the previously taken into account depreciation bonus amount into non-operating income. In this case, the restored amount of the depreciation bonus is not subject to accounting as part of expenses either during the restoration period or in subsequent periods, including through depreciation charges.

⇐ Previous15Next ⇒

Income tax: modernization

When components are used to improve the technical characteristics (in essence, modernization) of a computer that is not a fixed asset, write off their cost as a reduction in taxable profit upon completion of the work (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation).

Include components used in the modernization of a fixed asset in its initial cost (clause 2 of Article 257 of the Tax Code of the Russian Federation). If the organization uses the accrual method, increase the initial cost of the computer as components are replaced (clause 1 of Article 272 of the Tax Code of the Russian Federation). If the organization uses the cash method, increase the initial cost of the computer as components are replaced and paid for (clause 3 of Article 273 of the Tax Code of the Russian Federation).

The organization has the right to take into account at a time no more than 10 percent (30% in relation to fixed assets included in the third to seventh depreciation groups) of the cost of components used in upgrading the computer as expenses (clause 9 of Article 258 of the Tax Code of the Russian Federation). For more information about this, see How to reflect the modernization of fixed assets in accounting.

After upgrading, an organization can extend the useful life of a computer. This is possible if, after upgrading, the characteristics of the computer have changed in such a way that this will allow it to be used longer than previously established. At the same time, you can increase the useful life within the depreciation group to which the computer belongs. Therefore, if the maximum period of use was initially set, it cannot be increased after upgrading. Such rules are established in paragraph 1 of Article 258 of the Tax Code of the Russian Federation.

Computer equipment belongs to the second depreciation group (Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1). That is, for purchased computers, a maximum useful life of 36 months can be established (clause 3 of Article 258 of the Tax Code of the Russian Federation).

After modernization, depreciation on the computer is calculated at the previous rates. Unlike tax accounting, in accounting, depreciation on a modernized computer is calculated based on the remaining useful life (i.e., according to new standards). Therefore, if before the modernization the monthly amounts of depreciation deductions in accounting and tax accounting were the same, then after the modernization they will differ.

An example of how to reflect in accounting and taxation the replacement of components when upgrading a computer (fixed asset). The organization applies a general taxation system

In January, the computer of the chief accountant of Alpha LLC, which was purchased in 2014, was upgraded. Namely, the chief accountant had his old monitor replaced with a new LCD monitor, the cost of which was 11,800 rubles. (including VAT - 1800 rubles). In the same month, an act was drawn up in form No. OS-3. In the future, the organization plans to sell the old monitor at a price of 2,360 rubles. (including VAT - 360 rubles). Alpha uses the accrual method and pays income tax on a monthly basis. The organization does not perform operations that are not subject to VAT. The organization keeps records of materials without reflecting them on accounts 15 and 16.

To reflect the received spare parts in the accounting, the Alpha accountant opened a subaccount for account 10, “Spare parts identified during repairs.”

The initial cost of the computer at which it was accepted for accounting is 42,300 rubles. Computer equipment belongs to the second depreciation group. When the computer was accepted for accounting, the maximum useful life was set at 3 years (36 months). For accounting and tax purposes, depreciation is calculated using the straight-line method.

For accounting purposes, the annual depreciation rate for a computer is 33.3333 percent (1: 3 × 100%), the annual depreciation amount is 14,100 rubles. (RUB 42,300 × 33.3333%), monthly depreciation amount – RUB 1,175/month. (RUB 14,100: 12 months).

For tax accounting purposes, the monthly depreciation rate for a computer is 2.7778 percent (1: 36 months × 100%), the monthly amount of depreciation is 1,175 rubles/month. (RUB 42,300 × 2.7778%).

In January, Alpha's accountant made the following entries:

Debit 10-5 Credit 60 – 10,000 rub. (RUB 11,800 – RUB 1,800) – monitor purchased;

Debit 19 Credit 60 – 1800 rub. – VAT is included on the cost of the monitor;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1800 rub. – VAT is accepted for deduction;

Debit 60 Credit 51 – 11,800 rub. – funds were transferred for the monitor;

Debit 08 subaccount “Modernization expenses” Credit 10-5 – 10,000 rubles. – the new monitor is written off;

Debit 01 Credit 08 subaccount “Modernization expenses” – 10,000 rubles. – the initial cost of the computer was increased by the cost of purchasing a new monitor;

Debit 10 subaccount “Spare parts identified during repairs” Credit 91-1 – 2000 rubles. (2360 rub. – 360 rub.) – the old monitor was capitalized;

Debit 26 Credit 02 – 1175 rub. – depreciation has been calculated on the computer.

