What is inventory

This term refers to the verification and calculation of fixed assets listed on the balance sheet of the enterprise. In turn, fixed assets include all the property of the company that is used to carry out its activities. In particular, these are: equipment, machinery, instruments, transport, buildings and structures, etc. One of the main features of an object, in order to classify it as a fixed asset, must be the period of its use: at least one year, as well as a certain minimum value threshold (which is established at the legislative level and changes over time).

Reasons for verification actions

The reasons for inventory activities can be very different: upcoming annual reports on accounting and taxes, a change in financially responsible employee, theft, theft, other abuses of the organization’s property, the upcoming transfer of fixed assets to a tenant or a new owner.

In addition, property inspection is carried out during the reorganization of the company and its impending liquidation, as well as in force majeure circumstances (fires, floods, accidents, etc.). Inventory can be carried out both on a voluntary basis and compulsorily, both one-time and regularly, and its duration can vary from several hours to several days. At large enterprises, inventory is carried out separately for each structural unit.

What goals are set and what results can be

Based on the above, it is not difficult to understand the main goals and objectives of this event.

- First of all, this is a certification that all fixed assets credited to the organization’s balance sheet are safe and sound, there are no surpluses or shortages, and that all factual data fully corresponds to what is reflected in the documents.

- Thanks to the inventory, management gets the opportunity to get a real picture of the enterprise’s property, as well as to carry out timely write-off of fixed assets (broken, obsolete or lost).

- This procedure also has a disciplinary nature: knowing about its implementation (especially if it is carried out regularly), materially responsible employees perform their job duties with greater care and reliability, avoiding negligence and deliberate violations.

Inventory procedure

In terms of structure, inventory can be divided into three main stages.

The first stage is preparation, during which a plan is developed, the availability of documentation for fixed assets is checked and its content is examined, and a corresponding order is issued on behalf of the director of the enterprise. By means of the above order, an inventory commission is appointed (it can be permanent), which should include employees from different departments, then the financially responsible employee writes a receipt, and the balances of fixed assets are determined using the accounting data.

The second stage is the inventory itself. Here everything is measured and calculated, an inventory list is drawn up, into which all the material assets actually available in the enterprise are entered. At the same stage, an assessment of previously unaccounted for objects occurs, a description of the degree of their wear and condition.

And finally, the third stage : the final one. During this process, the received information is compared with accounting information, deviations are identified, as well as their causes, and a statement of discrepancies is compiled. At the end, preparations are made for entering all detected discrepancies into accounting.

Inventory list (matching statement) for objects of non-financial assets (form 0504087).

To reflect the results of the inventory of non-financial assets carried out by the institution (hereinafter referred to as NFA), an inventory list is used (f. 0403087). The following changes have been made to this register:

| Column number | Indicator name | Note |

| Actual presence (condition) (indicators columns 5 – 9) | ||

| 5 | Price (estimated value) of the inventory item | When taking inventory of material assets for sale, the price of the product or product is indicated |

| If a surplus is identified, the estimated value of the object is reflected | ||

| 8 | Status of the accounting object (this column indicates information about the condition of the property as of the inventory date, taking into account the assessment of its technical condition and (or) the degree of involvement in economic turnover) | In relation to fixed assets, the following is indicated: “in operation”, “requires repair”, “is under conservation”, “does not meet operational requirements”, “has not been put into operation” |

| In relation to material inventory items, the following is indicated: “in stock (for use)”, “in stock (in storage)”, “inadequate quality”, “damaged”, “shelf life has expired” | ||

| In relation to objects of unfinished construction, the following is indicated: “construction (acquisition) is underway”, “the object is mothballed”, “construction of the object is suspended without conservation”, “transferred into ownership of another public legal entity” | ||

| 9 | Target function of the asset (this column indicates information about possible ways to involve inventory objects in economic circulation, use them to obtain economic benefits (extract useful potential) or, if this is not possible, about ways to dispose of the object) | In relation to fixed assets, indicate: “commissioning”, “repair”, “mothballing of the facility”, “retrofitting (retrofitting)”, “decommissioning”, “disposal” |

| In relation to inventory items, indicate: “use”, “continue storage”, “write-off”, “repair” | ||

| In relation to unfinished construction objects, the following is indicated: “completion of construction (reconstruction, technical re-equipment)”, “mothballing of an unfinished construction object”, “privatization (sale) of an unfinished construction object”, “transfer of an unfinished construction object to other economic entities” | ||

| Inventory result (indicators columns 13 - 18) | ||

| 13 | Quantity (indicates the number of inventory items for which a shortage was identified according to accounting data) | |

| 14 | Amount (this column reflects the cost of the item for which a shortage was detected) | Determined by multiplying the indicator in column 13 by the result of dividing the indicator in column 12 by the indicator in column 11 |

