Operating profit: definition

The concept of operating profit is intended to identify the company's performance in its main line of business. The basis for calculating this indicator is the total revenue in monetary terms received after the sale of manufactured products and resale of goods.

When operating profit is determined, the calculation formula should not take into account the amounts of financial flows and investment funds. The sequence of calculations is as follows:

- the total revenue value is displayed;

- the gross profit indicator is found (cost amounts for products sold are subtracted from revenue);

- how to calculate operating profit - the total gross profit is reduced by the costs incurred to sell batches of goods to end consumers.

Gross profit is intended to show the degree of influence of product costs on the profitability of production. The operating profitability indicator makes it possible to make performance data more objective. The level of tax burden and possible actions of fiscal authorities do not affect the value of this type of profit.

Calculation of the efficiency of operating expenses

Efficiency calculation

The efficiency index for incurred operating expenses is established by the management body for each regulated company. One of the methods used is the efficiency of investment capital or indexation of established tariffs to optimize their level.

Investments raised to reduce costs are taken into account, and their impact on the level of costs at the stage of development and implementation of the application plan is studied.

Important: if, thanks to the implemented investment program, expenses can be reduced by 5%, then the efficiency index is applied at a 5% value.

At the same time, for enterprises:

- for thermal energy production, an index of 1%, maximum 5% is applied;

- for enterprises transmitting energy, the index obtained by applying the following formula IORj = max (IORj inv; IOR jcomp) , but not more than 5%.

After establishing the method, the management team monitors the activities of enterprises every 5 years and analyzes their activities through comparison. As a result, after comparative activities, an index of the efficiency of the companies' work process is determined.

Such a calculation of the efficiency index and comparative analysis are necessary to determine the level of costs and find ways to optimize them. So that the cost of production can be reduced if it turns out to be too high. The coefficient gives a clear idea of what percentage goes to maintaining the company's activities.

By drawing up graphical dynamics of activity using a coefficient, you can increase the company’s productivity by completely eliminating costs.

Reflection of profit in reporting

Operating profit in the balance sheet - the line for this indicator is not highlighted in the report. It is easier to derive it from the data from the profit and loss statement (financial results). To do this, use the string values:

- revenue (line code 2110);

- cost of sales (data from line code 2120);

- commercial expenses (in the report this is line 2210);

- management expenses (from the column under code 2220).

How is operating profit calculated in management accounting - based on natural measures of sales volume, current prices of commodity items and full cost amounts. The formula for calculations is:

Sales volume x Price level – Sales volume x Cost.

Net operating profit for the general financial market is derived by finding the difference between the values of the following report lines:

2110 (revenue total) – 2120 (cost of sales) – 2210 (commercial types of expenses incurred) – 2220 (expenses for management purposes) + 2310 (income received by the enterprise from participation in the capital of other organizations) + 2320 (interest amount, receivable) – 2330 (interest accrued and payable to third parties) + 2340 (other income) – 2350 (other expenses) – 2410 (income tax amount) + (-) line 2430 + (-) line 2450 – 2460 (other).

Net operating profit after tax will show, based on the results of calculations, the objective level of profitability of the project. Investors prefer to assess risks and prospects by comparing different types of returns. Operating profit is not reflected in the balance sheet; it cannot be determined based on data from this report alone. The reason is that the balance sheet form displays the values of indicators as of a certain date by placing the ending account balances in the lines. The financial results statement is convenient because it reveals the amounts accumulated over a period of time.

What does the term "operational analysis" mean?

There is such a thing as “operational analysis”. What is noteworthy is that this type of analysis is considered a trade secret and is not disclosed to third parties. This method is based on calculation and the study of several basic indicators and is used in management accounting. In particular, the following are subject to study:

- profitability threshold or break-even point or critical volume of production, sales (revenue received by the enterprise, which covers all expenses with zero profit), i.e. the enterprise in this situation has neither profit nor damage;

- operating leverage or production, operating leverage (the ratio of variable and fixed expenses, which influences the OP in a certain way, reflects the excess of the growth rate of profit over revenue);

- margin of financial strength, an indicator of financial stability (the excess of revenue received from the sale of goods over the profitability threshold shows to what extent production can be reduced so as not to incur losses).

In addition, in the process of operational analysis, gross margin ratios (GMR) and changes in gross sales (CGSP) are calculated. The first indicator (KVM) shows how capable the enterprise is of covering its own fixed expenses and, accordingly, receiving OP, i.e., sales profitability. The second (CIVP) allows you to analyze the dynamics of change. It can be used to characterize changes in the volume of gross sales that occurred in the current and previous periods.

Operational analysis is used in planning and forecasting the operation of enterprises. With its help, you can find out the most acceptable prices for products, the most profitable, cost-effective and most unprofitable products, the most significant spending lines and ways to influence them, etc. This is a kind of search for the most optimal suitable combinations between variable expenses, cost and sales volumes.

The OP indicator is used as one of the important components of this analysis. With his participation, they also determine the profitability of products by type, the influence of cost on pricing, the margin of financial strength of the enterprise, the minimum permissible volume of production (sales) corresponding to the break-even point, the influence of production volumes on expenses, etc.

Operational analysis is often called break-even analysis. This name speaks for itself. With its help, you can calculate the required number of sales at which the company will have neither loss nor profit. To survive in the current financial situation, the company needs to overcome and exceed this break-even point.

Indicator analysis

A business is generally considered sustainable if it can earn enough from its operations to support itself and the people involved in it. Thus, a higher operating profit ratio is better than a lower one as it shows the financial strength of the company.

The trend in operating profit margins must be analyzed over several periods in the context of the industry in which the company operates.

Generally, a higher operating profit margin is desirable because it implies greater potential for profit generation and greater protection from any increased competition or rising costs.

The change in rate can be explained by several factors, as reflected in the table below.

Example No. 1. Consider a simple example, calculation.

