General description of the balance sheet for account 70

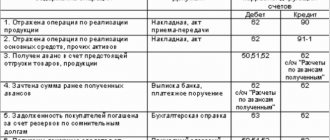

This register groups information about balances at the beginning and end of the period, turnover for the reporting period in account 70 “Settlements with personnel for wages”. Data in the statement must be disclosed for each employee. The procedure for recording transactions on account 70 is regulated by Section VI of the Order of the Ministry of Finance of the Russian Federation “On approval of the chart of accounts for accounting…” dated October 31, 2000 No. 94n:

| Transactions reflected in the debit of the account. 70: | Operations reflected on the credit account. 70: |

|

|

*The “Salary Deposit” operation is becoming less and less common these days. Its meaning is to close the payroll compiled for a group of employees when paying wages in cash. Since currently most organizations use non-cash forms of payment to pay wages, the formation of a unified payroll is losing relevance.

Moreover, as of November 30, 2020, the Bank of Russia’s directive No. 5587-U dated October 5, 2020 eliminated the rule about reflecting in the payroll the deposit of wages that were not paid on time.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free. In K+ you can also check whether you are processing salary payments correctly. If you do not have access to the K+ system, sign up for a trial demo access and study the material for free.

The balance can be anything: active, passive and active-passive. Basically the balance of the account. 70 can be passive, this is due to the fact that wages are calculated on the last day of the reporting (worked) month, and are issued to the employee in the subsequent month. An active or active-passive balance can be when an excessive payment of wages to an employee exceeds their accrual, for example, when an erroneous transfer is made to a salary account.

An example of filling out a statement of accounts. 70 you can look at on our website. follow the link below.

Credit 70 account | What it shows and how to calculate

Credit 70 of the account shows all financial calculations for each employee. Each organization, regardless of the direction of work and the number of employees, has an entire accounting staff (or a specialist in the singular) who deal with salary issues. The correctly calculated and accrued amount is the correspondence of several accounts involved in this operation and the security of the debt, and productive activities of each employee. The general information that falls on credit 70 of the account shows what financial calculations were made for an individual employee for a certain reporting period. In addition to the fact that credit 70 of the account shows the salary (due salary), it also includes an additional a list of payments and charges that are made in favor of workers. Among them:

- various bonuses; additional payments (harmful conditions, multi-shift schedule, overtime, etc.); possible bonuses (for a high level of qualifications, combination of professions, etc.); bonuses for achieving high performance indicators.

In addition, the account also reflects:

- payment of pensions for pensioners working at this enterprise; carried out deductions (targeted, mandatory, etc.), these include alimony, contributions to the pension fund, the amount of personal income tax, various types of compensation for harm, loss of a breadwinner, etc.

For the convenience of reflecting and seeing the full picture, it is advisable to conduct all transactions (analyst) separately for each employee. You may be interested in: According to the definition, wages are an expense of the enterprise at the moment when it has an obligation to pay it, that is, every hour that the employee has worked. Based on the instructions, such a need to pay for labor appears when several moments occur. Monthly salary, as well as bonuses to employees. Credit 70 of the account in this version corresponds with the debit accounts, which are responsible for various production costs.

Practical use of the balance sheet for account 70

In the balance sheet, the credit balance from the account statement. 70 as of the reporting date is reflected in the “Short-term liabilities” section in the line “Accounts payable” (clause 20 of PBU 4/99).

If there is an active-passive balance on the account. 70 data from the register is reflected in both the asset and liability of the balance sheet. Reducing assets and liabilities between themselves by offset is prohibited (clause 34 of PBU 4/99). At the same time, the active balance on the account. 70 is reflected in section II “Current assets” in the “Accounts receivable” line of the balance sheet.

It must be remembered that if the report indicators are of a significant level, then the data on them must be reflected separately.

Our article “What requirements should accounting reporting satisfy?” will help you understand the definition of the concept of “materiality level.”

In this case, you need to highlight a separate line in the balance sheet:

- in the liabilities side of the balance sheet in the “Short-term liabilities” section, the line “Debt to the organization’s personnel”

or

- in the balance sheet asset in the “Current assets” section, the line “Advances issued to employees.”

There are some difficulties in the practical application of the balance sheet for account 70. Thus, detailed information about the nature of settlement transactions with employees may be useful for interested users, such as:

- type of accrual;

- source of financing (cost, net profit, reserve, etc.);

- method of repaying debt to an employee (cash payment, deduction based on a writ of execution, deduction of personal income tax, use of non-monetary forms of payment, etc.).

SALT on account 70 does not provide users with such information. It only answers questions such as: “How much was accrued and issued to the employee? What is the balance of mutual settlements with him? To obtain more complete information on account 70, it is advisable to use other registers: payroll, summary of accrued wages, account turnover, etc.

More details about the payroll statement are described in the material “Unified Form No. T-49 - Form and Sample”.

Is it possible to pay part of the salary in kind on a time frame that is different from the time period for payment of the daily salary? The answer to this question was explained by the State Counselor of Justice of the Russian Federation, 2nd class of the State Labor Inspectorate in the Perm Territory, Yu. A. Dotsenko. Study the official’s point of view by getting trial access to the ConsultantPlus system for free.

Accounting for settlements with suppliers

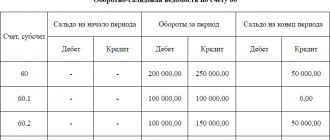

Article 60 is the accounting of a synthetic species. The balance sheet displays all debt for all obligations to suppliers and contractors.