| 15 | Quantity (indicate the number of inventory items for which surpluses have been identified) | |

| 16 | Amount (this column reflects the cost of an unaccounted object identified during the inventory) | Determined by multiplying the indicator in column 15 by the indicator in column 5 |

| 17 | Quantity (shows the number of inventory items for which the institution’s commission has determined that they do not comply with the conditions for recognition of assets for accounting purposes) | |

| 18 | Amount (indicates the value of objects that do not meet the criteria for classifying an object as an asset) | Determined by multiplying the indicator in column 17 by the result of dividing the indicator in column 12 by the indicator in column 11 |

| 19 | Note (information is indicated that is not reflected in other columns of the form) | Information is provided on accounting objects in respect of which a shortage has been identified, and the number of accounting objects that have retired within the limits of natural loss norms is indicated. This column also indicates information about the reasons (grounds) for changing the status and (or) target function of the accounting object from the previous inventory |

* When forming an accounting policy, the institution independently determines the method of indicating the status of an accounting object by its name and (or) code.

The inventory list (f. 0504087) is signed by the chairman and all members of the commission of the institution carrying out the inventory after the responsible person(s) have provided an explanation of the reasons for the discrepancies (if any) and the conclusion of the commission of the institution on the results of the inventory.

Example 1:

Based on the results of the inventory carried out in the budgetary institution by the commission, it was revealed that, according to accounting data, the following objects are taken into account and are actually in a certain state:

- carpentry equipment that has not been put into operation and is subject to additional equipment;

- plywood in the amount of three sheets, of inadequate quality - subject to write-off;

- an unfinished construction project is a non-residential building that was previously mothballed and is currently under construction.

In particular, the inventory list (f. 0403087) will reflect the following information:

| Name of the non-financial asset item | Actual availability (condition) | According to accounting data | Note | ||

| Quantity | Accounting object status | Asset objective function | Quantity | ||

| 2 | 6 | 8 | 9 | 11 | 19 |

| Carpentry equipment | 1 | Not put into operation | To be retrofitted | 1 | |

| Plywood | 3 | Poor quality | To be written off | 3 | It fell into disrepair as a result of a pipe break in the warehouse |

| Non-residential building | 1 | Construction is underway | 1 | Removed from conservation, construction completed | |

Document format and design

Today, the statement of discrepancies can be made in any form or according to a template that is developed and approved within the company. However, many businesses still prefer to use the previously unified form because it is convenient and includes all the necessary fields, rows and cells. The format of the statement must be fixed in the local regulations of the organization.

The statement is made in two copies identical in content, each of which is certified by the signatures of responsible employees. There is no need to stamp the form.

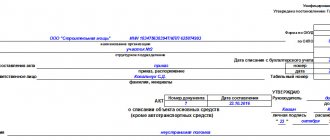

Form and sample filling

form for statement of discrepancies based on inventory results (f. 0504092).

Sample of filling out a statement of discrepancies based on inventory results:

Similar articles

- Inventory results report (filling sample)

- Transmittal sheet for the bag (form and sample)

- Collation statement

- INV-26 statement of accounting of results identified by inventory

Sample statement of discrepancies based on inventory results

- At the beginning of the document, standard data is filled in: date of formation of the statement, name of the organization, name of the structural unit and information about the financially responsible employee.

- Next comes the main part, which is presented in the form of a table. It contains the name of the inventory object, its inventory sign (number), the unit of measurement in the form of a code and its decoding (pieces, liters, meters, etc.), and the accounting account number.

- Then the table contains data regarding the actual results of the event: first, what is the shortfall. Here you write the book value of the object, information about natural losses (quantity and amount), the price at the time of inventory, loss in excess of the established norm of natural loss, the difference between the price on the balance sheet and the market value (plus or minus).

- Then, if surpluses are identified, information about them is entered: their quantity and cost.

- In conclusion, the document must be signed by the materially responsible employee, as well as the accountant.

How to make a matching statement

The form of the matching statement is established by law. Its form is presented below.

It consists of two parts: the document header and the main (tabular) part.

The following information is written in the header of the statement of discrepancies based on the inventory results:

- date of filling out the statement;

- the name of the company in which the statement is prepared;

- department names;

- OKPO code.

The tabular part of the statement is filled in with the following information:

- surname and initials of the material employee;

- name of the accounting item;

- inventory number of this accounting item;

- in what unit of measurement the item is measured - name and code;

- account number;

- inspection results - shortage:

- book price of the object;

- loss within the limits of natural loss - its quantity and amount;

- market price of the product;

- loss in excess of the norms of natural loss - its quantity and amount;

- difference between market and book price;

- test results - surplus:

- amount of surplus;

- the size of the surplus in value terms.

The chief accountant, as well as the employee who compiled the statement, must put their signatures under the tabular part. After the signatures, the date of certification of the document is indicated.