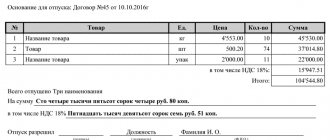

The initial data for the calculation are presented in the table below.

| Index | Value, p. |

| Gross Sales | 564000 |

| Return of sales | 54000 |

| Cost of sales | 240000 |

| Labor costs | 43000 |

| General and administrative expenses | 57000 |

Calculation:

- Let's find net sales:

56400-54000 = 510000 rub.

- Let's find the gross profit. Subtract the cost of goods sold from net revenue:

510,000 – 240,000 = 270,000 rub.

- Subtract operating expenses from gross profit to find operating profit:

270,000 – 43,000 – 57,000 = 170,000 rub.

- Using the operating profit rate formula, we get:

170 000 / 510 000 * 100 = 1/3 * 100 = 33,33%.

Example No. 2. Another example.

Consider ABC Company's income statement.

| Index | Value, rub. |

| Total income | 1 000 000 |

| Cost of goods sold | 750 000 |

| Salary | 250 000 |

| General expenses | 50 000 |

| Other operating expenses | 100 000 |

Calculation:

- Operating profit:

750 000 –0 100 000) =

- Norm:

350 000 /1 000 000 * 100 = 35%

Balance sheet profit of the enterprise in reporting

Accounting statements reflect all performance indicators of companies. It allows you to assess the degree of success of a business project, calculate its profitability and prospects. The line in the balance sheet for book profit is not highlighted. The report shows the value of the profit remaining after deducting from it all types of costs and tax liabilities.

The reason for the impossibility of identifying the value of balance sheet profit according to the balance sheet reporting form is the different approach to reflecting the results of operations. The balance sheet is compiled on the basis of the ending account balances. Balance sheet profit must be calculated based on information generated cumulatively. The calculation can be made based on the balance and data from accounting registers. To do this, the amount of income tax paid during the year must be added to the retained earnings from the balance sheet line under code 1370.

Operating profit: formula

Expenses in calculations should be taken into account only in that part that relates to the sold batch of goods. Accounted expense items are classified into the following categories:

- variable costs in the form of prime cost;

- overhead expenses aimed at paying for rent of premises, licenses and certificates.

How to calculate operating profit if the accounting records include turnover on interest from loans and investments - their values are not taken into account when calculating the required indicator. The final formula looks like this:

Operating profit = Revenue – Variable costs – Overhead

Formula for calculating net profit on balance sheet

In the standard form of the balance sheet, approved by the order of the Ministry of Finance of Russia “On forms of financial statements of organizations” dated 07/02/2010 No. 66n, there is no net profit indicator. But in Section III “Capital and Reserves” of the balance sheet, line 1370 reflects retained earnings (uncovered loss), part of which is the net profit (loss) of the current period.

Most businessmen start their companies out of a desire to make a profit. There are several metrics that business owners can use to determine the performance of their business. One such indicator is profit before tax.

The profitability of a company can be calculated using the profit before tax indicator. The significance of this indicator in efficiency calculations is very high.

Profit before taxes covers all income earned, regardless of where it comes from. It includes sales, commissions, income from other services and interest income. All expenses are subsequently deducted except for income taxes. Alternatively, the indicator can be calculated by taking the organization's net profit and adding income tax.

where PN – profit before tax, etc.;

B – sales revenue, t.r.;

C – cost, t.r.;

UR – management costs, t.r.;

DI – income from participation in the activities of other companies, etc.;

PP – interest to be received, etc.;

PD – other income, t.r.;

PR - other expenses, t.r.

Page 2300 = page 2110 – page 2120 – page 2210 – page 2220 page 2310 page 2320 – page 2330 page 2340 – page 2350

Algorithm for calculating profit before tax:

- collection of all financial data on the income received by the company. Revenue can come from various sources such as rental income, discounts received, and general sales. Other unique sources of income include service income, interest earned on bank accounts, and bonuses;

- determination of all expenses. These include: rent, debt, utilities and cost of goods sold;

- subtracting expenses from income received to obtain gross profit;

- determination of commercial and administrative expenses;

- subtracting the amount of selling and administrative expenses from gross profit to obtain profit from sales;

- adding to the profit from sales the amounts of income from participation in other companies, the amount of interest received and other income;

- subtracting interest payable and other expenses from the resulting amount;

- formation of profit before tax indicator.

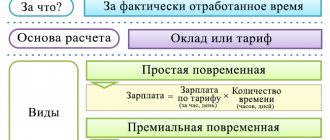

The scheme for calculating the indicator is presented more clearly in the figure here.

| Index | 2017, t.r. | 2018, t.r. |

| Revenue | 547800 | 654700 |

| Expenses | 321470 | 455900 |

| Business expenses | 12455 | 17855 |

| Administrative expenses | 9875 | 9777 |

| Income from participation | 5446 | 6511 |

| Interest receivable | 7885 | 8444 |

| Interest payable | 15477 | 19745 |

| Other income | 5423 | 2144 |

| other expenses | 7895 | 6744 |

To calculate the profit from sales, we use the table below.

| Index | 2017, t.r. | 2018, t.r. | Absolute deviation, t.r. | Rate of change, % |

| Revenue | 547800 | 654700 | 106900 | 119,5 |

| Expenses | 321470 | 455900 | 134430 | 141,8 |

| Gross profit | 226330 | 198800 | -27530 | 87,8 |

| Business expenses | 12455 | 17855 | 5400 | 143,4 |

| Administrative expenses | 9875 | 9777 | -98 | 99,0 |

| Profit from sales | 204000 | 171168 | -32832 | 83,9 |

| Income from participation | 5446 | 6511 | 1065 | 119,6 |

| Interest receivable | 7885 | 8444 | 559 | 107,1 |

| Interest payable | 15477 | 19745 | 4268 | 127,6 |

| Other income | 5423 | 2144 | -3279 | 39,5 |

| other expenses | 7895 | 6744 | -1151 | 85,4 |

| Profit before tax | 199382 | 161778 | -37604 | 81,1 |

As can be seen from the table, by 2021 there is a decrease in profit before tax by 37,604 tr. or by 18.9%. This decrease is due to the fact that the growth rate of revenue (19.5%) was lower than the growth rate of expenses (41.8%). Along with the decrease in profit before tax, one can also see a decrease in gross profit by 27,530 tr., profit from sales by 32,832 tr.

