Punishment for non-payment of taxes

So, paying taxes is one of the main responsibilities of taxpayers (subclause 1, clause 1, article 23 of the Tax Code of the Russian Federation):

- Legal entities.

The amount to be paid to the budget is determined by the organization independently, depending on the taxation system applied. It is reflected in tax reporting submitted to the Federal Tax Service at the end of the reporting (tax) period.

- IP.

Entrepreneurs themselves calculate only those taxes that they pay in connection with their business activities. The only exception is PSN. In this mode, the tax (patent cost) payable is calculated by the tax authority. As for property taxes of individual entrepreneurs (on land, transport, property), the Federal Tax Service Inspectorate is responsible for their calculation.

- Self-employed (NPP payers).

The tax payable by self-employed citizens is calculated independently by the Federal Tax Service on the basis of data on the income received, reflected in the “My Tax” application. The amount to be paid is reflected in the application.

- Individuals.

In most cases, the Federal Tax Service calculates all taxes for individuals independently (property tax, land tax, transport tax). The exception is personal income tax. A citizen who has received taxable income from the sale of property (apartment, land, car) is obliged to declare it and pay income tax on it to the budget.

As punishment for non-payment of taxes, the Federal Tax Service has the right to:

- write off the amount of debt from the current account of an organization or individual entrepreneur (Article 46 of the Tax Code of the Russian Federation);

- block the taxpayer's current account (Article 76 of the Tax Code of the Russian Federation);

- seize the organization’s property (Article 77 of the Tax Code of the Russian Federation);

- go to court to collect the debt (clause 2 of article 45 of the Tax Code of the Russian Federation).

In addition to these sanctions, penalties and fines may be assessed on the amount of debt.

Certificate of debt from the Federal Tax Service

A certificate about the status of settlements with the budget will be required if an organization (IP) needs to find out the exact amount of debt for a specific tax.

The certificate of fulfillment of the obligation does not contain exact data on the amount of debt and the types of taxes for which this debt arose. It only reflects information about whether the taxpayer has fulfilled his obligation to pay taxes (fees, insurance contributions). If an organization or individual entrepreneur has an arrears, the Federal Tax Service will generate a certificate with the entry: “It has an unfulfilled obligation to pay taxes, fees, insurance premiums, penalties, fines, interest payable in accordance with the legislation on taxes and fees.” As a rule, this document is requested by legal entities when applying for participation in a tender or to obtain a loan from a bank.

To obtain such certificates, you will need to send a corresponding request to the Federal Tax Service. This can be done in your personal account on the Federal Tax Service website, by sending a request to the Federal Tax Service Inspectorate in writing or via TKS. This document does not have a unified form, but the Federal Tax Service website contains recommended request forms. To obtain certificates, we recommend using these document forms to avoid possible disputes with tax authorities:

Request for a certificate in writing:

Request for information in writing

Request for information on TKS:

Request for information on TKS

Types of certificates from the Federal Tax Service

Regulation No. 99n dated 07/02/12 provides for two forms of providing information. Taxpayers can obtain the following data from the Federal Tax Service for free:

| Help title | a brief description of | Formal requirements |

| About the status of settlements | The certificate is issued no later than 5 business days from the date of registration of the request. The document contains information about payments, arrears, and accrued penalties. Information is issued as of the date of application from the inspection database. The reliability and relevance of the data is confirmed by the signature of the head and the seal of the Federal Tax Service. The certificate form was approved by order of service No. ММВ [email protected] dated 12/28/16 | The conditions for consideration of the request are listed in paragraphs 125-160 of Regulation No. 99n. The same normative act approved the recommended form of application (Appendices 8 and ). It should be submitted to the inspectorate at the place of registration of the taxpayer |

| On the fulfillment of obligations to pay taxes, fines, penalties | This document contains general information about whether or not the company has debt. It is drawn up on a form approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-8 / [email protected] dated 01/20/17. If arrears are recorded, an appendix with a brief explanation is issued along with the certificate. 10 days are allotted for issuing information to the inspection. | The procedure for executing the request is described in paragraphs 161–185 of Regulation No. 99n. The appeal is made using the same forms (Appendices 8 and 9) |

In conclusion, we note that conscientious firms willingly provide potential counterparties with accounting information about their solvency. The reluctance of an enterprise to disclose information about settlements with the budget, business partners or government funds is already an alarming signal.

How to find out tax debt through your personal account

An organization or individual entrepreneur can obtain data on existing tax debts and fees in their personal account on the Federal Tax Service website.

To register in your personal account, an organization will need to issue an electronic signature to the director or other responsible person of the company.

Individual entrepreneurs can use the login and password from the personal account of an individual taxpayer to access their personal account. If the individual entrepreneur has not opened a personal account at all, he can do this in 3 ways:

- By contacting any Federal Tax Service with your passport and TIN. After checking the documents, the tax authority employee will issue a document with a login and temporary password, which will need to be replaced within 1 month.