All transactions on this account can be classified into two types:

- Acquisition of property rights, goods, etc. These could be supply contracts, utilities or sales contracts.

- Payment for contractors' services. These are, first of all, transactions for the provision of contract services, paid services and R&D.

The data is obtained:

- for unpaid accepted payments and other payment documents;

- if bills have not been paid;

- for uninvoiced deliveries;

- advances that have been issued;

- on promissory notes with undue payment terms;

- on overdue bills;

- due to commercial loans.

Movement on account 60 occurs in the presence of the following regulations:

- In order for an enterprise to record a debt for materials or services provided, the supplier or contractor must present an invoice or delivery note to the company. They are the basis for the creation of a purchase ledger (received VAT).

- To repay a debt obligation to organizations, it is necessary to present a payment order or demand to the debtor organization.

- An expense order, which confirms the repayment of a debt in part or in full, using cash payment at the cash desk of the paying company.

- The basis for payment for work or services can be an act of completion of work. 5. When repaying the claim amount in cash or in the case of returning the prepaid contribution, a receipt order is issued.

Credit transactions:

- The debt incurred by the organization to its counterparties is displayed here.

- The balance at the beginning of the reporting period (month) is recorded as a credit, but if, according to the terms of the agreement, a prepayment payment was transferred to the supplier, then it can be displayed as a debit.

Debit transactions in correspondence:

- 07 and 08 – acquisition, improvement and use of non-current assets;

- 10, 15 – purchased funds (materials, goods);

- 20 (20, 23, 25, 26) – work provided by third-party companies in order to increase the cost of production of main and additional production or for general economic and general expenses for the production process;

- 41 – purchase of goods;

- 43, 44 – increase in trading costs due to the provision of services by contractors;

- 50 (51, 52, 55) – operations to reimburse financial resources from counterparties. For various reasons (inflated payment, settlements on claims, in case of detection of poor quality goods or when less goods were shipped due to its shortage);

- 60 – crediting of previously paid advance funds;

- 66 – payment of a short-term loan or loan using an assignment agreement;

- 76 – the amount of claims that were presented to the buyer;

- 79 – the main company made a payment for the goods and materials supplied to the subordinate company or branch office;

- 91.2 – if the difference in the exchange rate (negative) was written off as other costs.

Debit transactions on the account:

- 10, 15 — return of inventory items;

- 50 - repayment of debt on the presented invoice at the company's cash desk in cash;

- 51 – payments by non-cash method from a current or other type account;

- 52 – payment to the supplier in the currency specified in the text of the contract;

- 55 – payment with funds blocked until the goods arrive (finances are debited from the company’s account and transferred to a special letter of credit issued at the recipient’s cash desk or bank - the amount is determined by the rules of the contract);

- 60 – the previously made advance payment is taken into account;

- 66 – with the help of a short-term credit loan, the debt to counterparty enterprises was repaid;

- 72 – when the debt is assigned under an assignment agreement to another third-party company.

Write-off of accounts payable for reasons:

- The deadline for filing claims has passed.

- Liquidation of the creditor organization.

- The difference is in the course.

- Recalculation of the debt amount.

- Penalties arising from violation of the terms of the contract.

Results

SALT for account 70 is one of the possible registers for grouping data on settlements with employees. The data from this report is used to generate financial statements. Balance sheet according to the account. 70 provides information on accrued and paid wages and balances as of reporting dates for each employee of the organization. In order to obtain more detailed information on settlements with personnel, it is necessary to use other forms of accounting registers.

Sources: Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

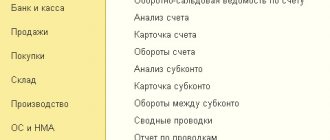

How to analyze OCB

Analysis of the balance sheet is quite simple: all items are indicated in the decoding of the codes. You just need to close all possible accounts as much as possible at the end of the analyzed period. For example, a large balance in account 10 “Materials” indicates an overstocking of raw materials (or accounting shortcomings). The balance is always assessed on an accrual basis.

Where to see the company's revenue

Receipt of revenue and write-off of the cost of products (works, services) are carried out in accounts 90.01 and 90.02. Companies on the general taxation system charge VAT on their products on account 90.03. And also management expenses are reflected in account 90.08. By analyzing these accounts, the company's profit before taxes can be determined.

VAT accounting procedure

It is important for any manager not to forget to monitor the turnover in accounts 50 and 51, which reflect the movement of cash and non-cash funds. A tax specialist should regularly monitor balances on accounts 19 and 68, which account for tax calculations, in particular VAT.

To understand the balance sheet, a beginner should memorize the names of all accounting accounts

How to calculate profit and loss for SALT

To calculate profits and losses in the balance sheet, account 99 is provided, to which sub-accounts are opened that detail the calculations. The manager should remember that the debit balance on account 99 means the company’s final loss, and the credit balance means net profit.

There are many accounting programs that only require posting transactions. The correctness of accounting is tracked automatically, which is very convenient, especially for novice accountants. As a rule, these programs are linked to primary documents and contracts and are based on Excel. The most popular program is 1C.

If you keep records in the 1C program, then work becomes easy and interesting. Post transactions across accounts, and the program will create the balance for you. You just need to read it correctly, find random errors and correct them in a timely manner. In addition, there are a lot of additional features that are recommended to be used not only by accountants, but also by managers for maintaining management accounting.