Types of profit in accordance with form No. 2

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 3 of 6Next ⇒

Profit —

this is the difference between revenue and all costs of the production and financial activities of the enterprise. The profit of an enterprise characterizes the excess (if vice versa, then a loss) of revenue over expenses, is the main indicator of operational efficiency and reflects the goal of entrepreneurship.

Depending on the calculation method and distribution directions, the following main types of enterprise profit are distinguished: gross (balance sheet) profit, operating profit, profit from ordinary activities and profit after tax (net profit).

Gross (balance sheet) profit (Gross Profit) is the difference between net income from product sales and cost of products sold.

The cost of products sold, in addition to production costs, also includes the amount of associated payments: property tax; tax on vehicle owners; land payment; excise duty, etc. Accordingly, gross profit is reduced by these fees and charges. Operating Profit is book profit adjusted for the difference between other operating income and operating expenses.

Other operating income includes income from the operating activities of the enterprise, except for income (revenue) from sales of products (which is already included in gross profit):

· income from rental property;

· income from operating exchange rate differences;

· income from the sale of current assets (except for financial investments);

· reimbursement of previously written off assets and the like.

Operating expenses include the costs of conducting the operating activities of the enterprise, namely:

· administrative expenses (general business expenses associated with the management and maintenance of the enterprise);

· sales costs (costs of storage, sales of products, advertising, delivery of products to consumers, etc.);

· other operating expenses (cost of inventory sold, bad debts, losses from operating exchange rate differences, losses from depreciation of inventories, imposed economic sanctions and other expenses arising in the course of the operating activities of the enterprise (except for expenses included in the cost of production)).

Operating profit is a reflection of the efficiency of the company's core activities and shows how successful the company's production activities are without taking into account the influence of other factors.

Profit from ordinary activities is operating profit adjusted for finance income and financial expenses. Profit from ordinary activities is profit subject to taxation (taxable profit).

Financial income: income from investments in other businesses; dividends; interest on loans; income from non-operating exchange rate differences, etc.

Financial expenses: payment of interest on loan capital; losses from write-down of financial investments and non-current assets; other losses and expenses not related to operating activities.

Net profit (Net Income) is the profit that comes to the disposal of the enterprise after paying income tax. The company uses net profit at its discretion in two directions:

1. The accumulation fund (reinvested profit) is used to develop production, create a reserve fund, and invest in other enterprises.

2. The consumption fund is used to pay owners, shareholders, material incentives to staff based on work results, solve social problems, and charity.

The profit of each enterprise is formed from the following sources:

· Profit from the sale of products (provision of services) is the profit from the operating activities of the enterprise. This type of profit reflects the result from the main activity of the enterprise in the market and its profile. Profit from sales is the difference between revenue from sales of products (excluding value added tax and excise duty) and the full cost of production.

· Profit from the sale of property is the profit of an enterprise from the sale of tangible assets (fixed assets, inventories) and intangible assets, securities, etc. Profit from the sale of property is defined as the difference between the sale price and the book (residual) value of the property being sold.

· Profit from non-operating transactions is profit from joint activities of enterprises, interest on acquired shares, fines paid by other enterprises for violation of contractual obligations, income from the ownership of debt obligations, royalties, etc.

Please note that various sources offer other definitions of book profit and there is no single normative act or opinion on this matter. So be careful when using this term, try to use other, more standardized ones. Here are some additional definitions:

Balance sheet profit is profit from production activities and non-operating operations.

Balance sheet profit is profit from ordinary activities, financial results from operating and non-operating operations and extraordinary circumstances.

11. Methods for planning pain

Profit planning is a complex and multifaceted process, including an analysis of the enterprise’s economic relations and financial indicators for the period preceding the planned one.

The provision of financial resources for the process of production and marketing of products and the level of personal income of workers formed from the consumption fund depend on the correctness of profit planning.

An enterprise also needs an optimal profit plan in order to correctly make advance payments of income tax to the budget, thereby protecting itself from penalties from the tax authorities.

The enterprise independently develops a profit plan based on agreements concluded with suppliers and consumers; economic standards established by the state; materials from the analysis of economic and financial activities for the previous period.

Profit planning includes two interrelated processes:

1. determination of the volume of gross profit and identification of factors influencing its value;

2. planning of profit distribution.

The amount of profit largely depends on economically sound methods of planning it, of course, in compliance with the principles of the accounting policy adopted by the enterprise for the coming year.

In the Russian economy, the following methods are traditional for profit planning:

1. direct account;

2. analytical;

3. normative;

4. combined account method.

Let's consider the direct counting method. The total amount of gross profit from industrial activity consists of profit from the sale of products, non-operating income (less expenses) and profit from the sale of fixed assets and other property.

Profit from sales of products includes profit from commodity output and profit from the balance of unsold products at the beginning and end of the billing period (quarter, year).

Profit from the production of commercial products (Ptv) is calculated using the formula:

where T i is the market price of a product of the i type;

C i is the total cost of the product of the i-th type according to cost calculation;

K i – the number of products of the i-th type to be produced in the planned period (based on concluded contracts with consumers);

n – number of groups (types) of products (i = 1, 2, 3…n)

This formula can be presented in a simpler form:

Ptv = VR – Srp,

VR – revenue from sales of products at market prices;

CRP – cost of goods sold.

