An agent is an intermediary between the seller and the buyer who helps them complete the transaction. For example, you are a courier and deliver goods from online stores to customers. Or you take a product from a supplier and sell it in your store, receiving a commission for it. In these situations, money received from buyers passes through you and is not your income.

[motivationNew(30 days free of charge', subcaption: 'for new business', href: '/?utm_source=enq227'>)=The service will calculate taxes and prepare reports for individual entrepreneurs, LLCs and employees. You can do it even if you don't know anything about accounting.]

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

If the principal applies conventional...

Agency agreements are widespread in business practice. They are often used in the provision of transport services, in international trade and advertising business. How to calculate taxes for one of the parties to such an agreement - an agent applying the simplified taxation system? Let's talk about this.

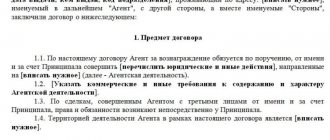

Chapter 52 of the Civil Code of the Russian Federation is devoted to the agency agreement. Under an agency agreement, one party, the principal, instructs the other party, the agent, to perform legally significant or other actions for a fee.

The agent can execute the order either on his own behalf or on behalf of the principal. In both cases, the agent is paid with the principal’s funds.

An agent who acts on his own behalf acquires rights and obligations arising from an agreement concluded with a third party.

The principal pays the agent a fee, the amount of which is provided for in the contract. If an agent undertakes to sell products, the amount of remuneration can be calculated as a percentage of sales volume.

Suppose an agent orders services on behalf of a principal or purchases property for him. In this case, the remuneration is expressed as a percentage of the cost of the purchased property or ordered services.

The agent is obliged to provide the principal with reports on the execution of the order and attach to them documents confirming expenses incurred at the expense of the principal. The principal has the right to submit his objections to the report within 30 days.

Depending on the terms of the agency agreement, the remuneration is either paid to the agent by the principal after approval of the report, or is withheld by the agent from amounts due to the principal. The latter is possible if the agent acts on his own behalf (according to the model of a commission agreement in accordance with Article 997 of the Civil Code of the Russian Federation).

This is explained by the fact that the rules provided for commission agreements apply to relations arising from agency agreements (Article 1011 of the Civil Code of the Russian Federation). But only on the condition that these rules do not contradict the provisions of the Civil Code on the agency agreement or the essence of such an agreement.

Agency agreement in small business

As a rule, agency agreements are concluded for the purpose of transferring non-core activities for the company to a specialized organization. Often such an agent is a small enterprise, which fully justifies its use of the “simplified approach”.

For example, in the situation discussed in the article, a small advertising agency, competing with larger firms, can provide an additional 18% in its profit margin or make significant concessions to the customer when concluding an important contract.

Secondly, it reduces labor costs for accounting. And finally, the third advantage: the less taxes an enterprise pays and the fewer reporting forms it submits, the less likely an error will result in tax penalties.

Let's consider the features of taxation of an agent using the simplified tax system.

Agent's income

Let’s say that an agent undertakes under a contract to conclude a contract in the interests of the principal for organizing an advertising campaign and to conduct the principal’s affairs related to this assignment. As an object of taxation, the agent has the right to choose either income or income reduced by the amount of expenses. In article 346.

15 of the Tax Code states that a taxpayer applying the “simplified taxation” must be guided by the provisions of Articles 249 and 250 of the Tax Code of the Russian Federation when determining income. Income specified in Article 251 of the Code is not taken into account for tax purposes.

Therefore, funds received by the agent in connection with the fulfillment of his obligations under the agency agreement, for example, to pay the costs of producing advertising products, are not included in the single tax base.

This means that the taxable income of the “simplified” agent is his remuneration. Taxpayers using the simplified tax system use the cash method of determining income.

As a rule, an agent who enters into a contract at the expense of the principal withholds the amount of remuneration from the funds received for the execution of the contract.

Therefore, remuneration for tax purposes is recognized as income for the taxpayer-agent at the time of transfer of funds by the principal.

The agency agreement may provide that the agent pays for the advertising campaign from his own funds and then issues an invoice to the principal for reimbursement of expenses. In this case, the agent's income is also recognized at the time the remuneration is transferred. The amount of remuneration may be included in the amount of compensation transferred by the principal.

The moment of acceptance of the report by the principal is not particularly important, since the “simplified” agent recognizes income on a cash basis. Let's look at what has been said with an example.