- Using the State Services login and password. This method is only suitable for those individual entrepreneurs who have a confirmed account on the State Services portal. If it is not there, then it is easier to contact the Federal Tax Service for a login and password for the LKN.

- Using digital signature. This option is convenient for those individual entrepreneurs who have a qualified digital signature. If it is not there, then issuing an electronic signature only for opening a personal identification document is inappropriate.

Ways to check tax debts of legal entities using TIN

Without registration, checking the debts of individuals and legal entities is possible only on the FSSP website. To obtain information about an organization, you must enter the name of the enterprise, its address and select the region. Next you will be asked to enter the code from the picture. After this, information about the debts of a particular institution recognized in court, including to the budget, will be displayed. The peculiarity of this method is that the FSSP database displays only those debts that are in enforcement proceedings with bailiffs.

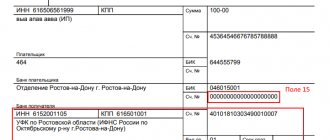

You can find out the tax debt of an organization using the Taxpayer Identification Number (TIN) on the website of the State Services or the Federal Tax Service. In both cases, you will need to register and create a personal electronic account. ]]>a new service]]> has appeared on the website of the Federal Tax Service Inspectorate for information about legal entities with current debts to the budget. The resource is working in test mode. To find out the tax debt of an LLC using the TIN, simply enter the TIN number of the enterprise and the proposed digital code option.

The peculiarity of this method is that the databases are updated once a month; information is entered into them only about those enterprises that have not submitted tax reports for more than a year or have accumulated a debt of more than 1,000 rubles. Information will not be available for other categories of taxpayers.

LLCs and other legal entities can find out their tax debts through the taxpayer’s personal account form. After the registration procedure and receipt of electronic signature verification key certificates, you can send electronic requests for certificates, view the status of current payments for each tax, pay amounts of arrears and fines, and initiate a reconciliation with an inspector.

Tax debts of legal entities by TIN can be found on the State Services portal. The site services take information from the Federal Tax Service databases; access to the entire range of information is available only after completing the registration procedure and issuing an electronic signature. A corresponding notification with search results for a debt request is received in the form of a message in your personal account on the portal or by email to the specified e-mail address.

How to find out debt through State Services

This method is only relevant for individual entrepreneurs. Organizations will not be able to find out about their debt to the budget through State Services.

To receive information, an individual entrepreneur will need to log in to the system using the individual’s login and password. That is, in order to find out his debt, an individual entrepreneur must have a confirmed account with State Services.

Why can individual entrepreneurs find out about their debt through State Services, but organizations cannot? The whole point is that an individual entrepreneur is responsible for his obligations with all his property and his debts are transferred from him as an individual entrepreneur to him as an individual. Organizations, in exceptional cases, are liable for their obligations with personal property (subsidiary liability).

We will look at more details about how an individual can find out about his tax debt on the State Services portal below.

Debt verification service on the website of the Federal Tax Service of the Russian Federation

In total, the Federal Tax Service website has several services for checking whether an organization or individual entrepreneur has debt. The most popular of them:

- “Information about legal entities that have tax arrears and/or have not submitted tax reports for more than a year.”

This service is intended more for checking counterparties than for obtaining information about the presence of debt in “your” organization. With its help, any interested party can find out whether his counterparty is a tax debtor. If the organization has a debt to the budget of more than 1,000 rubles. and/or does not submit reports for more than a year, information about this is entered into the Federal Tax Service database and becomes publicly available. But information can be obtained using this service only for legal entities. Individual entrepreneurs, self-employed people and individuals are not reflected in it.

- "Transparent business".

Another service from the Federal Tax Service. Just like the previous resource, this service provides information about legal entities according to several parameters:

- “Mass” director - whether the head of the organization (IP) is a director in several legal entities.

- “Mass” founder - whether the head (participant) of an organization (IP) is a founder in several companies at once.

- Disqualification of a director - whether the head of the organization (IP) is included in the register of disqualified persons.

- “Mass” legal address - whether the organization uses a mass registration address, that is, one for which several legal entities are registered.

- Data on filing documents for state registration - whether the organization or individual entrepreneur has submitted documents to make changes to the Unified State Register of Legal Entities (USRIP) in the near future.

Detailed information about taxes and fees

To obtain detailed information about the listed amounts and existing debts in terms of taxes, you need to click “Details” in the “Taxes and Fees” or go to the “Taxes and Fees” .

Analytics of taxes paid

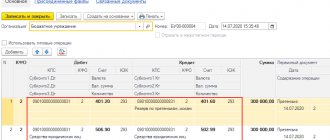

When generating information on debt, the amounts of taxes, penalties and fines will be highlighted in separate columns.

Tax debt analytics

The user also has access to the function of downloading data, which occurs in .xlsx, .docx, .pdf . Thanks to this function, you can analyze data in a familiar format, and also share the information received with partners.