The amount of revenue from products sold is determined for each type of product or for larger groups if a large assortment of products is produced. To do this, each item in the nomenclature plan is multiplied by the market price and the results obtained for individual items are summed up.

The full cost of products is calculated in terms of its assortment (nomenclature) or by enlarged groups if a large assortment of products is produced.

In addition, profit is established on the inventory balances in the warehouse and in shipment at the beginning and end of the planned period (quarter, year) for their entirety, since assortment accounting for them is usually not maintained. Warehouse inventory balances at the beginning and end of the planning period are accounted for at production costs. In this regard, profit on carry-over inventory is determined as the difference between their value in free wholesale (market) prices and production costs:

Pr = P1 + Ptv – P2,

where Pr is the profit from sales of products in the billing period;

P1 and P2 - profit in the balance of unsold products at the beginning and end of the billing period;

Ptv is the profit of commodity output in the billing period.

Then:

VP = Pr ± VD + Pimusch,

where VP is gross profit;

Pr – profit from sales of products;

ND – non-operating income minus expenses;

Pimushch – profit from the sale of fixed assets and other property.

The direct counting method is relatively easy to use and does not require much labor if electronic computing technology is used.

The use of this method is possible only in conditions of a stable economic situation, the company has a predetermined portfolio of orders and product prices.

Calculating profit using the analytical method includes two types:

1. by spending 1 rub. commercial products;

2. through the percentage of basic profitability.

Profit planning through costs per ruble of marketable products is carried out according to the formula:

where TP – commercial products at market prices;

Pk – profit in kopecks per ruble of marketable products.

When determining the total amount of planned profit, to the amount of profit from commodity output, it is necessary to add profit from other sales, as well as profit in the balances of unsold products at the beginning and end of the period.

Example. TP output at market prices is 120 million rubles, costs per 1 ruble. TP 85 kopecks, profit 15 kopecks. (100 – 85). The amount of profit from the release of TP = 18,000 thousand rubles; profit in the balance of unsold products 2000 thousand rubles (5 thousand - 3 thousand); unrealized income (without expenses) 500 thousand rubles. Total gross profit = 21,500 thousand rubles. x (18 million +1 million + 5 million – 3 million + 500 thousand).

This method is not labor-intensive and is used when developing plans and forecasts for the development of an enterprise, since the basis for calculations is the entire volume of technical support.

The method of planning profit using a percentage of basic profitability is discussed in detail in educational literature on enterprise finance.

With the standard method, the amount of profit in the planning period is determined on the basis of the profitability percentage established by the enterprise for all products sold (without taking into account input and output balances at the beginning and end of the billing period). It is also used when planning profits in construction companies, which include the amount of profit in the contract price for construction products. The rate of return (in percentage) is agreed upon with the customer (investor).

Stable economic activity of enterprises is possible only on the basis of constant technical updating of production. Enterprises with sufficient profits have the opportunity to ensure expanded reproduction on a high technical basis, which will have a positive impact on their future financial well-being.

Calculation of the planned amount of profit at financially stable enterprises can be carried out using the self-financing method. The sequence of calculations is as follows:

1. based on the enterprise development plan, the need for monetary resources for production and social development (PPSD) is calculated, minus depreciation charges;

2. the share of profit for production and social development (UPSD) in the total amount of net profit for the reporting period is calculated;

3. The amount of net profit is determined to provide self-financing opportunities (PPSF):

4. the share of net profit in the volume of gross profit is established on the basis of actual data for the reporting period (Uchp):

5. The amount of gross profit is determined that provides the conditions for self-financing in the forecast period (VPsf):

Example. The enterprise's need for production and social development in the planning period = 81,000 thousand rubles; amount of depreciation charges = 20,250 thousand rubles.

Actual data for the reporting period:

1. gross profit = 108,000 thousand rubles;

2. net profit = 63,000 thousand rubles;

3. profit aimed at production and social development = 45,000 thousand rubles.

Solution:

1. .

2. .

3. .

4. .

6. Increase in VP = 37900 thousand rubles. (145900 – 108000) or 35.1%.

This method of profit planning is designed to promote the activation of investment activities to update the production potential of the enterprise.

A sound marketing policy and the study of supply and demand for goods are important for profit planning. Since in the conditions of market relations the basis for ensuring the life of an enterprise becomes real proceeds from sales (in monetary form), then plans for this indicator must be justified, taking into account market conditions. To do this, it is advisable to include in the production plan products for which sales are guaranteed, that is, the share of risk should be minimal.

The cash flow forecasting model is new for the Russian economy. The current plan for the receipt and expenditure of funds for operating activities developed by the enterprise is taken as the basis for the calculation. The basic model for calculating operating profit (OPP) for the coming period is as follows:

CHOP = PDRpl. – RDRpl. – AOpl. – PKpl.,

where PDRpl. – planned amount of receipt of cash resources for operational activities;

RDRpl. – planned amount of expenditure of monetary resources for operational activities;

AOpl. – planned amount of depreciation charges;

PCpl. – planned interest on the loan (it is reflected in cash flows from financial activities, but is included in the accounting range of operating costs).

Based on the calculated planned amount of private equity, the planned volumes of gross operating profit (GOP) and marginal operating income (MOI) are determined.

VOP = CHOP x 1.3

where the coefficient of 1.3 includes an income tax rate of 0.3 or 30%:

MOD = VOP + CIPL.

Sales volume = MOD + PIpl

SI – fixed (stable) costs;

PI – variable costs.

The use of this model allows you to more closely link the planned operating profit with the net cash flow from current activities, as well as detail its formation by periods (quarters). Another model used in Western industrialized countries is cost-benefit analysis. Based on the analysis of this indicator, the minimum sales volume (turnover) is determined to cover variable and fixed costs. Calculation of the minimum turnover is necessary to prevent the enterprise from falling into the loss zone.