When calculating income tax for January, the accountant took into account in non-operating income the market value of the old monitor in the amount of 2,000 rubles, and in expenses - depreciation charges on the computer in the amount of 1,175 rubles.

Replacing the monitor did not increase the useful life of the computer. Therefore, for accounting and tax purposes, the useful life of the computer was not revised. In accounting, depreciation on equipment was accrued over a period of 26 months. Therefore, for accounting purposes, the remaining useful life of the fixed asset after reconstruction is 10 months (36 months - 26 months).

The initial cost of the computer, taking into account the cost of purchasing a new monitor, was 52,300 rubles. (RUB 42,300 + RUB 10,000). The residual value of the computer excluding these expenses is 11,750 rubles. (42,300 rubles – 1175 rubles/month × 26 months), and taking into account – 21,750 rubles. (RUB 11,750 + RUB 10,000).

For accounting purposes, the monthly depreciation amount is 2175 rubles/month. (RUB 21,750: 10 months). In tax accounting, the monthly amount of depreciation deductions after modernization was: 52,300 rubles. × 2.7778% = 1453 rub./month.

Since after modernization the monthly amount of depreciation charges for accounting and tax purposes began to differ, the organization had a temporary difference in the amount of 722 rubles. (2175 rub./month – 1453 rub./month), leading to the formation of a deferred tax asset.

From February to November (10 months), the accountant reflected the accrual of depreciation charges by posting:

Debit 26 Credit 02 – 2175 rub. – depreciation has been calculated on the upgraded computer;

Debit 09 Credit 68 subaccount “Calculations for income tax” – 144 rubles. (RUB 722 × 20%) – a deferred tax asset was accrued from the difference between monthly depreciation charges for accounting and tax accounting purposes.

In November, in accounting, the computer was completely depreciated (52,300 rubles – 1175 rubles/month × 26 months – 2175 rubles/month × 10 months). Therefore, since December, the accountant stopped calculating depreciation on it.

In tax accounting, the computer is not depreciated in the amount of 7,220 rubles. (52,300 rubles – 1175 rubles/month × 26 months – 1453 rubles/month × 10 months), therefore, in tax accounting, the accountant continued to calculate depreciation.

Since December, when calculating depreciation for tax accounting purposes, the accountant reflected the write-off of the deferred asset by posting:

Debit 68 subaccount “Calculations for income tax” Credit 09 – 291 rub. (RUB 1,453 × 20%) – the deferred tax asset is written off.

Computer depreciation and upgrading

Based on the results of modernization, the useful life of the computer can be increased. However, this can only be done within the 2nd depreciation group to which the PC belongs. SPI for it is from 2 to 3 years (Article 258 of the Tax Code of the Russian Federation, clause 1). The company is not obliged to increase SPI, but has the right to do so.

On a note! Restrictions on the period of use apply only to tax accounting. The BU does not provide for such restrictions. However, it is advisable in both cases to establish the same depreciation rules in order to simplify accounting.

Modernization costs are included in the calculation of depreciation charges. “New” depreciation is accrued from the month in which the modernization was completed.

Depreciation is reflected by posting Dt 26 (44) Kt 02.

Linear method

Let a company have a computer that is depreciated at the calculated rate. After a certain period of operation of the PC, it was decided to depreciate, but not increase the SPI. In this case:

- the cost of the PC will increase by the amount of modernization;

- the depreciation rate as a percentage will remain the same;

- before the modernization, a certain amount of depreciation will already be accumulated;

- after modernization, the calculation will be based on the new cost and the established norm;

- depreciation continues to accrue until the expiration of the fixed income investment period;

- the difference between the total amount accrued during the SPI amount of depreciation and the cost of the upgraded PC is written off as the balance of depreciation, using standard transactions.

Nonlinear method

The depreciation rate is determined by the formula from Article 259 of the Tax Code of the Russian Federation. The residual value of the PC is multiplied by the depreciation rate. The residual value calculated after modernization will increase by the amount of modernization. From the moment the modernization is completed, the new residual value is taken as the basis for calculations. If the SPI is decided not to increase, then the norm will remain the same.