Unless another payment procedure is specified in the agreement, the principal must transfer the amount to the agent within 7 days from the date of submission of reports for past periods. Both parties can create legal restrictions in relation to each other (Art.

1007 Civil Code), if this is stated in the documentation. In accordance with Art. 1007, paragraph 3 of the Civil Code, it is prohibited to establish provisions in agency agreements that will allow the sale of products, the provision of services and work to certain consumers or those consumers who live in the specified territory.

Otherwise, the report is provided as the conditions are met or after the end of the contract (Article 1008, paragraph 1 of the Civil Code). Certificates of expenses incurred are attached to the reports.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH).

ten and a half months go in a year When an employee who has worked in an organization for 11 months is dismissed, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169). But sometimes these 11 months are not so spent. <...

We invite you to read: Execution of a court decision on reinstatement at work

If the principal works with VAT, issue an invoice

If you are selling goods on your own behalf to a principal who works with VAT, you will have to issue invoices for buyers and report to the tax office. At the same time, you do not need to pay VAT itself.

You issue an invoice for the client on your own behalf. In the seller's data you indicate your details, and in the buyer's data - the client's details. You give one copy of the invoice to the client, the second one you keep for yourself and send a copy of it to the principal. The principal will issue the same invoice on the same date, but in his own name, and give it to you. Both invoices must be recorded in the invoice journal. By the 20th day of the month following the quarter in which the invoices were issued, you must submit the tax journal in electronic form.

If you work on behalf of the principal, you won’t have to bother with VAT. You can, by proxy of the principal, issue an invoice on his behalf. Or the principal will do it himself. In this situation, you do not need to report to the tax office and pay VAT.

Income under an agency agreement for the agent and the principal: under the simplified tax system, for individual entrepreneurs, for legal entities

Agency agreements are transactions that are concluded with the participation of third parties who act as intermediaries between sellers and buyers and contribute to the successful implementation of transactions.

Consequently, this is an agreement between the principal and the agent, under the terms of which the agent, for a certain fee, carries out certain operations, based on the instructions of the principal or at the expense of his funds.

Such ADs are used to provide and receive legal services, construction, translation, sale-purchase-rent of real estate, etc.

General information about income from agency agreements

- The party who hires the intermediary to sell and buy goods or services is called the principal. In this case, he can act as a seller or buyer.

- The intermediary between the buyer and seller is called an agent.

For example, an online store hires a courier to deliver purchases and collect money from customers.

In this case, the courier acts as an agent, and the store acts as a principal, and an intermediary agency agreement is also concluded.

Ways to carry out work

The agent works in two ways:

- Concludes and conducts a transaction on his own behalf, draws up all documents for himself. Sometimes the third party doesn't even know they are working with an intermediary. All claims and issues are resolved without the participation of the principal (Chapter 5 of the Civil Code of the Russian Federation).

- The agent performs actions on behalf of the principal : all documents are drawn up in his name. The agent acts as an intermediary; he does not have any obligations under the transaction (Chapter 49 of the Civil Code).

But no matter how the agents act, they always carry out operations at the expense of the principals (Clause 1 of Article 1005 of the Civil Code of the Russian Federation). Therefore, they are required to submit reports within the established time frame, accompanied by the necessary documentation of expenses.

The legal basis of agency agreements is reflected in Chapter 52 of the Civil Code. In some cases, an agent may act simultaneously on his own behalf and on behalf of the principal when making one transaction.

Advantages and disadvantages of cooperation

The presence of an agent complicates accounting, but this is compensated by the fact that this increases the benefits for all parties to the contract.

With the help of agents, it is possible to expand the geography of the business and successfully solve problems not directly related to production, for example, advertising issues, legal services, and finding clients. Accordingly, the principal's income increases.

Such deals are no less profitable for the agent:

- He gets the opportunity to freely, without investing funds, use the principal’s product and receive his commission for it.

- Under the simplified tax system, the tax burden is reduced, that is, not all amounts received under the contract are considered income, but only those received in the form of a commission for agency services.

Agent profit generation

The agent's income is formed from money received from the principal in accordance with the signed agreement (Article 1006 of the Civil Code of the Russian Federation). The reward amount is issued in several ways:

- An agreement is concluded for the agent to receive a specific amount for conducting a transaction. This is beneficial to the principal: he knows exactly the amount of expenses. But the agent will not be able to earn more than the amount established in advance, so such an agreement is not always beneficial for him.