The minimum sales volume is calculated using the formulas:

or

Profit forecast = (minimum turnover x predicted value of economic profitability of sales): 100.

The above models allow us to determine the amount of planned operating profit acceptable for the enterprise.

⇐ Previous3Next ⇒

Net operating profit: definition and calculation

The number in line 2100 (indicator F2100 in the formula) corresponds to the difference between the indicators in lines 2110 and 2120 of the report. In turn, line 2110 corresponds to the difference between the balance CT 90 (subaccount “Revenue”) and the balance Dt 90 (subaccount “VAT”), and line 2120 corresponds to the balance Dt 90 (subaccount “Cost of sales”).

The indicator in line 2220 (indicator F2200) corresponds to the balance of Dt 90 (subaccount “Administrative expenses”).

You can get acquainted with other nuances of the formation of indicators in the financial results report (its traditional name is the profit and loss statement) in the article “Profit and loss report - form No. 2 (form and sample)”.

The concept of operating profit is intended to identify the company's performance in its main line of business. The basis for calculating this indicator is the total revenue in monetary terms received after the sale of manufactured products and resale of goods.

When operating profit is determined, the calculation formula should not take into account the amounts of financial flows and investment funds. The sequence of calculations is as follows:

- the total revenue value is displayed;

- the gross profit indicator is found (cost amounts for products sold are subtracted from revenue);

- how to calculate operating profit - the total gross profit is reduced by the costs incurred to sell batches of goods to end consumers.

To increase the objectivity and visibility of the financial performance indicator, the operating profit amount is adjusted to the amount of tax payments made. This allows you to determine what part of the income will remain for the company to dispose of after a full range of expenses for production needs and repayment of tax obligations.

If an investor is faced with a choice between several projects in different regions or countries, this indicator will help him determine:

- which business will be more profitable;

- which territories have the most favorable conditions for the implementation of commercial ideas;

- How will the fiscal burden affect the dividends received?

Illustration 3. Consolidated income statement of Groupe Danone (in millions of €, excerpt).

| as of December 31 | |||

| 2016 | 2017 | ||

| Sales | Revenue | 21,944 | 24,677 |

| Cost of goods sold | Cost of goods sold | (10,744) | (12,459) |

| Selling expense | Business expenses | (5,562) | (5,890) |

| General and administrative expenses | General and administrative expenses | (2,004) | (2,225) |

| Research and development expense | R&D | (333) | (342) |

| Other income (expense) | Other income (expenses) | (278) | (219) |

| Recurring operating income | Recurring (constant) operating profit | 3,022 | 3,543 |

| Other operating income (expense) | Other operating income (expenses) | (99) | 192 |

| Operating income | Operating profit | 2,923 | 3,734 |

| Interest income on cash equivalents and shortterm investments | Interest income from cash equivalents and short-term investments | 130 | 151 |

| Interest expense | Interest expenses | (276) | (414) |

| Cost of net debt | Net result from interest income and expenses | (146) | (263) |

| Other financial income | Other financial income | 67 | 137 |

| Other financial expense | Other financial expenses | (214) | (312) |

| Income before tax | Profit before tax | 2,630 | 3,296 |

| Income tax expense | Income tax | (804) | (842) |

| Net income from fully consolidated companies | Net profit from fully consolidated Group companies | 1,826 | 2,454 |

| Share of profit of associates | Share of profits attributable to associates | 1 | 109 |

| Net income | Net profit | 1,827 | 2,563 |

| Net income - Group share | Net profit - Group shares | 1,720 | 2,453 |

| Net income - Non-controlling interests | Net income - non-controlling interests | 107 | 110 |

Expenses.

Differences in the presentation of certain items, such as expenses, are also common.

Expenses reflect outflows, asset depletions and liabilities incurred in the course of doing business.

Expenses can be grouped and presented in different formats to suit specific requirements.

Net income.

At the bottom of the income statement, companies display the item "Net income" (companies may use other terms such as "Net income" or "profit or loss", English. 'Net income', 'Net earnings', 'Net profit', 'Profit or loss').

For 2021, AB InBev reported $9.183 million in “Profit of the year”, Molson Coors reported $1,436.4 million in net income including non-controlling interests, and Danone reported €2.563 million in net income.

Net profit is often called the bottom or bottom line .

This is due to the fact that net profit is reflected in the end, i.e. on the bottom last line of the income statement.

Because net income is often viewed as the single most significant numerical measure of a company's financial performance over a given period of time, the term "bottom line" is sometimes used in business to refer to any bottom line or most significant result.

Despite these differences in terms and headings, note that each company provides additional detail on net income : information about how much of that net income is attributable to the company itself and how much is attributable to non-controlling interests, also called minority interests. . 'minority interest').

Companies consolidate subsidiaries over which they have control. Consolidation means that they include in the group's (parent company's) P&L all income and expenses of subsidiaries, even if the group owns less than 100% of the equity interests in those companies.

See also:

IFRS 10 - Basic rules for the preparation of consolidated financial statements.

Earnings items for noncontrolling interests represent the portion of earnings that are “owned” by the minority shareholders of the consolidated subsidiaries rather than by the parent company itself.

- For AB InBev, $7.996 million of total earnings is attributable to AB InBev shareholders, and $1.187 million is attributable to noncontrolling interests.

- For Molson Coors, $1,414.2 million is attributable to Molson Coors shareholders and $22.2 million is attributable to noncontrolling interests.

- For Danone, €2.453 million in net income is attributable to Groupe Danone shareholders and €110 million attributable to non-controlling interests.

Gains and losses.

Net income also includes net income and expenses (also called simply gains and losses or the result of a transaction) associated with increases and decreases in economic benefits that may or may not arise from the ordinary activities of the company.

For example, when a manufacturing company sells its products, these transactions are reflected as revenue, and the costs of obtaining this revenue are expenses and are reflected separately.