This calculation will be valid until the residual value is equal to 20% of the original and is not fixed as the basis for calculations. Then the amount of depreciation for the month is calculated by dividing the base amount by the remaining SPI.

The computer is completely depreciated

In such cases, the original cost already written off through depreciation is added to the costs of modernization. Before the initially established SPI, another period is “added” within the depreciation group PC (Article 258-1 of the Tax Code of the Russian Federation). Based on the total, newly calculated useful life, the depreciation rate is calculated.

Income tax: use of old components

After replacement, old components may be suitable for further use. For example, an organization can sell them or use them to repair other computers.

Situation: how to reflect when calculating income tax the receipt and use of components that had to be replaced when upgrading or repairing a computer? The components are suitable for further use.

When calculating income tax, include the cost of materials received during the repair (upgrade) of a computer as non-operating income. The fact whether the computer is a fixed asset or is accounted for as inventory does not matter. This conclusion follows from Article 250 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated October 14, 2010 No. 03-03-06/1/647, dated October 6, 2009 No. 03-03-06/1/647, dated September 28 2009 No. 03-03-06/1/620 and the Federal Tax Service of Russia dated November 23, 2009 No. 3-2-13/227.

Income must be reflected at the time the spare parts arrive at the warehouse (when drawing up an invoice in form No. M-11) (subclause 1, clause 4, article 271, clause 2, article 273 of the Tax Code of the Russian Federation). Include materials in income at market value determined according to the rules of Article 105.3 of the Tax Code of the Russian Federation (clause 5 of Article 274 of the Tax Code of the Russian Federation).

Whether capitalized parts can be expensed depends on whether the computer is a fixed asset or not.

If spare parts are received from the repair (modernization) of a fixed asset, their cost can be taken into account in expenses for further use in the organization’s activities. Taxable profit can be reduced by the cost of spare parts, which were previously included in income when they were received during repairs (modernization). This right is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation. It says that as part of material expenses, the organization has the right to take into account the cost of surplus inventories identified during the inventory, suitable for further use, and (or) property obtained during the dismantling and disassembly of fixed assets decommissioned, as well as during their repair, modernization, reconstruction, technical re-equipment, partial liquidation.

If an organization decides to sell spare parts received during the repair (upgrade) of a computer, then their cost can be taken into account as part of the costs of sales (subparagraph 2, paragraph 1, article 268, paragraph 2, paragraph 2, article 254 of the Tax Code of the Russian Federation).

The procedure for determining the cost of extracted spare parts is prescribed in paragraph 2 of paragraph 2 of Article 254, paragraphs 13 and 20 of Article 250 of the Tax Code of the Russian Federation.

Spare parts received from repairing (upgrading) a computer that is not a fixed asset cannot be written off as expenses. For more information about this, see What material expenses should be taken into account when calculating income tax.

BASIS: VAT

Input VAT on components purchased for replacement in a computer should be deducted in the usual manner (paragraph 1, clause 5, article 172 of the Tax Code of the Russian Federation). That is, after registration of the specified components and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). Exceptions to this rule, in particular, are cases when:

- the organization enjoys VAT exemption;

- the organization uses the computer only to perform VAT-free transactions.

In these cases, include input VAT in the cost of components used to upgrade or repair the computer. This procedure follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

If an organization uses a computer to perform both taxable and non-VAT-taxable operations, distribute the input tax on the cost of components (clause 4 of Article 170 of the Tax Code of the Russian Federation).

When calculating property tax, take into account the costs of purchasing components included in the initial cost of the computer from the 1st day of the month following the completion of modernization (clause 4 of Article 376 of the Tax Code of the Russian Federation).

simplified tax system

If a simplified organization pays a single tax on income, the costs of replacing computer components do not reduce the tax base (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, then how to reflect the replacement of components in expenses depends on the cost of the computer.

Computers are recognized as fixed assets if they cost more than 100,000 rubles. (clause 4 of article 346.16, clause 1 of article 257 of the Tax Code of the Russian Federation). Therefore, if components are used to repair such a computer (fixed asset), their cost reduces the tax base on the basis of subparagraph 3 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

To learn how to take into account the costs of replacing components when upgrading a fixed asset, see How to reflect the modernization of fixed assets in accounting.