- An agreement is signed to receive a percentage of the total transaction volume. Quite profitable for the agent: he has the opportunity to sell more and receive a larger amount of money. For example, if an agent receives 10% from the sale of each unit of goods (for example, a vacuum cleaner for 12,000 rubles), then by selling 10 vacuum cleaners, he will earn 12 thousand rubles.

- A premium is provided to the original price of goods and services. The principal fixes the selling price, but the maximum is not limited. Therefore, the agent is motivated to sell at a higher price and earn more. That is, if the principal set the starting price for vacuum cleaners at 12,000 rubles, and the agent sells them for 14 thousand rubles, then by selling 10 pieces, he will gain 20 thousand rubles.

Money can be paid at different times:

- The agent's service is paid in advance by the principal.

- The agent keeps his remuneration, the rest is transferred to the principal's account.

- The principal pays the agent after the transaction is completed. If a specific period is not specified - within 7 days.

Taxation

- According to the Tax Code of the Russian Federation (clause 41, clause 1, article 146), the provision of various types of services is subject to value added tax (VAT). The tax base is established based on paragraph 1 of this article.

- In accounting, revenue under an agency agreement is considered as income from ordinary activities (PBU 9/99). Agency agreements and services are available to intermediaries who pay taxes under a simplified system.

- When calculating and paying personal income tax, income code 2010 “income from civil contracts, excluding copyrights” is used.

Accounting for income by AD

- For a principal using the simplified approach, income arises when funds are received in the agent’s bank account, electronic wallet or cash desk.

- Moreover, according to the law, the agent, after receiving money from the sale of a product or service, is not obliged to notify the principal that the money is already in his account. Therefore, it is necessary to prescribe in the contract a clause on the timely notification of the principal by the agent about the receipt of money from the sale of goods.

- At the end of the month, the agent prepares and sends a report to the principal on payments received. After reviewing the report, the money received from the buyer is transferred to the principal’s account as early as the next month. These funds are accounted for at the time they arrive in the bank account.

- The agent considers agency fees as income. This is done immediately after receiving the advance payment for the execution of the contract, if the remuneration is included in this payment.

- If the remuneration is received separately, it should be taken into account at the time of receipt.

This video will talk about the agency agreement, including the accounting of income under it:

Features of accrual under the simplified tax system

According to the simplified system (STS Income and STS DMR), all expenses are taken into account after they are paid upon the fact (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Not subject to accounting:

- money transferred to the agent in advance to fulfill the contract;

- amounts of payments returned by the agent.

Further accounting of the amounts sent to the agent to fulfill the contract depends on the conditions specified in the contract and the subject of the contract:

- When purchasing goods for the principal under the object “income minus expenses,” the amount of expenses is accounted for after the sale (clause 2, clause 2, article 346.17 of the Tax Code).

- When purchasing fixed assets, expenses are taken into account until the end of the year (clause 3 of Article 346.17 of the Tax Code).

Important:

- When transferring agency fees as part of the total amount for the execution of the contract, it is subject to accounting by the principal in expenses according to the terms of its accrual under the contract. Typically, the basis for accounting is the agent’s report, where this amount will be recorded (clause 24, clause 1, article 346.16 of the Tax Code).

- In case of a later (separate from the principal amount for the execution of the contract) transfer of the remuneration amount, it is indicated in the agent's expenses upon the fact of the transfer.

- The agent's income includes only his remuneration. Money received in advance to fulfill the contract does not apply to it (clause 1.1 of article 346.15, clause 9 of clause 1 of article 251 of the Tax Code).

The remuneration is recognized as income based on the terms of the contract. If the amount of remuneration is transferred together with fixed assets to fulfill the contract, then the agent independently allocates his remuneration and reflects it in KUDiR. If the reward is received separately, the facilitator agent records the amount at the time of receipt.

Source: https://uriston.com/kommercheskoe-pravo/dokumentatsiya/dogovor/agentskij/uchet-dohodov.html

Agency agreements: how an agent pays taxes on the sale of goods and services of the principal

An agent is an intermediary between the seller and the buyer who helps them complete the transaction. For example, you are a courier and deliver goods from online stores to customers. Or you take a product from a supplier and sell it in your store, receiving a commission for it. In these situations, money received from buyers passes through you and is not your income.

[motivationNew(30 days free of charge', subcaption: 'for new business', href: '/?utm_source=enq227'>)=The service will calculate taxes and prepare reports for individual entrepreneurs, LLCs and employees. You can do it even if you don't know anything about accounting.]