Unloading

Information about the presence of debts on taxes and fees will help protect the organization from concluding an agreement with a large debtor to the budget. Also, in order to analyze a potential counterparty, the Kontur.Focus system offers the user the following options: monitoring the counterparty, special registers of the Federal Tax Service, notes about the company.

How to find out the tax debt of an individual

A citizen can independently find out about the presence of a tax debt in several ways:

- In your personal account on the Federal Tax Service website

This method is suitable for those who have access to LKN. Using the LKN, you can find out the exact amount of the debt and the type of tax for which it was formed. In LKN, you can immediately pay the debt in several ways: by generating a receipt or paying online through the website of the selected bank.

- On a personal visit to the Federal Tax Service.

To obtain information, an employee of the Federal Tax Service will need to present a passport and Taxpayer Identification Number (TIN). You can make an appointment with the inspectorate online on the Federal Tax Service website.

- Through the State Services portal.

To obtain information about tax debt, you need to fill out an application in which you will need to indicate your TIN. But if you have a confirmed account containing information about the TIN, you do not need to do this: the system will automatically generate data on the presence or absence of debt. You can also pay existing arrears online at State Services.

- At the MFC during a personal visit.

To find out your tax debt, you can contact any (MFC). To do this, you will need to fill out an application for recognition of confidential tax information (all or part for a certain period) as publicly available.

- On the SSP website.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

How to find out for what types of taxes a tax debt has arisen

The tax service sends notifications to individuals and entrepreneurs containing information about the type of debt that needs to be repaid and the timing of its payment. The letter, as a rule, already contains payment receipts for convenience.

Each type of tax has its own specific payment deadline. It is better to check for debts before you receive a letter from the tax office. If a person has already transferred money to pay off a debt, then for your own peace of mind it is worth checking whether the payment has reached the addressee. Otherwise, the debt will grow. There are several ways to check the status of your payment and, at the same time, repay it.

1. Personal application to the tax office.

You need to come to the tax office and, contacting the inspector, ask for pay slips. After your passport is checked, you will receive the appropriate receipts for payment of a certain type of tax. You can transfer money at each bank branch using a cash register or ATM.

2. On the official website of the tax service.

On the tax website, each taxpayer has his own personal account. It contains information about unpaid duties and all due dates for repayment of debts. In addition, if you have any fines and penalties, then full data about them will be indicated there.

To get a login and password for your personal account, you should contact the tax office, where an employee of the institution will give you a special form with all the information. Do not put off working with your account for too long, because if you do not use the site within a month from the issuance of this document, you will need to go to the branch again for new registration data.

So, you have found out your login and password. Go to the website, go to the “Personal Account” tab, enter the information, and after that you will see data on your debts and fines. If you wish, for your convenience and greater security, you can change your password.

3. Through online banking applications.

Some banks are partners with the tax service. These include Sberbank and VTB-24. By using their online services, you will find out the type and amount of debt. In addition, if you have the necessary funds on the card, you can immediately pay off your tax debt.

To do this, open the “Payments” tab, then go to the taxes section. There you will need to enter your TIN, and then all the information you are interested in about the type of debt will appear.

To clarify your TIN:

- make a request to the tax office;

- or use the tax website.

4. Through the State Services website.

The State Services website is accessible from any gadget: computer, phone and tablet. The service provides its services only to registered users. Find the tab there dedicated to debts, fill out the application, and then information will open on the debts that you currently have. Here you will need your TIN again. This document is required for all transactions related to taxes, duties and fees.

The Gosuslugi website not only provides information about the types of tax debts, but also offers to pay off the debt by making an online payment using a bank card.

5. Through Yandex.Money.

The first step is to register an online wallet. You can deposit money into it by making a transfer from a bank card or other wallet of a similar type. Find the “Goods and Services” page there, and in it the “Taxes” tab. Then enter your Taxpayer Identification Number. The whole process will take you a couple of minutes, there is nothing complicated here. You will be able to find out the amount of your existing debt, as well as immediately pay off the debt through Yandex.Wallet.

IMPORTANT: keep in mind that the longest method of the above is a direct application to the tax service. It will take you very little time to find out the size and type of tax debt via the Internet. In addition, you can immediately pay off your debt without leaving your computer.

Let's sum it up

- Timely payment of taxes is one of the main responsibilities of organizations, individual entrepreneurs and individuals.

- Organizations and individual entrepreneurs can find out about their debt by requesting a certificate about the status of settlements with the budget or about the fulfillment of the obligation to make payments.

- You can also obtain data on existing tax arrears in your personal account on the Federal Tax Service website, in the “Tax Debt” service on the State Services portal and by personally contacting the Federal Tax Service Inspectorate and the MFC (relevant only for citizens).

- You can also find out about debt to the budget on the FSSP website, but only if enforcement proceedings have already been initiated in relation to this debt.

If you find an error, please select a piece of text and press Ctrl+Enter.