The Tax Code of the Russian Federation does not provide for a special procedure for accounting for expenses for repairing (upgrading) a computer, which is not a fixed asset. Therefore, the organization has the right to write off the costs of repairing (modernizing) such property according to the expense items provided for in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Provided that all the requirements imposed by Chapter 26.2 of the Tax Code of the Russian Federation for the procedure for recognizing these costs are met (expenses are economically justified, documented, paid, etc.) (clause 2 of article 346.16, clause 2 of article 346.17, Clause 1 of Article 252 of the Tax Code of the Russian Federation). The cost of devices purchased to replace failed elements of computer equipment can be taken into account as part of material costs (subclause 5, clause 1 and clause 2, article 346.16, subclause 1, clause 1, article 254 of the Tax Code of the Russian Federation). This conclusion can be drawn from the explanations of the Ministry of Finance of Russia, given in letter dated November 14, 2008 No. 03-11-04/2/169.

Reduce the tax base as components are replaced and paid for (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Situation: how to reflect in a simplified form the receipt and use of components that had to be replaced when upgrading or repairing a computer? The components are suitable for further use.

When calculating the single tax, include the cost of components received as a result of repairing (upgrading) a computer as part of non-operating income (Article 250, paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation). The fact whether the computer is a fixed asset or is accounted for as inventory does not matter.

Income must be reflected at the time the spare parts arrive at the warehouse (when drawing up an invoice in form No. M-11) at market prices (clause 1 of article 346.17, clause 4 of article 346.18 of the Tax Code of the Russian Federation).

If in the future such spare parts are reused (sold), they cannot be taken into account in expenses.

Organizations that pay a single tax on income do not take into account any expenses when calculating the tax base (clause 1 of Article 346.14, clause 4 of Article 346.18 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses recognize any expenses only after they are actually paid. Payment is recognized as the termination of obligations to suppliers by transfer of funds or otherwise. This procedure is provided for in paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

When receiving components replaced when upgrading or repairing a computer, the organization does not have any obligations. Moreover, identifying such materials does not incur any costs, since the economic benefits of the organization are not reduced. Further use in production or sale of used components will also not affect the calculation of the single tax. After all, the condition for repaying the debt in relation to the received property will remain unfulfilled.

Thus, organizations that use the simplification have no reason to include in expenses the cost of components replaced during modernization (repair).

Sample modernization act

Resolution No. 7 approved the act of acceptance and delivery of repaired fixed assets to formalize and record the acceptance and delivery of fixed assets restored and ready for further use. In accordance with paragraph.

67 Recommendations No. 91n, costs for OS repairs are shown in accounting based on primary data for accounting for transactions for the release of inventory, payroll and other costs. According to clause 6 of PBU 6/01, an asset accounting unit is an inventory item that is assigned an individual inventory number.

When receiving an object, an OS-6 inventory card or an OS-6a book is created for it, in which all information about it is entered. Download the unified form OS-6 Inventory card for group accounting of fixed assets.

Form OS-6a Sample of filling out form OS-3: In organizations with a large range of fixed assets, OS-6 cards are grouped by depreciation groups of fixed assets.

Fixed assets (FPE) tend to fail and wear out. To resume operation, they can be repaired, reconstructed or modernized. Repair helps eliminate breakdowns and defects, which allows the OS to be used for its intended purpose again. Modernization and reconstruction improve the properties of the facility and its production performance.

Restoring and adjusting the OS can be done independently or with the help of a third party. An act of acceptance and delivery of repaired fixed assets (form OS-3) is drawn up upon delivery of the object upon completion of repair, restoration or improvement.

Order on modernization of fixed assets

Attention

These include the following points:

- if the work was carried out at the expense of the company’s own funds, the document can be drawn up in one copy, which will be stored in the accounting department of the enterprise;

- if the repairs were ordered from other persons, then the form is filled out in a number of copies equal to the total number of all participants in the process.

For example, an enterprise has entered into an agreement with a contractor. A transport company was hired to transport the fixed asset.

In this case, the document is drawn up in three copies: for the customer, the carrier and the contractor. The form is filled out on two pages. The document consists of several sections:

Form os-3. act of acceptance and delivery of repaired fixed assets

Important

Formation of an act in the OS-3 form is the final stage of repair, reconstruction or modernization of an object that is part of the enterprise’s fixed assets. This form belongs to the primary documentation, is the most important accounting document and has its own filling characteristics.

FILESDownload a blank form OS-3 .xls fill out form OS-3 .xls What is considered fixed assets A company's fixed assets include any items used in its daily current activities. This could be tools, appliances, equipment, transport, furniture, equipment, etc.