However, if a manufacturing company sells excess unwanted land, the transaction is recorded as profit or loss (result of sale). The amount of profit or loss is the difference between the book value of the land and the price at which the land is sold.

For example, in Exhibit 1, AB InBev reports a loss (gains less book value) of $39 on the sale of business and assets for 2021, and profits on this item of $377 million and $524 million in 2021 and 2015 , respectively.

Details of these gains and losses can generally be found in the disclosures in the notes to the financial statements. For example, AB InBev disclosed that its $377 million profit in 2021 was primarily driven by the sale of one of its breweries in Mexico.

Profit and loss formula in P&L.

The definition of income includes both revenues and similar gains (profits), and the definition of expenses includes both expenses incurred in the ordinary course of business and similar losses.

See definitions of income and expenses in CF(2018):4.68-4.72.

See also:

CFA - Conceptual Framework of IFRS: Elements of Financial Statements.

Thus, net profit (or loss) can be determined as follows:

- Income - Expenses , or what is the same

- Revenue + Other Income + Gains - Expenses , or what is the same

- Revenue + Other Income + Gains - Operating expenses - Other Expenses - Losses.

The last definition can be modified as follows:

Net income = Revenue - Operating expenses + Other Income - Other Expenses + Gains - Losses.

Revenue from sales in the balance sheet: asset lines

With a high degree of probability, it can be argued that many lines of both parts of the balance sheet are related to the revenue indicator. For example, a sharp decrease in the value of fixed assets or intangible assets (lines and) at the end of the period may indicate their sale, therefore, there is reason to believe that the total revenue of the enterprise includes a share of income from the sale of these assets.

The appearance in the balance line of information about financial investments in material assets indicates not only the possible receipt of revenue from the provision of property for rent, but also about investment in the development of the company (purchase of assets for leasing) at the expense of the profit that the revenue itself generates.

Financial investments (line 1170), i.e. investing money in the purchase of securities or in the authorized capital of third-party enterprises, can also be made from the company’s profits, and the appearance of information in this line indicates both the use of profits and the expected increase in revenue.

A clearer picture of costs and income from revenue can be obtained by analyzing the data in the second section of the balance sheet. Thus, a significant decrease in inventories on line 1210 may indicate the transfer of inventory items into production or directly for sale. True, this can only be asserted if there is a sharp decrease in the balance of reserves and knowledge that they were not replenished throughout the entire reporting period.

The relationship between revenue and working capital can be viewed on line 1250 “Cash and equivalents”, since it goes to the bank account and to the cash desk. But even here it is impossible to give an unambiguous assessment of the volume of revenue received. For example, a small balance on a line does not always indicate a shortage of money in the company; it is quite possible that the company quickly finds a use for the proceeds received into the account.

You can see the amount of revenue in the balance sheet on line 1230 “Accounts receivable”, if money for the shipped goods has not been received from all customers in the reporting period and there is no other debt besides these debts, but in practice this happens extremely rarely, and the debt cannot be considered revenue . Moreover, it should be taken into account that VAT is present in the amount of unreceived revenue reflected in receivables.

What do operating expenses include?

In the generally accepted sense, operating expenses are those that are not directly related to the implementation of work activities. Previously, all enterprise costs were grouped into:

- Operating rooms.

- Non-realization.

- Extraordinary.

Currently, this classification has been canceled (Order of the Ministry of Finance No. 116n dated September 18, 2006). The term operating expenses (OP) has been replaced by officials with others. These same costs include emergency and non-operating costs. According to the current edition of PBU 10/99, all company costs are divided into:

- Ordinary, that is, related to work activities.

- Others, that is, not directly related to economic activities.

Note! The same rule is true for the organization's income. Depending on the field of activity, all income is divided into income from other operations and from ordinary activities (clause 4 of PBU 9/99).

Thus, after the entry into force of Order No. 116n, the complex classification of income and expense indicators is excluded. However, for ease of accounting, the organization can continue to use the usual grouping. For these purposes, the provisions of PBU 9/99 and 10/99 should be adhered to. Let's consider what relates to operating expenses (clause 11 10/99).

Operating expenses include the following costs:

- Providing company assets to others on the basis of temporary use or ownership.

- Providing, on a paid basis, rights to intellectual property, including patents for designs, inventions, etc.

- Arising from the company's participation in the authorized capital of other persons.

- Arising from the write-off of fixed assets, products, goods (any assets other than cash), including disposal of property and sale.

- Maintenance services in financial and credit institutions - RKO.

- Interest paid by the company, accrued by the lender for the use of funds.

- Deductions to reserves formed by the company according to accounting rules, including for doubtful debts, for depreciation of financial investments, as well as due to recognition of the facts of economic activity as conditional.

Note! The above types of enterprise costs are included in operating expenses if they are not related to the performance of the main work activity. Otherwise, such costs should be classified as ordinary.

Uncovered loss: definition and reasons for its occurrence

If there is a loss for the current year, the calculation formula will look like this:

- NPk = NPn

Y – loss for the current year.– U – D, where

The NPK indicator may be negative if the resulting current loss exceeds the NP value at the beginning of the year. It is in this case that the loss becomes uncovered. Those. uncovered means a loss that occurs when the enterprise receives an actual loss and is unable to cover it with reserve funds (including when funding reserves were not created). The main causes of PE are considered to be:

- Excess of company costs over income due to various reasons;

- Radical changes in accounting policies that significantly affected the financial position of the company;

- Errors discovered in the reporting period from previous years, etc.

If there is a loss, the company carefully analyzes the causes of the phenomenon, since it may be a consequence of a drop in the competitiveness of the products being manufactured, which will require a change in the sales strategy or re-profiling of production, or may be a temporary phenomenon with the infusion of impressive, but slowly recouping investments into production.

Let's look at it with an example.