Give the agent's report to the principal

Do not forget to report to the principal on the work done. To do this, draw up an agent report within the deadlines established by the contract - every week, monthly, or only based on the results of work.

In the report, indicate what you bought for the principal and how much money you spent on it. Attach to the report documents confirming the purchase - acts, invoices, checks, etc. Also write down the amount of your remuneration in the report. If this is not done, you will have to draw up a separate act for the agency fee.

Documents for the buyer

The buyer must complete the same documents as in a regular transaction. For wholesale sales - an invoice, for retail sales - a cash register or sales receipt. When selling services, draw up a deed. If you are selling on your own behalf, please include your details in the documents. If you are acting in a transaction on behalf of the principal, indicate him in the documents.

In the documents, indicate the entire amount of the transaction, without separately highlighting the agency fee. After all, it makes no difference to the buyer whether he communicates with the seller directly or with his agent.

Agency agreement under the simplified tax system. Accounting Features

USN and agency agreement

First of all, it should be noted that the use of an agency agreement under a simplified taxation system (income minus expenses) allows the entrepreneur to transfer a number of powers to an intermediary - the counterparty under the agency agreement.

If the company uses the simplified tax system for taxation, then when subsequently drawing up the so-called agency agreement it will be necessary to be guided by certain rules.

But, first, let's look at what this agency agreement is and why it is needed.

An agency agreement is an agreement in which, for payment, one party (the agent) performs legal or other actions on behalf of the other party (the principal).

At the same time, the agents themselves can conduct this activity both on their own behalf (using the principal’s funds) and on behalf of the principal.

In general, this is an intermediary type of document, the preparation and implementation of the terms of which is regulated by Article fifty-two of the Civil Code of the Tax Code.

The agency agreement under the simplified tax system under consideration today is a fairly common occurrence in the work of enterprises that use this taxation regime.

As an object, a person has the right to choose profit or profit reduced by expenses, according to the Tax Code.

When determining the profit of an individual entrepreneur on a “simplified basis”, he must rely on the provisions of articles two hundred and forty-nine and two hundred and fiftieth of the Tax Code. In turn, this means that the entire amount received during the provision of services by the agent will not be included in the single tax base.

In this case, the actual taxable income of agents will be their real remuneration. It is necessary to recall that taxpayers of the simplified tax system must use a cash register when calculating profits.

As a rule, agents who have entered into contracts at the expense of the principals take remuneration from the amount received for the execution of the contract.

Thus, all remuneration (payments) to agents are considered profit received from the principals.

For example, the agency agreement states that the agent himself pays for an advertising campaign with personal money, after which this amount is billed to reimburse the principals. These funds will also serve as income.

It should be noted that the agents themselves do not have the right to recognize the costs of advertising the product of their principals as part of the costs that are taken into account when actually calculating the amount of the single tax.

The law does not prohibit an entrepreneur applying the simplified taxation system from buying and selling goods under an agency agreement; however, it is necessary to take into account some features of the design of an agency agreement and the recognition of income and expenses that naturally arise during the execution of an agency agreement.

- The terms of the agency agreement are divided into two categories: basic and additional. The main condition of the agency agreement is its subject matter. An additional condition of the agency agreement is the provisions on the amount and terms of payment of the agent's remuneration.

- It is necessary to indicate the form of the agency relationship between the agent and the principal.

Thus, the agent, according to the provisions of the contract, can perform legally significant actions, both on his own behalf and on behalf of the principal. - It is mandatory to specify in detail the level of authority of the agent in accordance with the provisions of the agency agreement. For example, an agent can make some transactions on his own behalf, and some transactions on behalf of the principal.

- The level of restrictions imposed by the agency agreement on each of the parties to the agreement should be provided for.

- In the case when settlements with the buyer occur with the participation of an agent under an agency agreement (as a rule, in such cases, payment is made through the agent’s current account or cash desk), it is necessary to include in the agency agreement a clause on the time period during which the agent undertakes to inform the principal about the receipts his name is cash.

In the accounting of agents, revenue that is directly related to intermediary services is usually considered profit from ordinary operations (clause 5 of the Accounting Regulations PBU 9/99 - Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n).

Reflection of amounts received under an agency agreement in accounting is carried out using account 90, where sales are reflected, as well as using subaccount 90-1, where revenue is reflected.

Account 76-5 is used for settlements with companies.

Account 26 is used to indicate expenses for general business needs.