Significance of the document Any means of labor inevitably wear out and age during operation. As a result, breakdowns occur, malfunctions occur, and the need for their repair and reconstruction arises.

Documentation of modernization of fixed assets

Based on the order of the manager, a corresponding commission is created, which recognizes a particular object of the material and technical base as in need of updating, draws up a work schedule and prepares other documentation.

She also controls the modernization procedure, and then, after improving manipulations have been carried out, accepts the fixed asset. Who writes the order The direct function of drawing up the order can be assigned to the head of a structural unit, secretary, lawyer or other employee close to the company's management.

After the order is formed, it must be submitted to the director for signature - without his autograph the form will not acquire legal status.

Form os-3. certificate of acceptance and delivery of wasps after repair

Conclusion of the commission: The work provided for in the contract (order) has been completed in full/not completely (indicate what exactly has not been completed). Upon completion of the work (repair, modernization), the facility was tested and put into operation.

Changes in the characteristics of the object caused by major repairs, modernization: The Customer inspected the vehicle in the presence of the Contractor. Chairman of the commission: position signature decryption of signature Members of the commission: position signature decoding of signature position signature decoding of signature The vehicle was handed over: » » g.

positionsignature decryption of signature M.P. accepted: » » Mr. Position signature transcript of signature M.P. chief accountant: Signature decryption of signature Save this document now.

Certificate of acceptance and delivery of work on repairs and modernization of a vehicle

- order - this detail indicates the contract number and the date of its preparation;

- periods of reconstruction work are established in the agreement and recorded in the act;

- Document Number;

- date of compilation, that is, the day the fixed asset is transferred from repair to operation.

- First section. This table provides information about the condition of the object before the start of repairs:

- name of the product according to the inventory card;

- serial number (i.e. serial);

- inventory number of the object recorded in accounting data;

- passport ID;

- the size of the replacement or residual value of the object;

- service life, which does not include periods of time during which the asset was mothballed.

Drawing up an act of acceptance and delivery of repaired fixed assets

As a result, for further uninterrupted use, they must be updated or modernized in a timely manner. This is also relevant in case of obsolescence of labor tools that arose during their use, breakdowns and malfunctions.

Modernization is work carried out in relation to fixed assets, which leads to their improvement, change in purpose (technological or service), increase in power, productivity, expansion of application capabilities, etc.

In addition, modernization leads to an increase in the book value of the fixed asset and the duration of its use. Modernization can be carried out by the company’s employees (if qualified specialists are available) or using the services of a third-party company.

Why is an order needed? An order to modernize a fixed asset is necessary in order to start this process.

The procedure and sample for filling out the unified form of the OS-3 act

Source: https://kodeks-alania.ru/akt-modernizatsii-obrazets/

Unified form No. os-3 - form and sample

Features of the act, general points If you are given the task of creating an act of acceptance and delivery of a fixed asset that has undergone repair work, and you do not know exactly how to do this, carefully read the recommendations below.

Look at the example of filling it out - you can easily draw up your document based on it. Before moving on to a detailed description of the act, we provide general information about the document.

Let's start with the fact that today there is no single unified model (the abolition of mandatory forms of primary documents occurred in 2013). This means that an act can be formed in any form or according to a template approved in the accounting policy of the enterprise.

However, the option of using the previously generally applicable OS-3 form is in greatest demand - it is convenient in structure, understandable and contains all the necessary information.

OSNO and UTII

A computer can be used in the activities of an organization subject to UTII and in activities for which the organization pays taxes under the general taxation system. In this case, if the replacement of components was carried out during modernization, then for the purposes of calculating income tax, it is necessary to distribute the monthly amount of depreciation deductions. For the purposes of calculating property tax - the residual value of the fixed asset, taking into account the costs of modernization. This procedure follows from paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

If the replacement of components is not considered an upgrade of the computer, then you need to distribute the costs of their acquisition (clause 9 of Article 274 of the Tax Code of the Russian Federation). The costs of purchasing components for a computer used in one type of activity of the organization do not need to be distributed.

The VAT allocated in the invoice for the purchase of computer components also needs to be distributed. Apportion the VAT in proportion to the share of transactions subject to this tax. Determine the share of transactions subject to VAT based on the cost of shipped goods (work, services, property rights) subject to VAT in the total volume of shipments for the tax period. This procedure is provided for in paragraphs 4, 4.1 of Article 170 of the Tax Code of the Russian Federation.

The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).