Formation of a balance sheet in accordance with IFRS standards (IAS)

The line codes of the Russian balance sheet are given in curly brackets.

| N | Analytical balance sheet lines | Calculation formula |

| 1 | Current assets: | Sum of lines: 2+3+4+8+9+14+15 |

| 2 | Cash | Cash {260} |

| 3 | Short-term investments | Short-term financial investments (56,58,82) {250} |

| 4 | Short-term receivables: | Sum of lines: 5+6+7 |

| 5 | Accounts and bills receivable | Goods shipped (45) {215}+ buyers and customers (62,76,82) {241} + bills receivable (62) {242} |

| 6 | Intercompany receivables | Debt of subsidiaries and dependent companies (78) {243} |

| 7 | Other receivables | Debt of participants in contributions (75) {244}+ advances issued (61) {245}+ other debtors {246} + VAT on acquired assets (19){220} |

| 8 | Long-term accounts receivable | Loans (more than 12 months) {144}+Accounts receivable (more than 12 months) {230} |

| 9 | Inventory: | Sum of lines: 10+11+12+13 |

| 10 | Raw materials, materials and components | Raw materials, materials and other analogues. values (10,12,13,16) {211} |

| 11 | Unfinished production | Animals for growing and fattening (11) {212}+ costs in work in progress (20,21,23,29,30,36,44) {213} |

| 12 | Finished products | Finished goods and goods for resale (16,40,41) {214} |

| 13 | Other stocks | Other inventories and costs {217} |

| 14 | Future expenses | Deferred expenses (31) {216} |

| 15 | Other current assets | Other current assets {270} |

| 16 | Long-term assets: | Sum of lines: 17+18+19+20+21 |

| 17 | Land, buildings and equipment | Fixed assets (01,02,03) {120} |

| 18 | Intangible assets | Intangible assets (04.05) {110} |

| 19 | Long-term investments | Investments in subsidiaries {141}+ investments in dependent companies {142}+ investments in other organizations {143}+ other long-term financial investments {145} |

| 20 | Unfinished investments | Construction in progress (07,08,16,61) {130} |

| 21 | Other long-term assets | Income investments in tangible assets (03) {135}+Other non-current assets {150} |

| 22 | TOTAL ASSET | Row sum: 1+16 |

| 23 | Current responsibility: | Sum of lines: 24+25+32+33+34 |

| 24 | Short-term loans | Loans and credits (90.94) {610} |

| 25 | Accounts payable: | Sum of lines: 26+27+28+29+30+31 |

| 26 | Bills and bills payable | Suppliers and contractors (60.76) {621}+ bills payable (60) {622} |

| 27 | Taxes payable | Debt to extra-budgetary funds (69) {625}+ debt to the budget (68) {626} |

| 28 | Intercompany accounts payable | Debt to subsidiaries (78) {623} |

| 29 | Advances received | Advances received (64) {627} |

| 30 | Dividends payable | Debt to participants (75) {630} |

| 31 | Other accounts payable | Debt to personnel (70) {624}+ other creditors {628} |

| 32 | revenue of the future periods | Deferred income (83) {640} |

| 33 | Reserves for upcoming expenses and payments | Reserves for upcoming expenses and payments (89) {650} |

| 34 | Other current liabilities | Other current liabilities {660} |

| 35 | Long term duties: | Sum of lines: 36+37 |

| 36 | Long-term loans | Loans and credits (92.95) {510} |

| 37 | Other long-term liabilities | Other long-term liabilities {520} |

| 38 | Equity: | Sum of lines: 39+40+41+42+43 |

| 39 | Share capital | Authorized capital (85) {410} |

| 40 | Reserves and funds | Reserve capital (86) {430} |

| 41 | Extra capital | Additional capital (87) {420} |

| 42 | retained earnings | Retained earnings of previous years (88) {460}-Uncovered loss of previous years (88) {465}+Retained earnings of the reporting year (88) {470}-Uncovered loss of the reporting year (88) {475} |

| 43 | Other equity | Targeted funding and revenues (96){450} |

| 44 | TOTAL LIABILITY | Sum of lines: 23+35+38 |

What is operating profit

By operating profit, economists understand the profit of an organization that is generated in the process of the company’s main activity (selling goods, performing work, providing services). Operating profit is an indicator that is calculated by subtracting from gross profit those expenses that are usually classified as operating, that is:

- aimed at the purchase of raw materials, materials, components;

- aimed at paying for electricity and equipment repairs;

- represented by management costs.

At the same time, when calculating operating profit, interest payable, as well as other income and expenses of the company (which may be associated, for example, with investment activities) are not considered.

A common formula for calculating operating profit looks like this:

OP - operating profit;

VP - gross profit;

KR - commercial expenses;

HP - overhead costs.

You can learn more about common approaches to determining the essence of operating profit in the article “Calculation and formation of operating profit (formula).”

How can the OP indicator be calculated using certain sources of accounting reporting?

A common point of view is that, in the terminology of Russian accounting standards (RAS), operating profit will correspond to profit from sales (recorded in the financial results report in line 2200).

Thus, the main source of data for calculating operating profit in a modern Russian enterprise is the financial results statement. The organization's other main reporting document, the balance sheet, is not used when determining operating profit.

It is almost impossible to determine operating profit on the balance sheet even indirectly. This is explained by different principles for the formation of two reporting documents: the balance sheet records account balances as of a certain date, and the financial results report displays the financial performance of the company: revenue, cost, as well as other expenses and income, the turnover of which is summed up on an accrual basis.

So, to calculate operating profit, the financial results report is used. Let's look at how exactly.

What is operating income?

Like costs, income is recognized as OA if they are not directly related to the main business activities. Otherwise, such operations must be taken into account according to the account. 90 and recorded as ordinary revenue. The composition of the OD is given in clause 7 of PBU 9/99. These include the following receipts:

- Related to the presentation of company assets on temporary terms of use or ownership.