Note! Organizations using the Simplified Taxation System do not have to pay Value Added Tax (in accordance with the provisions of Article 346.

11, paragraph 2 of the Tax Code of the Russian Federation), which means that when providing services they do not have the right to charge such a tax on their price.

Agents using the simplified taxation system also cannot issue invoices to their principals that include Value Added Tax.

How are the agent’s expenses for the simplified tax system taken into account?

An agent applying a simplified taxation system (income minus expenses) is obliged to form a budget for costs associated with the implementation of the terms of the order.

Expenses, in this case, are made from the agent’s own funds, but invoices for reimbursement of expenses are issued to the principal.

A typical example for an agency agreement. Agents do not have the right to recognize expenses for advertising the principals' products as expenses, which are taken into account when calculating the amount of the single tax if, according to the agreement, they must be reimbursed.

In order for a simplifier to sell or buy goods through an agent, he must take into account 2 types of organizational and accounting requirements:

- to draw up an agency agreement (AD);

- to the recognition of income and expenses arising from the execution of AD.

The use of an agent’s services when selling goods from a simplified customer generates both income and expenses:

- according to paragraph 1 of Art. 346.15 Tax Code of the Russian Federation - income from the sale of goods;

- according to sub. 23 clause 1 art. 346.16 of the Tax Code of the Russian Federation - expenses in the form of the purchase price of goods;

- according to sub. 24 clause 1 art. 346.16 of the Tax Code of the Russian Federation - for payment of remuneration to the agent;

Learn about the intricacies of accounting for agency fees when combining modes from the message posted on our website.

- according to sub. 8 clause 1 art. 346. 16 of the Tax Code of the Russian Federation - expenses for VAT paid to the agent (in terms of remuneration);

The material will tell you how to take into account “outgoing” and “incoming” VAT in a simplified manner.

- expenses related to reimbursement of other agent expenses.

The simplified customer includes expenses for AD if:

- money transfers made to the agent are on the authorized “expenditure” list of the simplifier;

- the agent submitted documents confirming the expense (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

The simplified customer reflects the income received through the AD and the expenses incurred in KUDiR based on the following:

- income from the sale of goods through an agent:

- is recognized on the day of receipt of money from the buyer (clause 1 of Article 346. 17 of the Tax Code of the Russian Federation) - if the agent does not participate in the settlements;

- at the time the intermediary receives money from the buyer - if payments are made through an agent;

Expenses are taken into account in the usual manner for a simplifier.

What to take into account when filling out the KUDiR - see the material.

The process of using the services of an agent when purchasing goods is associated with the occurrence of 3 groups of expenses:

- purchase expenses - they include the cost of purchased property, goods or other valuables;

- tax expenses - consist of amounts of “input” VAT transferred to the supplier and (or) agent;

- intermediary costs - related to the payment of remuneration to the agent and reimbursement of amounts associated with the execution of the AD.

We suggest you read: Prepayment clause in the contract

Expenses included in these groups reduce the income of the simplifier in accordance with clause 2 of Art. 346.18 Tax Code of the Russian Federation. The following accounting scheme is used:

- inclusion of expenses related to AD into the tax base of the simplified customer is made after their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation);

- The procedure for accounting for intermediary remuneration depends on the type of property acquired by the agent for the simplified customer:

- according to sub. 5 p. 1 art. 346.16, paragraph 2 of Art. 346.16, paragraph 2 of Art. 254 of the Tax Code of the Russian Federation - if, with the help of an agent’s services, inventories are purchased (the agent’s remuneration is included in the initial cost of inventories);

- according to sub. 23-24 paragraph 1 art. 346.16 of the Tax Code of the Russian Federation - when purchasing goods (agent’s remuneration is taken into account as a separate type of expense);

- according to sub. 1 clause 1 and clause 3 art. 346.16 of the Tax Code of the Russian Federation - when purchasing fixed assets and intangible assets (the agent’s remuneration is included in the initial cost of the asset).

VAT accounting scheme:

- as a separate expense (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- as part of the initial cost of acquired fixed assets and intangible assets (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

How does the purpose of the OS affect when a simplifier recognizes its value in expenses - see the material.

An additional benefit (AD) when executing an AD arises if the agent made a transaction on terms more favorable than those provided for in the contract.

When purchasing (selling) goods through an intermediary, the following must be taken into account in terms of DV recognition:

- DV may appear if the agent succeeds in:

- sell goods at a price higher than stated in the AD;

- buy goods at a price less than stipulated in the contract.