- Related to the paid provision of rights to various types of intellectual property.

- Conditioned by the company's participation in the management of other persons, including those related to interest or profit from securities.

Example of NOPAT calculation

The company has presented its statement of financial position and income statement.

Statement of financial position, thousand.e.

Profit and loss statement, thousand.e.

Some of the equipment used by the company in its operational activities is used on the basis of an operating lease agreement, which will be valid for the next 3 years. Lease payments according to the agreement amount to 3,800 thousand. in year. The company's weighted average cost of capital (WACC)

) is 11.63%, and the income tax rate is 30%.

Let's calculate the amount of after-tax operating profit for each approach.

Operational approach

Since the company disclosed operating income (EBIT) in its income statement, the operating approach can be used to calculate NOPAT. To obtain its value, it is necessary to make the following adjustments to operating income:

- add the amount of change in the reserve for doubtful debts 24 thousand. (140-116);

- subtract the amount of change in deferred tax liabilities of 140 thousand. (370-230);

- add the value of the tax shield from non-operating expenses to 360 thousand. (1,200×30%);

- deduct the amount of income tax paid 1,620 thousand cu;

- add the amount of implied interest on operating leases.

Because an operating lease is an off-balance sheet source of financing, we must treat it as if it were a finance lease and the property is carried on the lessee's balance sheet. In this case, the implied carrying amount of the equipment will be equal to the present value (PV) of future lease payments. In this case, WACC should be used as the discount rate.

Thus, if we consider operating leases as a debt source of financing, its book value should be CU 9,183.3 thousand.

Reflection of operating expenses in accounting

Account reflection 91

After finding out which company expenses are not core, you need to understand the peculiarities of their accounting. In accounting, they are accounted for in account 91, while income goes in subaccount 91.1, and expenses go in subaccount 91.2.

Important: entries are made to open accounts cumulatively, and at the end of the billing period, the difference between costs and other income is calculated and entered into subaccount 91.9, showing losses as a debit and profits as a credit.

Accounting is carried out in such a way that it is easy to conduct analytics for each previously performed operation.

Formula for calculating operating profit

Like all accounting and reporting indicators, operating profit is calculated solely on the basis of the enterprise’s operating results, analysis and collection of primary documentation data. In simple terms, EBIT equals book profit plus interest payable.

The indicator can also be calculated as the difference between the gross profit received and the administrative, commercial, and other costs of the enterprise.

The general EBIT formula looks like this: OP = GR – CE – ME – OE + OR + PC.

Let's decipher the indicators of the formula:

- OP, that is, operating profit - of course, the operating profit itself, which we have to calculate;

- GP, that is, gross profit - basis, gross profit, the largest indicator in this formula is usually;

- CE, that is, commercial expenses - these are all the commercial expenses of an enterprise;

- ME, that is, management expenses - expenses for running a company, management;

- OE, that is, other expenses - all other expenses of the company;

- OR, that is, other revenue - all other income of the enterprise, additional;

- PC, that is, percent - all the interest that will be paid to the company.

There is a simpler formula: OP = BP + PC.

You already know what OP and PC are, and BP, or balance profit, represents balance sheet profit.

If you want to calculate EBIT based on the balance sheet, use the following formula: OP = line 2100 - line 2210 - line 2220 - line 2350 + line 2340 + line 2330

The indicators, as we see, are still the same:

- line 2100 of the balance sheet indicates gross profit, GP;

- balance line 2210 contains commercial, basic expenses, CE;

- line 2220 will tell us the amount of management costs, ME;

- line 2350 will help you find the amount of other expenses, OE;

- line 2340 will indicate the amount of other income of the company, OR;

- and line 2330 will show the interest payable, that is, our PC from the previous formulas.

Example of calculating EBIT:

For clarity, let's give a simple example. Let's imagine an enterprise, LLC Molochny Dom, which processes milk and produces various dairy products, purchasing raw materials from local farmers. The company's performance indicators for the last two years are as follows:

| Index | Balance line code | 2017 | 2018 |

| Gross profit, GP | 2100 | 120000 | 130000 |

| Commercial Expenses, CE | 2210 | 9000 | 9500 |

| Administrative expenses, ME | 2220 | 12000 | 13000 |

| Other income, OR | 2340 | 1500 | 2500 |

| Other expenses, OE | 2350 | 2000 | 2000 |

| Balance sheet profit, BP | 2300 | 98500 | 108000 |

| Interest payable, PC | 2330 | 8000 | 10000 |

So, we consider:

OP for 2021 = GR – CE – ME – OE + OR + PC, that is, 120,000 – 9,000 – 12,000 – 2,000 + 1,500 + 8,000 = 106,500 rubles.

OP for 2021 = GR – CE – ME – OE + OR + PC, that is, 130,000 – 9,500 – 13,000 – 2,000 + 2,500 + 10,000 = 118,000 rubles.

It is much easier to calculate operating profit if you know exactly the balance sheet profit. As you remember, you just need to add interest to this indicator:

OP for 2021 = BP + PC = 98500 + 8000 = 106500 rubles.

OP for 2021 = BP + PC = 108,000 + 10,000 = 118,000 rubles.

Operating profit: formula

Important: In this article we will look in detail at the types of profit and how to calculate them, but we will immediately make a reservation that the terms “revenue” and “profit” should be distinguished. The amount obtained after subtracting costs from revenue is profit.

Thus, the general formula for calculating profit will look like this: Profit = Revenue - Costs (in financial terms) Contents

- What is net profit

- How to calculate net profit

- What is gross profit

- What is contribution margin

- What is operating profit

- What is book profit

- General concept of revenue

- What is gross revenue

What is net profit? The net profit of an enterprise is the funds remaining from the balance sheet profit after deducting taxes, fees, deductions and other established payments to the budget.

Tags: asset, balance sheet, accountant, capital, coefficient, credit, tax, order, expense, means, formula